Investing $5 Billion to 'Prepare' for 618: Is This Tmall's Pivotal Stand Amidst Slowing Growth?

![]() 05/06 2025

05/06 2025

![]() 616

616

In the ever-evolving landscape of e-commerce, 618 has transcended mere shopping spree status; it has emerged as a critical battleground where platforms demonstrate their prowess and vie for market dominance. As this year's 618 approaches, all players are gearing up for the fierce competition ahead.

Recently, at Taobao Live's 618 product selection meeting, Mengxin, the General Manager of Taobao Live Operations, announced, "This year, the platform will invest $2 billion in cash during the 618 period." This investment aims to empower brands, merchants, and influencers across multiple dimensions, striving to revitalize the "people-goods-field" ecosystem, reignite the platform's growth vitality, and foster a sense of certainty in growth.

Simultaneously, at the "Quality Wins 618 Growth Strategy Conference," Alimama unveiled strategies to enhance efficiency with AIGX capabilities, integrating search and recommendation to bolster brand power. Furthermore, incentives such as $3 billion in red envelope subsidies were announced, unwaveringly implementing the strategy of "supporting the excellent and fostering the new," underscoring Alibaba's resolve to triumph in this year's 618.

Currently, the e-commerce market is undergoing rapid changes. With the adjustment of the "only refund" rule, the e-commerce ecosystem is facing a reshaping, and Tmall views the 618 stage as a crucial opportunity to showcase its competitive edge. Thus, this battle must be won.

The anticipation for 618 is palpable in the air.

In the realm of e-commerce, the 618 Shopping Festival holds a pivotal position, akin to a decisive battle that shapes the fate of enterprises midway through the year. Although the 2025 618 Shopping Festival is still some time away, not only Tmall but also JD.com, Douyin, Kuaishou, Xiaohongshu, and even Bilibili have already commenced their "preparations."

Despite occasional murmurs of fatigue towards the 618 Shopping Festival in recent years, it cannot be denied that the consumption potential of the masses remains robust. Each platform is pulling out all the stops, exerting efforts from multiple dimensions such as resource investment, gameplay innovation, and cooperation expansion, in a bid to seize the initiative in this fiercely competitive e-commerce war.

JD.com has chosen to partner with Bilibili to upgrade the "Jinghuo Plan." Eligible merchants can not only receive subsidies such as Spark+ and traffic investment returns but also enjoy a maximum matching investment policy of 120%, thereby attracting merchants to join and expanding the consumer base, particularly the young consumer group covered by Bilibili, infusing new vitality into JD.com during the 618 Shopping Festival.

Similarly, leveraging its unique strengths in short videos and e-commerce live streaming, Douyin E-commerce has conducted multiple live broadcasts focused on "520" and "618" preparation guides, while simultaneously opening up merchant recruitment, fully preparing for the pre-heating stage. Douyin's rich content ecosystem can precisely target users of different interest groups, intuitively showcasing products through live streaming, stimulating consumers' purchasing desires, and securing a commanding position in content marketing within e-commerce competition.

Additionally, Kuaishou has released a preparation guide, introducing four major activities during the 618 period: Million Points Battle, Golden Ox Adventure, Industry Live Streaming Ranking, and Dividing Million Prize Pool, to facilitate rapid merchant growth. Rooted in the tier-two and tier-three markets, Kuaishou can harness its unique community atmosphere and user loyalty to mobilize merchants' enthusiasm through various incentive activities.

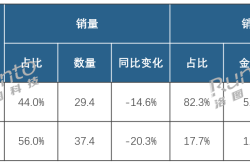

The current price competition in the e-commerce industry has reached a feverish pitch. According to StarChart data, the total sales across the entire network during the 2024 618 Shopping Festival amounted to $742.8 billion, a year-on-year decrease of 7% compared to $798.7 billion last year. Consumers are gradually becoming immune to low-price strategies, and merchants' enthusiasm for participation has plummeted to an all-time low.

Under such trying circumstances, the competition among platforms during the 618 Shopping Festival is no longer merely a numbers game but a crucial battle to defend their industry position and reshape platform value. It is foreseeable that the platform competition will remain intense during this year's 618.

Tmall Invests $5 Billion in 618 Preparations

Compared to e-commerce platforms like JD.com and Pinduoduo, Tmall's preparations for this year's 618 are remarkable in terms of scale and investment. Behind this lies both the impetus of its own developmental challenges and considerations for addressing industry competition.

The third-quarter financial report for fiscal year 2025 reveals that Taobao and Tmall Group's revenue reached $136.091 billion, a year-on-year increase of 5%. Moreover, the adjusted EBITA (earnings before interest, taxes, and amortization) for this quarter was $61.083 billion, an increase of 2% compared to the same period in 2023. However, revenue and net profit growth have nearly stagnated.

More concerningly, Taobao and Tmall Group's direct sales and other revenues were unsatisfactory, with revenues of $28.726 billion in the same period, a year-on-year decline of 9%, following declines of 9% and 5% in the previous two quarters, respectively.

Amidst such growth challenges, Tmall urgently needs a victory to turn the tide, and the 618 Shopping Festival presents itself as an excellent opportunity.

On one hand, Tmall aims to attract high-quality merchants with substantial investments, enhancing the quality of products and service levels on the platform, and propelling both merchants and the platform to new heights of development, achieving high-quality growth.

The most prominent manifestation is Tmall's significant investment in preferential support for existing "quality" merchants and "quality" products. For instance, Taobao Live has clearly allocated $2 billion in cash to support brands, merchants, and influencers, while Alimama's $3 billion in red envelope subsidies will also incentivize various merchants across different tracks, helping them break through traffic bottlenecks and achieve double growth in both brand and sales.

Whether it's Taobao Live's $2 billion investment in cash subsidies or Alimama's $3 billion investment in red envelope subsidies, these measures clearly demonstrate that Tmall is vigorously supporting high-quality merchants and products through resource allocation, reshaping the platform's quality ecosystem, and enhancing consumers' perception of Tmall's high-quality shopping experience.

On the other hand, Tmall hopes to leverage the traffic dividends of the 618 Shopping Festival to accelerate the platform's digital transformation, optimize operational efficiency using cutting-edge technologies like AI, and solidify its leading position in the e-commerce industry.

After years of accumulation and development, Taobao and Alimama have built an AIGX technology system that aligns with their own ecosystem and capabilities, encompassing technical capabilities such as AIGB intelligent bidding, AIGC creativity, and AIGE simulated bidding environment, and integrating them into all aspects of merchant operations.

During Tmall's 618, Alimama will deliver comprehensive efficiency improvements through AIGX capabilities and integrate search and recommendation to bolster overall brand power. The application of these technological means not only optimizes merchants' operational efficiency and reduces operational costs but also provides consumers with more precise and high-quality shopping recommendations, enhancing the shopping experience and further cementing Tmall's leading position in the e-commerce industry.

In summary, Tmall's aggressive preparations for this year's 618, whether it's investing heavily to build a quality ecosystem or leveraging technology to achieve digital transformation, are robust measures taken to defend its position and seek long-term development amidst the complex and severe industry competition environment.

The Battle for Quality, Service, and AI

Historically, price wars have always been the mainstay of the 618 Shopping Festival, with major platforms wielding the sharp sword of "low prices" to compete in the market, attempting to harness massive traffic with price advantages and win over consumers.

Times have changed, and the current e-commerce landscape has undergone profound transformations. The platform economy is transitioning from an extensive model focused on harvesting traffic to refined operations that delve deeper into ecological value. Quality and service have quietly usurped price as the new focal points of this year's 618 battle.

Firstly, consumers are gradually becoming more rational and mature, developing an aesthetic fatigue towards price promotion methods such as full reductions, discounts, and subsidies. Against this backdrop, e-commerce platforms must re-evaluate their competitive strategies and seek new breakthroughs, with quality and service naturally emerging as the primary concerns.

Secondly, e-commerce platforms' unwavering pursuit of quality can not only satisfy consumers' escalating consumption needs but also enhance their trust and loyalty towards the platform, thereby reshaping the platform's quality image, forming a differentiated competitive advantage, and standing out in the fiercely competitive 618 market.

Thirdly, with the rapid advancement of AI technology, utilizing cutting-edge technologies like AI to further optimize quality and service, and consolidate one's leading position in the e-commerce industry, has become a strategic choice for e-commerce platforms aiming to achieve both short-term growth and long-term development.

In essence, the shift in the focus of 618 competition reflects the evolution of the e-commerce industry from a mere trading platform to a value community. Platforms that remain fixated on the GMV numbers game will eventually be swept away by the tide of consumers' trust. Conversely, enterprises that genuinely build an iron triangle of "quality-service-technology" will reap the true rewards of long-termism in the era of stock competition.