Cold Reflection after the Traffic Frenzy: Navigating POP MART's IP Life Cycle Dilemma

![]() 05/06 2025

05/06 2025

![]() 903

903

From the bustling blind box machines in Beijing's Sanlitun to the immersive flagship stores on Shanghai's Nanjing Road East, POP MART has propelled niche fashion toys into the mainstream of mass consumption within a decade, achieving a market value that once surpassed HK$100 billion. Its revenue soared from less than RMB 10 billion in 2022 to break the RMB 13 billion mark in 2024, marking an exponential leap that is rare in business history.

This company, which began with blind boxes, is now reshaping the global pop culture landscape at an astonishing pace. In Hanoi, Vietnam, youths queue up to grab limited-edition Xiao Ye IP blind boxes at the castle-themed store, while outside the Louvre pop-up store in Paris, collectors praise "Made in China" in six languages.

The Growth Code in Financial Reports

Amidst a receding tide of consumerism, POP MART has bucked the trend and authored a growth myth. Financial reports reveal that in 2024, POP MART generated revenue of RMB 13.04 billion, a 106.9% increase from RMB 6.301 billion in 2023. This achievement stems from POP MART's meticulous management of its IP ecosystem, product matrix, and online and offline channels.

Firstly, POP MART's revenue growth is closely tied to the popularity of its various IP series. In 2024, its four major headline IPs—THE MONSTERS, MOLLY, SKULLPANDA, and CRYBABY—each generated over RMB 1 billion in revenue, collectively contributing over RMB 7.6 billion, or 58.3% of total revenue. Notably, THE MONSTERS achieved an annual revenue of over RMB 3.04 billion, with a year-on-year surge of 726.6%, through its innovative "plush + collaboration" strategy.

More remarkably, POP MART boasts 13 proprietary IPs with annual revenue exceeding RMB 100 million, with the new generation IP CRYBABY experiencing a stunning growth rate of 1537.2%, demonstrating POP MART's industrialized capacity for content incubation. This surge is not fortuitous but the fruit of long-term R&D investments and the creative synergy of its eight design centers worldwide. While traditional toy manufacturers rely on a single IP, POP MART has constructed an IP ecosystem that spans all age groups and scenarios.

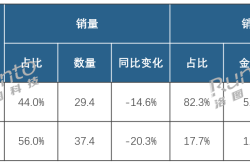

Secondly, amidst a saturated traditional blind box market, POP MART proactively adjusted its product matrix. Plush toys emerged as a significant revenue driver, contributing RMB 2.83 billion in 2024, a year-on-year increase of 1289%, accounting for 21.7% of total revenue. The MEGA series continued its high-end trajectory, launching 1000% limited editions to entice collectors, with annual revenue of RMB 1.684 billion, up 146% year-on-year. The launch of the new building block category also yielded impressive results, reflecting POP MART's efforts to expand its male user base. POP MART's product structure adjustment is not merely a categorical overlay but the outcome of deeply integrating IP cores with material innovation and process upgrades through big data to precisely capture user preferences.

Lastly, the three-dimensional expansion of POP MART's channel network contributed to its revenue growth. In 2024, POP MART's net increase in mainland retail stores was 38, totaling 401, while the number of robot stores surpassed 2,300. The opening of landmark projects such as the flagship store at the Louvre in Paris and the theme store at Banna Hill Park in Vietnam signifies a new phase in its globalization strategy. The enhancement of these channel networks has become a potent lever for POP MART's rapid revenue growth.

Strategies for Offense and Defense in the Globalization Game

As domestic market penetration nears saturation, globalization becomes an inevitable choice. Financial reports indicate that in 2024, POP MART's overseas and Hong Kong, Macao, and Taiwan business revenue amounted to RMB 5.07 billion, a year-on-year increase of 375.2%, comprising 38.9% of total revenue.

On the offensive front, POP MART adopts a locally adapted business strategy for overseas expansion. It has divided the global market into four regions—Greater China, the Americas, Asia-Pacific, and Europe—with independent operation centers in each to empower local teams to devise strategies tailored to local characteristics. For instance, in France, POP MART launched a French limited edition of SKULLPANDA Mirror Person, while in Thailand, it collaborated with renowned local artist Molly to create the CRYBABY series. These strategies enable POP MART to align precisely with overseas youths' preferences, earning widespread acclaim.

Moreover, POP MART selects overseas store locations with reference to international luxury brands. Its stores in Paris are situated in the Champs-Élysées business district, and its New York flagship store resides on Fifth Avenue. This proximity to luxury stores not only underscores the brand's tone but also successfully attracts mid-to-high-end consumer groups who prioritize quality of life.

On the defensive front, robust channel construction has swiftly introduced POP MART to overseas consumers. Offline, POP MART has opened numerous physical stores and themed pop-up stores abroad, creating an art gallery-like shopping environment through immersive scene design, naturally evoking consumers' purchase desires as they immerse themselves in the story scenarios. Online, POP MART has not only established an independent global website but also opened stores on multiple mainstream e-commerce platforms to reach overseas consumers comprehensively. Financial reports show that in 2024, POP MART's overseas website revenue surged 1246.2% year-on-year, Shopee revenue increased by 656.0%, and TikTok platform revenue skyrocketed by 5779.8%.

Hidden Concerns Behind High Growth

Despite POP MART's dominance in the fashion toy sector, it cannot afford to be complacent.

Firstly, POP MART faces intense market competition. Domestic competition has broadened from fashion toy brands to internet giants. For example, in 2023, TOP TOY, a Miniso subsidiary, surpassed 500 stores, diverting users with its low-price strategy and "IP + lifestyle grocery" model. ByteDance launched the "Douyin Fashion Toys" channel, capturing traffic through live streaming and algorithmic recommendations. Even Luckin Coffee collaborated with LINE FRIENDS to introduce blind box cup sleeves, crossing over to share the market. Meanwhile, niche markets like BJD dolls and GK statues are growing rapidly, attracting high-end players, challenging POP MART's dominance in the mid-to-low-end market.

Secondly, POP MART encounters challenges in IP operation. While owning numerous proprietary and exclusive IPs, these IPs have limited life cycles. Most of POP MART's IPs heavily rely on eye-catching designs but lack backstories and cultural connotations. Once the novelty fades, consumers often lose interest, making it difficult for the characters to appreciate in value.

Thirdly, POP MART faces hurdles in overseas expansion. As its second growth curve, the overseas business achieved remarkable results in 2024. However, due to various factors, POP MART also confronts numerous challenges in overseas markets. Cultural differences pose a challenge; in European and American markets, some consumers perceive Molly's "expressionless" design as "lacking emotional connection." Additionally, POP MART must compete with international brands like Lego and Funko. For instance, Funko achieved revenue of over USD 1.3 billion in 2023 with IP licenses from Marvel, Star Wars, etc. Finally, supply chain management is crucial; unlike the domestic market, overseas production and transportation chains are lengthy, and inaccurate sales forecasts can easily lead to product overstocking.

POP MART's success underscores the explosive potential of the "IP + scenario + user" model in Gen Z consumption. However, the challenges it faces are equally formidable: extending the IP life cycle, balancing the blind box frenzy with sustainable growth, and finding the right pace in globalization and technologization. The fashion toy industry has entered a phase of "infinite games," and only through continuous innovation can POP MART maintain its throne.