Behind JD.com's Takeout Surge: Billion-Dollar Subsidies Reveal Four Key Challenges

![]() 05/07 2025

05/07 2025

![]() 681

681

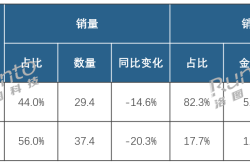

For a considerable period, the takeout market has been dominated by a duopoly of Meituan and Ele.me. Leveraging its early mover advantage, robust ground promotion team, and refined operational strategy, Meituan has long maintained a commanding lead in market share. As of the first half of 2024, Meituan Takeout led the industry with a 68.2% market share, cementing its position as the undisputed leader. Its footprint extends from bustling business districts in tier-one cities to the streets and alleys of second- and third-tier cities, providing convenient takeout services to countless consumers nationwide.

As a cornerstone of Alibaba's local life services, Ele.me has also secured a firm position in the market, ranking second with a 25.4% share. While trailing Meituan in market share, Ele.me has amassed a significant user base by leveraging super traffic portals like Alipay and Taobao, particularly in tier-one and tier-two cities, where it enjoys a stable user base.

Together, these two giants control over 90% of the market share, effectively dividing the takeout market. Their long-term market cultivation has ingrained user habits; when consumers think of ordering food, Meituan and Ele.me are often the first platforms that come to mind. Ordering food via their apps has become a daily routine for many.

Merchants, too, heavily rely on these platforms for business expansion and order acquisition. For many, withdrawing from these platforms could severely impact their operations.

In 2025, JD.com entered the takeout sector with a bang, offering '0% commission' and 'billion-dollar subsidies' in an attempt to disrupt the duopoly of Meituan and Ele.me. However, this ambitious foray has gradually unveiled some underlying challenges.

Shortcoming 1: Merchant-End System Disarray

JD.com Takeout's '0% commission' policy indeed attracted a flood of merchants, but the disorganized order-taking system has left some merchants frustrated. Many merchants complain about the complex and unintuitive backend interface, plagued by issues like delayed order pushes and classification confusion.

The head of a chain restaurant brand revealed, "On our first day, we missed over 20 orders due to system failures, and customer service response was sluggish, resulting in a direct loss of nearly 1,000 yuan." The platform's lack of a comprehensive merchant training system leaves new merchants floundering in unexpected situations, sometimes forcing them to temporarily halt operations. This dual deficiency in technology and service significantly dilutes the allure of '0% commission', increasing the risk of merchant churn.

However, JD.com Takeout's merchant cooperation strategy holds unique advantages. Its 'zero-commission' policy drastically reduces merchants' operating costs, with commission-free access for early adopters before May 2025 and an 8% commission cap the following year, far below the industry average of 23%. This has attracted numerous chain brands and high-quality small- and medium-sized restaurants. One chain restaurant brand calculates that per-order costs on the JD.com platform can be reduced by 10%, allowing for profit margins to be reallocated towards enhancing product quality. Simultaneously, JD.com rigorously selects 'quality dine-in restaurants', ensuring food safety through qualification audits and offline verifications, steering the industry towards a 'quality war' rather than just a 'price war'.

Shortcoming 2: Subpar User Experience

Issues such as 'no riders picking up orders within an hour of placement,' 'delivery delays without compensation,' and 'cold food arrival' are prevalent.

On social media, complaints like 'using JD.com Takeout is like having no food to eat' have become a viral meme, eroding user trust in the platform. Data shows that in the first month after JD.com Takeout's launch, the user complaint rate was three times the industry average, and the platform's promised '30-minute delivery' fulfillment rate was less than 40%. This poor consumer experience negates the price advantage brought by billion-dollar subsidies, leading to lower-than-expected user retention rates.

Nevertheless, JD.com Takeout is striving to bring new value to users. Leveraging Dada Group's 1.3 million riders and an instant delivery network spanning over 2,300 counties and districts, it promises 'delivery in as fast as 9 minutes.' Additionally, JD.com taps into its warehousing resources in categories like fresh produce, 3C electronics, and digital products to foster an ecological synergy of 'high-frequency takeout driving low-frequency retail,' enabling users to purchase daily necessities alongside food orders and enjoy one-stop delivery services.

This 'instant retail + takeout' model offers enhanced convenience to users. Simultaneously, JD.com rigorously selects merchants, allowing only chain brands with physical stores and high ratings to join, eliminating 'ghost kitchens' and ensuring food safety, thereby rebuilding consumer trust.

Shortcoming 3: Aggressive Operational Strategy with Latent Risks

JD.com's takeout strategy is marked by 'blitzkrieg' tactics, revealing the latent risks of overeagerness for quick success. To swiftly capture market share, JD.com expanded hastily without a well-established delivery system, resulting in insufficient rider capacity. The platform invested heavily in marketing and promotion while neglecting the core fulfillment capacity building essential for the takeout business. Insiders reveal that the JD.com Takeout team relies excessively on headquarters support, with regional operations lacking autonomy, making it challenging to adapt strategies flexibly to complex local markets. This 'heavy on marketing, light on operations' approach is eroding the patience of users and merchants.

However, in terms of rider rights protection, JD.com sets an industry benchmark. Starting from March 1, it gradually provides full-time JD.com Takeout riders with five social insurances and one housing fund, and offers accident insurance and health insurance for part-time riders. In the future, the company will bear the portion that full-time riders would otherwise need to contribute personally, ensuring their income remains unaffected by these contributions. This initiative boosts riders' sense of belonging and attracts more high-quality riders, providing a solid foundation for delivery service quality.

Shortcoming 4: User Retention Post-Subsidy Withdrawal

While JD.com Takeout is backed by a financial and logistics powerhouse in the e-commerce realm, the unique challenges of the takeout industry make it difficult to translate these advantages into winning strategies. When the '0% commission' and billion-dollar subsidy burn model becomes unsustainable, can JD.com Takeout fend off the counterattacks of Meituan and Ele.me and retain its market share?

Cultivating user habits, refining the merchant ecosystem, and optimizing the delivery system all demand long-term investment. If JD.com Takeout fails to address its shortcomings promptly, this grand foray into uncharted territory might ultimately devolve into another 'subsidy bubble' in the capital market.

JD.com Takeout's entry into the market seems to have stirred up the takeout sector, but it has also exposed the vulnerabilities of cross-border players in specialized domains. As the frenzy of billion-dollar subsidies subsides, the true competition in the takeout industry will hinge on the most fundamental service capabilities and operational maturity – precisely the lessons JD.com Takeout urgently needs to internalize.

Conclusion

JD.com Takeout's entry has infused new vitality and variables into the takeout sector. This competition is no longer solely between Meituan and Ele.me; JD.com's participation has diversified the market landscape.

In this intense rivalry, merchants enjoy more choices and are no longer overly reliant on a single platform, allowing them to better balance operating costs and profits. Riders' rights have garnered increased attention and protection, promising further improvements in their working environment and benefits. Consumers stand to benefit the most, enjoying not only more competitive prices and a broader selection of dishes but also higher-quality delivery services.

Looking ahead, the takeout industry will continue to evolve through competition and innovation. Platform competition will spur all stakeholders to continually enhance services, elevate user experience, and explore more innovative business models and service methodologies. With ongoing technological advancements, such as the application of artificial intelligence, big data, and drone delivery, the takeout industry is poised for more efficient, intelligent, and convenient growth.