Not yet released, iPhone 17 is already stabbed in the back by its own people

![]() 05/09 2025

05/09 2025

![]() 778

778

Source | YuanSight

Apple's knife skills seem to have dulled.

In the second fiscal quarter of FY2025, Apple delivered a "contradictory" earnings report - total revenue of $95.359 billion and net profit of $24.78 billion, both up 5%, but revenue in Greater China declined by 2% to $16.002 billion. Cook, who once precisely captured global consumers, has rarely "missed" in the Chinese market this time.

A more subtle signal lies in the market's reaction. More than four months before the iPhone 17 series is released, "spoilers" about the 2026 new products have suddenly emerged in large numbers: foldable screens, under-display cameras... These technologies that should belong to the "future" have been brought to the negotiating table in advance. However, the iPhone 16, which was supposed to deliver, hasn't even done well in "squeezing out incremental innovations" - the promised AI features have been delayed, and the core selling points have become empty talk.

Behind the failure of Apple's knife skills lies a deeper dilemma. The Chinese mobile phone market has long been a red ocean, with Huawei and Xiaomi fiercely competing. The tariff overhang from the Trump era has not dissipated. When the business model of "precise castration" collides with the battlefield of "comprehensive involution," Apple's "profit myth" is facing its most severe challenge.

01

Flamed Out

The numbers Cook least wanted to see have emerged.

As Apple's global revenue surpassed the $95 billion mark, the growth engine that was once Greater China quietly flamed out. On the other hand, the growth of the service business, which has always been a "lay-back" profit source, also fell short of expectations. Facing the risk of being "encircled and suppressed" by all parties, revitalizing the Chinese market is Cook's top priority.

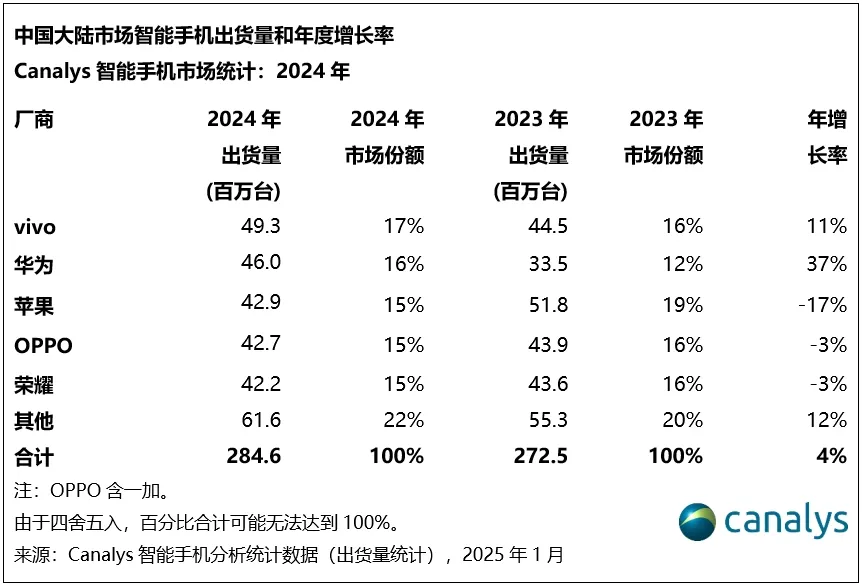

A report released by Canalys shows that in 2024, Apple's share of the Chinese smartphone market plummeted from 19% in the same period of 2023 to 15%, slipping from first place to third, surpassed by vivo and Huawei.

Source: Canalys

This downtrend continued into 2025. In the first quarter of this year, Apple's shipments were 9.2 million units, down 8% year-on-year, ranking fifth in China with a market share of 13%.

Source: Canalys

According to Apple's latest earnings data, the iPhone installed base hit a new high in 2024, but service business revenue was $26.645 billion, up 12% year-on-year. This figure did not meet analysts' expectations of $26.713 billion, and the growth rate was also lower than the 14.2% in the same period last year.

When looking at the broader environment, Apple's service business is facing dual challenges from encirclement by all parties and changes in user subscription habits.

On the one hand, the "Apple Tax," considered a "cash cow" by Cook, is being "encircled and suppressed" globally. Recently, the U.S. District Court for the Northern District of California formally ruled that external link transactions will be exempt from the "Apple Tax" in the legal dispute between Epic Games and Apple, further pointing out that Apple executives may face criminal prosecution for perjury related to the "Apple Tax," revealing cracks in Apple's moat.

Previously, the European Union has also taken regulatory action against the "Apple Tax." On April 23, the European Commission announced a fine of 500 million euros against Apple for restricting app developers from guiding users to third-party channels in its App Store. In March last year, the European Union imposed an antitrust fine of over 1.8 billion euros on Apple.

Last year, conflicts between Apple and Chinese internet companies such as Tencent escalated due to the "Apple Tax," attracting widespread attention. Apple stepped up pressure on Tencent and Douyin, requiring them to rectify their payment models.

The core of the controversy is that Apple believes WeChat and Douyin have payment loopholes that allow users and developers to bypass Apple's in-app purchase system, preventing Apple from collecting a 30% transaction commission. To ease tensions, Apple officials have publicly emphasized the outstanding performance of the Apple ecosystem in the Chinese market, trying to calm the storm.

At the end of last year, Apple released a new research report written by Associate Professor Ju Heng from the School of Business, Shanghai University of Finance and Economics. The study found that since 2019, the scale of the App Store ecosystem in China has grown by more than 100%. The developer turnover and sales facilitated by the App Store ecosystem in China have grown from 1.65 trillion yuan in 2019 to 3.76 trillion yuan in 2023.

However, all this is built on the long-term stable growth of Apple's iPhone-centric intelligent terminals in the Chinese market. If the basic shipment volume cannot be guaranteed, it will shake the determination of developers to continue to delve deeper into the Apple ecosystem. Coincidentally, 2024 marked the beginning of the decline in iPhone sales in China.

On the other hand, even without considering the "Apple Tax," from a purely commercial perspective, Apple's service business ecosystem is also being poached by various forces.

Currently, a large number of free or low-cost services are rapidly occupying the market due to their low thresholds. For example, in the video and music industries, short video platforms such as Douyin and Kuaishou meet users' fragmented entertainment needs with abundant free content; local platforms such as Tencent Music, iQIYI, and Tencent Video have a large amount of exclusive content and mature operating models, posing strong competition to Apple Music and Apple TV+, making it challenging for Apple's service business to acquire and retain new users.

In addition, in the payment field, Apple Pay has a low market share in China, with WeChat Pay and Alipay dominating due to their extensive user base, rich payment scenarios, and highly localized services. It is extremely difficult for Apple Pay to promote and cultivate user habits, making it hard to expand its market share.

02

PPT-style AI

Over the past few years, Cook's precise "knife skills" - releasing limited innovations in batches, coupled with precise pricing strategies, have always worked in the Chinese market. Even though it was criticized for "squeezing out incremental innovations," Apple was still able to stabilize the situation with brand premium and ecological advantages. However, the iPhone 16 series disrupted even this "incremental innovation" rhythm.

When Cook described the iPhone 16 as offering a "revolutionary AI experience" during the launch event, no one expected it to become Apple's biggest marketing blunder in recent years.

Months have passed, and those cool AI features are useless in the Chinese market. Consumers who spent tens of thousands of yuan on the "AI flagship" received a castrated version.

Screenshot from Apple's official online store

This downtrend continued into 2025. In the first quarter of this year, Apple's shipments were 9.2 million units, down 8% year-on-year, ranking fifth in China with a market share of 13%.

Even in some Apple flagship stores, sales consultants have learned a new script - "This AI feature needs to wait for subsequent system updates" and "Some services may be temporarily unavailable." However, in neighboring domestic phone experience stores, staff can demonstrate AI features such as intelligent voice interaction and image optimization to customers.

This contrast is too stark, leading some netizens to joke that Apple's AI is PPT-level.

The mistake in the AI strategy may be the last straw that breaks the camel's back, and the resulting chain reaction increases uncertainty about Apple's future. While the Android camp is localizing large models, Apple can only comfort its fans with "next time for sure."

This gap between expectations and reality is pushing Apple into an awkward situation - even if groundbreaking features are truly launched in the future, consumers may no longer buy it.

Market feedback may illustrate the problem. In user review sections on e-commerce platforms or Xiaohongshu, there are numerous complaints about Apple's current products, describing them as "utterly unoriginal" and "the worst ever."

In addition, many domestic brands have begun to focus on the concept of being an alternative to Apple, trying to divert the group of previously highly loyal Apple fans. Liu Zuohu, Chief Product Officer of OPPO, bluntly stated that he wants to convert Apple users and give Apple fans another choice. Furthermore, OPPO has gone a step further by applying to register the "OPhone" trademark.

News from the supply chain is also not optimistic. According to the Taiwan Economic Daily, Apple has reduced production orders for the iPhone 16 series with suppliers such as Foxconn, with a production cut of about 15%. Multiple analysis agencies predict that iPhone shipments in China for the full year of 2025 may decrease by 8 to 10 million units compared to 2024.

03

Where Are the Expectations?

Under competitive pressure, the calendar on Cook's desk seems to be speeding up.

The direction of public opinion is accelerating towards unreleased new products - it has been less than a year since the release of the iPhone 16, and the supply chain has already spread news that Apple is requiring contract manufacturers to prepare for mass production of the iPhone 17 series in advance; various messages about iPhone 17 specifications and new product release frequencies have emerged.

Furthermore, even details about Apple products that will not be released until next year are constantly being exposed. TF Securities analyst Guo Mingqi revealed in his tweet that Apple's foldable iPhone project has been accelerated, and large-size foldable phones may meet us next year, priced at over $2,000, positioning it as the highest-end iPhone; another rumor claims that the iPhone 18 Pro/Max may be equipped with under-display 3D facial recognition, and the Apple-developed A-series chips carried by the entire product line will be manufactured using 2nm process technology.

Before the new products of 2025 are released, the specifications of the next year's products have been exposed in multiple aspects. This way of "squeezing out incremental innovations" may even reduce consumers' desire to purchase, and the current new products face the risk of being stabbed in the back.

Behind this iteration lies Apple's dilemma. On the one hand, the Chinese high-end mobile phone market is undergoing a subtle shift - after Huawei returns with 5G chips, it is fulfilling its promise of being "far ahead"; Xiaomi's series of brand-boosting operations have gradually gained a foothold in the mid-to-high-end field.

The latest "Smartphone Model Sales Tracking Report" released by Counterpoint shows that the sales share of China's high-end smartphones (priced at $600, 4,350 yuan, and above) has climbed to 28% of the overall market in 2024, a significant increase from 11% in 2018. Among them, Apple, Huawei, and Xiaomi rank the top three. Although Apple occupies the top spot, its market share has dropped to 54%, the lowest point in nearly seven years, approaching the 50% mark, while Huawei is approaching its pre-"supply cut" state with a 29% share.

In late April, three major market research agencies (IDC, Canalys, Counterpoint) successively released data on China's smartphone sales and market share in the first quarter of 2025. In the statistics of IDC and Canalys, Xiaomi became the sales leader, while Counterpoint ranked Huawei at the top. Although different market research agencies gave different first-place rankings, making the top spot a "Rashomon," it reflects the strength of brands such as Huawei and Xiaomi in the Chinese local market.

In contrast, the Chinese version of the iPhone 16, with the absence of AI features, is indeed difficult to compete in its "full form." Although it was reported at the beginning of this year that Apple had reached relevant AI cooperation with Alibaba and Baidu, it has not materialized until near the midpoint of this generation of iPhone's life cycle. In the iOS 18.4 system update last month, the official mentioned the launch of Chinese-language Apple AI, but it is only available for Hong Kong and Taiwan versions of the iPhone, with the Chinese mainland version still excluded.

With high-level functions such as AI unable to be implemented, if Apple wants to stabilize the situation in the future, it can only reluctantly enter the "hardware involution" race that Huawei and Xiaomi excel at.

In the past, Apple would strictly follow the "test-improve-retest" process. Joining the hardware involution means compressing the verification cycle and putting forward new requirements and production rhythms for upstream and downstream suppliers.

Moreover, from the perspective of the practical application efficiency of hardware, Apple lags behind first-tier domestic brands. For example, ultra-thin models, foldable screens, and under-display cameras, which have recently been prevalent in the market, have mostly been pushed to the market by first-tier domestic brands. Without overwhelming innovation over competitors, Apple's accelerated technological iteration may also challenge its product quality control and brand appeal.

On the other hand, the tariff policy after Trump returned to the White House is like an invisible barrier in front of Apple. Supply chain sources revealed that to avoid tariffs, Apple has shifted some models to Vietnam for assembly. During the latest earnings call with analysts, Cook said, "If the current global tariff rates remain unchanged for the rest of the quarter and no new tariffs are added, we expect this to result in an increase in Apple's costs of $900 million in the quarter ending in June."

Today's Apple wants to maintain the earlier technology replacement frequency through "squeezing out incremental innovations" but also has to participate in hardware involution; it needs to maintain a global supply chain while also dealing with geopolitical risks. In this race against time, they seem to have fallen into the innovator's dilemma.

Some images are sourced from the internet. Please inform us for removal if there is any infringement.