Exploring China's Chip Giant: A Counterpart to NVIDIA

![]() 08/22 2025

08/22 2025

![]() 611

611

Author: Poetry and Starry Sky

ID: SingingUnderStars

My passions lie in marathon running and astrophotography. Years ago, I exhibited my photographic works in "Astronomy Enthusiast" and contributed columns to magazines like "Chinese National Astronomy".

What many outsiders may not realize is the considerable investment required for astrophotography. Besides high-sensitivity full-frame cameras and large-aperture ultra-wide-angle lenses, it necessitates high-performance computers.

For instance, this star trail photo was crafted by stacking hundreds of images captured over three hours using Photoshop. On a standard computer, this process could take hours; however, with 32GB RAM and an SSD hard drive, it only takes a few minutes.

Once, I purchased two memory sticks on JD.com, but upon opening the package to install them, I discovered that the interfaces were incompatible.

Since the advent of DDR memory, several interface standards have emerged, from DDR1 to DDR4 and DDR5, with some memory interfaces being incompatible.

To prevent issues arising from mixing incompatible memories, manufacturers have intentionally designed distinct, foolproof slots. Yet, due to their similar appearance, I struggled and couldn't insert them.

The heart of a memory stick is the memory chip, with leading manufacturers including Samsung, Hynix, Micron Technology, and the domestic rising star CXMT. The component that connects the chip to the motherboard is the memory interface.

01

Montage Technology's Sphere of Influence: Memory Interface

Since DDR2, a company with "mixed blood" has emerged as a significant player in the memory interface industry and has become a mainstay in the DDR5 era, currently setting standards.

This company is Montage Technology.

Why is it referred to as "mixed blood"? Initially, the company was established by a foreign investor, but with the company's growth and capital operations, the largest shareholder at the time of its initial public offering was a Chinese enterprise, with Intel as the second-largest shareholder, and most of the top ten shareholders were Chinese-funded.

In early 2025, Intel exited the top ten shareholders.

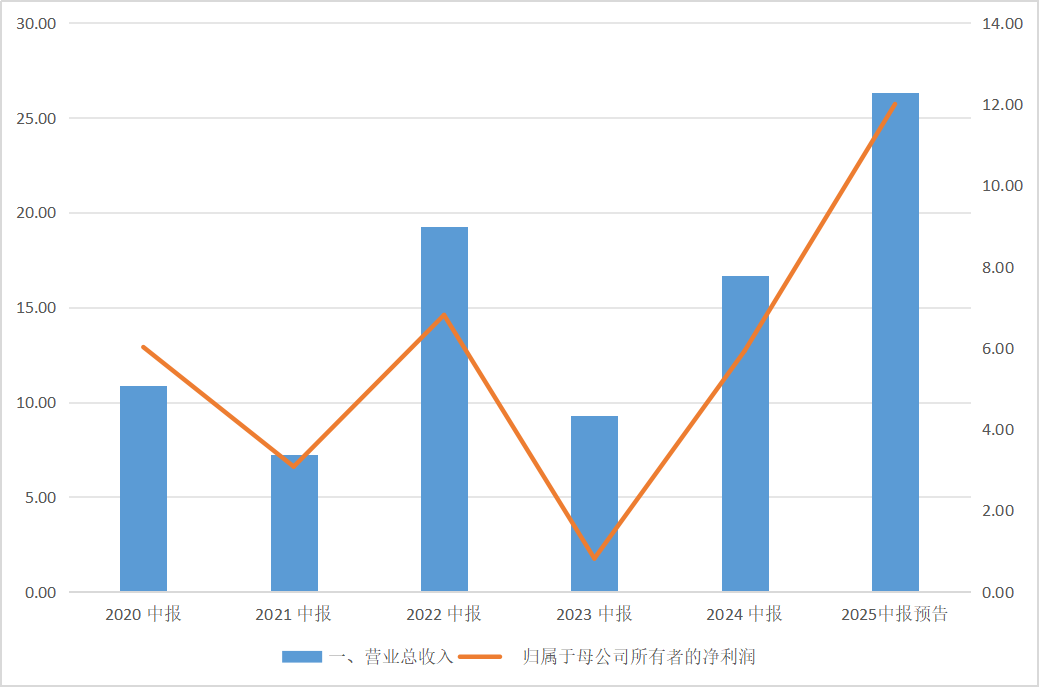

Data Source: iFind

According to the company's semi-annual report forecast, Montage Technology achieved operating revenue of approximately RMB 2.633 billion in the first half of 2025, representing a year-on-year increase of approximately 58.17%. Net profit attributable to the owners of the parent company ranged from RMB 1.100 billion to RMB 1.200 billion, an increase of 85.50% to 102.36% year-on-year.

In terms of business lines, interconnect chip sales revenue was approximately RMB 2.461 billion, a year-on-year increase of approximately 61.00%, serving as the main driver of the company's revenue growth. Among these, the combined sales revenue of high-performance transport chips (including PCIe Retimer, MRCD/MDB, and CKD products) reached RMB 294 million, a significant increase from the same period last year.

Reviewing previous years' financial reports, the company's financial performance from 2022 to 2024 displayed a "V"-shaped recovery.

In 2022, the company achieved revenue of RMB 3.672 billion, a year-on-year increase of 43.33%; in 2023, affected by market conditions, revenue fell sharply to RMB 2.286 billion, a year-on-year decrease of 37.76%; in 2024, it rebounded strongly to RMB 3.639 billion, a year-on-year increase of 59.20%.

In terms of net profit, the net profit attributable to the owners of the parent company was RMB 1.299 billion in 2022, a year-on-year increase of 56.71%; it fell sharply to RMB 451 million in 2023, a year-on-year decrease of 65.30%; and it increased significantly to RMB 1.412 billion in 2024, a year-on-year increase of 213.10%. This recovery trend is closely tied to the optimization of the company's product structure and changes in market demand.

02

AI Computing Power Extends Beyond Graphics Cards

Particularly, the demand for high-performance transport chips is primarily driven by the rapid development of the AI industry.

When discussing computing power, most individuals think of graphics cards. However, AI has revolutionized server architecture.

Recently, I've been fascinated with AI model training. Besides high demands for video memory, large models also place substantial strain on memory, often leading to memory overload.

For Montage Technology, the remarkable growth in performance in 2025 is attributed to changes in product structure in two key areas.

First, there's a surge in demand for DDR5 memory interface chips.

Montage Technology's core business centers on interconnect chips and the Hybrid CPU™ server platform. Among these, interconnect chips form the cornerstone of the business, encompassing memory interface chips, memory module supporting chips, high-performance transport chip solutions, and clock chips.

In the first half of 2025, the company's shipments of DDR5 memory interface and module supporting chips significantly increased, primarily due to the rapid advancement of the AI industry. AI servers have an escalating demand for high-bandwidth memory, and DDR5, with its high bandwidth (such as 6400MT/s) and low latency characteristics, has become a vital component to fulfill AI computing needs. As the international standard leader for DDR5 RCD chips, Montage Technology's products are increasingly being incorporated into AI server memory modules.

It's worth noting that the proportion of shipments of second-generation and third-generation RCD chips increased, further enhancing product value-added. RCD chips (Registered Clock Driver) are core logic devices in server memory modules that directly impact memory stick performance. Montage Technology has consistently maintained a leading position in the competition during the DDR5 era, with its DDR5 memory interface chip shipments surpassing those of DDR4 memory interface chips in 2024.

Second, high-performance transport chips exceeded expectations.

The company's three high-performance transport chips (PCIe Retimer, MRCD/MDB, and CKD) generated combined sales revenue of RMB 294 million, representing a significant increase of 15% year-on-year. This growth is primarily fueled by the continuous increase in demand for AI computing power.

In AI computing clusters, high-speed interconnectivity between accelerators such as GPUs and TPUs is crucial. PCIe Retimer chips enhance signal retiming, extending the distance for high-speed data transmission and improving system reliability and stability. They are key components for GPU interconnectivity in AI servers. As one of the world's two major PCIe Retimer providers, Montage Technology's products are widely utilized in AI servers.

03

Plan for Hong Kong Stock Exchange Listing

On July 11, 2025, Montage Technology officially submitted an application to the Hong Kong Stock Exchange for the issuance of overseas listed shares and listing on the Exchange.

According to the prospectus, Montage Technology's fundraising on the Hong Kong Stock Exchange will primarily be used for three areas: full interconnect chip research and development, global business expansion, and strategic investments. This funding plan is highly aligned with the company's future development direction.

In terms of research and development, the company is actively deploying cutting-edge technologies such as PCIe 6.0 Retimer chips and CXL 3.0 MXC chips to meet the continuous upgrade in AI computing power demand. In June 2025, the company announced that its MXC chip had passed the CXL 2.0 compliance test, becoming one of the first CXL 2.0 compliant suppliers, validating its technological leadership.

In terms of global business expansion, the Hong Kong Stock Exchange listing will facilitate the company's expansion into overseas markets such as Southeast Asia and Europe, enhancing its international brand influence. Additionally, Hong Kong, as an international financial center, will aid the company in attracting global investors and optimizing its capital structure.

04

Risks of Catching Up in a Competitive Market

It should be noted that Montage Technology has benefited from catching up in a competitive market.

However, the advent of the AI era has also presented competitors with an opportunity to catch up.

Globally, the memory interface chip industry is primarily shared by three major players: Montage Technology, Renesas, and Rambus. With the rapid growth in demand for AI computing power, international giants may increase their investments, intensifying market competition.

For Chinese high-tech enterprises related to chips, geopolitical risks must also be considered, which could potentially impact the company's international business expansion and supply chain stability.

While listing in Hong Kong can enhance the company's international influence, it also presents challenges in adapting to different market environments.

-END- Disclaimer: This article is based on the public attributes of listed companies and focuses on an analysis and research of information publicly disclosed by listed companies according to their legal obligations (including but not limited to interim announcements, periodic reports, and official interactive platforms). Poetry and Starry Sky strives to ensure the fairness of the content and viewpoints in the article but does not guarantee its accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and Poetry and Starry Sky will not be held responsible for any actions taken based on this article. Copyright Notice: The content of this article is original to Poetry and Starry Sky and may not be reproduced without authorization.