The ASP and Storage Costs Double Helix: Xiaomi's Mobile Phone Gross Margin Recovery Timeline

![]() 08/22 2025

08/22 2025

![]() 683

683

In previous articles, we established and validated a fundamental analysis framework for Xiaomi mobile phones:

1) Storage costs began influencing mobile phone gross margins.

2) ASP (Average Selling Price) improvement through product premiumization is key, with pricing power mitigating cost pressures.

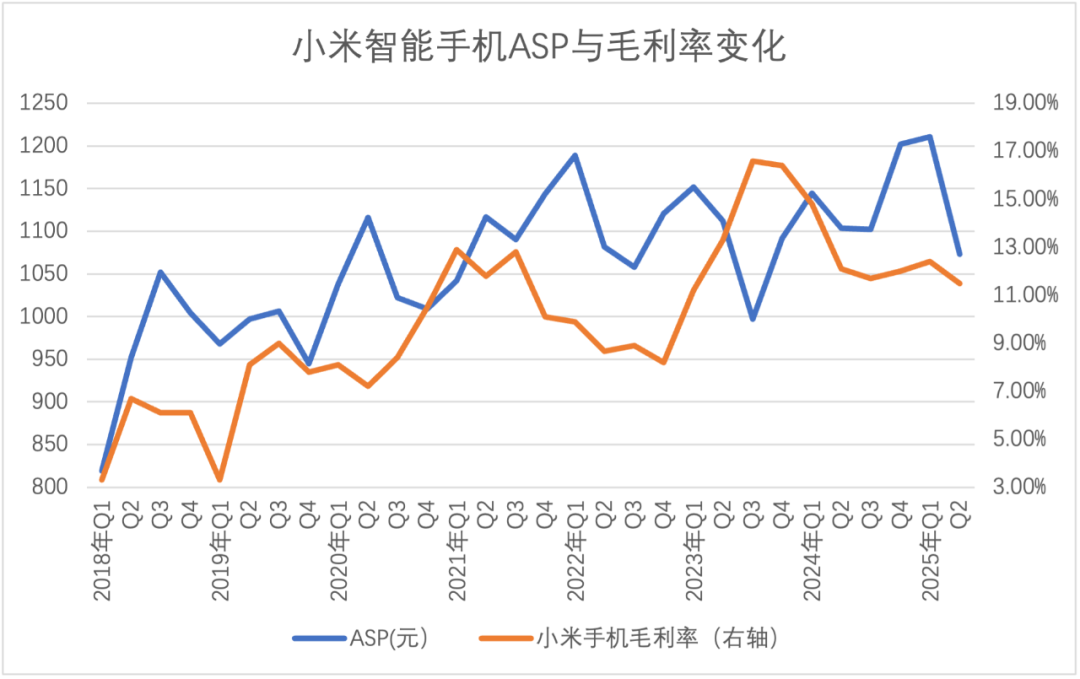

In Q2 2025, both Xiaomi's mobile phone gross margin and ASP declined, with the latter hitting a recent low, raising concerns about premiumization hurdles.

What challenges does Xiaomi face, and will its situation improve soon? The core insights of this article are:

Firstly, while Xiaomi's financial performance in this quarter seems poor based on raw numbers, a detailed analysis reveals a positive domestic market performance.

Secondly, Xiaomi's long-standing low-price strategy in overseas markets may need reevaluation.

Thirdly, Xiaomi's mobile phone gross margin improvement hinges on domestic premiumization in the short term and strategic adjustments in the long term.

Pricing-Sensitive vs. Cost-Sensitive Markets

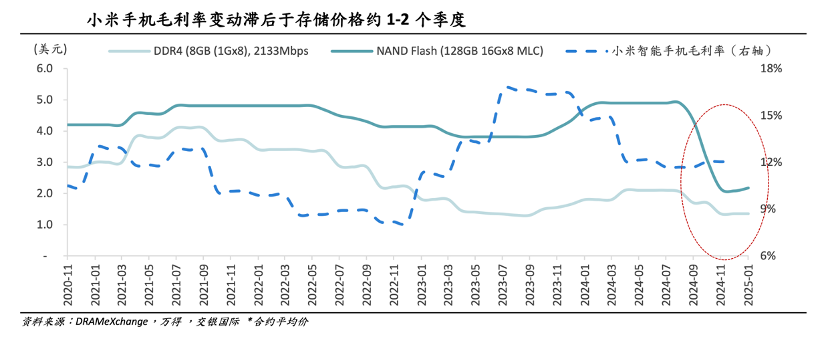

Post the AI phone trend, large-model phones spurred a new wave of replacements, fostering industry optimism. However, these phones increased storage demand, driving up costs. Consequently, Xiaomi's mobile phone gross margin became heavily reliant on storage prices.

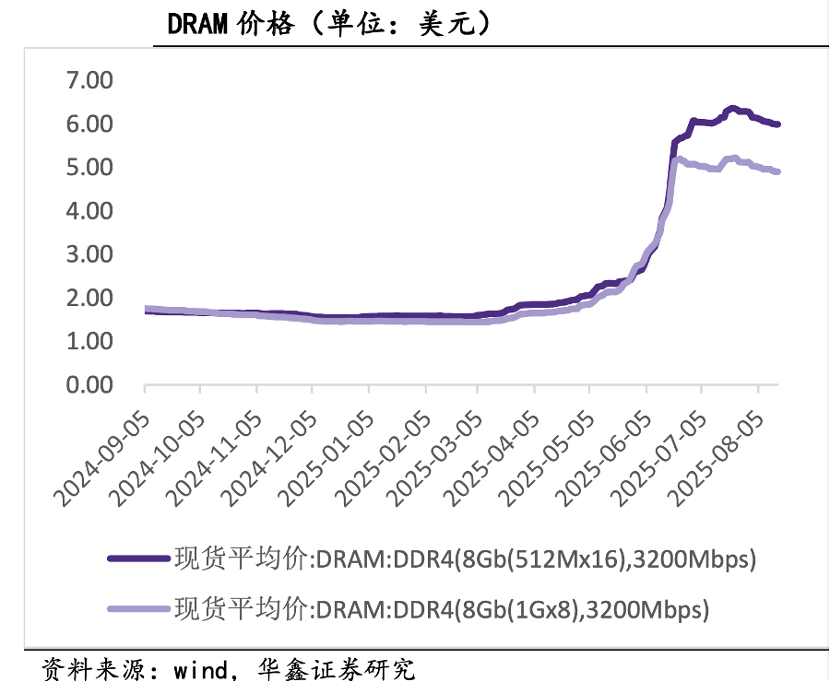

Since Q1 2025, international storage prices rebounded, disrupting Xiaomi's gross margin improvement post Q2 2024 and significantly impacting Q2 2025 operations.

From a cost perspective, this explains Xiaomi's mobile phone gross margin trend. However, a demand-side view offers a different narrative.

In a market economy, prices are determined by supply and demand. When demand outstrips supply, prices rise, enhancing profitability. Thus, ASP often reflects a company's brand competitiveness, a focus Xiaomi has shared previously.

The figure above shows Xiaomi's ASP fluctuating upwards, closely correlated with gross margin. In Q2 2025, ASP significantly corrected, yet gross margin adjusted minimally. Given weak pricing power and soaring raw material costs, gross margin should have corrected sharply. Thus, Xiaomi's mobile phones operate in two distinct environments:

Firstly, Xiaomi employs low-ASP, low-spec phones in overseas markets to gain share, exemplified by the REDMI A5 (Q1 launch, $79/$574, €99.99/$785 in Europe). This largely explains this quarter's ASP decline.

Counterpoint Research data shows global smartphone shipments grew just 3% in Q2 2025, indicating sluggish demand. Xiaomi's low ASP strategy in overseas markets is thus understandable to stabilize financial indicators.

However, these low-spec phones lack AI features and have lower hardware requirements (REDMI A5 base model with 3GB storage), minimizing cost pressures from premium hardware.

Secondly, Xiaomi pursues premiumization in the domestic market with AI phones, where rising storage costs impact this segment.

The coexistence of pricing-sensitive (overseas) and cost-sensitive (domestic) markets means the former dilutes ASP with lower cost pressures, while the latter bears higher raw material costs mitigated by pricing power through premiumization.

Our clear assessment of Xiaomi mobile phones is:

The overseas market dilutes ASP, while the domestic market should have higher gross margin and ASP. Despite a significant gross margin correction this quarter, the above logic stabilizes this indicator, preventing drastic changes.

Focus Shifting to Revenue Scale

In an investor conference call, Lu Weibing stated that "with new product launches concentrated in Q4, the mobile phone business gross margin is expected to rebound." What's the logic behind this?

From a cost perspective, high storage costs persisted from Q2 to Q3 2025, and AI phones in the domestic market faced significant cost pressures. Thus, new product launches will require aggressive pricing strategies. Discussing gross margin now hinges on "cost pass-through" ability rather than "operational efficiency".

We have no doubts about Xiaomi's competitiveness and believe operational adjustments can improve its business strategy. However, let's discuss Xiaomi's overseas business strategy.

After its meteoric rise in China, Xiaomi enthusiastically ventured overseas (achieving sales milestones in India and Eastern Europe), repeating its cost-effective model with low-priced phones to drive sales and pursue premiumization through brand education. Low prices became the key to overseas market entry.

Xiaomi's internalized pricing strategy in overseas markets reflects a path dependency.

However, overseas markets are complex and volatile, with growth paths differing from China:

1) Geopolitical factors are unpredictable, and Xiaomi's Indian market experience may not be isolated.

2) The overseas mid-to-high-end market is dominated by Apple and Samsung. Excessive low-price positioning may delay Xiaomi's brand premiumization or anchor it in the low-price segment.

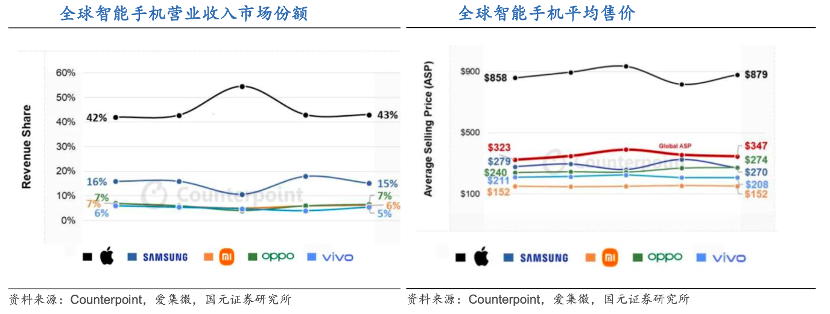

According to Counterpoint Research, Xiaomi's global mobile phone shipments account for 14% of the total, behind Samsung (20%) and Apple (17%). However, in terms of operating revenue, Xiaomi only accounts for 6%. OPPO's global ASP is $120 higher, reflecting a higher revenue market share.

This prompts us to ask: Is shipment volume or revenue scale more important?

Historically, shipment volume represented brand recognition, user base, and supply chain advantages. However, in today's saturated market, global shipments may decline. Revenue scale's importance increases, with brand premiumization, profitability, and sustainable operating capacity becoming market concerns.

As the market enters a red ocean, with large models and 5G phones failing to boost demand, enterprises prioritize profitability.

In the short term, Xiaomi's mobile phone gross margin improvement hinges on the domestic market (premiumization via high-end phones). Long-term, if Xiaomi adjusts its overseas operational pace, this indicator has greater improvement potential.

While Xiaomi's automotive business garners attention, its mobile phone business, as the foundation, should not be overlooked. This segment is crucial for stabilizing operating profits. In a complex environment, management should support the mobile phone business (market budget for brand upgrading). Short-term Q2 2025 financial report fluctuations will pass, and we eagerly await Xiaomi's future focus on ASP or cost sensitivity.