Domestic RF Industry: A Competitive Landscape

![]() 08/25 2025

08/25 2025

![]() 578

578

The domestic RF chip industry is notoriously competitive.

Recently, industry insiders noted that, according to a report by Pristine Market Insight, in 2024, foreign companies accounted for over 80% of the global market share, while no domestic RF chip company exceeded a 3% global market share. Domestic RF chips did not exceed 20% of the overall global RF market share.

So, what caused this? Let's delve into the background.

01

From Catch-Up to Dilemma

RF chips are the linchpin of wireless communication. Mobile phone calls, 5G base station signal transmission, IoT device interaction, and automotive electronic connections all rely on their ability to transmit and receive electrical signals. This "hidden champion" embedded within electronic devices has long been dominated by international giants such as Skyworks, Qorvo, and Broadcom, with domestic enterprises playing the role of "followers" for a long time.

The turning point arrived on the eve of 5G commercialization. Around 2018, the acceleration of domestic 5G construction spurred a surge in demand for RF chips. With policy support and capital inflows, a number of domestic enterprises emerged: Zosmic entered the market with RF switches and low-noise amplifiers, becoming a "dark horse" in mobile phone RF front-ends; Weijie Chuangxin focused on power amplifiers and achieved breakthroughs during the transition from 4G to 5G; Huizhi Micro aimed at integrated modules, attempting to break into the high-end market. In just a few years, domestic enterprises have transitioned from "piecemeal" discrete devices to "full-link coverage" modularization, giving the industry hope for "overtaking in curves."

However, behind the prosperity lies hidden concerns. There are over 300 domestic RF-related enterprises, with nearly 50 major participants in the mobile phone RF front-end field. But in the global market, the overall domestic share is less than 20%, and no single enterprise's share exceeds 3%. The limited pie is contested by many players, directly distorting the industry ecosystem—enterprises no longer focus on technological depth but instead engage in price wars and market share battles, thus opening the Pandora's box of "excessive competition."

According to information from the National Enterprise Bankruptcy Reorganization Case Information Network, on July 11, domestic RF chip manufacturer Wenjianlu (Zhejiang) Semiconductor Co., Ltd. (formerly known as Hangzhou Wenjianlu Technology Co., Ltd., hereinafter referred to as "Wenjianlu Semiconductor") was subject to a bankruptcy review application by Suzhou Xinneng Environmental Technology Co., Ltd.

Data shows that Wenjianlu Semiconductor was established in 2016 and is primarily engaged in the mass production of RF chips. Its founder, Sheng Jinghao, once worked at Tokyo Precision in Japan. From its inception, the company aimed to enter the 5G RF communication field, choosing to tackle high-frequency filters, one of the 35 key technologies listed by the country as bottlenecked, and following an IDM route. Its products are mainly used in mobile phones and various consumer electronics and communication facilities.

This once highly promising enterprise ultimately failed to withstand the industry's winter, and its fate reflects the "excessive competition" dilemma that the entire domestic RF field is currently mired in.

02

How Competitive Is It?

Price wars are the most intuitive manifestation of "excessive competition." In mainstream markets such as mobile phones, routers, and base stations, the competition for RF chips has become fierce due to homogenization.

Currently, domestic RF enterprises such as Zosmic, Weijie Chuangxin, and Feixiang Technology focus their business on discrete devices (such as power amplifiers (PA), RF switches, and low-noise amplifiers (LNA)) and low-integration modules in mobile phone RF front-ends. These areas have relatively low technical thresholds, making market competition among enterprises exceptionally intense. Many enterprises choose to sacrifice price for volume to seize market share, directly leading to a continuous decline in the industry's overall gross profit margin. As industry insiders describe the current competitive landscape: the price of 4G PAs has long fallen to "cabbage prices," and some manufacturers even ship products at prices below cost to maintain their market presence.

Behind the price wars lies the proliferation of homogenized products. The core competitiveness of RF chips lies in their performance indicators—subtle differences in parameters such as frequency band coverage, noise figure, linearity, and power consumption can directly affect communication quality. However, most domestic enterprises lack underlying technological accumulation and can only imitate mature products from international brands through reverse engineering, resulting in highly convergent performance parameters for RF chips on the market. "If you can do it, I can do it too, so in the end, it's all about price."

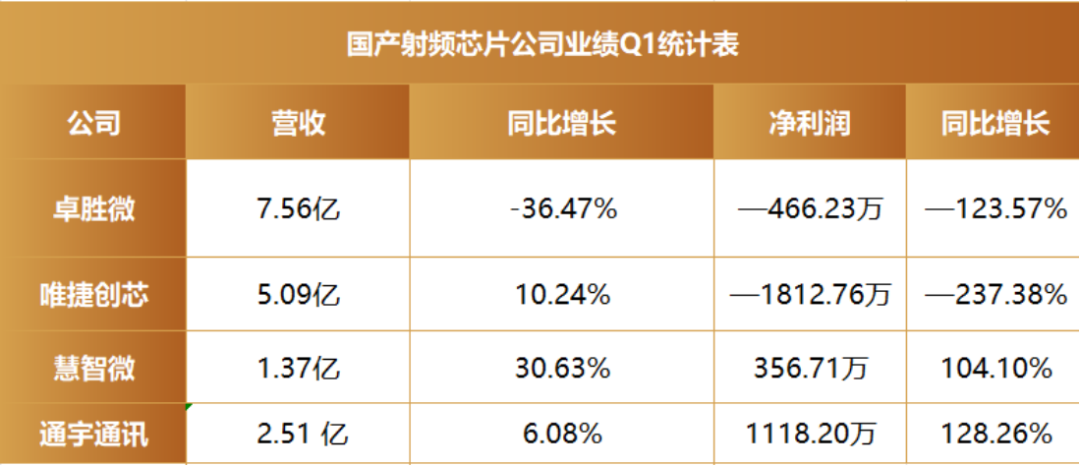

Data Source: Company Financial Reports, Semiconductor Industry Landscape Chart

Excessive competition is directly reflected in financial reports, as seen in the latest Q1 financial reports of various manufacturers. Zosmic's Q1 revenue was 756 million yuan, a year-on-year decline of 36.47%; net profit was -4.6623 million yuan, a significant year-on-year decrease of 123.57%, with both revenue and profit declining. Weijie Chuangxin's revenue was 509 million yuan, achieving a year-on-year increase of 10.24%, but net profit was -18.1276 million yuan, a year-on-year decline of 237.38%, showing a situation of increasing revenue but not profit. Huizhi Micro performed impressively with a revenue of 137 million yuan, a year-on-year increase of 30.63%; net profit was 3.5671 million yuan, a year-on-year increase of 104.1%, with both revenue and profit showing good growth. Tongyu Communications' revenue was 251 million yuan, a year-on-year increase of 6.08%; net profit was 11.1820 million yuan, a year-on-year increase of 128.26%, showing a prominent growth trend. Overall, the development of the domestic RF chip industry in Q1 was uneven, with differentiated performance among different enterprises, some showing growth and others declining, reflecting the complex competitive and developmental landscape within the industry.

Most manufacturers face common issues of low gross profit margins and difficulty in profitability. Take Onray Micro as an example; the company is still in a state of continuous loss. From 2022 to 2024, its revenue scale grew from 923 million yuan to 2.1 billion yuan, with a compound annual growth rate of 50.88%, but net losses attributable to shareholders were 290 million yuan, 450 million yuan, and 64.7092 million yuan, respectively; although the comprehensive gross profit margin increased year by year, from 17.06% to 20.22%, it was always lower than the average level of comparable companies in the same industry. As of the end of 2024, Onray Micro's cumulative uncompensated losses had reached 1.239 billion yuan. The company admitted that even after completing its initial public offering and listing, the cumulative uncompensated losses on its books may continue to exist, making it difficult to distribute cash dividends to shareholders in the short term.

Another company, Feixiang Technology, is also under performance pressure. From 2019 to 2023, the company's revenue grew significantly from 116 million yuan to 1.717 billion yuan, but it incurred cumulative losses of around 700 million yuan from 2021 to 2023, including losses of 175 million yuan in 2021, 360 million yuan in 2022, and narrowed losses of 193 million yuan in 2023. In terms of gross profit margin, its main business gross profit margins from 2021 to 2023 were 3.19%, 13.37%, and 14.07%, respectively, while the average gross profit margins of comparable companies in the same industry during the same period were 25.83% (2022) and 23.59% (2023), respectively, showing a significant gap.

However, against this backdrop, one company still delivered an outstanding performance—Zenlay Technology.

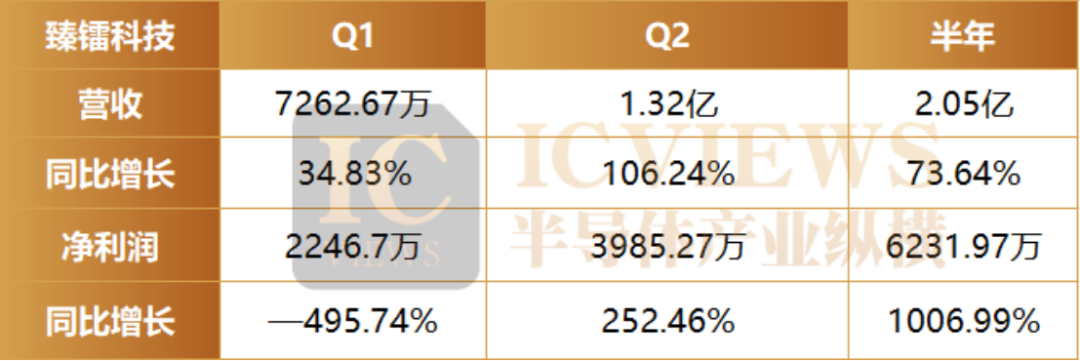

Data Source: Company Financial Reports, Semiconductor Industry Landscape Chart

Zenlay Technology's performance in the first half of 2025 exhibited significant characteristics of high growth and structural optimization. Financial report data showed that the company's revenue in the first half of the year increased by 73.64% year-on-year to 205 million yuan, and its net profit surged by 1006.99% to 62.3197 million yuan, mainly due to a substantial increase in the company's main business revenue.

Zenlay Technology stated that in the first half of 2025, facing the trend of downstream industry recovery and sustained demand, the company continued to consolidate its advantages and markets in special fields such as data links, electronic countermeasures, wireless communication terminals, new-generation radios, and phased array communications, achieving a significant year-on-year increase in orders and projects in hand; at the same time, it seized the development opportunities of strategic emerging industries such as commercial aerospace, low-altitude economy, and deep-sea technology, relying on its advanced research layout and technological barriers to proactively and deeply bind customer needs, earning good customer feedback and high recognition, resulting in significant growth in revenue and net profit.

03

What Is the Root Cause of the Competition?

The excessive competition in the domestic RF industry is not an accidental phenomenon but the result of a combination of market misjudgment, capital myopia, and technological barriers.

In recent years, the technological breakthroughs of domestic RF chips have been evident, especially in areas such as power amplifiers (PA), RF switches, and low-noise amplifiers (Switch&LNA), where the speed of technological iteration has significantly accelerated, narrowing the gap with international standards to a certain extent.

However, the landing scenarios for these technological breakthroughs are highly concentrated—a few mainstream markets such as mobile phones, routers, and base stations have become the battlegrounds for domestic manufacturers. When a limited market space is crowded with a large number of participants, and products become highly homogenized due to converging technological paths, excessive competition becomes inevitable. Ultimately, the industry easily falls into the quagmire of "price wars," forming a cycle of "technological breakthrough → market concentration → overcapacity → price competition."

Blind optimism about market size is the starting point of excessive competition. According to Yole's "RF Industry Status" report, the RF front-end (RFFE) market size will grow from $51.3 billion in 2024 to $69.7 billion in 2030, with a compound annual growth rate of 4.5%. 5G, consumer interconnectivity, and emerging 6G technologies will drive this growth, with mobile and consumer electronics dominating the RF market.

According to data released by the General Administration of Customs, the export value of integrated circuits reached $159.5 billion in 2024, surpassing mobile phones to become the single commodity with the highest export value. For a long time, the saying that "China's integrated circuit imports exceed crude oil" has been repeatedly mentioned, seemingly implying huge market space for domestic substitution. However, the RF chip market is highly segmented, with different application scenarios having significantly different requirements for performance and reliability, meaning not all import volumes can be converted into the "pie" of domestic substitution.

Taking mobile phone RF front-ends as an example, although domestic mobile phone shipments account for more than 60% of the global total, the RF modules of high-end models still rely heavily on international brands such as Skyworks and Qorvo, with domestic enterprises mainly occupying the mid-to-low-end market.

Capital myopia has accelerated the spread of excessive competition. RF chips belong to the typical field of "slow technology," with their design involving complex aspects such as high-frequency electromagnetic simulation, thermal management, and packaging processes, requiring engineers to accumulate experience through a large number of experiments. The development cycle for a mature product often takes 3-5 years. However, the domestic capital market generally pursues "quick wins" with short payback periods, often valuing and evaluating enterprises' performance on a quarterly basis. Under this pressure, enterprises have to abandon long-term research and development, instead choosing low-threshold, quick-to-market mid-to-low-end products. When all enterprises flock to the mid-to-low-end market, homogenized competition naturally intensifies, eventually forming a vicious cycle of "insufficient R&D investment → weak product competitiveness → price wars → profit decline → even more difficult R&D investment."

The difficulty in breaking through technological barriers exacerbates the dilemma of excessive competition. International giants have accumulated decades of experience, deploying thousands of patents in core areas such as filters and integrated modules, forming an impenetrable patent barrier. Take Murata as an example; it has over 5,000 patents in the SAW filter field, providing comprehensive protection from material formulations to process details. If domestic enterprises want to circumvent these patents, they need to incur huge R&D costs. More importantly, the performance of RF chips depends not only on design but also closely relates to manufacturing processes. High-end RF chip foundry capacity has long been monopolized by a few companies such as TSMC and Win Semiconductors, and there is still a gap in the process level of domestic foundries. This full-chain barrier of "design-manufacturing-patent" makes it difficult for domestic enterprises to enter the high-end market.

04

Conclusion

The domestic RF industry's intense competition is an unavoidable aspect of its growth process. It highlights the sector's vulnerabilities in market understanding, capital management, and technological foundation, prompting businesses to reassess their positions and development strategies. As the dust settles from price wars, those enterprises capable of delving into technological depths, exploring new markets, and cultivating unique advantages will undoubtedly emerge victorious in the industry's realignment.

Looking ahead, with the relentless progress of 5G infrastructure, the accelerating research into 6G, and the burgeoning markets of IoT and automotive electronics, the demand for RF chips will surge. This period of hyper-competitive strife may mark the dawn of an industry transformation—when the tide retreats, it reveals those who lack preparation, while simultaneously showcasing those who have honed the skills necessary to navigate and advance in the deep, uncharted waters of technological advancement.