Xiaomi's Complexity and Evolution

![]() 08/28 2025

08/28 2025

![]() 589

589

Source | BohuFN

Recently, Xiaomi unveiled its financial report for the second quarter of 2025, revealing a continuation of its robust performance.

The report highlights a revenue of 116 billion yuan, marking a 31% year-on-year increase, and an adjusted profit of 10.8 billion yuan, up 75% year-on-year. This not only maintains Xiaomi's previous benchmark of "100 billion in revenue and 10 billion in profit" but also sets a new record.

However, the secondary market's response was relatively muted. Post-report, Xiaomi's share price hovered around HK$52. Despite maintaining 'buy' ratings, institutions like Goldman Sachs and HSBC Research lowered their target prices for the company.

This reaction is understandable. While Xiaomi's core metrics hit new highs, some figures fell short of external expectations. For instance, analysts anticipated an adjusted profit in the range of 12-13 billion yuan for the quarter.

Furthermore, despite Xiaomi's momentum, its core businesses operate in highly saturated and competitive industries, and there has been no recent positive news comparable to the impact of Xiaomi's YU7.

The secondary market's response aptly mirrors Xiaomi's current situation.

Xiaomi's long-term stock price slump since its listing is largely attributed to the perceived ceiling for its single mobile phone business. The buoyant stock market over the past year has been fueled by Xiaomi's foray into the automotive sector, leading to brand expansion and synergistic business development. Notably, Xiaomi's full-year adjusted profit in 2022 was 8.5 billion yuan, whereas in 2025, it surpassed this figure in just one quarter.

Xiaomi can no longer be solely categorized as a mobile phone manufacturer or consumer electronics company. Compared to Apple, Xiaomi boasts a more comprehensive ecosystem advantage. Compared to automakers and other manufacturing enterprises, Xiaomi possesses stronger software capabilities and a broader brand influence.

Xiaomi's complexity ensures greater imagination but also presents more business challenges.

01 The Historical Trajectory of Premiumization

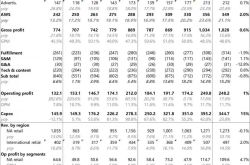

At least in the second quarter of this year, Xiaomi's mobile phone business remained its cornerstone. According to the financial report, Xiaomi's smartphone revenue for the quarter was 45.5 billion yuan, accounting for nearly 40% of total revenue.

However, this is Xiaomi's only major business that witnessed a decline. Last year, the mobile phone business revenue was 46.5 billion yuan, marking a 1 billion yuan decrease this year. Gross profit margin also declined, from 12.1% last year to 11.5% this year.

It's noteworthy that Xiaomi sold more phones in the second quarter of this year compared to last year: IDC data indicates a 3.4% year-on-year increase in domestic smartphone shipments, totaling 10.4 million units. Xiaomi's own disclosure reveals a 0.6% year-on-year increase in global shipments, approximately 42.4 million units.

So, why did sales increase but revenue decrease?

In essence, the issue lies in pricing, but not due to premiumization.

Each quarter, Xiaomi discloses two key indicators: "the proportion of high-end smartphone sales to overall smartphone sales in the Chinese market" and "market share of high-end smartphones in the Chinese market." In terms of overall sales, Xiaomi's high-end smartphone sales proportion increased by 5.5% in the second quarter compared to the same period last year, with the "4000-5000 yuan" and "5000-6000 yuan" price ranges increasing by 4.5% and 6.5%, respectively. Clearly, more consumers are willing to spend higher prices on Xiaomi phones.

The primary reason for the decrease in the average selling price of mobile phones is globalization.

Currently, domestic smartphone industry growth is entirely driven by replacement demand, akin to a zero-sum game. In the second quarter of this year, the domestic mobile phone market's overall growth was negative. Therefore, expanding overseas has become the best strategy to stabilize the mobile phone business.

Xiaomi has always been a domestic manufacturer proficient in globalization, maintaining a top-three share in the industry for years and occasionally surpassing Apple to come in second. However, global market competition has intensified over the past two years. In March of this year, Hu Boshan, COO of vivo, stated during an interview at the Boao Forum for Asia in Hainan that the company's overseas revenue accounted for over 50% of total revenue and is expected to reach 60% next year and 70% the year after. "For us, the future definitely lies in overseas markets."

Taking the Southeast Asian market as an example, Canalys data shows that Xiaomi ranked first in Southeast Asia with a 19% market share in the second quarter of this year, but its advantage is not significant. Transsion, Samsung, OPPO, and vivo ranked 2nd to 5th with market shares of 18%, 17%, 14%, and 11%, respectively.

Most user groups in emerging markets are price-sensitive. Although Xiaomi has emphasized the breakthrough of its main brand in the Southeast Asian market, such as the 54% year-on-year increase in sales of high-end models like the Xiaomi 15 series, the main force in market development still focuses on mid-to-low-end models. This has led to a decline in the average selling price of Xiaomi phones despite good progress in high-end markets both domestically and internationally. Xiaomi officially explained in its financial report that the REDMI A5, launched in April 2025, lowered the ASP in overseas markets.

However, both globalization and premiumization are essential for Xiaomi's mobile phone business: market share is the result, and premiumization is the goal.

Therefore, Xiaomi is making significant adjustments to its management team in the African market, preparing for significant growth. Additionally, Lu Weibing, president of the group, stated when forwarding a Weibo post about Xiaomi ranking first in Southeast Asian smartphone shipments, "Market share is not the most critical factor; the most critical factor is high-end models."

In overseas markets in the first half of this year, more than half of Xiaomi's smartphone sales were models priced above 600 US dollars. In mature markets such as Europe, Xiaomi proactively reduced low-end models to optimize its product mix.

In reality, the ultimate outcome of premiumization in the mobile phone industry must be a combination of hardware and software. Neither chip iterations nor system refinements can be accomplished in a short period. Until substantial progress is made in premiumization, the gross profit margin and average selling price of the mobile phone business may continue to face pressure.

02 Business Synergy Across People, Cars, and Homes

Xiaomi's financial report for this quarter included two surprises.

One is the record-high growth of the IoT business. In the second quarter, this segment generated revenue of 38.7 billion yuan, a 44.7% year-on-year increase; the gross profit margin reached 22.5%, a 2.8% year-on-year increase. The main driver of growth was major appliances, with revenue increasing by 66.2% year-on-year and 133.7% quarter-on-quarter.

The other is the significant reduction in losses in the automotive business. In Q2, Xiaomi's automotive business losses narrowed to 300 million yuan, a 40% improvement quarter-on-quarter, and the gross profit margin increased from 23.2% in Q1 to 26.4%.

Highlighting these two surprises, we can draw two conclusions.

First, Xiaomi's ecosystem momentum across people, cars, and homes is forming, and this momentum is significantly stronger than that of the single mobile phone business. Even when entering fully competitive industries, Xiaomi can siphon market share from other players through innovation, ecosystem, and brand capabilities.

The air conditioning business serves as a prime example. As a mature industry, the air conditioning industry is highly concentrated. According to AVC Revo data, the combined market share of Midea and Gree air conditioners in online and offline channels exceeded 60% in 2024.

Last year, Xiaomi's market share grew rapidly, with annual shipments exceeding 6.8 million units, an increase of over 50% year-on-year, ranking third in the industry after Midea, Gree, and Haier. Initially, Xiaomi's growth in the air conditioning market relied on a cost-effective strategy, with an average selling price of 2,353 yuan, significantly lower than Gree (3,540 yuan) and Midea (3,187 yuan).

However, entering 2025, Xiaomi began enriching its high-end product line, such as the Mijia Central Air Conditioning Pro series, comparable to Daikin. Simultaneously, it leveraged its ecosystem and technological innovation to create differentiated advantages. The financial report shows that in the first half of the year, the number of users with five or more devices connected to Xiaomi's AIoT platform reached 20 million, a 26.8% year-on-year increase.

In the second quarter of this year, even amidst heated price wars, Xiaomi's air conditioning business maintained rapid growth, with shipments exceeding 5.4 million units and a year-on-year growth rate exceeding 60%. Lu Weibing noted that the average price of Xiaomi air conditioners increased by approximately 10% in the quarter.

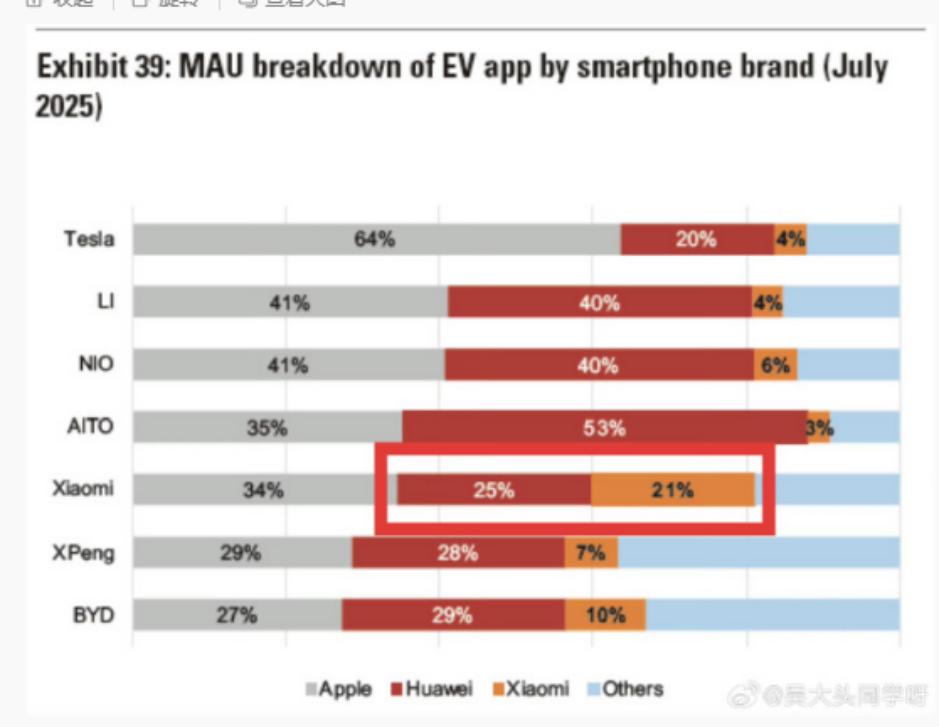

Secondly, the high-end influence brought by Xiaomi's automotive business is still strengthening. In the second quarter, the average selling price of Xiaomi automobiles exceeded 250,000 yuan (tax-included price exceeded 280,000 yuan), approaching the average price of BMW, Mercedes-Benz, and Audi in China, which is approximately 300,000 yuan. According to data previously disclosed by foreign media, among Xiaomi automobile users, only 21% use Xiaomi mobile phones, while 25% use Huawei mobile phones and 34% use Apple mobile phones.

With the automotive business leading the way, Xiaomi's various businesses are forming notable synergistic effects.

For instance, offline channels have always been a weakness for Xiaomi. Due to low channel profits, Xiaomi has struggled with offline expansion. However, following the immense popularity of Xiaomi's su7, some malls were even willing to reduce rent to one-tenth of the original price to attract traffic, significantly boosting the expansion of offline stores. As of June's end, Xiaomi had over 17,000 offline stores. Meanwhile, compared to OV's offline model, Xiaomi's new retail model, which combines online and offline, is more efficient, and the expansion of offline channels effectively supports the mobile phone and IoT businesses.

If Apple's strength lies in building an experience wall through a closed ecosystem and hardware-software integration, Xiaomi's current strength is in establishing multiple interconnected ecological strongholds within a broader scope.

03 All Eyes on Lei Jun

Understanding Xiaomi's current mobile phone business state and the synergistic effects of its ecosystem across people, cars, and homes, it's evident the challenges Xiaomi faces at this juncture.

Xiaomi's strategy of an ecosystem spanning people, cars, and homes means it's engaged in a comprehensive war. While Xiaomi can achieve rapid development in new areas through product innovation, iteration, and brand effects, when the low-hanging fruit is picked, it still must compete fiercely with industry giants. This competition spans both product-level and public opinion-level.

Taking the air conditioning industry as an example, the domestic air conditioning market's annual scale exceeds 200 billion yuan, but growth has shown signs of fatigue. Leading enterprises' net profit rates generally hover between 8% and 10%, indicating an industry efficiency ceiling. Technical accumulation and industrial chain layout are the advantages of traditional giants. Simultaneously, competitors have begun learning from Xiaomi. Fang Hongbo, chairman and CEO of Midea Group, previously stated that he had written a 100,000-word report studying Xiaomi. In terms of product lines, Midea has learned from Xiaomi to reduce the SKU of home appliance products, improving efficiency and market response speed. In terms of product positioning, a strategy combining "moving upwards" and "moving downwards" has been adopted.

This suggests that in the future, Xiaomi's businesses may inevitably encounter a situation similar to its mobile phone business – sacrificing gross profit margin to expand market share.

However, the most crucial factor is Xiaomi's own capabilities. Within its ecosystem spanning people, cars, and homes, Xiaomi has proven its capability circle – the combination of supply chain and brand capabilities allows Xiaomi to form a scale advantage in nearly all consumer electronics sectors. Once it enters the global market, the aforementioned problems will no longer be significant issues.

Therefore, ultimately, all judgments about Xiaomi must still focus on Lei Jun himself.

Xiaomi's modus operandi is to pioneer new ventures, beginning with mobile phones and branching out into a diverse range of products. From compact items like power banks, which have become staple Mi Home products, to larger industries like automobiles, which have garnered significant industry acclaim, Xiaomi consistently stirs up a "Xiaomi shock" among its competitors when entering a new sector. Many are amazed by the seamless integration of Xiaomi's automotive offerings, both in terms of product quality and promotional strategy, a true testament to Lei Jun's vision. Nevertheless, in the past, categories that fell outside Lei Jun's direct purview, such as power banks and tablets, have seen their advantages diminish, even fading into obscurity.

While Xiaomi has cultivated a highly capable senior management team, the founder's role during pivotal moments remains unmatched.

A popular joke on Weibo sums it up well: if Xiaomi has a product undergoing rapid iterative updates, it's a sign that Lei Jun is personally invested in it.

The cover image and accompanying visuals in this article belong to the respective copyright holders. Should the copyright owners believe their work is unsuitable for public viewing or should not be used without charge, please contact us promptly. We will make the necessary corrections immediately.