DingTalk introduces new strategies, while Feishu has no magic tricks

![]() 04/11 2025

04/11 2025

![]() 610

610

Whether Wu Zhao will become more extreme or broader after his return is the more decisive factor.

Author|Lan Dong Business Zhao Weiwei

At that time, the user base was the largest, and competition was fierce.

WeChat Work was about to be launched, Feishu had just been established, and Alibaba's DingTalk advertisements were plastered all over the subway stations under Tencent's headquarters building in Shenzhen. The ad copy directly mocked WeChat, "Using XX at work, you're always distracted by trivial gossip, so you keep working overtime." A month later, an advertisement mocking WeChat users for being scammed in WeChat groups was published on the front page of newspapers in South China.

This alarmed Ma Huateng, who later directly contacted Ma Yun. As a result, Ma Yun formally apologized to Ma Huateng and Tencent for the low-quality advertisement.

Eight years have passed, and the competitive landscape has been initially established.

DingTalk, WeChat Work, and Feishu share the market of office management tools. In 2023, in terms of user scale data, DingTalk ranked first, WeChat Work second, and Feishu third. Since then, none of the three have disclosed specific user scales, and instead, the focus has shifted to commercialization revenue.

From last year's commercialization data, it is difficult to distinguish the three.

WeChat Work quietly made a fortune, with its unique advantage of being integrated with WeChat being unmatched. Its revenue doubled in the fourth quarter. Industry insiders estimate that WeChat Work's revenue last year was approximately 2 billion to 3 billion yuan, making it the first to achieve profitability; After slimming down its team, Feishu also announced in advance that its software subscription revenue has reached over $300 million (2.21 billion yuan); In Alibaba's fiscal year 2025, DingTalk's subscription revenue also exceeded 3 billion yuan and is expected to achieve break-even in 2025.

Nowadays, advertisements for DingTalk and Feishu frequently appear in airports in Beijing, Shanghai, Guangzhou, and Shenzhen, which are the best places for them to accurately acquire customers.

Feishu highlights its star clientele, including DeepSeek and the Big Six, with the slogan "Advanced teams use Feishu first"; DingTalk is not to be outdone, with the slogan "In the era of AI, scientific and technological innovators choose DingTalk", featuring founders of star companies such as Stronger Brain Technology and Unitree Robotics.

Similar slogans and competing on the same stage indicate the intense competition between the two.

When DingTalk's founder Wu Zhao returns to take up the position of CEO again, Feishu's 2025 does not seem to have a magical trick up its sleeve, but a good strategist does not rely on brilliant moves, referring to the stability and sustainability of strategy. From AI evolution at the product level to customer competition at the market level, DingTalk and Feishu are undoubtedly important players in the market.

Wu Zhao's return, targeting Feishu?

On March 31, news broke that Wu Zhao had taken up the position of CEO of DingTalk, and just three days later, news came that DingTalk was undergoing changes to return to its entrepreneurial roots.

Efforts were made to overhaul attendance, enforce work discipline, hold morning meetings and evening summaries, prohibit the use of social media products such as Xiaohongshu and WeChat during working hours, have technical staff personally write code, learn Python, and when encountering others requesting to add WeChat, "Sorry, I only have DingTalk"... It can only be said that this series of operations is very much in line with Wu Zhao's extreme and obsessive style.

What kind of situation does Wu Zhao face upon his return to DingTalk? Undoubtedly, it is AI transformation and intensifying competition.

AI is Alibaba's main direction. Alibaba's investment in AI and cloud infrastructure over the next three years will exceed the sum of the past decade. In the past period, Alibaba's Quark has become a prominent star in the AI strategy. While Quark's AI search is To C, DingTalk is the best candidate for To B, along with Gaode, serving as the testing ground for Alibaba's AI strategy to land on the enterprise side. At the same time, AI tools can also drive the growth of Alibaba Cloud.

How effective is DingTalk's embrace of AI?

From a timeline perspective, it cannot be said to be inactive. In 2023, DingTalk integrated Tongyi Qianwen, which had just been launched, and launched AI functions such as the Magic Wand by transforming products through large models; In 2024, DingTalk officially launched the AI Assistant Market (AI Agent Store), with the first batch introducing over 200 AI assistants covering categories such as enterprise services, industry applications, efficiency tools, finance and tax legal services, education and learning, lifestyle, and entertainment.

In the popular year of 2025 for DeepSeek, DingTalk also actively embraced this trend by providing users with different parameter versions of the DeepSeek model to use.

Technologically, DingTalk keeps up with AI trends, but how about its commercialization capabilities? DingTalk may currently be in a situation of being large but not strong.

This large but not strong situation is relative to Feishu. DingTalk has over 25 million enterprise organizations and over 700 million users, while Feishu's user base is much smaller, with an unofficially announced monthly active user (MAU) of approximately 12 million. However, Feishu's annual subscription revenue in 2024 has exceeded $300 million, an increase of 50% from 2023. In contrast, DingTalk's annual subscription revenue is at a level of over 3 billion yuan, with a small gap in commercialization revenue.

"Feishu has a higher average revenue per user (ARPU), and customers pay for its products and services, especially in serving medium and large enterprises, where it has strong capabilities. In contrast, many DingTalk users are on the free version, and many customers do not bring value," an industry insider revealed.

Feishu's product capabilities are one of the reasons prompting DingTalk users to migrate. Industry insiders revealed that although Feishu's paid prices are higher than DingTalk's, many enterprise users prefer to use Feishu Docs and Spreadsheets, which are more cost-effective than DingTalk + Shimo Docs, so they choose to switch from DingTalk to Feishu.

In addition, Jiemian has reported that in the past six months, DingTalk and Feishu have been poaching each other's clients. Multiple retail and consumer brands such as Eifini, Insta360, and Haoxianglai have migrated from DingTalk to Feishu, while brands such as Best Express, Lierda, and Weimai have migrated from Feishu to DingTalk.

Therefore, upon his return to DingTalk, Wu Zhao faces a situation where scaled expansion is giving way to commercial competition, and the up-and-coming Feishu is undoubtedly one of DingTalk's strongest competitors.

As early as the 2023 DingTalk Ecosystem Conference, Wu Zhao, as a guest, proposed three suggestions: making DingTalk smaller, better, and cooler. "Smaller DingTalk" refers importantly to serving the vast number of micro, small, and medium-sized enterprises, supporting 52 million micro, small, and medium-sized enterprises and 7 million new enterprises each year.

This is a return to DingTalk's entrepreneurial origins and certainly a development approach that distinguishes it from Feishu's pursuit of star companies and large corporations. However, in fact, large and small companies are not the main contradiction in DingTalk's development. At that time, micro and small enterprises already accounted for 58% of DingTalk's commercial clients, a figure that cannot be considered low.

Where is DingTalk heading?

With Wu Zhao's return, DingTalk will definitely undergo changes. Strict attendance and restrictions on the use of WeChat are only superficial changes. The deeper issue is what new and greater changes DingTalk will bring at the team, product, and commercialization levels? This will obviously require a longer time to observe, and there is a sequence to it.

Team changes will definitely come first. On social media, there was once a prophecy circulated by a former Alibaba employee about the future changes of DingTalk: attributing all problems to the predecessor, using change as an excuse to replace the team with one's own people, sidelining those who are not one's own, and setting them a radical KPI. After half a year, the organization will be restructured, returning to the initial structure, with a conservative KPI. The lack of product growth before was due to the predecessor's incompetence, and now the lack of growth is due to a more pragmatic focus on product quality.

This prophecy is only half right because such changes are not uncommon in business history, especially for founders with distinctive personalities. Prioritizing personnel arrangements and adjustments, or "people before things," is bound to happen.

When Steve Jobs returned to Apple after an absence of 10 years, the first thing he did was to install friends he brought from NeXT into senior management positions, and the second thing was to focus on the disorganized product line and dismantle many projects left by his predecessor. Of course, the more important change was Jobs himself. After 10 years of experience, he was no longer the overly aggressive and impatient personality he once was. He was more willing to follow his intuition and take a slow path.

Therefore, behind the changes in DingTalk's organizational team, there must be changes in the founder himself. Whether founder Wu Zhao becomes more extreme or broader is the more decisive factor.

At the product level, DingTalk will definitely become more intelligent and do a good job of integrating large models with DingTalk's existing ecosystem. This is in line with Alibaba's current bet on AI and represents the room for improvement for DingTalk in competition with products such as Feishu and WeChat Work.

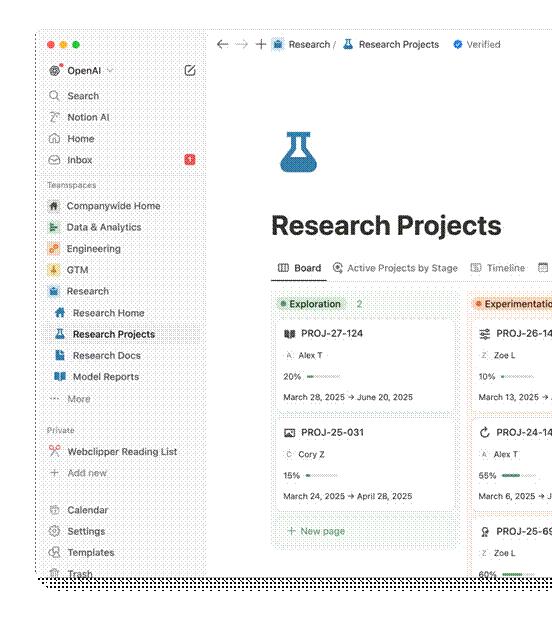

Taking the overseas office product Notion as an example, it launched a new Notion AI last year, and now OpenAI has become its latest showcased customer case.

From project research, engineering, to launch, OpenAI uses Notion to transform shared knowledge into faster workflows. Collaboration makes knowledge more actionable, thereby accelerating collaboration, decision-making, and product development for products like GPT-4. OpenAI's researchers use Notion to document experiments and track progress in real-time, customizing their work with the panel, list, or timeline view that best suits their process.

The core point is project management. OpenAI's researchers seamlessly connect plans and discoveries to product development, mobilizing relevant software to solve problems. "Their work outcomes are directly communicated with engineers and project managers and connected with specialized tools used by the team (such as GitHub and Linear). Ultimately, it forms a collaborative and searchable hub that helps the team quickly build on each other's work and jointly accelerate progress."

Looking at the core point of Notion's rise, it caters to the working methods of younger generations. It has a user-friendly interface, simple operation, and can be mixed and matched like building blocks to create personalized workspaces. The potential brought by AI further enhances its functions, helping users edit and translate, and also possesses powerful analysis and service capabilities.

Capturing the needs of younger users may be the greatest inspiration that Notion, which does not rely on brilliant moves, brings to DingTalk.

Notion's founder Ivan Zhao once mentioned, "The biggest wave is the intergenerational wave." Compared to office products like Microsoft and Google that serve the previous generation, Notion is simpler and more focused on serving college students because simplicity remains unchanged. The core demand of office work is to easily complete tasks. They will develop habits in Notion and apply these habits to their future work.

This may also be one of the reasons why Feishu has captured users' minds in the past few years. Enterprise service software is no longer sales-driven but more product-capability-driven. When users truly like a product, they will start to advocate for the service software and make purchasing decisions. High user satisfaction leads to stronger user stickiness.

This is also a possibility for DingTalk's future development. Can it capture the younger generation in the intergenerational wave and deeply understand what they want and don't want?