Breaking News! Huawei and Xiaomi Invest in 8.5 Billion RMB Super Unicorn in Beijing's Haidian District

![]() 04/11 2025

04/11 2025

![]() 578

578

The global wave of 5G communication is sweeping in, propelling a surge in demand for RF chips in smartphones and IoT devices. This racetrack, long dominated by international giants like Broadcom and Qualcomm, is now witnessing a "Chinese breakthrough battle" quietly unfold.

On March 28, 2025, Onsemi's application for an IPO on the STAR Market was accepted, aiming to raise 2.067 billion RMB for the R&D of 5G RF modules and IoT chips.

As the third-largest domestic RF front-end chip design enterprise, Onsemi has secured backing from both Huawei's Haibo Investment and Xiaomi's Yangtze River Industrial Fund, each holding 4.16% of shares, with annual chip shipments exceeding 1 billion units.

Its self-developed 5G PA chips have pioneered large-scale mass production shipments for flagship models of mainstream mobile phone brand customers, freeing them from their absolute dependence on American giants like Skyworks and Qorvo.

According to the "2024 Hurun Global Unicorn Index" released on April 9, 2024, Onsemi's valuation reached 8.5 billion RMB, ranking 976th on the list.

- 01 -

Breaking Through the "Choking Point" of Technology

Qian Yongxue, the leader of Onsemi, graduated from the Physics Department of Hunan University in 1999 and later obtained a master's degree in Microelectronics and Solid-State Electronics from the Institute of Microelectronics of the Chinese Academy of Sciences. He is renowned as a pivotal figure in the technological breakthrough of domestic chips.

During his tenure at RDIC, known as the "Huangpu Military Academy of Chinese chips," Qian Yongxue led his team to launch the first domestic 2G RF power amplifier chip amid overseas manufacturers' "choking" of RF technology.

In 2012, Qian Yongxue and his technical partner Yang Qinghua jointly founded Zhongke Hantianxia (later renamed Onsemi).

With its flagship product, CMOS PA, Onsemi has accumulated deep PA analog technology. As an established domestic PA design manufacturer, its 3G series products achieved a monthly shipment volume of over 8 million units as early as 2015, securing the highest domestic market share.

Amid the 5G wave, Onsemi focuses on R&D for RF front-end chips and IoT SoC chips. Its 5G L-PAMiD module was the first to be mass-produced and shipped in flagship models such as Honor and Samsung, breaking the monopoly of high-end RF modules by international manufacturers like Skyworks and Qorvo, and enabling domestic chips to firmly establish themselves in the supply chains of the world's top ten mobile phone brands (excluding Apple).

Currently, Onsemi's headquarters is located in Haidian, Beijing, with R&D centers in Shanghai, Shenzhen, Guangzhou, Dalian, Xi'an, and Hong Kong, China, sales/technical support centers in Shanghai, Shenzhen, South Korea, etc., and an operation center in Suzhou.

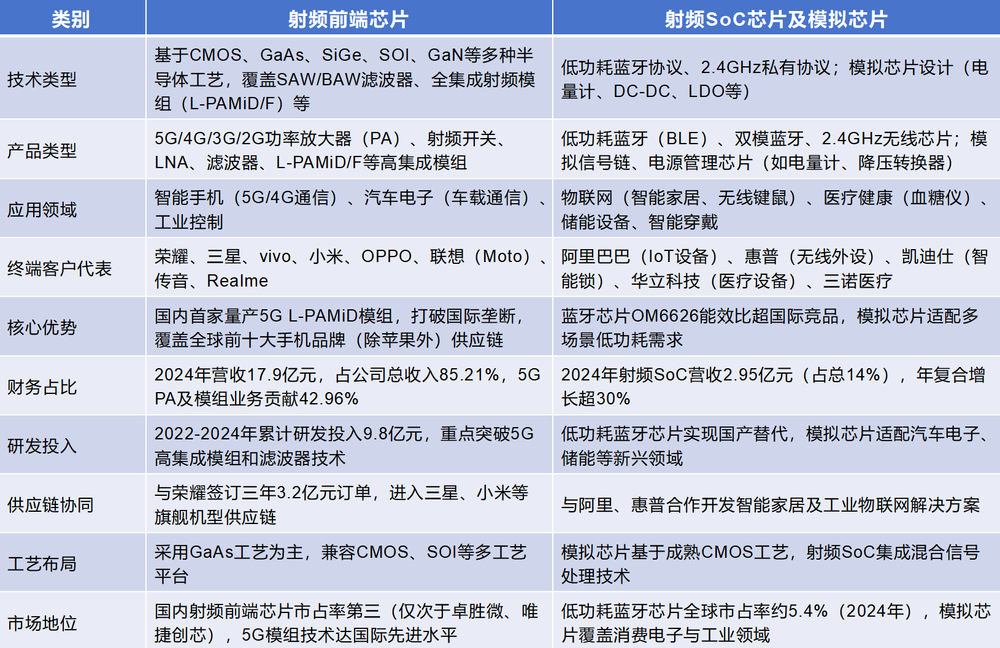

Overview of Onsemi's Business Chart.

Caption: The table compares the technical, product, and market differences between RF front-end chips and RF SoC/analog chips, drawing data from the prospectus and public information.

- 02 -

Rare 13 Rounds of Funding

With a rapid growth rate of 50.88% compound annual growth rate, Onsemi achieved revenue of 2.101 billion RMB in 2024, of which the RF front-end business contributed 1.79 billion RMB, ranking third domestically after Zosmic and Weijiechuangxin.

Moreover, its RF SoC chip products have been introduced to well-known industrial, medical, and IoT customers such as Alibaba, Xiaomi, HP, Kaadas, Holley Technology, and Sunray Medical.

Compared to the nRF52832 of renowned peer company Nordic, Onsemi's OM6626 RF SoC chip outperforms the competitor in both transmit and receive power consumption, with a lower sleep current.

The capital market's favor has fueled this hard technology enterprise. Starting with a 3 million RMB angel round investment from Guoke Investment in 2013, Onsemi has successfully completed 13 rounds of funding.

In 2020, it welcomed the "double star blessing" of Xiaomi's Yangtze River Industrial Fund and Huawei's Haibo Investment, each holding 4.16% of shares, ranking as the fifth and sixth largest shareholders, respectively, fostering an ecological synergy of "terminal manufacturers + chip design." The entry of leading institutions such as Shenzhen Capital Group and Legend Capital has also provided ample funding for technological R&D.

- 03 -

Huawei and Xiaomi's Strategies

The entry of Huawei's Haibo Investment and Xiaomi's Yangtze River Industrial Fund into this seemingly parallel industrial capital layout actually underpins the deep strategies of these two technology giants in supply chain competition.

Huawei aims to enhance the autonomy and controllability of the semiconductor industry chain, reducing its dependence on overseas suppliers.

Especially amidst U.S. technology blockades, supporting local enterprises like Onsemi can accelerate the breakthrough of domestic RF chips in high-end markets (such as 5G PAMiD modules) and provide more suitable localized solutions for its base stations and terminal devices.

Xiaomi focuses on supply chain security and cost optimization.

By deepening cooperation with Onsemi through capital ties, it ensures a stable supply of RF chips for its smartphones and IoT devices, consolidating its market competitiveness with Onsemi's cost-effective products (such as RF front-end modules with 30% increased integration and 20% reduced power consumption).

Additionally, both parties target the growth potential of the RF front-end market.

According to Gartner's prediction, the global market size will reach 21 billion USD in 2026, with a compound annual growth rate of 8.3%. Currently, domestic manufacturers have a market share of less than 15%, leaving significant room for substitution.

With the global semiconductor supply chain being reconstructed, Huawei's Haibo Investment has funded over 40 chip companies in the past three years, building an autonomous and controllable industry chain through the "order + capital" model. Xiaomi's Yangtze River Industrial Fund has improved its ecological layout by investing in over 80 semiconductor enterprises.

As the third-largest domestic RF front-end chip design enterprise, Onsemi had a global market share of 1.22% in 2024, and its 5G RF front-end chips continue to gain increasing penetration in brands such as Xiaomi and vivo, resonating with the expansion of Huawei and Xiaomi in the 5G terminal market.

Furthermore, Onsemi's layout in automotive-grade chips and the IoT field aligns with Huawei's "1+8+N" all-scenario strategy and Xiaomi's IoT ecological needs, enabling both parties to achieve technological synergy and market sharing through capital ties.

- 04 -

The Challenge of Blood Formation in China's Semiconductor Industry

The capital feast cannot conceal the industrial dilemma.

Despite Onsemi's three-year revenue compound growth rate exceeding 50%, its cumulative losses from 2022 to 2024 exceeded 800 million RMB, and its gross profit margin of 20.22% remains weak compared to the over 40% level of international giants, reflecting the predicament of domestic chips being "technologically caught up but still trapped in foundry shackles".

Its GaAs process relies on Win Semiconductors for foundry services, with the cost per wafer being 17% higher than Skyworks' self-built production line. Orders from Huawei and Xiaomi have not yet formed a scale effect, with the top five customers accounting for around 70% of concentration.

The semiconductor industry to which Onsemi belongs grapples with common issues at the technical, ecological, and capital levels.

Technically, 70% of domestic enterprises still use processes above 0.35 microns, the localization rate of EDA tools is less than 5%, and the number of RF front-end chip patents is only 1/20 of that of the United States. Ecologically, most enterprises in the industry are foundries, with the cost per chip being 17% higher than that of self-production lines, and the localization rate of materials such as photoresist and large silicon wafers is less than 15%. Capital-wise, the average R&D intensity of semiconductor enterprises is only 8.3%, less than half of that in the United States, and SMIC's R&D investment of 1.7 billion USD is only 1/13 of Intel's.

This status quo of "low R&D investment, fragile supply chain, and large technological generation gap" keeps the industry trapped in a vicious circle of "the more it chases, the more it loses".

Onsemi's financial difficulties (cumulative uncompensated losses of 1.2 billion RMB) mirror the blood formation challenges faced by the entire industry.

Firstly, the sunk costs of early-stage R&D are enormous, and it takes 3-4 years of continuous investment before mass production of its 5G L-PAMiD chips. Secondly, price wars compress profit margins, such as the 30% price reduction by international manufacturers like TI, which directly led to annual losses for local enterprises like Nuovo-Micro.

Furthermore, the cooling of the capital market has narrowed financing channels, with the financing scale of chip startups in 2024 plummeting by 60% year-on-year.

This characteristic of "high investment - slow return," coupled with the patent barriers of international giants (the average annual patent application volume of the top 5 semiconductor enterprises globally exceeds 5,000), means that even high-quality enterprises receiving strategic investments from Huawei/Xiaomi need to endure a loss cycle of up to 10 years before realizing technological transformation.

However, it's worth noting that with the deepening of domestic substitution policies (such as the "14th Five-Year Plan" setting a semiconductor self-sufficiency rate target of 70%) and the continuous expansion of the domestic demand market (estimated to reach 21 billion USD by 2026 alone for the RF front-end market), Onsemi and other companies with full-standard technical capabilities are embracing a historic window of opportunity.

The content of this article is for reference only and does not constitute any investment advice. This article refers to relevant content from Gelonghui, Lieyunwang, Smart Communication Positioning Circle, Electronic Enthusiast Network, and Market Value Finance during its creation, and expresses gratitude to them. The images are sourced from WeChat images.