Which US Goods Will Be Affected by China's Additional Tariffs?

![]() 04/11 2025

04/11 2025

![]() 587

587

Which categories are heavily reliant on the US?

On April 10, Trump again reneged, suspending reciprocal tariff policies on other countries while retaining an additional 10% tariff, but imposing an additional 125% tariff on China on top of the previous 20%, totaling 145%.

In response, we naturally imposed an additional 84% tariff on goods originating from the US.

Trump's capricious nature aside, his actions raise suspicions of insider trading. Online reports indicate abnormal options trading in the US stock market before his tweet, with massive purchases of SPY and other call options, resulting in some options soaring by 2100%.

Let's set that aside for now and focus on which US goods will be affected by these tariffs.

According to DeepSeek, based on trade data from 2024 and early 2025, China's major imports from the US are concentrated in the following five core areas:

I. Mechanical and Electronic Products (23.17%)

- Integrated Circuits: 83.9 billion yuan (about $11.8 billion), accounting for 7.21%, mainly for domestic demand for high-end chips.

- Semiconductor Manufacturing Equipment and Components: 31.9 billion yuan (about $4.5 billion), reflecting the domestic semiconductor industry's reliance on US technology.

- Other segments: Including engines and parts (53.2 billion yuan), valves/bearings (14.675 billion yuan), etc., involving industrial manufacturing and precision processing.

II. Agricultural and Sideline Food Products (16.33%)

- Yellow Soybeans: 85.648 billion yuan (about $12 billion), accounting for 7.36%, with an import volume of 22.1342 million tons, a crucial source for China's soybean crushing and feed production.

- Meat: Mainly pork and beef, with imports of 21.617 billion yuan, accounting for 1.86%.

- Cotton: 13.18 billion yuan (about $1.85 billion), accounting for 11.4% of domestic consumption, mainly used in the textile industry.

III. Energy Products (14.12%)

- Liquefied Propane/Butane: 82.744 billion yuan (about $11.7 billion), accounting for 7.11%, primarily used as chemical raw materials and civilian gas.

- Crude Oil: 42.853 billion yuan (about $6 billion), accounting for 3.68%, with an import volume of about 9.64 million tons.

- Liquefied Natural Gas (LNG): 17.18 billion yuan ($2.4 billion), supplementing domestic energy demand.

IV. Chemicals and Chemical Products (12.62%)

- Organic/Inorganic Chemicals: 44.7 billion yuan (about $6.3 billion), used in medicine and industrial raw materials.

- Pharmaceutical Chemicals: Mainly vaccines and sera, with imports of 40.1 billion yuan (about $5.7 billion), indicating the medical industry's reliance on US technology.

V. Transport Equipment (9.33%)

- Civil Aircraft and Parts: 37.022 billion yuan (about $5.2 billion), mainly Boeing aircraft.

- Off-road Vehicles/Cars: 51.707 billion yuan (about $7.3 billion), with an import volume of 105,500 vehicles, meeting demand for high-end automobiles.

VI. Other Important Categories

- Precision Instruments: 83.9 billion yuan (about $11.8 billion), covering medical equipment (such as MRI, gene sequencers) and scientific research instruments.

- Plastic/Rubber Products: 78.7 billion yuan (about $11.1 billion), used in manufacturing and packaging industries.

Supplementary Explanation

China's imports from the US emphasize both resource-based commodities and high-tech products. While some commodities (like soybeans and energy) can be replaced by countries like Brazil and Russia, high-end chips and aerospace engine fields still rely on US technology. The recent Sino-US tariff dispute may increase the prices of some imported goods, but in the long run, China is diversifying its supply chain to mitigate risks.

For specific commodity amounts or detailed data, please refer to the General Administration of Customs or relevant trade reports.

The above is the answer from DeepSeek.

Overall, there is a significant dependence on US precision instruments, components, high-end chips, vaccines/sera, etc. The industry should strive for localization, but this will take time. Let's delve into a few key points.

1. High-End Chips

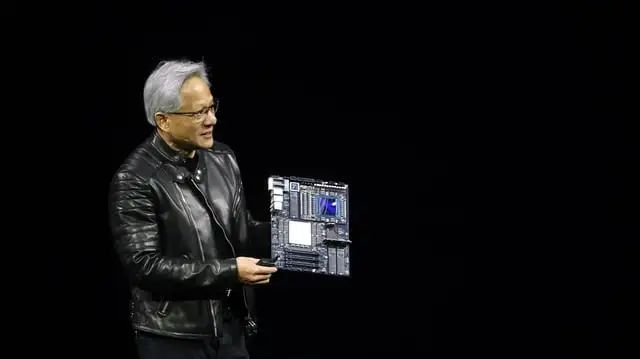

The situation is evolving rapidly. Despite bipartisan pressure to strengthen technology export restrictions, the Trump administration chose to compromise. After a private dinner at Mar-a-Lago, the administration suddenly halted export restrictions on NVIDIA's latest AI chip, H20, shocking the world.

It's said that NVIDIA CEO Jen-Hsun Huang attended this high-stakes fundraising dinner and promised to expand investment in AI data centers in the US, potentially swaying Trump's decision.

While the H20 chip has been downgraded for export to China, it still outperforms most domestic AI chips. In the first quarter of this year, $16 billion worth of H20 inventory was hastily purchased.

Is this a victory for Chinese tech enterprises? Perhaps in the short term, but definitely not in the long run, as it limits China's independent R&D progress.

Moreover, tariffs alone cannot effectively control chip exports. Powerful enterprises can buy chips in third countries and train locally, making continued sales more beneficial.

According to the State Council Tariff Commission, starting from April 10, 2025, all imported chips originating from the US will be subject to an additional 34% tariff on top of the current rate. This policy applies to the entire territory of China, including the Hainan Free Trade Port, with exemptions for goods shipped before April 10, 2025, and imported before May 13, 2025.

In international trade rules, the origin of chips is determined by the source of their core technology for design and development, not solely by the final assembly location. Therefore, chips like NVIDIA's AI chips, Apple's A-series chips, and Qualcomm's Snapdragon chips, despite being manufactured in Taiwan or South Korea, are still considered US origin and subject to additional tariffs.

This policy underscores China's intent to control its dependence on US chips.

2. Energy and Automobiles

China can reduce imports or source from other countries. Domestic automobiles are also competitive, minimizing the impact, though high-end imported cars may be affected.

3. Agricultural Products

These may significantly impact ordinary people as China is a major agricultural consumer. There is still a high dependence on the US for soybeans, cotton, and sorghum.

However, since sorghum can be partially replaced by corn in feed, the expected increase is limited, potentially benefiting corn consumption in the short term.

Imported soybeans are crucial for protein feed. After the 2018 trade war, soybean meal reduction and replacement were promoted, reducing dependence on US soybean imports. In 2024, US soybean imports dropped to 21%, while Brazil's share reached 71%, a record high. Future imports from Brazil may increase further, while those from the US decrease.

This may temporarily raise breeding costs, driving up meat prices, but the effect will take time to reach consumers.

It also presents investment opportunities for the domestic breeding and seed industry, as well as local pet food substitution.

Prices of US imported meat in some supermarkets will rise, but there are many substitutes, and imported beef increasingly comes from countries like Argentina.

4. Medical Devices

Rumors of increased import costs for devices like Thermage leading to price hikes may be merchant tactics to raise prices. Such service users are in the minority, not affecting the overall trend.

5. Pharmaceutical Drugs

The specific number of US originator drugs that have won bids in centralized procurement is not fully disclosed, but multiple varieties from companies like Pfizer and Johnson & Johnson have participated and won. With the centralized procurement policy, the proportion of US originator drugs in public hospitals has declined. Those not winning bids continue to circulate through e-commerce platforms, private hospitals, or cross-border pharmaceutical e-commerce to meet high-end demand. Price increases depend on market conditions.

For example, Azithromycin (Zithromax) by Pfizer (now Mylan) saw its generic drug price fall to as low as 3 yuan per box after centralized procurement, gradually withdrawing from public hospitals. Ibuprofen Suspension (Motrin) by Johnson & Johnson has annual sales of 50 million yuan through e-commerce channels.

These originator drugs have corresponding generic alternatives with lower costs, minimally impacting medical insurance and user consumption. In cases requiring originator drugs, it depends on insurance coverage and reimbursement ratios.

The above analysis assumes tariff policies remain unchanged. Changes will alter the logic accordingly.

What other commodity prices do you foresee changing significantly? Share your thoughts in the comments.

Reference Materials: