European Auto Market | Germany in August 2025: Volkswagen Holds Its Ground, Chinese Brands Make Steady Inroads

![]() 09/11 2025

09/11 2025

![]() 576

576

Compiled by Zhineng Technology

In August 2025, the German new car market witnessed a 5% year-on-year growth, with sales reaching 207,000 units. Electric vehicles (EVs) shone brightly, recording a 45.7% sales increase and capturing 19% of the total market share.

Volkswagen continues to dominate with a range of popular models, while premium local brands like BMW and Audi maintain steady performances. Meanwhile, brands such as Opel, Hyundai, and Toyota encounter certain hurdles.

Chinese automakers are making significant strides, with BYD, Leapmotor, SAIC MG, and XPeng gradually establishing their presence in the German market.

01

German Market Overview

In August 2025, Germany's passenger car sales climbed to 207,229 units, marking a 5% increase from the previous year. Although this reflects an improvement over 2024, it still lags far behind the pre-pandemic levels of 2019, with monthly sales down by 34%. Cumulative sales for the first eight months stood at over 1.87 million units, showing a 1.7% decrease year-on-year.

EVs emerged as a standout segment, with 39,367 units sold in August, a 45.7% surge, accounting for 19% of the total sales. Cumulative sales for the first eight months reached 337,000 units, representing an 18% market share.

By Brand:

◎ Volkswagen led the pack with 37,467 units sold, accounting for 18.1% of the market, maintaining its top position with growth aligned with the overall market trend.

◎ Mercedes-Benz sold 19,148 units, experiencing a slight decline and capturing 9.2% of the market.

◎ BMW and Audi witnessed growth exceeding 15%, with market shares of 9% and 7.4%, respectively.

◎ Skoda remained relatively stable but saw minimal growth, slipping slightly in the rankings.

◎ Opel faced a nearly 10% decline, while Hyundai, Toyota, and SEAT also recorded slight drops.

◎ Notably, the Spanish brand CUPRA performed exceptionally well, with a 73% year-on-year increase, securing a leading position outside the top ten.

By Model:

◎ The Volkswagen T-Roc topped the monthly sales chart with 7,001 units, maintaining its lead through clearance discounts, with cumulative sales nearing those of the Golf.

◎ The Golf followed with 4,632 units sold, ranking second.

◎ The Tiguan secured the third position with 4,389 units sold.

◎ The Opel Corsa and BMW X1 were close behind, while compact models like the SEAT Leon, Audi A3, and BMW 1 Series saw their sales double, indicating robust demand.

◎ Notably, the Volkswagen ID.3 recorded a 170% increase, selling 2,350 units in a single month, signaling a resurgence of new energy vehicles in the local market.

02

Performance of Chinese Brands in Germany

Chinese automakers are making rapid inroads into the German market, leveraging a 'latecomer advantage.'

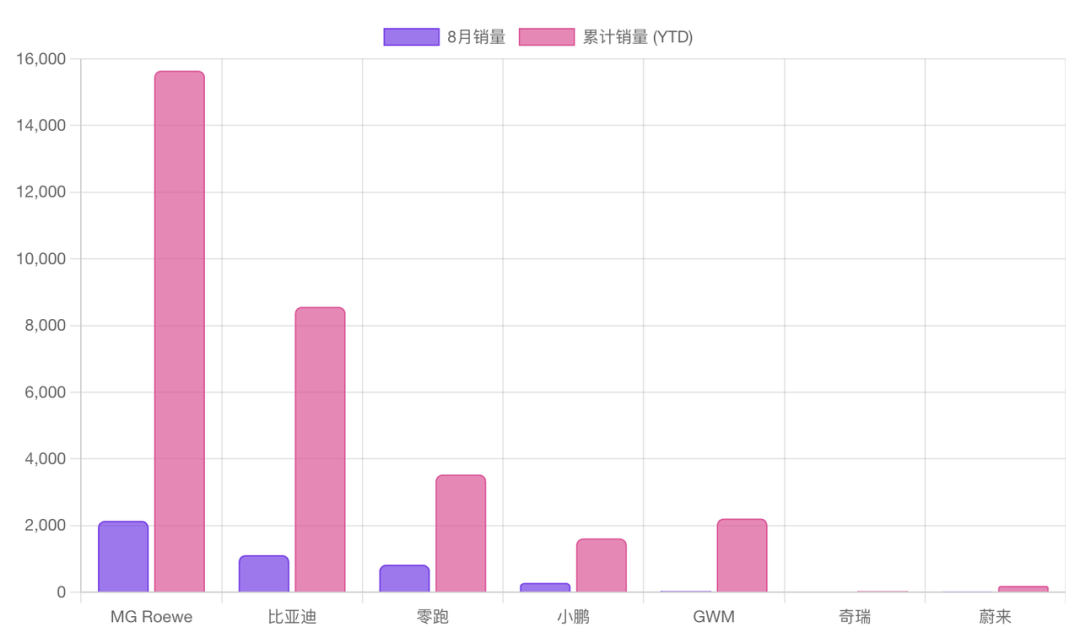

◎ SAIC MG maintained steady growth, selling 2,140 units in August, a 260% increase, with cumulative sales exceeding 15,000 units. After several years in Europe, it has built a loyal customer base through competitive pricing and EV offerings.

◎ BYD sold 1,114 units in August, a more than fourfold year-on-year increase, with cumulative sales reaching 8,563 units, up 419%. It has entered the small and medium-sized car market with models like the Dolphin and Seal, attracting German buyers with competitive pricing and impressive range.

◎ Leapmotor performed admirably, selling 826 units in August, entering the top 30 for the first time. Cumulative sales have exceeded 3,500 units, showing rapid growth despite relatively low volumes.

◎ XPeng sold 283 units in August, a 757% year-on-year increase. While the base is small, the momentum is strong, with cumulative sales exceeding 1,600 units. It is gaining recognition in Germany for its intelligence and advanced driving assistance systems. Other Chinese brands are still exploring the market.

◎ Zeekr, NIO, Chery, and Lynk & Co have seen sporadic sales. Lynk & Co sold 35 units in August, a significant increase, but overall volumes remain small. NIO sold only 23 units, a 34% year-on-year decline, indicating challenges for its premium positioning in Germany. Great Wall Motors sold 42 units in August, an over 80% decline, suggesting the need for product and channel adjustments.

Chinese brands in Germany have adopted three main strategies:

◎ BYD and SAIC MG pursue a volume-oriented approach, targeting mainstream buyers with competitive pricing.

◎ Leapmotor and XPeng focus on intelligence and EVs to tap into niche markets, showing significant potential.

◎ Premium brands like NIO and Zeekr face more challenges and need to refine their positioning and distribution strategies.

Summary

The German auto market is gradually recovering from the pandemic and supply chain disruptions, but its scale remains smaller than before. Volkswagen maintains its position with best-selling models, while local luxury brands also perform well. The electrification trend is reshaping the market, with Chinese brands rapidly entering through flexible strategies, competitive pricing, and advantages in EVs, gradually expanding from the mainstream to the premium segment.