10 Million Units Sold! Sales Skyrocket! What Makes China's New Energy Vehicles So Outstanding?

![]() 10/13 2025

10/13 2025

![]() 696

696

By Wang Xin, Art Editor: Yang Lingxiao, Produced by: Electric New Species

In the first three quarters of 2025 alone, China's new energy vehicle market has delivered a remarkable performance.

According to the latest data from the China Passenger Car Association (CPCA), from January to September 2025, the cumulative wholesale sales of new energy passenger vehicles by manufacturers across the country reached 10.446 million units, marking a 32% year-on-year increase and comfortably surpassing the 10-million-unit milestone. This achievement arrived earlier and more solidly compared to previous years.

In September alone, the estimated wholesale sales of new energy passenger vehicles by manufacturers hit 1.5 million units, showing a 22% year-on-year rise and a 16% month-on-month increase. This provided crucial support for the cumulative sales to break the 10-million-unit mark.

Globally, China's new energy vehicles have transitioned from being “followers” to “leaders.” As previously stated by the Minister of Science and Technology, the cumulative sales of new energy vehicles nationwide have exceeded 40 million units, with China maintaining the top position in both production and sales volumes globally for ten consecutive years.

Achieving 10 million units in sales in the first three quarters of this year not only highlights the strong market demand but also underscores the resilience of China's new energy vehicle industry. This accomplishment significantly contributes to the global automotive industry's transformation and carbon reduction goals.

01 Surpassing 10 Million Units in Sales Is No Accident: Multiple Factors Drive Market Growth

The milestone of over 10 million units in new energy vehicle sales in the first three quarters is not attributable to a single factor but rather the combined efforts of the market, policies, and automakers.

From a market perspective, September this year had 22 working days, the same as the previous year. However, with the Mid-Autumn Festival included in the National Day holiday, consumers had more time to view and purchase vehicles, resulting in higher market enthusiasm compared to the previous year.

Many 4S dealerships reported a 30% increase in foot traffic from late September to before the National Day holiday, with most visitors showing interest in new energy models. This natural growth in consumer demand laid the foundation for increased sales.

Policy support has also played a crucial role. The Ministry of Industry and Information Technology, along with multiple departments, has regulated competition in the new energy vehicle industry, fostering a fairer and more orderly market and boosting consumer confidence in vehicle purchases.

Simultaneously, national-level trade-in policies, combined with local incentives, have steadily restored market enthusiasm mid-month. For instance, many regions offer subsidies to consumers who replace fuel vehicles with new energy alternatives, reducing purchase costs and directly driving sales growth.

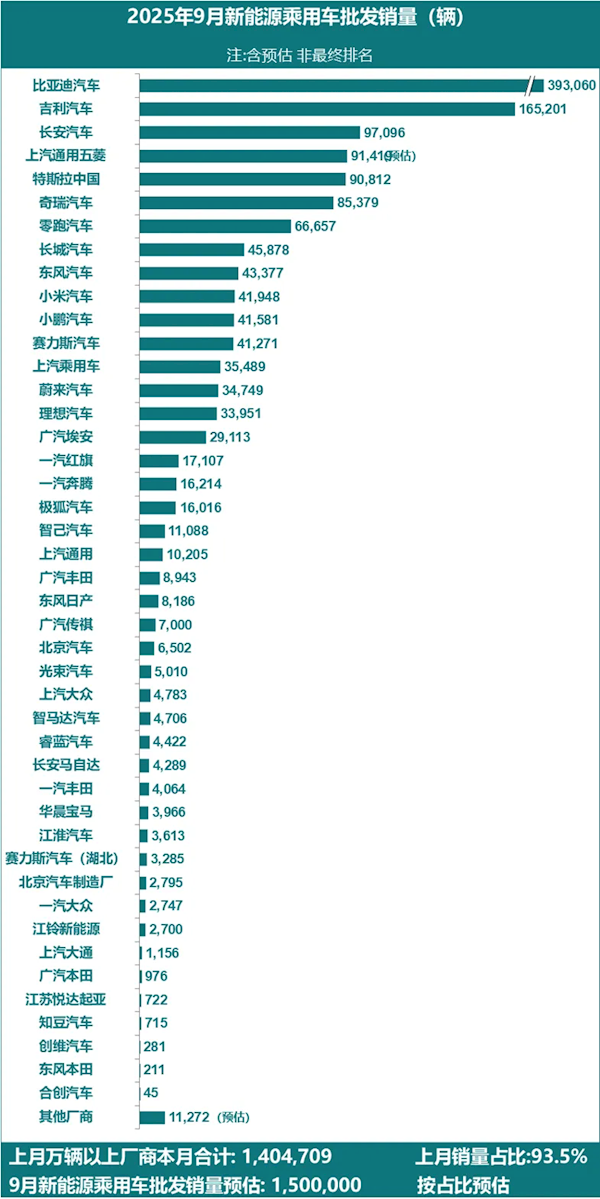

Automakers have also performed exceptionally well. In September, several manufacturers, including Geely, Changan, Leapmotor, Dongfeng, Xiaomi, and XPeng, set new monthly records for new energy wholesale sales.

The stable performance of leading automakers has been particularly vital. BYD led the pack with 393,060 units sold in September, followed by Geely with 165,201 units and Changan with 97,096 units. The sales scale of these top players has directly supported half of the market's growth.

Additionally, breakthroughs in electrification and the launch of popular new models by major automakers have driven consumption.

For example, BYD's “Divine Eye” advanced driver-assistance system, launched earlier this year, has seen cumulative sales of over 1.4 million units for models equipped with it. In August, 90% of BYD's domestic sales were models with advanced driver-assistance systems. Geely's newly launched Galaxy M9, featuring a next-generation intelligent cockpit and emotional AI, quickly became a hit after its September debut.

Coupled with the strong growth in new energy vehicle exports, the combined efforts of domestic and overseas sales have driven structural high growth in the market.

02 New Energy Vehicles Have Become the Mainstream in China's Auto Market

Behind the 10-million-unit sales in the first three quarters lies a more noteworthy trend: new energy vehicles are accelerating the replacement of fuel vehicles and becoming the mainstream in new car sales.

CPCA forecasts indicate that new energy vehicle sales are expected to reach 1.25 million units in September this year, compared to 900,000 units for fuel vehicles, with new energy vehicles outselling fuel vehicles by 350,000 units.

This data is not coincidental. In August, retail sales of narrowly defined new energy passenger vehicles reached 1.115 million units, with a penetration rate of 55.2%. By September, the total retail market for narrowly defined passenger vehicles is estimated to reach 2.15 million units, with new energy retail sales around 1.25 million units, pushing the penetration rate to 58.1%, a new all-time high.

Another indicator of new energy vehicles becoming mainstream comes from charging data. Monitoring data from the National Energy Administration shows that from October 1 to 8, national highway charging volumes for new energy vehicles reached 123 million kWh, averaging 15.3591 million kWh per day, marking a 45.73% year-on-year increase and setting a new record.

This indicates that more people are driving new energy vehicles for long-distance travel, transforming them from “urban commuting tools” to “all-scenario travel companions,” with user habits rapidly evolving.

From a longer-term perspective, market changes are even more pronounced. Data from the China Association of Automobile Manufacturers shows that in 2024, China's new energy vehicle sales reached 12.866 million units, accounting for 40.9% of total vehicle sales.

By 2025, based on current trends, annual new energy vehicle sales are expected to reach around 15.5 million units, with a penetration rate rising to about 48%. In just over a year, the penetration rate has increased by nearly 7 percentage points, a rare pace in global automotive industry history, indicating that Chinese consumers' acceptance of new energy vehicles has reached a new level.

03 Intelligence + Globalization: The Future of China's New Energy Vehicles Looks Even Brighter

The dual growth in sales and penetration rate of new energy vehicles is underpinned by the industry's strong capabilities. From technological breakthroughs to overseas expansion and intelligent ecosystem construction, China's new energy vehicle industry is forming comprehensive competitive advantages.

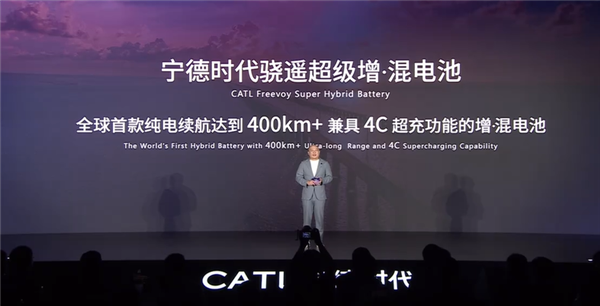

In core technologies, Chinese automakers and supply chain companies have achieved multiple breakthroughs. In power batteries, mass-produced ternary battery cells have reached an energy density of 300 Wh/kg. CATL's “Xiaoyao” extended-range hybrid battery offers over 400 km of pure electric range, with charging for 10 minutes providing over 280 km of range, and it can discharge normally in extreme cold conditions of minus 40 degrees Celsius.

In the drive motor sector, peak power density exceeds 10 kW/kg, with maximum speeds surpassing 20,000 rpm. The adoption of 800V silicon carbide electric drives and 5C ultra-fast charging is accelerating.

These technological breakthroughs have addressed consumer concerns about range, charging, and low-temperature performance. For instance, BYD's new pure electric platform, e-Platform 3.0 Evo, increases low-temperature range by 45 km and high-temperature range by 60 km, while reducing low-temperature charging time by 40%.

The development of intelligent technologies has further differentiated China's new energy vehicles. “AI-defined cars” have become an industry consensus, with nearly all new models launched this year emphasizing intelligence.

In advanced driver-assistance systems, nearly 80% of new energy passenger vehicles in China were equipped with L2-level or higher features in the first half of this year. Full-speed range adaptive cruise control (ACC) installation rates exceed 70% in the new energy passenger vehicle market, with highway and urban navigation assistant systems (NOA) becoming standard features in many new models.

Intelligent cockpits are also upgrading. For example, Geely's Galaxy M9 features an ultra-human-like emotional AI, Eva, which understands users' subtext and remembers family members' driving preferences. Leapmotor's models integrate DeepSeek and Tongyi Qianwen dual AI voice models, improving voice recognition efficiency and enabling continuous dialogue.

Overseas market expansion has broadened China's new energy vehicle “circle of friends.” In August this year, BYD's passenger vehicle and pickup truck overseas sales reached 80,464 units, marking a 146.4% year-on-year increase. By 2025, cumulative overseas sales have reached 630,728 units, up 135.7% year-on-year, accounting for 22% of total sales.

Not just BYD, Leapmotor has established 300 dealerships in Europe and plans local production next. Lynk & Co also launched a new model in Milan, Italy, accelerating its European market layout.

Chinese new energy vehicles are no longer relying on “low prices for high volumes” but are winning global recognition through technological advantages and product strength.

Additionally, the improvement of the industrial ecosystem provides further support. China has established a complete power battery industrial system covering basic materials, cell production, system integration, manufacturing equipment, and recycling. “Three Electric” (battery, motor, electric control) technologies have gradually built competitive advantages, with intelligent cockpits and driver-assistance systems reaching international advanced levels. Domestically produced high-computing-power chips, millimeter-wave radars, and central computing platforms have also achieved breakthroughs and are being installed in vehicles.

This full-industry-chain advantage gives China's new energy vehicles greater confidence in cost control, technological iteration, and production capacity guarantee.

Conclusion: 10 Million Units in Sales Is a New Starting Point as China's Autos Go Global

China's new energy vehicle sales surpassing 10 million units in the first nine months of 2025, with a 32% year-on-year increase, is not just a milestone in sales figures but also a strong testament to China's transformation from an “automotive giant” to an “automotive powerhouse.”

From policy support and a warming market environment to automakers' comprehensive efforts in sales, technology, and intelligence, China's new energy vehicle industry has formed a powerful driving force for development.

Technologically, China's new energy vehicles have achieved multiple breakthroughs in core areas such as power batteries, drive motors, and intelligent driving, addressing consumer concerns about range anxiety and low-temperature performance.

Globally, China's new energy vehicles are continuously increasing their export volumes and overseas market share, leading the global new energy vehicle industry's development.

In terms of intelligence, the integration of AI large models and the popularization of intelligent driver-assistance systems have ushered in a new era of “AI-defined cars” in China, offering more possibilities for future mobility.

Looking ahead, with the implementation of the “Work Plan for Stabilizing Growth in the Automotive Industry (2025 - 2026),” China's new energy vehicle industry will continue to maintain high-quality development, securing a more important position in the global automotive industry transformation and contributing more Chinese strength to the global automotive industry's green, low-carbon development and intelligent transformation.