《The Insights from the Budget Edition Model Y》

![]() 10/13 2025

10/13 2025

![]() 500

500

Lead-in

Introduction

"Don't attempt to emulate Tesla."

"I'm hesitant to criticize Apple phones now. If I do, people will accuse me of having a failed phone business. When I feel like criticizing, I wish I had never ventured into the phone industry."

"The industrial design of this phone is undeniably second-rate. Its patchwork aesthetic is unappealing, even worse than depicted in photos. I particularly dislike the camera button; it's utterly pointless. Moreover, it introduces another issue: the camera button cutout on the phone case is irritating."

"In essence, it's becoming increasingly unattractive. I dream of making a film where Steve Jobs bursts out of his coffin and fires everyone involved."

These humorous remarks from the first three paragraphs are taken from Luo Yonghao's latest podcast. When Tim from Film Storm unexpectedly sent him an iPhone 17 Pro Max 2TB, Luo didn't hesitate to launch into his characteristic sharp critique.

However, speaking rationally and objectively, despite its somewhat underwhelming appearance, this new iPhone generation is undeniably a commercial triumph. The robust sales, both online and offline, serve as the best evidence. Apple may no longer lead in every aspect, but its brand appeal remains incredibly strong.

The reason for dedicating considerable space to elaborate on these points is to better introduce the protagonist of today's article: another American company, Tesla.

Because in terms of product strategy, the approaches of these two companies are becoming increasingly similar.

Little did people anticipate that during the recent National Day holiday, with the highly anticipated release of the budget edition Model Y, the popularity of this new energy vehicle company soared to new heights.

Its entry also brings forth some intriguing insights.

01 Insight 1: Its Popularity in China is a Given

If the standard Model Y is akin to 'affordable housing,' then the budget edition Model Y is undeniably 'bare-bones housing.'

Seat ventilation and heating, steering wheel heating, ambient lighting, welcome lights, rear screen, coat hooks, electric rear seat tilting, oscillating front vents, optional towing hook, electrically folding mirrors, metallic reflective glass, acoustic glass, front and rear light bars, matrix headlights, and glass roof - all have been removed.

Leather seats have been replaced with fabric, seat adjustment has been simplified to a single-axis system, rear vents have been changed to manual, the 16-speaker audio system has been reduced to 11 speakers, the center console has been restructured into a two-piece design, adjustable damping suspension has been removed, and it now comes with 18-inch wheels.

It must be acknowledged that Tesla's cost-cutting measures are indeed ruthless and precise, all while maintaining the core electric systems and intelligent experience largely unchanged. The result is a $5,000 price reduction.

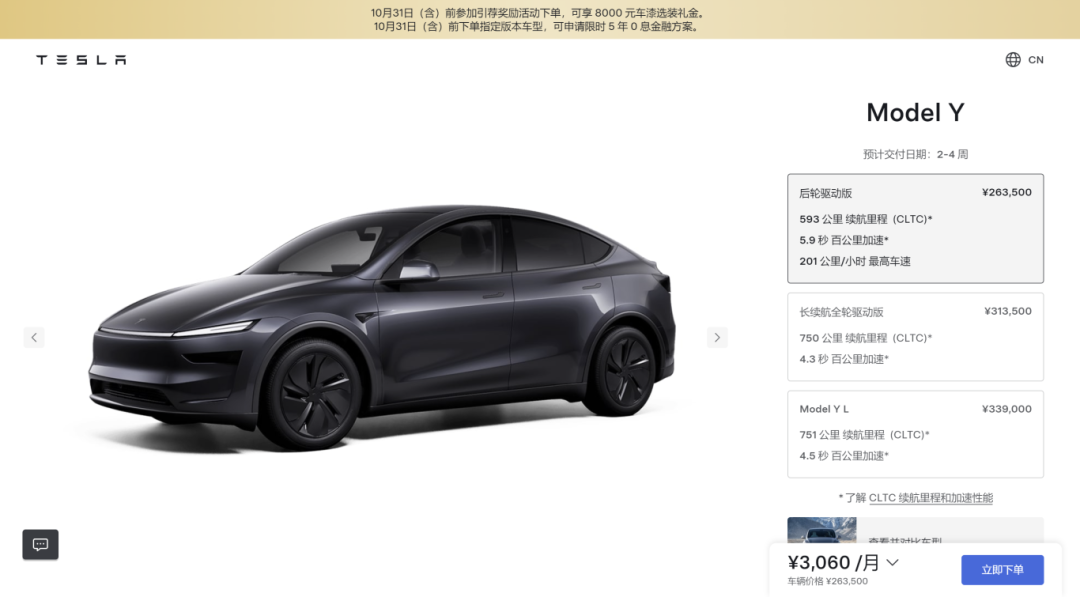

This raises a new question: How will the budget edition Model Y be priced when it enters the Chinese market?

At the current exchange rate, $5,000 equates to approximately 35,500 yuan. The starting price of the standard Model Y is 263,500 yuan. A simple calculation suggests it could drop to below 230,000 yuan.

Speculatively, given Tesla's style and the strategic importance of the Chinese market, there may be even bigger surprises in store.

Recently, I've come across a somewhat optimistic viewpoint suggesting that the 'bare-bones housing' budget edition Model Y will struggle to compete with a series of highly competitive pure electric SUVs from domestic brands once it enters China.

To this, I can only respond, 'Don't be naive.'

The budget edition Model Y's popularity in China is practically a foregone conclusion. The reason is straightforward: it's a 'Tesla.' Similar to when the six-seater Model Y was first launched this year, there were numerous negative voices, but what was the outcome?

At this moment, the only uncertainty is its exact pricing. Undoubtedly, it also serves as the 'Sword of Damocles' hanging over all competitors.

02 Insight 2: Don't Attempt to Imitate

Although reluctant to admit it, since Tesla's entry into China, a group of 'imitators' have indeed emerged. With the release of the budget edition Model Y, it's anticipated that some will choose to follow suit directly.

In my view, such an approach is doomed to fail.

The fundamental reason supporting the budget edition Model Y's popularity in China is Tesla's sufficiently strong brand appeal.

Even if your vehicle offers significantly higher comfort configurations, you still can't match its sales performance.

This feeling is indeed frustrating, but it's also an unchanging survival rule in the automotive industry: 'When it comes to selling cars, ultimately, it's all about the brand.'

Currently, in the era of intelligent electric vehicles where the actual experience is becoming increasingly homogeneous and the Matthew effect is intensifying, such phenomena are particularly prominent. For many challengers, the existence of a significant cognitive gap is something they must accept, whether they like it or not.

From the user's perspective, there's a large group of potential customers in the Chinese car market who 'only consider Tesla,' almost identical to those consumers who 'only choose Apple.'

No matter what offensive moves domestic brands make, this group remains unmoved.

Their mindset when buying a car is more akin to choosing the Model Y or nothing at all. After all, it definitely won't go wrong. It offers high ownership and resale value, and the explanation cost is low, saving a lot of unnecessary trouble.

The arrival of the even cheaper budget edition Model Y has obviously lowered the entry threshold again. What does it matter if it's 'bare-bones housing'? The diverse Chinese aftermarket will always have various solutions.

03 Insight 3: Focus Has Shifted Beyond Car Manufacturing

Looking at the current Model Y lineup - budget edition, standard edition, six-seater edition - doesn't it resemble 'medium, large, extra-large' cup sizes?

For some reason, I have a feeling that Tesla's future product strategy in the passenger car market will likely involve various reductions and downsizing, commonly known as 'filling in the gaps.'

As for the fundamental purpose, it's still to maintain its sales base in the global market in the simplest, most crude, and low-cost way possible. It must be acknowledged that the overall strategy is somewhat bland, and its long-term effectiveness remains a big question mark.

As an observer, I'm increasingly convinced that 'Elon Musk's ambitions lie elsewhere.' More bluntly put, his focus is no longer solely on car manufacturing.

In comparison, autonomous driving taxis, humanoid robots, autonomous driving technology, and AI large models are being given increasingly important positions within Tesla.

Not long ago, Elon Musk reiterated that the scaled-up deployment of FSD (Full Self-Driving) and Optimus would be the company's highest priority. 'In the future, 80% of our market value will be supported by them.' Before the widespread adoption of Robotaxi, it's speculated that its current product lineup will likely not see any significant expansion.

Of course, faced with this situation, there will surely be skeptics who argue: 'Elon Musk's vision of a poetic and distant future may be beautiful, but as competition in the global automotive market intensifies, Tesla is facing significant impacts and challenges. How will this American automaker navigate these tough times?'

My response is: 'Race against time and bet that the speed of technological revolution will outpace expectations.' Moreover, don't forget that Tesla is still a behemoth with a total market value exceeding $1.3 trillion.

In the end, it has sufficient resources to weather the storm. It still holds many trump cards like the budget edition Model Y. You may say it's becoming mundane, but you still have to acknowledge its strength.

Indeed, in the third quarter, according to official data, Tesla produced approximately 447,000 new cars globally and delivered 497,000 vehicles, a year-on-year increase of 7.4%, setting a new historical record and significantly surpassing analysts' expectations of 448,000 vehicles.

The recovery is quietly underway...

Editor-in-Chief: Yang Jing Editor: He Zengrong