JD's Bold Leap into Car Manufacturing: Spotlight on Participation

![]() 10/17 2025

10/17 2025

![]() 682

682

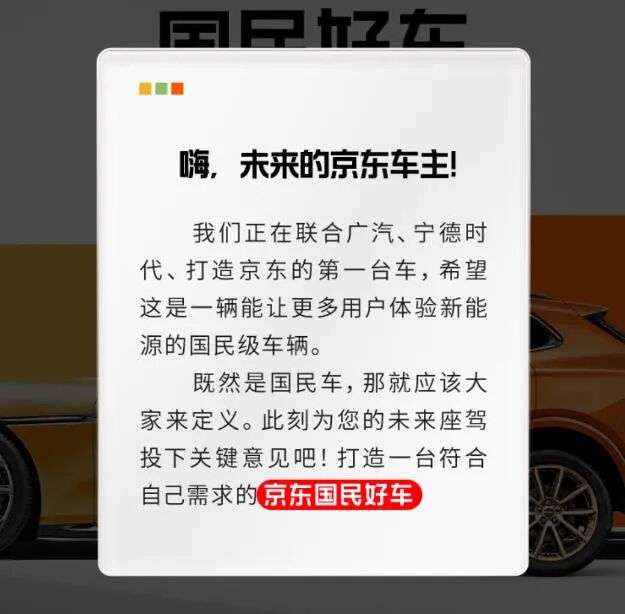

On October 14, during the '2025 JD 11.11 Surprise Open Day', JD unveiled its partnership with GAC Group and CATL to introduce a 'National Good Car' on November 9. This announcement sent ripples across the industry, with numerous media outlets interpreting it as JD's official foray into car manufacturing.

JD swiftly clarified that the new car represents a collaborative effort among the three entities, with JD primarily contributing user consumption insights and exclusive sales channels, without directly engaging in the manufacturing process. This response underscored JD's distinctive stance of 'prioritizing participation' in the automotive endeavor.

Contrary to Xiaomi's 'All-in' strategy of establishing its own factory, JD has opted for a distinct path—not becoming a manufacturer but an ecosystem orchestrator.

Collaborating with GAC and CATL: Leveraging Synergies

JD's cross-industry venture into car manufacturing has selected partners that form a 'dream team'. GAC Group, a leading domestic automotive group, handles vehicle R&D and manufacturing; CATL provides battery and battery swap solutions; while JD focuses on user consumption insights and exclusive sales. This division of labor enables each party to capitalize on its strengths, fostering a complementary partnership.

JD positions itself as an integrator of 'demand, channels, and services'. Leveraging the extensive consumer data amassed on its e-commerce platform, JD can precisely discern user preferences regarding car design, pricing, features, and more, thereby influencing and even guiding the product definition phase.

During the sales phase, the JD App serves as the exclusive pre-sale platform for this new car. Users can participate in surveys to express their preferences regarding car design, pricing, features, and more, fostering a sense of involvement in 'building JD's inaugural car'.

Based on the vehicle's base model, users can customize their purchase with various packages, introducing a novel consumption approach of 'all-inclusive car buying'.

JD introduces the concept of 'buying a car as effortlessly as buying a phone', integrating the convenience of e-commerce platforms into the automotive consumption realm. If successful, this transformation could significantly streamline the traditionally complex car-buying process.

CATL will provide 'chocolate battery swap' technical support for this vehicle, enabling owners to enjoy the convenience of a 5-minute battery swap, effectively mitigating range anxiety for electric vehicles.

A Decade of Strategic Planning: The Automotive Ecosystem Evolves

While JD's entry into the automotive sector may appear abrupt, it has been laying the groundwork for nearly a decade. A clear automotive ecosystem strategy is gradually taking shape, as evidenced by its development trajectory.

As early as 2015, JD Group founder Liu Qiangdong made a personal investment in NIO, marking JD's initial foray into the automotive sector and its engagement with the new energy vehicle industry at the capital level.

Subsequently, JD made steady progress in its automotive business: launching a vehicle trading platform in 2018; establishing an automotive division in 2021; and upgrading its offline automotive service brand 'Jingchehui' to 'JD Auto Maintenance' in 2022.

These initiatives have equipped JD with foundational capabilities in automotive sales and services.

By 2023, the JD Automotive Division commenced independent operations, proposing a closed-loop service ecosystem centered around the car owner's 'buy-equip-maintain-use-replace' lifecycle, thereby constructing a comprehensive automotive ecosystem chain.

In 2025, JD's automotive布局 (strategic layout) accelerated further. Not only did it secure a major after-sales contract with BYD, but it also registered multiple 'Joyrobotaxi' trademarks, marking JD's formal entry into the autonomous taxi sector.

JD envisions transforming the interior space of Robotaxis into 'mobile e-commerce terminals', enabling passengers to order fresh produce, daily necessities, and other goods while in transit.

JD's differentiated competitive strategy lies in 'ecosystem integration'. On one hand, leveraging its vast user consumption data, it can precisely dispatch vehicles to high-frequency consumption areas, minimizing idle driving rates;

On the other hand, by integrating the service capabilities of over 2,000 JD Auto Maintenance stores nationwide and 40,000 cooperative outlets, it provides convenient after-sales services for consumers.

A Comeback: Learning from Past Experiences

This is not JD's maiden attempt at automotive sales. Four years ago, JD partnered with Seres to launch the 'JD Selected Good Car' series, but the results fell short of expectations.

Reflecting on 2021, JD's collaboration with Seres was seen as a pioneering experiment for e-commerce platforms entering the automotive manufacturing sector: Seres supplied the products, while JD handled online channels and marketing.

However, the project's popularity waned quickly, and online buzz failed to translate into sales. At that time, the ME5 received virtually no orders on JD's official flagship store, and the delivery system and service capabilities were underdeveloped. The vision of selling cars through e-commerce was swiftly challenged by the realities of implementation.

Four years later, JD is making a comeback with a significantly refined strategy.

The partner has been upgraded from a second- or third-tier automaker to a domestic first-tier automaker like GAC Group, ensuring greater manufacturing quality and brand reputation. JD has also evolved from a mere sales channel to a co-creator involved in product definition, delving into the core stages of automotive product development.

This collaboration also introduces CATL's battery swap technology, which was absent in the previous partnership. Furthermore, 'Qichebatan' (a media outlet) reported that this new car will be a battery swap version of a GAC Aion model, equipped with CATL's 'chocolate battery swap' technology, effectively addressing range anxiety for electric vehicle users.

This time, JD places greater emphasis on constructing a service closed loop. The over 2,000 JD Auto Maintenance stores nationwide and 40,000 cooperative outlets may be transformed into 'inspection-battery swap integrated stations', providing convenient battery swap services for consumers.

Conclusion:

Although the vision of selling cars through e-commerce was swiftly challenged by the realities of implementation four years ago, JD has now returned with GAC and CATL. It has chosen not to manufacture cars itself but to define demands, connect markets, and integrate services. On November 9, when that 'National Good Car' officially debuts, we may witness not just a new car but another transformation led by JD in how future cars are manufactured, sold, and serviced.