The Beginning of Spring Arrives, Yet Automakers Still Trudge Through Winter

![]() 02/09 2026

02/09 2026

![]() 325

325

Lead

Introduction

Stepping into the era of inventory competition spells prolonged tough times ahead.

"By 2026, the competition will be even more ruthless."

Several days ago, at a banquet hosted by an Original Equipment Manufacturer (OEM), I encountered an old acquaintance from the automotive industry. His expression clearly betrayed a profound sense of fatigue. After a brief exchange, his opening remark encapsulated the core sentiment I gathered.

I had anticipated that after the challenges of 2025, everyone would enjoy a brief respite. However, the reality is starkly different—the increasingly fierce competition among Chinese automakers has swiftly intensified.

To illustrate, consider a simple example.

On January 6th, Beijing time, Tesla, in an effort to further stimulate sales in China amid a market downturn, unexpectedly introduced a "seven-year ultra-low-interest" financing scheme. This move immediately prompted competitors to follow suit, with both new-energy brands and traditional automakers offering concessions.

Little did we know, just this week, Dongfeng Nissan took it a step further by introducing an "eight-year ultra-low-interest" policy, applicable to its entire product lineup regardless of the powertrain. This escalated the competition to unprecedented levels and is merely a snapshot of the "abnormal" dynamics in China's auto market.

Thus, a new question arises: "Why is there a lack of enthusiasm to halt cutthroat competition?"

My response is straightforward: "Because the market landscape is far from settled."

This is not an alarmist statement. The coming 365 days will be pivotal in determining the final standings of automakers. However, from the current vantage point, two significant "obstacles" loom large, exacerbating an already cutthroat battle.

01 Making Money in Car Manufacturing is Becoming Increasingly Challenging

"This year, the cost pressures are substantial. Beyond basic raw materials, there's also the issue of memory chips. The entire industry must confront this severe challenge."

Also on January 6th, Beijing time, NIO celebrated the rollout of its one-millionth new vehicle. During a subsequent interview, Li Bin, the company's leader, did not shy away from highlighting this pain point when asked about the challenges facing China's auto market this year.

At this juncture, though reluctant to admit it, the "wave of price hikes" has indeed resurfaced.

Recently, I came across a research report from UBS. Its central thesis is that with the waning of stimulus policies in early 2026, overall market demand is already feeble.

To compound matters, the supply side has witnessed a sharp rebound in procurement prices for basic raw materials (such as copper, aluminum, and lithium) and key components (like memory chips and DRAM). According to UBS calculations, the inflationary impact on a mainstream mid-size smart electric vehicle could range from RMB 4,000 to 7,000.

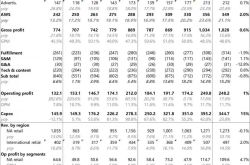

More critically, industry profit margins may face a compression risk of 5%-8%.

Delving deeper into raw materials, the price of lithium carbonate has surged from RMB 75,000 per ton in early 2025 to RMB 174,000 per ton in January 2026. Meanwhile, aluminum prices have exceeded RMB 25,000 per ton, and copper prices have soared above RMB 100,000 per ton.

Turning to memory chips, starting from the second quarter of 2025, this sector entered what can be termed a "super cycle." Data indicates that DDR4 prices alone have surged by over 150%, while DDR5 prices have risen by more than 300%.

The underlying issue is the explosion in AI computing power, leading to a structural supply-demand imbalance. Giants have shifted their production capacity toward high-margin HBM memory, squeezing quotas for the automotive industry and leaving the supply of automotive-grade memory chips at less than 50% fulfillment.

In the past, in a relatively healthy market, automakers would typically offset operational pressures from rising manufacturing costs through reasonable product price adjustments.

However, in China's auto market, such an approach is untenable. Amid increasingly fierce and even brutal competition, who dares to be the first to raise prices? Instead, brands can only silently endure the consequences, gritting their teeth and swallowing the bitterness.

Of course, leading players can mitigate the impact through economies of scale and supply chain cost reductions. For stragglers with weaker risk resistance, the impact of this "wave of price hikes" could be devastating.

To quote the UBS report directly, "It could completely erode their profits."

Some time ago, Cui Dongshu, Secretary-General of the China Passenger Car Association, also shared a set of data: In 2025, the automotive industry's sales profit margin continued to decline to 4.1%, hitting a historical low. Even in December, when a year-end rebound was expected, the profit margin dropped to a frigid 1.8%, down 2.6% month-on-month and 2.3% year-on-year.

Without a doubt, this is a dangerous signal. If conditions do not improve in 2026, many automakers will inevitably be dragged into a "chronic bleeding" abyss.

On one hand, there's the "wave of price hikes" at the manufacturing end; on the other, there's the "price war" at the sales end. This completely contradictory environment is making it increasingly difficult to make money in car manufacturing.

This formidable "obstacle" looms large for all automakers.

Given the current state of affairs, China's auto market, still in the midst of a fierce battle, undoubtedly requires a significant amount of time to mature and refine itself. Only through continuous iteration and transformation can it return to a virtuous cycle of "selling more cars and making more money."

This process is expected to be quite lengthy. From here on out, it will be a test of endurance.

02 It's Better to Wait; the Next Model Will Be Even Better

If the first major "obstacle" in China's auto market in 2026 is the flawed business model, then the second is the lack of demand for new vehicles caused by distorted consumer habits.

In January, judging by the terminal sales results announced by various automakers, few brands managed to maintain year-on-year and month-on-month growth, not even popular ones like BYD, HiMo Intelligence, and Xiaomi. According to forecasts from the China Passenger Car Association, overall retail sales are expected to remain flat year-on-year but will see a decline of over 20% month-on-month.

In any case, the situation is not overly optimistic.

The most mainstream analysis currently suggests, "China's auto market has slipped in 2026 primarily because January is traditionally a slow season, coupled with the transition period for local trade-in subsidies and the phase-out of new-energy vehicle purchase tax incentives, which have dragged it down to some extent."

However, I believe that cyclical impacts and the loss of policy support are just superficial. The deeper-lying issue, as mentioned at the beginning of this section, is the distortion of consumer habits.

"When buying an electric vehicle, remember these four points: 1. Don't buy at the original price; wait for a discount. 2. After a discount, don't buy yet; wait for the new model. 3. When the new model arrives, don't buy immediately; wait for its discount. 4. After its discount, don't buy yet; wait for the next generation."

Recently, I saw the above somewhat sarcastic joke in a car owner group. While exaggerated, it does reflect the mindset of many ordinary users.

Over the past few years, the wave of electrification has swept through every corner of China's auto market. Precisely because of this environment, many rules of the game have undergone earth-shaking changes.

For instance, the replacement cycle for a mainstream new-energy product has shortened to around three years, with significant configuration upgrades each year. Smart cockpit chips, intelligent driving hardware, and electronic electrical architectures are the "hard-hit areas."

This rapid pace of new releases has made everyone increasingly hesitant and indecisive.

At the same time, to cope with the "price war," automakers occasionally resort to official price cuts and various disguised promotional tactics. While these moves haven't yielded many orders, they have resulted in frequent instances of backstabbing and dismal second-hand car residual values.

These "scorched-earth" tactics have gradually eroded the trust that was hard to build up.

"I understand the principle of enjoying it early, but after all, it's a several-hundred-thousand-yuan purchase. I still want to buy at the most cost-effective point. Instead of rushing in, I'd rather wait and see."

This is not a fabrication. These words truly came from a family member of mine. At 35, expecting his first child, he plans to buy a large six-seater SUV.

But he's at a loss as to how to choose and when to make the purchase.

Even I, as an automotive media professional, think, "It's okay to wait." Because in 2026, the supply of this category is set to explode, and to boost sales, everyone is destined to fiercely compete. Against the backdrop of "more wolves than meat," the initiative often lies with consumers.

By extension, such situations are not isolated cases. "Wait-and-see" consumers in China's auto market have become widespread, and the subtitle of this section reflects their inner monologue.

At this moment, the lack of demand for new vehicles caused by distorted consumer habits has become another "obstacle" that cannot be ignored. Coupled with the continuous downturn in the economic environment, automakers are finding it increasingly difficult to stir up impulsive consumer desires, no matter how hard they try.

Unless you have a super phenomenal product, you'll be facing a very calm and even somewhat apathetic customer base. Objectively speaking, for most brands, this is not good news.

Because the lack of demand for new vehicles means an intensification of the Matthew effect. China's auto market is transitioning from an era of incremental competition to an even more brutal era of inventory competition.

Although the Beginning of Spring has arrived in 2026, winter has not yet passed for automakers...

Editor-in-Chief: Li Sijia Editor: He Zengrong

THE END