Chinese enterprises flock to Morocco: Hot spot, springboard, and challenges

![]() 07/16 2024

07/16 2024

![]() 524

524

Author | Li Xiaotian

Editor | Weber

In February of this year, Immortal, an employee of a state-owned enterprise in the engineering design field, followed the pace of China's new energy battery industry in setting up factories and arrived in Morocco from Turkey. Although Turkey is far more developed than Morocco in terms of per capita GDP and urban construction, Immortal believes that Morocco is now more deserving of the title of a "hot spot": "The first wave of our company's inspection team arrived in June last year, when Morocco was not as popular as it is now; but starting from April this year, Chinese-funded enterprises have simply flooded into Morocco, with inspection teams emerging in an endless stream, mainly focusing on five areas: new energy batteries, logistics, trade, automotive supply chain, and power."

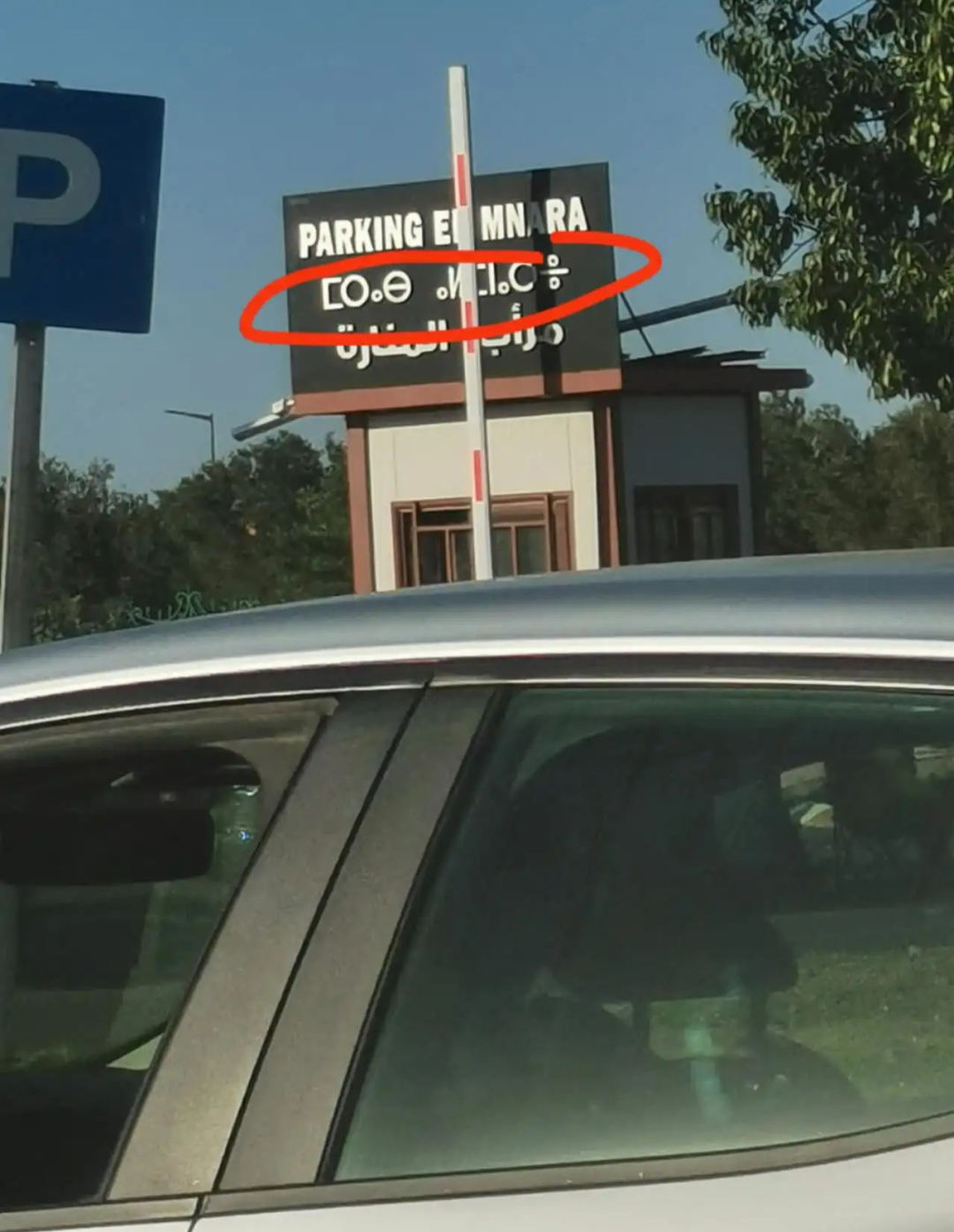

Today, the most profound impression left by Turkey on Immortal is that prices have nearly doubled in two years, President Erdogan's approval ratings have continued to decline, and the political situation is turbulent with a depressed economic environment; Immortal has gradually adapted to this unfamiliar exotic land of Morocco: translation software struggles to recognize the locals' non-standard French, English has not become prevalent enough to serve as a working language, and many locals encountered outside the workplace can only speak a unique dialect of Arabic, while in some public service areas, signs written in the local Berber language are often seen. More often than not, he relies on broken English + drawings + sign language to communicate with locals. There are no direct flights between Morocco and China, requiring at least one transfer in Paris, Dubai, or Doha, with the entire journey potentially taking more than 50 hours. And yet this North African kingdom, thousands of miles away, is becoming a promised land for Chinese manufacturing.

Berber language on signs in Morocco

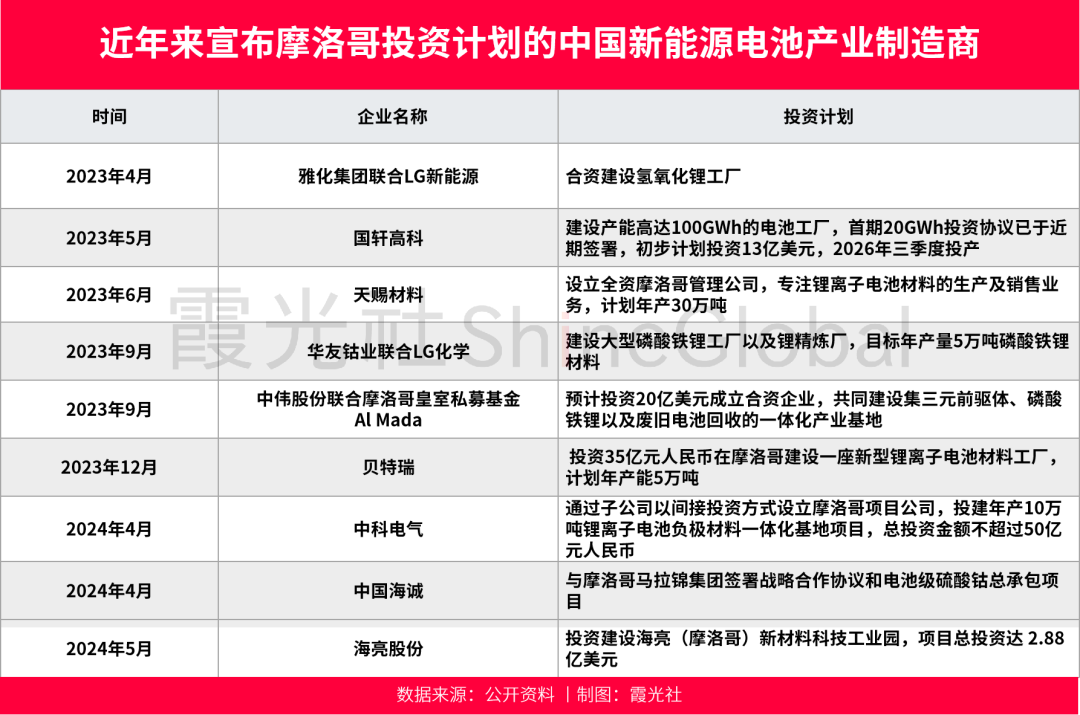

According to statistics, since August 2022, when the US Congress passed the Inflation Reduction Act to support domestic new energy vehicle manufacturing, at least eight Chinese battery manufacturers have announced new investment plans in Morocco. As the only country in Africa and the Middle East with free trade agreements signed with the EU, Turkey, African countries, Arab countries, Canada, and the United States, Morocco has become an important springboard for China's electric vehicle supply chain to reach North American and European markets.

Today, with increasingly close economic and trade exchanges with China, Morocco has seen many Chinese elements emerge. In the capital Rabat, the economic center Casablanca, and the transportation hub Tangier, there is a Confucius Institute in each location, and locals warmly greet East Asian faces with "Hello." Immortal also often sees large billboards for BYD on the streets, but the Chinese cars actually driving on the roads are Dongfeng and domestic three-wheeled vehicles. European cars still dominate here, with Renault, Peugeot, Dacia, or more premium brands like Porsche and Audi seen everywhere.

Street scene in Marrakech, Morocco

As the "backyard of Europe," Morocco has always been a core region for offshore outsourcing by Western European countries such as France and Spain. In 2012, Renault's factory in the northern port city of Tangier officially went into production, becoming the largest automotive assembly plant in Africa and the Arab region; in 2015, PSA Group chose to open an assembly plant in Kenitra, along Morocco's Atlantic coast. The influx of French automakers has driven upstream auto parts enterprises to invest and set up factories in Morocco, as well as the development of the entire automotive supply chain.

Today, Morocco has over 250 automotive suppliers, employing approximately 220,000 workers, in addition to manufacturers from France and Germany, China, Japan, and South Korea are also present. Although Morocco sold less than 162,000 vehicles in 2023, this North African country can produce 700,000 vehicles annually, supplying more cars to Europe than China and Japan. "We are trying to accomplish in ten years what the UK or France took 80 years to do," said a Moroccan businessman working at the French company Safran. This is a familiar narrative for almost all late-developing modern countries: it is necessary to drastically compress the course of industrialization experienced by Western countries to have a chance to integrate into today's global economic and trade system. Geographically, Morocco is the country in Africa closest to Europe, separated from Spain by only a strip of water, with the narrowest part of the Strait of Gibraltar being just 14 kilometers wide, closer than the commuting distance for many workers in Beijing. Standing in the Tangier Free Zone and looking across the water, one can see the rolling mountains of Spain. This unique geographical feature has created a cultural style in Morocco that combines Arab, African, and European characteristics. The late King Hassan II of Morocco wrote in his memoirs that Morocco is "located at the crossroads connecting oceans, continents, peoples, and civilizations."

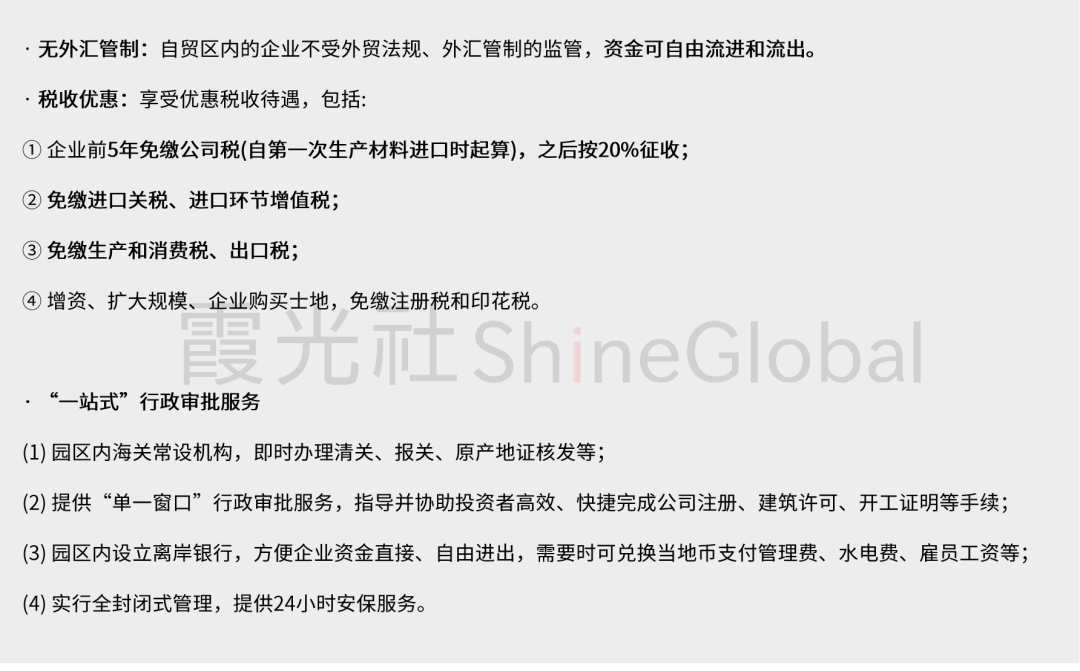

Tangier, a port city in northern Morocco, guards the western entrance of the Strait of Gibraltar, and 20% of global trade volume (including 60% of China's trade with Europe) passes through here. As Morocco's northern economic center and a hub of foreign investment, Tangier has established multiple industrial parks such as the Tangier Free Zone and Tangier Auto City, where over 1,200 foreign-funded enterprises are gathered. In the 2020 global ranking of the best free trade zones by FDI Intelligence, a subsidiary of the Financial Times, the Tangier Free Zone ranked second among 100 free trade zones worldwide, second only to Dubai Multi Commodities Centre (DMCC) in the United Arab Emirates; and in the World Bank's Container Port Performance Index (CPPI), the Tangier Med Port ranked fourth globally.

In addition to its geographical advantages, Morocco also possesses over 70% of the world's phosphate mines (China, in second place, accounts for only 4.5%), and phosphate is a core material for lithium iron phosphate batteries. Currently, all ten of the world's top-ranked companies in terms of installed capacity of electric vehicle power batteries are from China, Japan, and South Korea, with Chinese battery suppliers accounting for over 60% of the global market share, and the trend of "China rising, Korea declining" is becoming increasingly apparent. Unlike the ternary lithium-ion (NCM) technology route adhered to by Japanese and Korean enterprises, the lithium iron phosphate (LFP) battery technology adopted by Chinese enterprises is gradually becoming the mainstream in the market. "For example, the Tesla Model Y RWD, which became the sales champion of new energy vehicles in South Korea in the second half of last year, was produced at Tesla's Shanghai Gigafactory and equipped with lithium iron phosphate batteries also from the Shanghai factory, attracting strong attention in South Korea," Quan Xiaoxing of the Center for North Korean Studies at the University of International Business and Economics told Xiaguangshe.

The unique geographical location and resource endowments are the "right place"; and now, the opportunity for the reconfiguration of the global supply chain is the "right time" for Morocco. According to the industrial globalization research institution Xinfu Think Tank, as globalization recedes, the global supply chain is increasingly showing a trend of restructuring and layout centering on the three major consumption centers of China, the United States, and the European Union. In Asia, centered on China, India and Southeast Asian countries are undertaking the "overflow" of supply chains as China's industrial upgrading and production network expand; in North America, centered on the United States, Mexico and Brazil have become popular investment destinations for new manufacturing; and in Europe, centered on Western European countries such as France and Germany, Central and Eastern European countries such as Hungary, as well as Turkey and Morocco, have become important locations for manufacturing. The original supply chain was linear, converging from all directions to China, which then directly exported to Europe and the United States; now it has to bypass many places, becoming a curved era. Morocco, with its close geopolitical ties to Europe and a free trade agreement with the United States, has become an important transit station and stopping point in this era of curved supply chains. Bloomberg Businessweek calls countries like Morocco, which are increasingly crucial due to their geographical location and ability to promote trade, "connectors": "They all embrace an opportunistic desire to seize the upcoming windfall by positioning themselves as new ties between the United States and China (or China, Europe, and other Asian economies)."

Data confirms this windfall. In 2023, the European Bank for Reconstruction and Development (EBRD) counted 36 countries where it conducts business—from Poland in the east to Mongolia, and from Morocco in the south to Turkey—and collectively, they received nearly 39% of greenfield investments from China, far higher than the 5.1% in 2022, and just 0.6% two decades ago. Morocco became the first country in North Africa to sign a document related to jointly building the "Belt and Road" with China. The smart city project—Mohammed VI Tangier Tech City, which was launched in 2017, is a flagship project and major undertaking for China's "Belt and Road" initiative in Morocco. According to the plan, this smart city will accommodate about 200 Chinese companies and will include a 947-hectare industrial acceleration zone (ZAI), as well as a 1,220-hectare service and residential area and tourism complex.

Chang Yu, a professional translator who graduated from the University of Lyon III in France, has lived and worked in Morocco for many years. When she first arrived in Morocco, there were almost no traces of Chinese; but in 2016, after Moroccan King Mohammed VI visited China, Chinese-funded enterprises flocked in, and due to the introduction of visa-free policies, Chinese tourists also appeared in Casablanca, Marrakech, and Chefchaouen. Airports began to add Chinese signs, Confucius Institutes had more and more students, and local university students started choosing to study in China through exchange programs to improve their Chinese, as they discovered that graduates who spoke Chinese were in high demand and could quickly secure offers from Chinese-funded enterprises or companies with business cooperation with China.

This language from the far east is becoming another option for Moroccan youth besides French. However, the United States' tightening policies against China's electric vehicle industry are the main external factor affecting the stable operations of Chinese enterprises in "connector" countries like Morocco. In this regard, Xinfu Think Tank analyzed for Xiaguangshe that since the United States-Mexico-Canada Agreement (USMCA) came into effect in July 2020, many Chinese automakers, auto parts manufacturers, and home appliance enterprises have flooded into Mexico, a new continent for manufacturing. And recently, China's rapid investment growth in Mexico has attracted the attention of the US Congress. At the end of 2023, US Treasury Secretary Janet Yellen and Mexican Finance Minister Rogelio Ramírez signed a Memorandum of Intent, and Yellen stated at the press conference that cooperation with Mexico would focus on two aspects: one is to revise Mexico's foreign investment review mechanism, incorporating more US experience and practices; the other is to increase subsidy reviews and tariffs, and the United States may exert some pressure on Chinese new energy vehicles exported to the United States through Mexico by strengthening cooperation with Mexico. "Now that China's new energy vehicle supply chain is flooding into Morocco one after another, if the United States discovers this loophole opened to Chinese manufacturers, it may introduce corresponding policies to blockade it, and its policy focus will also shift from assembly sites to business entities," said Song Xin, founder of Xinfu Think Tank.

In modern Morocco, the annual oath of allegiance to the king, known as bayah, continues. When the king steps out of the palace gates, he is greeted by officials wearing white djellabas (a loose robe commonly worn by both men and women in Morocco) and pointed hoods, who collectively bow and kiss the king's hand. The long wait of officials in the scorching sun and the oppressive feeling of the king looking down on the people from horseback both demonstrate the undisputed authority and power of the royal family. Morocco is a constitutional monarchy, but its king is not merely a symbolic head of state; he has the final say in every important matter—he is the head of the armed forces, the supreme judicial authority, and can dissolve parliament through royal decrees. "Whoever disobeys me disobeys God," former King Hassan II once declared in 1994, quoting a prophecy.

Moroccan musicians wearing traditional costumes playing national instruments. In this regard, scholar Wang Xian analyzed the reasons for the sustained stability of Moroccan monarchical politics by examining Moroccan history: the king's hegemony over the public sphere hinders the ability of political parties to represent society, especially in policy-making. Almost all reform initiatives seen as liberalization and democratization are initiated by the king, and only the king can grasp the scale and scope of reforms, with the authority to reform basic institutions and implement liberalization measures, while establishing his own enlightened image while ensuring the stability of state power; in contrast, the government headed by political parties is primarily an executor, and any policy failures will be seen as implementation issues rather than rising to the level of questioning the legitimacy of the monarchy.

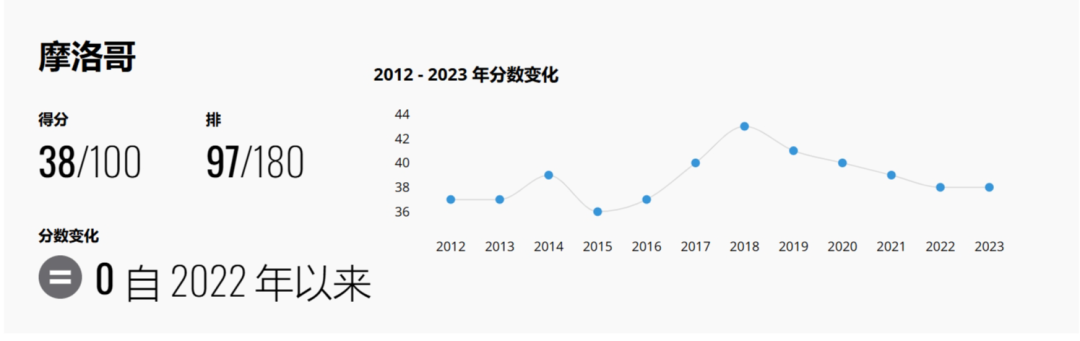

On the one hand, monarchical politics allows Morocco to maintain political and social stability; on the other hand, it inevitably brings about social problems such as corruption, low administrative efficiency, and wide income disparities. According to Tatler estimates, Morocco's current king, Mohammed VI, became the world's fifth richest monarch in 2019 with assets of $8.2 billion; but on the other end of the spectrum, underemployment and soaring inflation have plunged 9 million Moroccans into poverty. According to the 2023 Corruption Perceptions Index by Transparency International, Morocco scored 38 points, ranking 97th out of 180 countries. Since 2018, Morocco's Corruption Perceptions Index has continued to decline. "Corruption among government officials in Morocco is relatively common, and policy implementation is ineffective; moreover, the relationship between the royal family and the government is intertwined, and the hidden costs of enterprises landing in Morocco will be relatively high," Song Xin, founder of Xinfu Think Tank, told Xiaguangshe.

"When doing business locally, it is crucial to find a reliable local partner. This partner could be a law firm, an agency, or a consulting company, but it must have local capital. This is extremely important for language, culture, and project public relations," said Chang Yu, a French translator residing in Morocco. "The second piece of advice is to ensure that team members include individuals who are fluent in French. This makes communication with the locals much smoother."

She recounted an instance where a Chinese enterprise came to Morocco needing to rent land for factory construction, but the land already had tenants. The current tenants wanted to act as middlemen and profit from subletting. However, in Morocco, subtenants do not have the authority to sign sublease contracts.

"Because they did not thoroughly investigate the background of the land and the lessor, the company was tricked into signing an invalid contract." Additionally, recruiting suitable local talent is challenging in Morocco. In the 2024 Insider Monkey Global Education Index, Morocco ranks 154th out of 218 countries and regions. The major reasons for Morocco's talent shortage are the lack of quality universities, low average years of education per capita, and insufficient educational expenditure.

Moreover, according to Moroccan laws, the proportion of local employees hired by foreign companies investing in Morocco or engaged in contracting projects must not be lower than 70%. The Moroccan government is increasingly tightening its policies on foreign workers. Employment contracts for foreign workers must all be approved by the Rabat Labor Bureau, and job positions need to be advertised through the Moroccan government employment agency. Only if no suitable local candidates apply can foreign workers be approved to work in Morocco.

Immortal, who studied in the UK, feels that compared to the UK and Turkey, Morocco is the country where he feels the most cultural affinity. "I am surprised at how similar their cultural background is to China's. They value peace and kindness, taking care of neighbors, filial piety, and loyalty. They also worry about issues like managing relations between mothers-in-law and daughters-in-law or dealing with nepotism in companies."

However, cultural affinity does not mean that locals can easily identify with Chinese work concepts in the workplace. "Ordinary people here are not very enthusiastic about making money and are quite relaxed. For instance, they might refuse to do even easy money-making tasks if they are not in the mood. Additionally, when asking for a quote, if merchants feel that the likelihood of collaboration is low, they might even refuse to provide a quote," Immortal said. In Morocco, unpaid overtime is unheard of. "If you offer cash and good logistical conditions, they might be willing to work overtime, but if communication is poor, they will set additional conditions, or they will directly refuse to work overtime."

"They need to see the benefits first before they are willing to put in the effort," said Immortal. Although the staple food in Morocco's daily diet consists of various types of bread, they never accept empty promises in the workplace. All incentives must be immediately fulfilled. Besides the need to adapt and coordinate conflicting work concepts, an insider from a Chinese battery company in Morocco revealed that competition among Chinese enterprises is very intense due to the similarity in their fields.

Xinfotek Think Tank analyzed this situation for Xianguang News, stating that in overseas markets where geopolitical risks are increasingly prominent, even competing Chinese enterprises should unite and go abroad systematically. This is a better strategy for coping with the challenges. Industry researcher Lin Xueping expressed a similar view in his book "Supply Chain Warfare." He believes that in the face of the new global landscape, Chinese companies need to formulate a proactive "re-globalization" strategy and establish supply chain strongholds in the vast international market. Chinese enterprises should learn to use new rules, no longer fighting solo, but rather integrating resources like finance, intelligence, and logistics, much like "composite battalions" and "composite brigades" in military terms.

In this regard, Japanese companies from East Asia have already accumulated much experience. Take the expansion of Japanese car manufacturers in the Southeast Asian market as an example. On the policy infiltration front, many retired Japanese diplomats in various Southeast Asian countries do not return to Japan but become local consultants for Japanese car companies, influencing these countries' industrial policies. For instance, in Thailand, they can decide what types of vehicles qualify for lower taxes. They determine the requirements for cars to become taxis, thereby allowing Japanese car manufacturers to establish a competitive advantage at the legislative level. Additionally, their influence on local media and public opinion is profound, making it difficult for new brands to quickly overturn the perception of Japanese cars. Today, Chinese new energy vehicle companies are leveraging their technological and product advantages to directly compete with Japanese cars in Southeast Asia.

Notably, Chinese car companies in Southeast Asia generally adopt a collaborative approach rather than engaging in cutthroat competition. They work together to develop the Southeast Asian market: jointly lobbying local traffic management authorities to advocate for policies favorable to Chinese products, and collaboratively planning and formulating product solutions. They gradually move from understanding and mastering local market rules to continuously shaping and establishing these rules. For example, SAIC-GM-Wuling participated in the formulation of electric vehicle standards in Indonesia, signifying that Chinese companies are influencing the setting of global supply chain standards. Similar stories need to be replicated in countries such as Morocco, Turkey, and Mexico—all "connector" countries—so that Chinese companies can gain a voice and initiative in the wave of deep restructuring of the global supply chain.

Immortal's next destination is Hungary. This Central and Eastern European country, which is part of the EU and has signed the Belt and Road cooperation agreement with China, has also become a "bridgehead" for Chinese companies entering the European market. Immortal's journey represents the actions of many Chinese enterprises. While geopolitical factors can create barriers, technological and industrial advantages are sufficient to create openings in even the most fortified walls.