Taking over SAIC-GM's Old Factory Is Just the Beginning. Is Geely Planning for an Annual Production Capacity of 5 Million Units?

![]() 11/06 2025

11/06 2025

![]() 495

495

Preface

Introduction

Is It Aiming to Be China's Top Automaker?

Recently, it was reported that Geely Automobile has taken over SAIC-GM's former Beisheng plant (Phase III) in Shenyang, which is currently undergoing upgrades and will subsequently be used to supplement the production capacity of Geely Galaxy.

This new energy brand, which currently has the potential to catch up with BYD and has already achieved its annual sales target of one million units two months ahead of schedule in October this year, is now facing the sweet dilemma of 'production capacity chasing orders'.

The author also confirmed this news from job postings at Geely Automobile's Shenyang plant. The postings indicate that the base covers an area of 2.22 square kilometers, with planned production models ranking among the top sellers in their respective segments. The goal is to transform it into an advanced and highly intelligent vehicle production base and a 4.0 factory, with the first vehicle expected to roll off the line by the end of this year.

In addition, to enhance the production capacity supply for Geely Galaxy, Geely also plans to renovate the Lotus sports car factory in Wuhan. The project was signed in September this year and is expected to be completed in the first half of 2026.

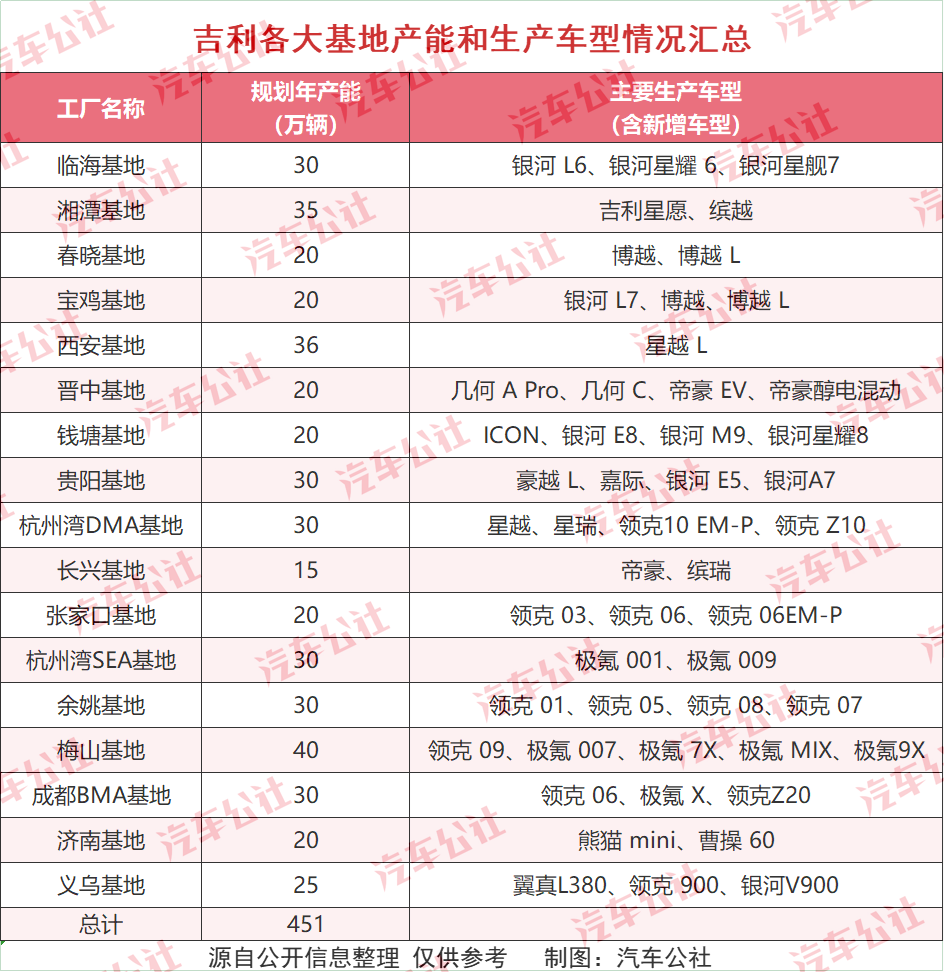

According to statistics from the 'Auto Business', Geely Automobile currently has 16 major bases nationwide, with a relatively concentrated presence in Zhejiang. Additionally, there are bases in Hunan, Guiyang, Sichuan, Xi'an, Hebei, Shanxi, Shandong, and other regions, with an actual planned production capacity exceeding 4.5 million units.

If we also consider Geely's current plans to expand production capacity through 'leasing + renovation' and its overseas factory layout (which means 'layout' in English, but kept as is for consistency with the original term used in the context of factory planning), Geely Automobile's total annual production capacity planning will exceed 5 million units, clearly aiming to become China's top automaker.

Given Geely's internal statement that 'next year will be a big year for products' and considering its production capacity planning and layout, when do you think Geely will truly ascend to the throne of China's top automaker?

01 Hot New Cars, Geely 'Borrowing' Production Capacity?

In fact, there were signs before the official disclosure of Geely taking over GM Beisheng plant. In February 2025, SAIC-GM's Beisheng plant was completely shut down. Subsequently, it was disclosed that the industrial land of the south plant would be converted for commercial and residential development, while the north plant (i.e., Phase III) would be retained.

As one of the old industrial bases in Northeast China, Shenyang was once a major automotive hub. Companies and bases such as Brilliance, BMW, Jinbei, and GM supported the local industrial foundation and formed an automotive industry cluster. However, with the decline of Brilliance, Jinbei, GM, and other enterprises, and BMW's market share in the luxury car segment being eroded by Chinese new energy vehicles, Shenyang also needs to introduce strong automotive enterprises to support its development.

In May this year, Shenyang Jichi Automobile was established. Although all the capital behind it is from Shenyang's state-owned assets, the inclusion of the character 'Ji' (Geely) in its name is self-explanatory. At that time, it was reported that the company would invest 890 million yuan to renovate and upgrade the base. Almost simultaneously, rumors emerged locally in Shenyang that Geely would take over the Beisheng plant.

Subsequently, job posting websites showed that the 'Geely Automobile Shenyang Base' was intensively recruiting positions such as welding engineers and new energy production line technicians, with a preference for candidates 'familiar with electric vehicle production line renovations.' The talent structure and job requirements implied that this traditional fuel vehicle factory would be transformed into a new energy exclusive base.

In September this year, Geely's Shenyang project was officially finalized, followed by the recruitment of production line employees. The factory underwent comprehensive renovations and upgrades starting in October. This former joint venture base, which once produced 500,000 vehicles annually, officially ushered in a new era belonging to Chinese brands.

The core reason for Geely's urgency in 'borrowing' production capacity everywhere is that its latest series of new cars, from Geely Galaxy to Lynk & Co and then to Zeekr, have far exceeded expectations.

'Although we currently produce around 700 units per day, production capacity is severely insufficient. Currently, only about 10,000 units are allocated to Galaxy M9, with a backlog of around 20,000 orders. Moreover, we are receiving around 20,000 new orders each month,' said a responsible person from Geely's Qiantang base, which produces Galaxy Starry 8 and M9, at the roll-off ceremony for 20,000 new Galaxy M9 vehicles on October 31. Both the Galaxy Starry 8 and Galaxy M9 are selling well, and we owe many customers their vehicles.

Large flagship SUVs like the Lynk & Co 900 and Zeekr 9X also have production capacities that cannot meet market demand. According to insiders from Lynk & Co and Zeekr, the production capacity of the Lynk & Co 900 is only around 7,000 units and is currently fully utilized; the initial production capacity of the Zeekr 9X is only around 5,000 units, but since its launch, orders have far exceeded Zeekr's expectations, and customers now have to wait at least six months for delivery.

According to data released by Geely in October, the Geely Galaxy brand achieved its annual sales target of 1 million units two months ahead of schedule that month. Among Geely Galaxy's 11 models currently on sale, seven have entered the '10,000-unit club,' still under tight production capacity conditions, indicating the market recognition and popularity of the Geely Galaxy brand.

'There's a severe shortage of vehicles, and production capacity is grossly insufficient...' The author learned from insiders involved in several Geely models that it's not just these large vehicles facing production capacity shortages; models like the Geely Xingyuan, Galaxy A7, and Galaxy Starry 6 are also bestsellers.

However, the question remains: Does Geely really lack production capacity? According to preliminary statistics and verification from the 'Auto Business', Geely currently has 16 major bases with a planned annual production capacity exceeding 4.5 million units. However, Geely Automobile expects to achieve annual sales of 3 million units this year, meaning there is still an excess production capacity of about 1.5 million units that is not fully utilized. Even if Geely aims for annual sales of 4 million units next year, the current production capacity is entirely sufficient.

Therefore, whether Geely is acquiring SAIC-GM's Beisheng plant in Shenyang or taking over the Lotus factory in Wuhan, its core objectives are, on the one hand, to expand production capacity and, on the other hand, to adjust production capacity, market, and industrial layout (layout).

From the map of Geely's base production capacity layout, its stronghold is in Zhejiang, with eight bases currently laid out, mainly serving the East China and South China markets. From the perspective of national base coverage, the three major bases in Zhangjiakou, Jinzhong in Shanxi, and Jinan in Shandong can serve the northern market; Chengdu and Guiyang can serve the Greater Southwest market; Xi'an and Baoji can serve the Northwest market; and currently, the Xiangtan base in Hunan serves the central market.

However, with the increasing demand for new energy vehicles and the gradual growth in penetration rates, some imbalances have emerged in Geely's new energy layout. Particularly in the western, northern, and central regions, there is a contradiction between surging sales and production capacity gaps. Moreover, if products are transported over long distances from more distant bases, it increases logistics and management costs. In today's era of gradually thinning profit margins, having bases closer to the market is more advantageous for enterprises.

Therefore, from a market perspective, the new energy penetration potential in the Northeast market constitutes a key attraction. Data from the China Association of Automobile Manufacturers shows that in the first half of 2025, the new energy vehicle penetration rate in Northeast China was only 18.2%, far below the national average of 35%. By locating a base in Shenyang, Geely can not only reduce logistics costs through 'local manufacturing' but also leverage geographical advantages to promote Geely's hybrid models suitable for cold regions. Currently, this region is dominated by BYD's new energy vehicles.

So, when recalling Geely Holding Group's (including Geely Automobile, Volvo, Farizon Commercial Vehicles, etc.) announcement in January this year that it aims to achieve annual vehicle sales of 5 million units by 2027, its external statements seem somewhat conservative.

02 Production Capacity Is a Double-Edged Sword

The rise and fall of SAIC-GM's Beisheng plant can be seen as a microcosm of the changes in China's automotive industry joint venture model. The 'golden decade' of the joint venture era has officially ended, and a new chapter of independent brand advancement is unfolding.

This joint venture base, established in Shenyang in 2004, had a peak annual production capacity of 500,000 vehicles and 450,000 engines, producing models such as the Buick GL8 and Chevrolet Equinox, which once dominated the Northeast market for a long time. However, with SAIC-GM's sales continuously declining from a peak of 2 million units in 2017 to 435,000 units in 2024, its production capacity utilization rate has dropped to only 22%, making the shutdown of the Beisheng plant inevitable.

When GM cedes its Northeast base to Geely, it essentially acknowledges the leading position of Chinese brands in the fields of new energy and intelligence.

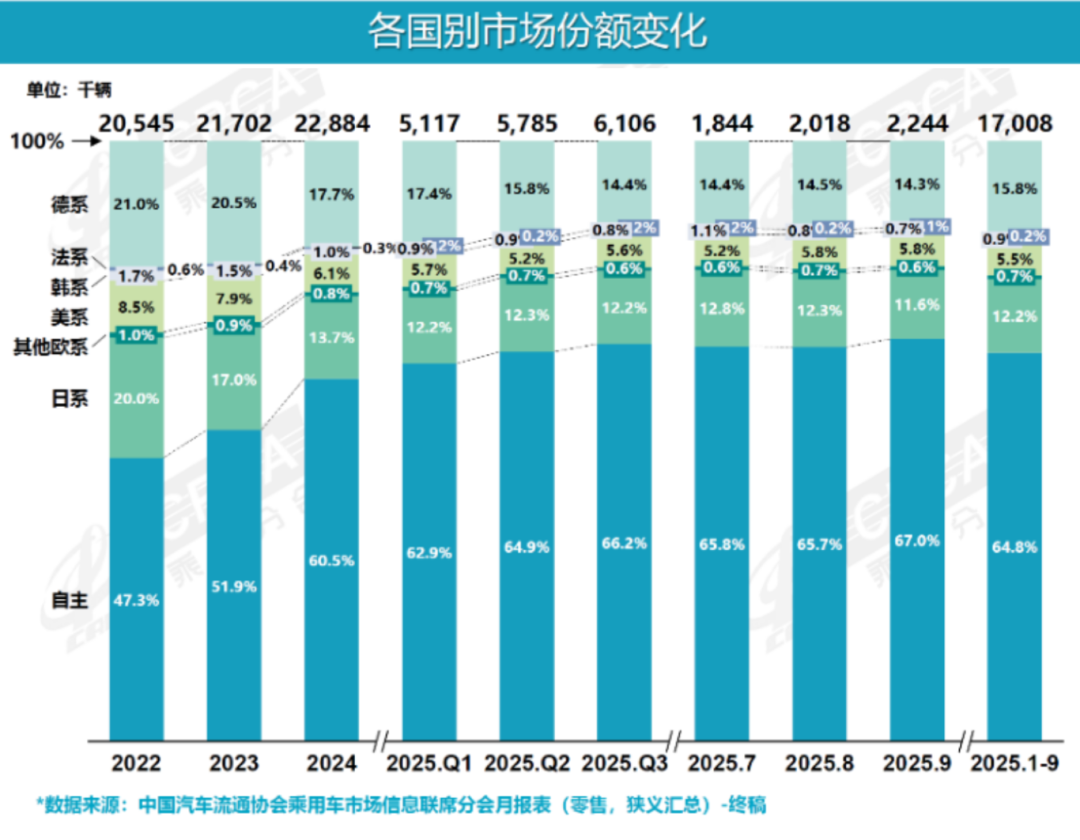

Data from the China Association of Automobile Manufacturers shows that the market share of joint venture brands has fallen from 60% in 2020 to 31.3% in 2025, while the proportion of independent brands is approaching 70%. Meanwhile, the new energy market share of independent brands exceeds 60%, while that of joint ventures is less than 10%. The capacity withdrawal of giants like GM and Volkswagen precisely provides expansion opportunities for leading independent brands such as Geely and BYD. This transformation is not only happening in Shenyang but will also unfold nationwide in the future. Against the backdrop of strict national policies on controlling new production capacity, acquiring old factories has become the optimal solution for leading enterprises to 'indirectly expand production.'

In fact, in June this year, Li Shufu, Chairman of Geely Holding Group, stated at the 2025 China Automotive Chongqing Forum that there is currently 'severe overcapacity' in the world's automotive industry. Therefore, Geely has decided not to build new automotive production plants or expand the production capacity of existing plants but to maximize practical cooperation and resource restructuring.

Therefore, production capacity upgrades are achieved through acquisitions (such as Shenyang Beisheng and Wuhan Lotus sports cars) and renovations of existing bases (such as Hangzhou Bay and Chengdu plants). This model not only avoids the approval thresholds for new factory construction but also quickly acquires mature production lines and existing supply chain resources, laying the foundation for production and sales targets.

More notably, these struggling bases, governments, and investors are eager to welcome new powerful partners to address issues related to taxation, employment, and development. Geely's current 'low-cost' entry also demonstrates its keen business acumen and insight as a Zhejiang merchant.

Taking the current Beisheng plant in Shenyang as an example, apart from having Ditong Industrial Holdings Group, a component of its Component system ( Component system means 'parts system' in English, but kept as is for consistency with the original term), land in Shenyang Huishan Economic Development Zone, Geely has not yet established any obvious commercial organizations related to passenger vehicle manufacturing locally. According to industry analysis, the initial renovation funds for the base are provided by the local state-owned assets supervision and administration commission, and it is not excluded that Geely and the local government may share industrial benefits and share (which means 'share' in this context, referring to sharing market risks) market risks in the future.

After all, the expansion of production capacity is not a one-time deal, nor does it guarantee that Geely's new cars will continue to sell well in the next one or two years just because they are popular now. The market is constantly changing, and competitors are surging. Countless stories from the past tell us that victory can drive people crazy. Once on the path of production capacity expansion, enterprises must bear the risk of downturns due to market changes. The cases of many past joint venture automakers going from Glorious expansion (which means 'glorious expansion') to decline and factory sales also tell us that production capacity expansion is a double-edged sword.

Therefore, the key to production capacity expansion lies in 'precision' and 'flexibility.' It requires not only matching the pace of market growth but also possessing the elasticity for rapid adjustments. Success or failure depends on the enterprise's judgment of market cycles and its own strengths, as well as its profound insight into future market patterns. Having once suffered a setback on the path of expansion, will Geely smoothly achieve its annual sales target of 5 million units this time?

Editor-in-Chief: Cui Liwen Editor: He Zengrong