Kuaishou Joins the 'Battle': What's the Allure of Spring Festival Gala Red Packets?

![]() 02/10 2026

02/10 2026

![]() 562

562

Original: Shenmou Finance (chutou0325)

On February 9, Kuaishou officially declared its collaboration with CCTV's Spring Festival Gala, offering viewers the chance to enjoy 2026 Gala content through live streaming, on-demand viewing, and short videos. Users can shake their phones to snag red packets, with a guaranteed 100% unlock rate for all progress red packets, rewarding lucky participants with an 88 yuan cash bonus. Kuaishou's entry into this arena continues the long-standing tradition of internet platforms leveraging content partnerships to boost traffic during the Spring Festival. However, the true battleground for this year's Spring Festival marketing lies elsewhere.

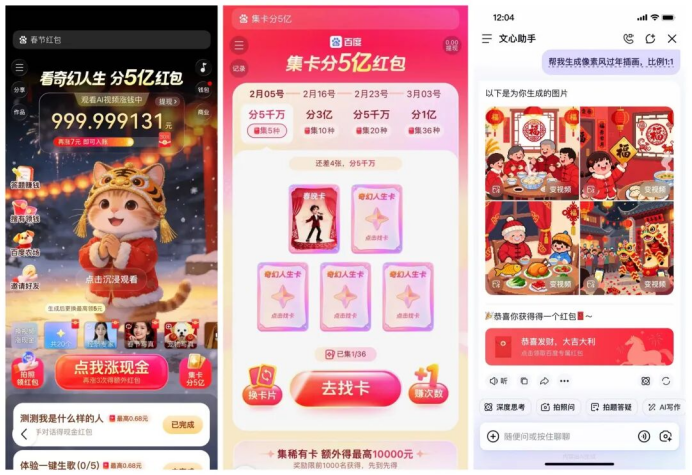

On January 25, Tencent Yuanbao and Baidu Wenxin Assistant announced staggering investments of 1 billion and 500 million yuan, respectively, in Spring Festival cash red packets. Meanwhile, Alibaba Qianwen set a new benchmark with a whopping 3 billion yuan 'Spring Festival Hospitality Plan.' ByteDance's deep integration with the Gala further escalates the total, with these tech giants collectively investing at least 4.5 billion yuan during the Spring Festival to vie for AI product users.

This figure not only eclipses previous Spring Festival marketing scales but also signals a profound shift in the focus of internet competition, transitioning from mobile payments and short video traffic to securing 'super entry points' in the AI era. The true 'mainline' of this year's Spring Festival marketing is becoming increasingly evident.

01

The Evolution of the Red Packet Wars

The tradition of internet platforms distributing red packets during the Spring Festival may be well-known, but its strategic significance has continuously evolved alongside changes in the internet development landscape.

Over the past decade, the red packet wars have undergone four distinct stages of evolution. The first stage, spanning from 2015 to 2018, was the 'Payment Entry Point Competition Period.'

During the 2015 Spring Festival, Tencent launched its renowned 'Pearl Harbor Attack,' distributing 500 million yuan in cash red packets through WeChat's 'Shake' feature. This move successfully bound 200 million bank cards within three months, breaking Alipay's monopoly in mobile payments.

The following year, Alipay, unwilling to concede defeat, invested 800 million yuan to launch the 'Xiu Xiu Xiu' collect-five-blessings campaign. This campaign became a phenomenal IP through social fission gameplay and the buzz generated by the scarcity of 'Dedication Blessings.' The core logic of this stage was to rapidly popularize payment tools and cultivate user habits through low-threshold cash incentives.

The second stage, from 2019 to 2023, belonged to the 'Traffic Ecosystem Expansion Period.'

In 2019, Baidu App distributed 900 million yuan in red packets during the Gala. In 2020, Kuaishou invested 1 billion yuan in video-liking red packets, finally achieving breakthroughs. In 2021, Douyin temporarily replaced Pinduoduo to partner with the Gala, distributing 2 billion yuan in red packets while launching its own payment service. In 2022, JD.com distributed 1.5 billion yuan in red packets and goods to counter Pinduoduo's aggressive offensive...

From Baidu to Kuaishou to Douyin and JD.com, major players joined the fray one after another, with red packet amounts continuously rising. The focus of this stage shifted from payments to traffic acquisition and ecosystem expansion, as each company hoped to leverage the national Spring Festival scene to drive traffic to their core products or emerging businesses.

However, as user growth peaked and marketing effectiveness declined, the red packet wars cooled significantly in 2023, with companies becoming more rational in calculating the ROI of their marketing investments.

By the third stage, from 2023 to 2026, Spring Festival red packets had all but disappeared, with no Gala-level spending or nationwide interactive campaigns. Companies began preferring to spend money on more certain placements and direct conversions.

Just as the market thought the 'red packet' format was outdated, the wars reignited suddenly in 2026.

This fourth stage can be considered the 'AI Entry Point Competition Period.' Unlike before, this year's red packet activities were all deeply integrated with AI products.

Users had to engage in dialogues, generate content, and perform tasks through AI assistants like Yuanbao, Wenxin, and Qianwen to receive red packet rewards.

Tencent's Pony Ma bluntly stated, 'We hope to recreate the glory of WeChat red packets,' but this time the goal is no longer payments but to get users to install and regularly use AI assistants on their phones, preferably without uninstalling them.

Behind this shift is the realization that with traditional entry points like search, information feeds, and e-commerce already established, AI assistants may become the core interface for next-generation human-computer interaction.

Companies have begun to realize that whoever can first get users to form the habit of 'asking AI first' will gain the power to define interaction rules and allocate traffic in the AI era.

02

A Strategic Entry Point That Cannot Be Overlooked

The effectiveness of these massive investments remains uncertain for internet giants like ByteDance, Alibaba, Tencent, and Baidu, but this seemingly high 'tuition fee' is a cost they cannot afford to ignore.

Driving this high-stakes gamble are three clear and urgent strategic logics: an unprecedentedly vast market, a closing time window, and an entry point defense war crucial for survival.

First, there is the enticing 'ticket' to a trillion-dollar market. A McKinsey research report shows that by 2030, the global AI To C market will reach 1.3 trillion US dollars, with an average annual growth rate exceeding 35%.

Under China's internet-validated logic of 'burning money to capture the market,' from ride-hailing wars to food delivery subsidies, from mobile payment popularization to short video breakthroughs, early strategic losses have often been a shortcut to seizing the track and defining rules.

Faced with the future AI To C market, the tens of billions invested during the Spring Festival are seen by giants as a necessary cost to secure a seat on the track.

Second, there is the critical window period for forming user habits.

Data from QuestMobile at the end of 2025 shows that Doubao APP had 155 million weekly active users, while DeepSeek APP ranked second with 81.56 million and Yuanbao APP third with 20.84 million.

Currently, as large model capabilities gradually converge and open-source models reduce technological gaps, user scale and frequency of use have become key to determining success.

The Spring Festival, as the only scenario capable of nationwide reach throughout the year, is a 'strategic window period' for rapidly expanding user bases and cultivating usage habits. Missing this window could mean falling behind during the critical phase of forming AI assistant mindshare.

The deepest and most acute anxiety stems from the fear of being 'pipelined.' Traditional internet entry points were mostly based on clear functional divisions, such as WeChat for socializing, Taobao for shopping, and Baidu for searching.

However, AI assistants are characterized by their universality and natural interaction capabilities, allowing users to address various needs through dialogue without jumping between apps. This means a sufficiently intelligent AI assistant could become a 'super entry point' above existing app matrices, redefining traffic allocation rules.

This conclusion undoubtedly deepens the 'anxiety' of major companies. If users become accustomed to handling various needs through a third-party AI assistant, super apps like WeChat, Taobao, and Baidu could be relegated to backend 'service providers,' losing direct connections and interaction control with users.

Therefore, this 'hollowing-out' risk forces companies to participate directly, sparking a new 'ranking war' for AI applications and traffic entry points.

Additionally, the evolution of AI products highly depends on real user interaction data. More users mean more high-quality data, leading to rapid iteration of model capabilities and forming a positive cycle of 'user growth - data accumulation - experience optimization.'

Spring Festival red packets can create massive user-AI interaction scenarios in a short time, providing valuable data fuel for model training.

For example, Baidu intentionally 'deeply integrated red packets with core functions like photo search and AIGC video creation' when designing its red packet gameplay, recognizing the long-term value of data accumulation.

Notably, each company has chosen different entry point strategic paths based on its unique resource strengths.

Tencent leverages WeChat's social relationship chains to launch 'Yuanbao Faction' to explore AI socializing. Alibaba utilizes its commercial ecosystem advantages to make Qianwen a service entry point connecting shopping and local life. ByteDance uses its content ecosystem to penetrate Doubao into short video creation and consumption scenarios. Baidu adheres to a search + AI technical route, strengthening information acquisition and task processing capabilities...

These differentiated attempts collectively form a diverse landscape of entry point competition in the AI era.

03

After Spending the Money, What's Next?

The extravagance of internet giants reflects their strong desire to restructure the market landscape through the Spring Festival window.

However, historical experience and business laws act as a calm mirror, reflecting the fragility of relying solely on cash incentives to build competitiveness. One aspect is the 'Retention Rate Paradox.' In the history of internet marketing, the 'pulsed traffic' brought by Spring Festival red packets often comes with dismal user retention.

For example, in 2019, Baidu partnered with the Gala for the first time, investing nearly 1 billion yuan to boost Baidu App's user scale and activity through Gala traffic. While Baidu's daily active users did surge from 160 million to 300 million on Gala day, the user retention rate after 30 days was a mere 2%.

Today, AI red packet activity chains are longer and operations more complex, requiring users to complete dialogues, generate content, and perform tasks to obtain rewards.

Although the design intent is to cultivate usage habits, many users come merely to 'clip coupons,' making it difficult to discover the core value scenarios of AI assistants under a 'claim and leave' mentality.

This creates a common dilemma of 'high customer acquisition costs and low retention efficiency,' where massive investments may only yield temporary false prosperity rather than sustainable user assets.

DeepSeek's successful path during last year's Spring Festival provides a stark contrast to this paradox.

Without any marketing or subsidies, relying solely on model capabilities, the DeepSeek app gained over 100 million new users in 7 days, setting a then-global record for the fastest AI app user base to reach 100 million. Just 3 weeks after launch, its DAU exceeded 22 million and quickly surpassed 30 million in early February, briefly becoming a nationally discussed product during the Spring Festival.

This case sharply reveals that after the 'stimulant' effect of subsidies wears off, what ultimately retains users is only the product's core ability to solve practical problems and its daily value.

On the other hand, there is the 'Data Quality Paradox.' Besides hoping to secure time and mindshare, another deep purpose of companies distributing red packets is to obtain valuable real user interaction data to feed model evolution.

However, when interaction motives are simplified to obtaining cash rewards, the resulting data quality is concerning. Users may input a large amount of meaningless instructions like '.', '111', or 'give red packets' rather than expressing real needs.

A 2025 University of Texas study shows that when junk data proportions rise from 0% to 100%, model reasoning capabilities plummet by 23.6 percentage points, and this degradation cannot be repaired through subsequent 'remedial' efforts.

This means blindly pursuing interaction volumes not only fails to optimize models but may also pollute data pools, harming AI's long-term evolutionary capabilities—the opposite of the original intent.

Despite these paradoxes, what is certain for now is that the 2026 Spring Festival will be remembered as a critical milestone for AI popularization in China. However, the industry's final landscape will never be determined by who spends the most money in the short term.

'Without any monetary incentives, is your AI assistant still worthy of staying on your phone's home screen?'

This may be the ultimate question that truly decides the outcome.

* Image sourced from the internet. Please contact for removal if infringement occurs.