Eleven Years of Internet Firms' Spring Festival Gala Marketing: 18 Billion Yuan in Giveaways, Yet the Era of WeChat Red Packet Excitement Fades

![]() 02/10 2026

02/10 2026

![]() 475

475

Author|Xie Jiabaoshu

The Spring Festival Gala, a highly anticipated annual spectacle, not only serves as a competitive marketing arena for companies but also offers a crucial window into the evolution and trends within China's industrial landscape.

Over a decade ago, amid the rapid proliferation of mobile internet, internet behemoths eagerly sought exclusive partnerships with the Spring Festival Gala, aspiring to replicate the commercial triumph of the “WeChat Red Packet” phenomenon.

According to incomplete statistics from Farsight, from 2015 to 2025, internet companies have collectively invested over 18 billion yuan in red packet giveaways during the CCTV Spring Festival Gala.

However, in recent years, as market dynamics have shifted, internet companies have adopted a more rational stance towards the Gala, showing diminished enthusiasm for exclusive partnerships.

Now, with AI technology gradually reaching maturity, the internet industry stands on the brink of a new “qualitative” leap. To gain a competitive edge, tech giants are once again placing their bets on the Gala, launching a series of high-profile marketing initiatives.

As the adage goes, “Those who forget history are doomed to repeat it.” Reflecting on over a decade of internet companies' Spring Festival Gala marketing endeavors, which firms have reaped exceptional rewards? Which have merely enjoyed fleeting successes, squandering resources? These experiences of triumph and failure will offer highly pertinent strategic insights for the next phase of AI-driven marketing.

01

WeChat Sparks Spring Festival Gala Marketing Frenzy, with 'BAT' Giants Following Suit

In fact, the early pioneers of Spring Festival Gala marketing were not internet companies. From the 1990s to the early 21st century, leading sponsors of the Gala were companies from the physical manufacturing sector, such as Kongfu Banquet Wine, Harbin Pharmaceutical Group Sixth Factory, and Midea.

It wasn't until 2015, when Tencent's WeChat forged a partnership with CCTV for the Spring Festival Gala, that the era of internet-driven Gala marketing commenced.

At that juncture, China's mobile internet industry was experiencing explosive growth. Data from the National Bureau of Statistics revealed that in 2015, China's mobile internet access traffic soared to 41.9 billion GB, marking a 103% year-on-year surge; mobile internet users numbered 620 million, up 11.31% year-on-year. Internet penetration reached 50.3%, an increase of 2.4 percentage points year-on-year.

Bolstered by products like QQ, Tencent Weibo, and QQ Mail, WeChat had already begun to cement its status as a national-level mobile social platform. Tencent's financial reports indicated that by the end of 2015, WeChat and WeChat had amassed a combined monthly active user base of 697 million, up 39% year-on-year.

Against this backdrop, Tencent's primary objective in partnering with CCTV for the Spring Festival Gala was not to further expand WeChat's user base but to propel WeChat Pay into the mainstream market.

Source: WeChat

In 2015, the CCTV Spring Festival Gala introduced full-scale new media interactivity for the first time, with WeChat becoming the red packet interaction partner. Users could shake their phones via WeChat to seize 500 million yuan in cash red packets. Leveraging WeChat's existing user base of hundreds of millions, the Gala drove a massive influx of users to WeChat Pay.

Official data showed that on Chinese New Year's Eve in 2015, WeChat users sent and received a staggering 1.01 billion red packets, more than 60 times the previous year's figure. Within three months, WeChat Pay added 200 million new bank card bindings, disrupting Alipay's near-monopoly in China's payment market.

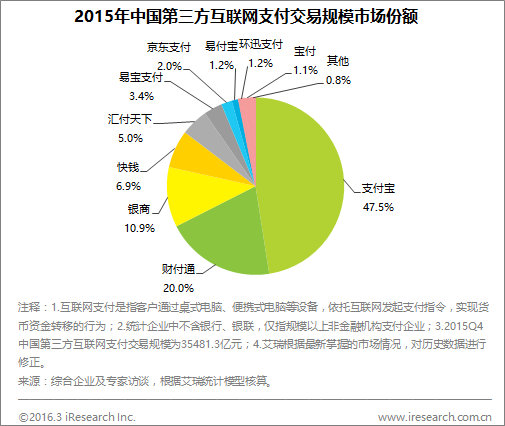

Source: iResearch Consulting

According to iResearch Consulting, in 2014, Alipay dominated China's third-party mobile payment market with an 82.8% share. By 2015, although Alipay remained in the lead, its market share had plummeted to 47.5%, while Tencent's Tenpay saw its share rise to 20%.

Taking a leaf out of WeChat's book, Alibaba partnered with CCTV for three consecutive years from 2016 to 2018, launching red packet giveaways and shopping cart clearance events through its Alipay and Taobao platforms, distributing over 2 billion yuan in red packets.

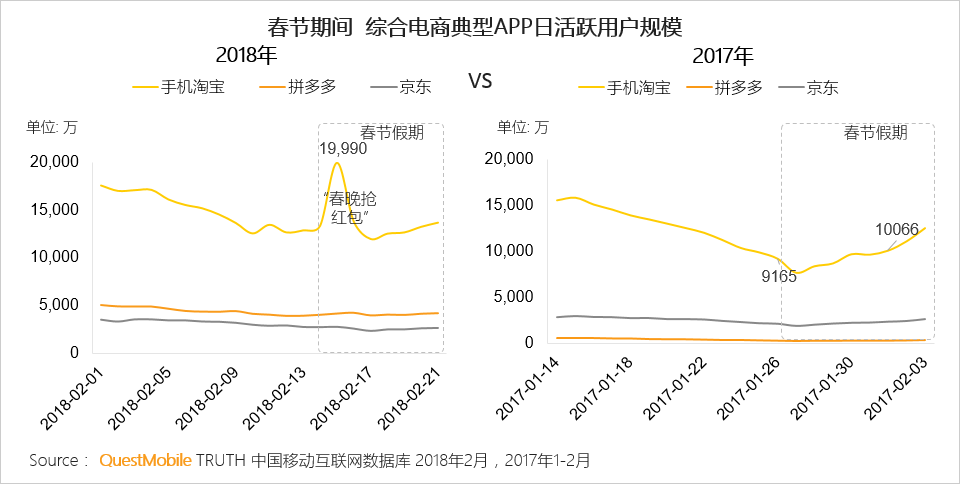

Source: QuestMobile

Although the Spring Festival has traditionally been a slow season for e-commerce, the Gala propelled Taobao's user base to new heights. QuestMobile data showed that on Chinese New Year's Eve in 2018, the Taobao app reached 200 million daily active users, with an average of 7.9 daily uses per user and an average session duration of 19.2 minutes, significantly outperforming competitors.

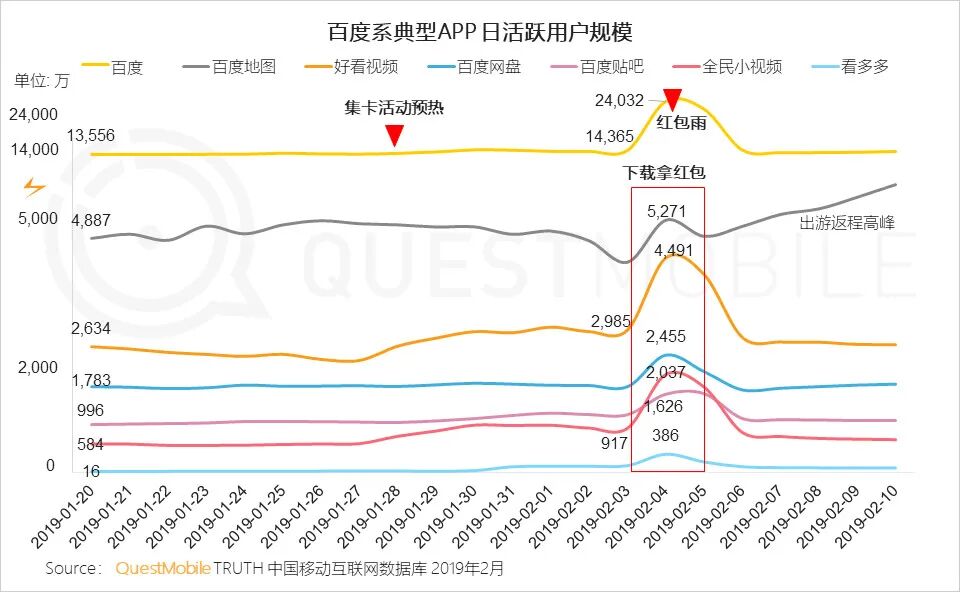

Source: QuestMobile

As one of the “BAT” (Baidu, Alibaba, Tencent) titans, witnessing Tencent and Alibaba successively capture massive user bases through Gala marketing, Baidu also jumped on the bandwagon, partnering with CCTV in 2019 to distribute 900 million yuan in cash red packets. QuestMobile data showed that on Chinese New Year's Eve in 2019, Baidu's product ecosystem witnessed a sharp rise in daily active users, with the Baidu app reaching 240 million DAUs, a 67.3% increase from the previous day, representing a net gain of nearly 100 million users.

Overall, for the physical retail sector, the Spring Festival Gala can deliver potent brand exposure but, due to lengthy transaction chains and complex conversion paths, it is challenging to achieve immediate feedback from Gala marketing. Thus, Gala marketing was previously confined to brand display and mindshare capture.

As Luo Zhenyu, founder of the app “De Dao,” once remarked, “We truly know nothing about the power of the Spring Festival Gala.” With the advent of the internet era, the Gala has transformed from a one-way advertising platform into a super-marketing scene with conversion capabilities. Because the internet transcends time and space limitations, internet companies can instantaneously capture massive user bases through Gala marketing.

Following the “BAT” era, short-video platforms like Douyin, Kuaishou, and WeChat Channels also leveraged the Gala to gain market traction and emerge as new content platforms.

02

The End of WeChat Red Packet Moments: The Mutual Evolution of the Gala and the Internet

For internet companies, the Spring Festival Gala has been a lucrative “gold mine” of traffic. In previous years, to monopolize the dividends, many internet platforms signed exclusive partnership agreements with CCTV.

However, after scrutinizing the data, Farsight found that after 2022, the Gala ceased to partner exclusively with a single internet company and instead collaborated with multiple platforms of varying natures. For instance, in 2022, although JD.com was the exclusive interactive partner for the Gala, Douyin, Kuaishou, and WeChat Channels also secured broadcasting rights.

Internet companies are no longer as enthusiastic about exclusive Gala sponsorships, perhaps recognizing that, with the decline of mobile internet dividends, the Gala is not a one-size-fits-all solution for boosting platform influence.

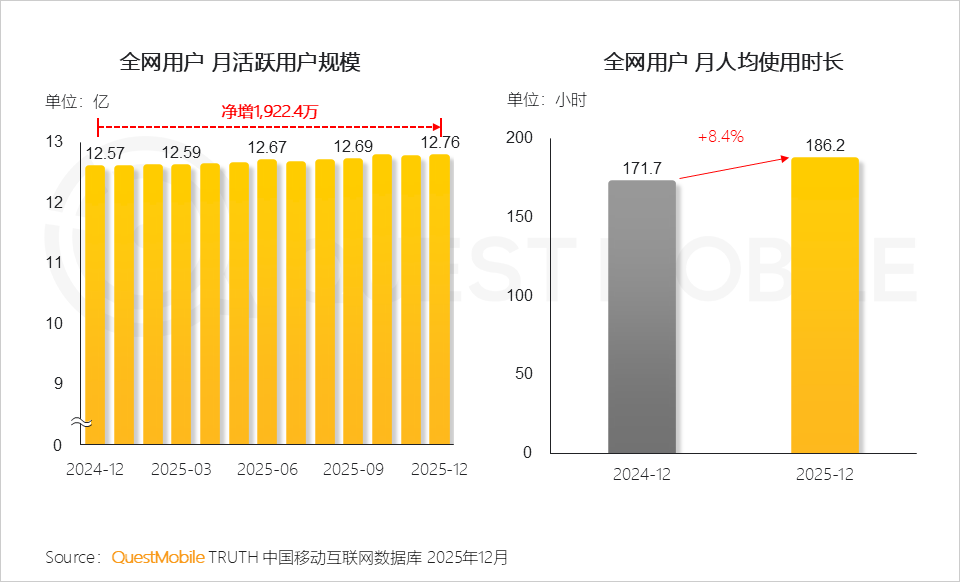

Source: QuestMobile

QuestMobile data showed that as of December 2025, China's mobile internet monthly active user base stood at 1.276 billion, with year-on-year growth hovering around 2% for multiple consecutive years. QuestMobile noted that “growth in mobile internet user numbers has stabilized, and the industry's growth engine has shifted to deep user engagement and mining existing value.”

While the Gala, with its hundreds of millions of viewers, can deliver massive traffic, it has not reversed the dwindling dividends of China's mobile internet and struggles to provide internet platforms with new, high-value user bases. After the Gala marketing campaigns conclude, internet platforms' core businesses often fail to retain users who were only interested in red packets, leading to inevitable user churn.

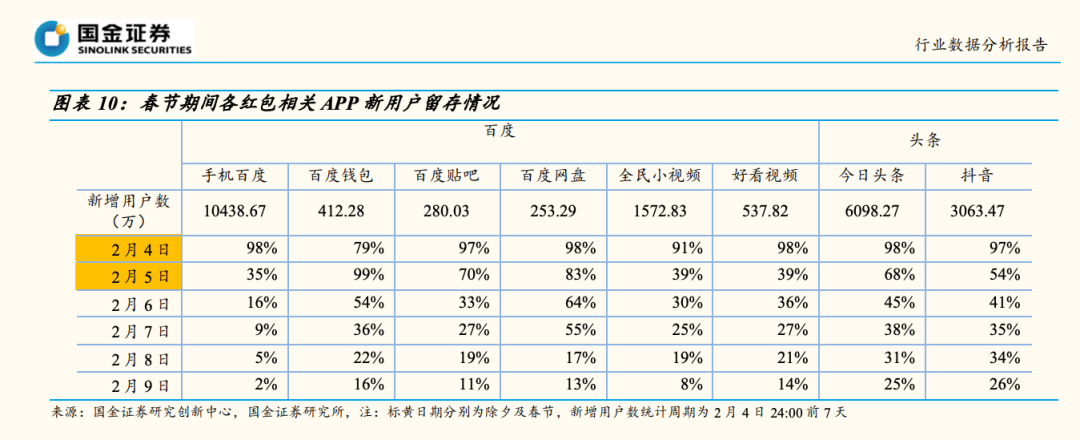

Source: Sinolink Securities

According to Sinolink Securities, although Baidu's app gained over 100 million new daily active users on Chinese New Year's Eve in 2019 due to Gala marketing, the retention rate was a mere 2% five days later. Sinolink commented, “Despite heavy spending, Baidu only attracted 'opportunity seekers' and gained short-lived heat (popularity), with disappointing results.”

In fact, Baidu's experience was not unique. User churn after the Gala has become a recurring nightmare for most internet platforms.

During the 2020 Spring Festival, Kuaishou's app reached 280 million DAUs but later fell to 250 million. During the 2021 Spring Festival, Douyin's app peaked at 580 million DAUs before dropping to around 500 million.

However, it's worth noting that unlike Baidu's more utility-focused app, short-video platforms rely on algorithmic recommendations and possess strong universal appeal. Although Kuaishou and Douyin witnessed user base declines after Gala marketing, as emerging platforms, they did manage to attract some incremental users through the Gala.

JD.com, with its focus on high-quality self-operated goods and a naturally limited audience, faced a similar situation to Baidu.

In 2022, JD.com invested 1.5 billion yuan in Gala marketing. On Chinese New Year's Eve, JD's app reached 151 million DAUs, an 81.4% increase from the previous day, but users quickly churned afterward. Financial reports showed that as of the end of September 2022, JD.com had 588 million annual active users, up just 6.5% year-on-year.

Consequently, after 2022, although internet companies continue to partner with the Gala, they no longer “blindly believe” in its effects and instead treat it as a routine marketing window, focusing more on return on investment. For example, since 2024, Xiaohongshu has been the Gala's note-sharing platform. Without splurging on red packets, it has attracted and retained massive users through high-quality community content.

Source: Xiaohongshu

Official data showed that in 2023, Xiaohongshu had 312 million MAUs. After two Gala collaborations, its MAUs rose to 350 million in 2025, a net increase of 38 million and a 12.18% jump.

For CCTV, although the Spring Festival Gala remains one of China's most influential TV programs, its appeal to viewers has been waning amid increasingly diverse entertainment options. Official data showed that before 2019, the Gala's viewership hovered around 30%, but it has declined steadily since 2020, reaching just 20.23% in 2023.

Given the Gala's shrinking audience, CCTV cannot afford to remain confined to traditional TV channels and must adapt to changing distribution channels by partnering with new media platforms. This is the primary reason why short-video platforms like Douyin, Kuaishou, and WeChat Channels have increasingly secured new media broadcasting rights for the Gala since 2020.

Source: CCTV

Indeed, after partnering with new media platforms, the Gala has reached a broader audience. Official data showed that as of January 29, 2025, the 2025 Gala generated 2.13 billion new media live views, up 26.04% year-on-year. “Vertical Screen Gala” live streams saw 530 million views, a 25.3% increase, with 300 million unique users, up 16.73%.

Clearly, with mobile internet user growth capped and ROI underwhelming, internet platforms have become disillusioned with the Gala. After 2022, they no longer blindly invest heavily in Gala marketing. Notably, in 2023, no internet company distributed red packets during the Gala.

As internet platforms adopt a more rational approach to the Gala, CCTV has also embraced change—abandoning its reliance on traditional TV broadcasts and expanding the Gala's reach and efficiency through deep collaborations with new media platforms, thereby enhancing its competitiveness.

In recent years, the relationship between the Spring Festival Gala and internet platforms has shifted from one-sided dependence to mutual benefit.

03

AI Reignites Red Packet Frenzy, but the Gala Is Not a Cure-All

Against the backdrop of normalized internet Gala marketing, the emergence of AI technology has once again sparked enthusiasm among tech giants.

According to LatePost, for the 2026 CCTV Spring Festival Gala, ByteDance secured the partnership at the highest

On February 1st, Tencent Yuanbao launched its New Year promotional campaign, offering a staggering 1 billion yuan in cash red envelopes. In response, Pony Ma, the founder, chairman, and CEO of Tencent, remarked, 'Some of our competitors have poured substantial marketing funds into television advertising. We've chosen to channel those funds directly into red envelopes, aiming to recreate the magic of eleven years ago when WeChat red envelopes stole the show at the Spring Festival Gala.'

Image source: Alibaba

On February 6th, Alibaba Qianwen rolled out its 'Qianwen Treats, Splitting 3 Billion' campaign. From February 6th to February 12th, users can grab 2 billion yuan in no-threshold discount vouchers, enabling them to enjoy an instant 25 yuan discount when placing orders through Qianwen's integration with Taobao Flash Sales. Subsequently, Alibaba Qianwen will distribute an additional 1 billion yuan in cash red envelopes.

Despite missing out on the CCTV Spring Festival Gala sponsorship, Qianwen secured exclusive sponsorship deals with the Spring Festival Galas of Dragon TV, Zhejiang TV, Jiangsu TV, and Henan TV. 'As an 'AI performer,' it participated in program recordings and is set to deliver creative and entertaining performances during the Spring Festival Galas,' the company announced.

The reason behind the renewed heavy marketing investments by internet giants during the Spring Festival largely stems from the maturation of technology, with AI poised to spark a new wave of 'gateway' transformation. Internet giants aspire to replicate the WeChat red envelope phenomenon from eleven years ago, leveraging the Spring Festival to establish a foothold in the AI era.

However, Farsight posits that the rapid market dominance achieved by WeChat red envelopes with the aid of the Spring Festival Gala was not due to any 'magical' power of the Gala itself, but rather because WeChat's social infrastructure was already well-established, and users had an inherent demand for sending and receiving red envelopes.

Thus, the 2015 Spring Festival Gala served more as a catalyst for WeChat red envelopes rather than a decisive factor, akin to firing a starting gun that was already loaded.

In contrast, today's popular AI products, while beginning to exhibit the hallmarks of a new generation of 'super gateways,' have not yet evolved into indispensable infrastructure products akin to WeChat, Alipay, or Taobao.

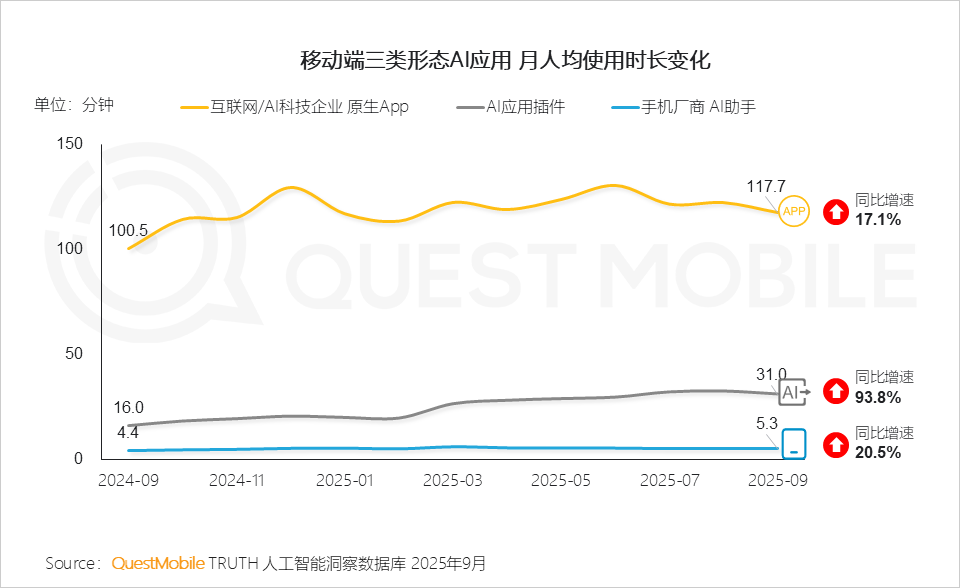

Image source: QuestMobile

A 2024 Gartner research report revealed that the 30-day average retention rate for consumer-grade AI applications stood at a mere 12.8%, 12.2 percentage points lower than that of traditional mobile apps. QuestMobile data indicated that as of September 2025, the average monthly usage time per person for AI-native apps was 117.7 minutes, up 17.1% year-on-year, but the average daily usage time per person was only 3.92 minutes, significantly lower than that of highly engaging products like WeChat, Douyin, and Xiaohongshu.

Indeed, Alibaba and Tencent have acknowledged the issue of low user engagement with Chatbot-style AI assistants and have responded with targeted initiatives such as free milk tea promotions or social features like 'Yuanbao Faction' to boost user interaction.

Judging by the promotions from internet giants, heavy subsidies have indeed galvanized user enthusiasm. For instance, Alibaba disclosed that within nine hours of launching the 'Qianwen 3 Billion New Year Giveaway,' over 10 million orders were placed.

However, it's crucial to note that the impressive results achieved by AI assistants at this stage bear a striking resemblance to how Baidu and JD.com rapidly garnered massive traffic by leveraging the Spring Festival Gala in the past—not entirely due to the products' inherent competitiveness but largely reliant on the short-term boom generated by heavy subsidies. Once the subsidies cease, whether users will continue to engage will become an unavoidable litmus test for AI assistants.

In summary, reflecting on the past decade of internet Spring Festival marketing history reveals that the Spring Festival Gala is not merely a critical marketing node but also a mirror reflecting the ebb and flow of China's internet industry.

Around 2015, China's mobile internet entered a phase of rapid expansion. WeChat, with its highly mature product design, resonated with the traffic dividend of the Spring Festival Gala and utilized red envelopes—a low-threshold, high-participation feature—to educate users, both tapping into the mobile payment market and allowing the internet industry to intuitively grasp the immense potential of Spring Festival marketing for the first time.

In the decade since, internet companies have taken turns gracing the Spring Festival Gala stage, betting heavily on this super gateway, but none have replicated the 'WeChat red envelope moment.' On the surface, this appears to be a marketing strategy failure; a deeper reason lies in the fact that as industry differentiation intensifies, more and more internet products are becoming vertical and niche, with product forms and usage barriers inherently misaligned with the 'universality' represented by the Spring Festival Gala.

The success or failure of most cases confirms a simple yet often overlooked fact: the Spring Festival Gala has never been a 'magic wand' that turns everything to gold. Only when a product itself possesses sufficient universality and maturity can Spring Festival marketing act as an 'amplifier'; otherwise, even the most surging traffic will ultimately fade away like a fleeting moment.

For the burgeoning AI industry, the successes and failures of internet Spring Festival marketing hold significant reference value.

This article is original content from Farsight and is prohibited from being reproduced without authorization.