Slash sales by 100,000 units, a plunge of 25%, leadership change at the last minute – can China's largest automaker withstand BYD?

![]() 07/17 2024

07/17 2024

![]() 685

685

Woodcutter's Works: People, Cars, and the Rise of China's Automotive Industry

SAIC Motor officially announces a leadership change, with Chen Hong stepping down and Wang Xiaoqiu taking over.

After the leadership change, will "internally and externally troubled" SAIC Motor be able to forge a path of counterattack for "Chinese partners" in joint ventures, revitalize the status of state-owned automakers in the joint venture era, and withstand BYD's attack? It remains to be seen.

Self-preservation and Leadership Change at the Last Minute

On July 11, SAIC Motor announced that Mr. Chen Hong, the company's former Chairman, had applied to resign from his positions as Chairman, Director, and member of the Strategy and ESG Sustainable Development Committee of the 8th Board of Directors of Shanghai Automotive Industry Corporation (Group) due to retirement at the age of retirement.

Meanwhile, the SAIC Motor Board of Directors resolved to elect Mr. Wang Xiaoqiu as the Chairman of the 8th Board of Directors, marking the official beginning of the Wang Xiaoqiu era at SAIC Motor.

It is worth noting that reaching retirement age is not mandatory retirement, and many state-owned enterprise leaders continue to hold important positions after reaching retirement age.

Chen Hong's voluntary retirement on the grounds of age has a distinct flavor of "self-preservation."

After all, as of June, SAIC Motor was still China's largest automaker.

Currently, the competition between new energy vehicles and traditional vehicles is intense, as is the competition among new energy automakers.

Amidst the price wars waged by various automakers, SAIC Motor has entered a crucial moment in defending its title as China's largest automaker. Chen Hong's resignation and Wang Xiaoqiu's appointment resemble the scene of Liu Bei entrusting his son to Zhuge Liang, a leadership change at the last minute.

During the Chen Hong era, it was a historic opportunity for the electrification and intelligentization of automobiles to achieve a breakthrough from zero to one. However, SAIC Motor missed this historic opportunity and failed to create a dominant new energy brand in the market. The sales of Flying A and IM have remained lukewarm.

In addition, the "Soul Theory" of the Chen Hong era is the most well-known policy. Whether this policy is correct or not is up to the public to judge.

As the saying goes, no accomplishment is a fault. SAIC Motor's biggest mistake is missing the historic opportunity. Against the backdrop of the national policy of changing lanes to overtake, it failed to seize the historical opportunity to stand out, which is regrettable.

A Reduction of 100,000 Units in a Single Month, a Plunge of 25%

SAIC Motor's Internal and External Troubles Are Epitomized in Joint Ventures

In June, SAIC Motor sold 300,000 vehicles across the board, a decrease of 100,000 units from the same period last year when it sold 400,000 vehicles, representing a steep decline of 25%. In the context of overall growth in China's automotive market, SAIC Motor's sales have decreased instead of increased, creating an urgent situation.

In contrast, BYD has surpassed the 300,000-unit monthly sales mark for two consecutive months, and the upward trend is still strengthening. The contrast between the rise and fall is clear.

Sales figures are the result, not the cause. SAIC Motor's dilemma lies in its internal and external troubles.

SAIC Motor's internal troubles are mainly manifested in its inability to carry the banner of new energy vehicles, especially the weakness of its independent brands.

As SAIC Motor's flagship products in exploring the new energy market, IM and Flying A have failed to carry the banner. Meanwhile, Wuling's new energy vehicles, which target the low- and mid-end markets, face the downward pressure from automakers such as BYD and Geely. In summary, SAIC Motor's new energy vehicles have not broken through.

SAIC Motor's external troubles are mainly manifested in the significant erosion of the traditional joint venture vehicle market by new energy automakers led by BYD.

In June, mainstream joint venture brands sold 480,000 vehicles, a year-on-year plunge of 27%. The retail share of German brands fell to 18.6%, a decrease of 2.6 percentage points year-on-year; the retail share of Japanese brands fell to 14.3%, a decrease of 3.5 percentage points year-on-year; and the retail share of American brands fell to 6.3%, a decrease of 2.9 percentage points year-on-year.

In terms of penetration rate, the domestic retail penetration rate of new energy vehicles in June was 48.4%, an increase of 13.5 percentage points from the same period last year when it was 34.9%.

It is evident that new energy vehicles have aggressively eroded the traditional fuel vehicle market, and SAIC Motor, whose core business is traditional fuel vehicles, is no exception.

SAIC Motor's dilemma of internal and external troubles can be summarized in one sentence: sluggish growth and an unsecured core business.

SAIC Motor's predicament is shared by all joint venture enterprises. The same applies to FAW, Dongfeng, and GAC.

BYD's Advance with a Large Force

SAIC Motor's Crown May Not Be Safe

In the new energy market, if you don't advance, you will retreat.

On one hand, SAIC Motor is experiencing sluggish growth, while on the other, BYD is advancing vigorously. SAIC Motor's position as the industry leader for many years may not be secure.

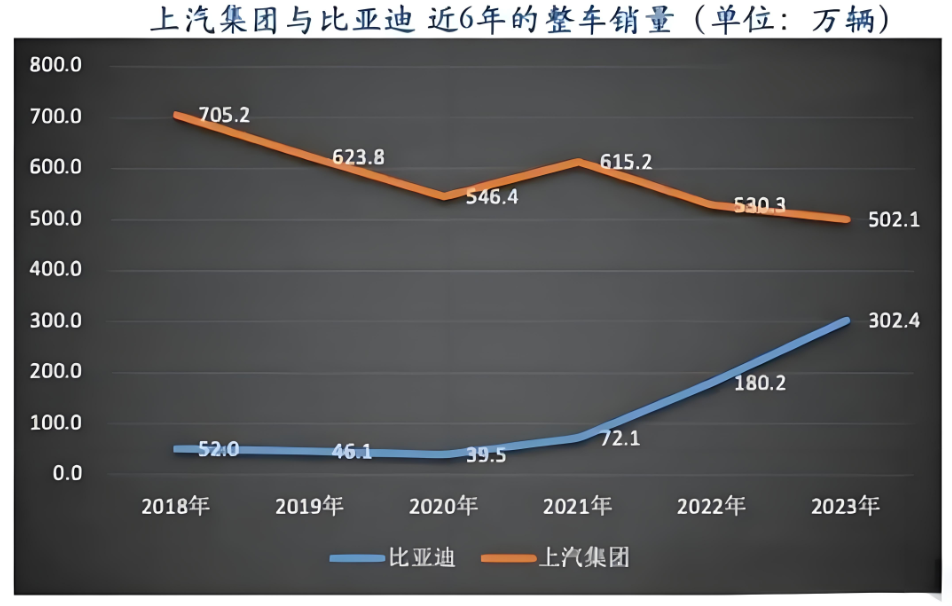

In terms of sales, SAIC Motor sold 1.83 million vehicles from January to June, a year-on-year decrease of 11.81%. In comparison, BYD sold 1.61 million vehicles during the same period, a significant increase of 28.46%. Based on the current sales trend, BYD's sales are expected to surpass SAIC Motor this year.

It is worth mentioning that in 2018, SAIC Motor sold a record 7.052 million vehicles. At that time, BYD sold only 520,000 new vehicles, less than one-tenth of SAIC Motor's sales. However, in less than six years, the sales gap between the two has narrowed dramatically.

Similar to sales, BYD's revenue is also rapidly approaching that of SAIC Motor.

In 2019, BYD's operating revenue was 127.7 billion yuan, while SAIC Motor's was as high as 843.3 billion yuan, a staggering difference of 715.6 billion yuan.

In 2020, BYD's operating revenue increased to 156.6 billion yuan, while SAIC Motor's was 742.1 billion yuan, narrowing the gap but still reaching 585.5 billion yuan.

In 2021, BYD's operating revenue continued to climb to 216.1 billion yuan, while SAIC Motor's was 779.8 billion yuan, leaving a gap of 563.7 billion yuan.

In 2022, BYD's operating revenue doubled to 424.1 billion yuan, while SAIC Motor's was 744.1 billion yuan, narrowing the gap to 320 billion yuan.

In 2023, BYD's operating revenue surged to 602.3 billion yuan, while SAIC Motor's was 744.7 billion yuan, further narrowing the gap to 142.4 billion yuan.

In the first quarter of 2024, BYD achieved sales revenue of 124.944 billion yuan, while SAIC Motor achieved revenue of 143.071 billion yuan, with a gap of less than 20 billion yuan. Whether BYD can surpass SAIC Motor remains to be seen.

It seems inevitable that BYD will surpass SAIC Motor to become China's largest automaker.

Some argue that as a representative and mainstay of the joint venture era, SAIC Motor failed to seize the historic opportunity to become a mainstream player in the new energy era because it rested on its laurels as a joint venture and failed to make progress, ultimately becoming a processing factory for foreign brands, leading to its inevitable overtaking by BYD. State-owned automakers such as FAW, Dongfeng, and GAC share the same common problem.

Opinions vary on whether this argument is correct or not.

Finally, we hope that under Wang Xiaoqiu's leadership, SAIC Motor can reverse its lagging position in the new energy era. If SAIC Motor can emerge from the joint venture dilemma, FAW, Dongfeng, Chang'an, and GAC can also follow in its footsteps.

To some extent, BYD has already surpassed SAIC Motor. As a representative of the new energy race, BYD's surpassing SAIC Motor represents the surpassing of new energy vehicles over traditional fuel vehicles.

We hope that China's automotive industry can replicate the experience of the Chinese market and push the surpassing of new energy vehicles over traditional fuel vehicles globally.