Lynk & Co 900 and Xingyao 8 Witness Surge in Orders, Fundamentally Reshaping the Automotive Industry Competitive Landscape

![]() 05/14 2025

05/14 2025

![]() 694

694

Introduction

When industry leader Geely adopts a new strategy, it signifies a genuine shift in industry trends.

Last week, Geely Galaxy unveiled Xingyao 8, a medium-to-large flagship sedan boasting a 5-meter length and nearly 3-meter wheelbase. Classified as a standard C-segment vehicle, it rivals the size of an A6L but is priced at the level of a used A4L, starting at 115,800 yuan for a limited time, with the top-of-the-line model priced just above 150,000 yuan.

Notably, the launch event directly targeted the BYD Han, particularly the larger Han L. The BYD Han is priced in the 150,000-200,000 yuan range, but Xingyao 8 is priced an entire tier lower, offering a vehicle of similar size and configuration to the BYD Han but only slightly more expensive than the Qin L.

Despite its surprising price, Xingyao 8 does not compromise on specifications. It offers advanced intelligent driving assistance across the entire lineup, including L2 or Qianli Haohan H1, complimentary VIP executive seats, a 16-speaker audio system, the highly regarded Flyme auto infotainment system, and a 3L-level fuel consumption under low battery conditions. Even critics of the 60km pure electric range version for insufficient endurance acknowledge that it can be driven as a conventional hybrid without charging, saving thousands of yuan in purchase tax.

Over the past week, Xingyao 8 has generated considerable buzz both within and outside the industry. Unofficial sources claim that orders exceeded 30,000 units on the second day after its launch. This pricing strategy even caused a competitor in Anhui to panic, inadvertently crossing a red line and drawing widespread criticism on social media. Consequently, senior executives from both companies had to issue statements, and the incident was resolved only after the involved party was suspended.

It is evident that Xingyao 8 will undoubtedly become another hit model for Geely Galaxy, following the success of the E5, Xingjian 7, and Xingyuan. Since the "Taizhou Declaration," Geely Group has been pragmatic in product definition and pricing, strategically focusing on exceeding consumer expectations.

The last Geely product to follow this approach was the Lynk & Co 900. Launched on April 28, it reportedly received 50,000 orders in just over half a month, despite the factory producing only over 6,000 vehicles. As a 300,000-yuan-level product, it has achieved almost the highest level of market enthusiasm in Lynk & Co's history.

From Lynk & Co 900 to Xingyao 8, Geely's success in creating hit models lies in not only meeting but exceeding consumer expectations in terms of experience, competitor comparison, and decisive pricing. Once a model is on a consumer's shortlist, it's hard to remove.

Initially, some mid-tier automakers resorted to overstepping competition out of necessity for survival. Now, leading giants like BYD and Geely are also adopting this strategy to gain more sales and market share. This signifies a fundamental change in the competitive logic of the Chinese automotive market, poised for another overhaul.

01 Disintegration of Size-Based Pricing System

Overstepping is Always the Optimal Solution

"Completely gone mad! The size-based pricing system has completely collapsed." This was how one media colleague described the launch of Xingyao 8.

Previously, vehicles in this class, larger than B-segment cars, would cost around 160,000-170,000 yuan in the gasoline car market, competing with models like the Accord and Camry. For those related to new energy, the price would start at 200,000 yuan. Hence, there was a period of analysis and judgment in the industry about the "532" market, referring to vehicles with a length of 5 meters, a wheelbase of 3 meters, and a price range of 200,000 yuan.

However, to date, there is only one successful product in this segment, which is the Xiaomi SU7. Other products, including Geely's own Galaxy E8, Lynk & Co Z10, and Zeekr 007, have struggled to gain a significant presence in the mainstream market.

Ultimately, it is challenging for traditional automakers to elevate their products and brands in the context of widespread price reductions in electric vehicles. Electric vehicles priced below 100,000 yuan can become hits if they are cheap enough and offer relatively high specifications. However, this becomes almost impossible above the 200,000-yuan mark, as even joint venture automakers have compromised on electric vehicle prices.

After the failure of its previous high-end pure electric products, Geely this time turned its focus to hybrid models, as seen with the Lynk & Co 900 and Xingyao 8. In terms of product definition and pricing, it aims to break industry standards and consumer perceptions, continuing to employ overstepping competition tactics, even by two tiers.

Take Xingyao 8 as an example. Its pure electric sibling, the Galaxy E8, was priced at 175,800-228,800 yuan when it launched a year ago. Earlier this year, the annual model of the Galaxy E8 saw a price reduction of over 20,000 yuan, starting at 149,800-198,800 yuan, effectively moving down half a tier to the 150,000-200,000 yuan range. This undoubtedly left room for Xingyao 8 to move down another tier in pricing (as hybrid vehicles in the same class cost less than pure electric vehicles).

Compared to its direct competitors in the same class, the most obvious being the BYD Han DM, despite the difference in pure electric range, Xingyao 8 is priced significantly lower, effectively tapping into the mid-size sedan segment like the Seal 07 and, to some extent, competing with the higher-end models of the BYD Qin L DM. It also leverages stronger brand power to compete with models like the Changan Qiyuan A07 and Zero Run C01 in the same class. Even with minor price differences, Xingyao 8 excels in various aspects such as the latest technological achievements and product configurations.

Even when compared to Geely's own fuel vehicles like the Xingrui, getting Xingyao 8 at a similar price point but with better size, space, and experience is a significant disruption, let alone when compared to traditional joint venture A-segment vehicles like the Sagitar at the same price point.

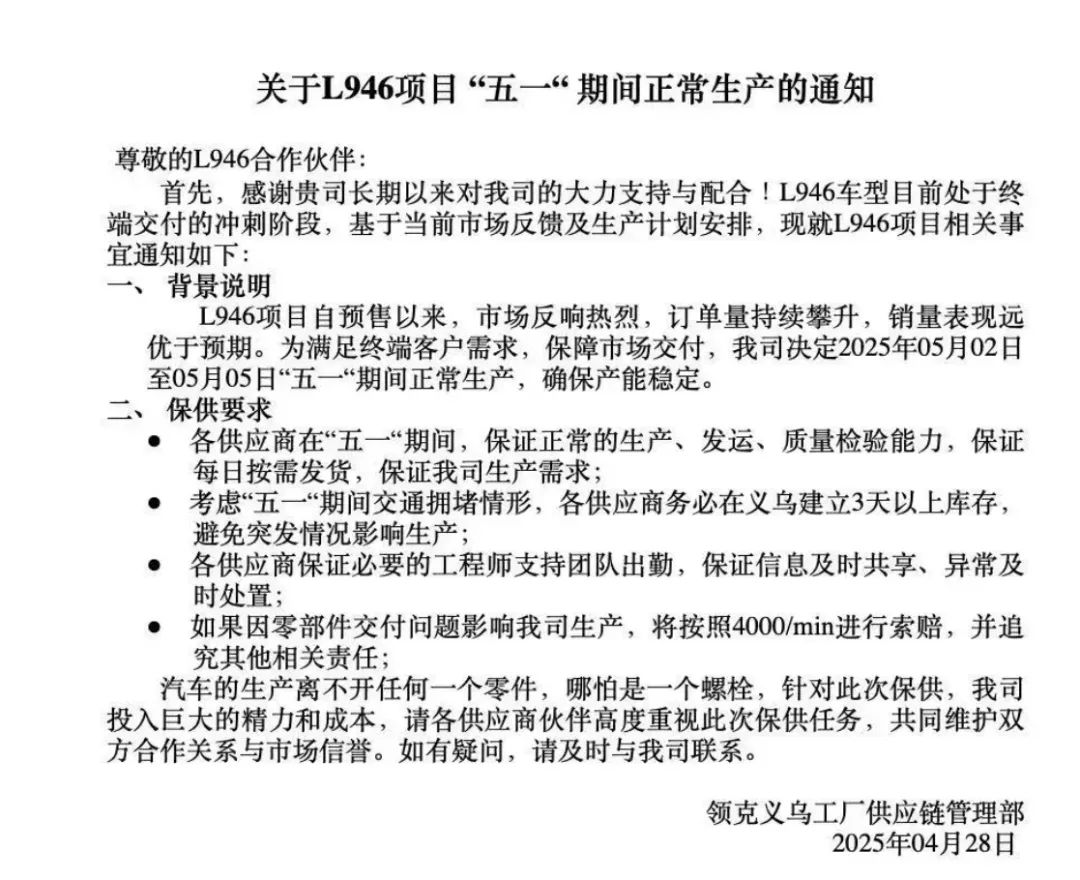

Lynk & Co 900 has also seen a sudden surge in orders, requiring suppliers to work overtime during the May Day holiday. Penalties for late delivery of parts can reach up to 4,000 yuan per minute, underscoring the urgency to ensure supply. Additionally, the official announcement regarding order and delivery times, starting from 6-8 weeks, indicates the tight production schedule for this mature automaker, reflecting the unexpected popularity of Lynk & Co 900.

The core reason lies in the superior cost-performance ratio that Lynk & Co 900 offers compared to its competitors in the large flagship SUV segment. For instance, when compared to models like the AITO M9, Lixiang L9, and Denza N9, although Lynk & Co 900 may not offer the same strong confidence in infotainment and intelligent driving as Huawei and Lixiang, the price difference of over 100,000 yuan can be a significant factor.

Once consumers test drive Lynk & Co 900, its architecture, quality, chassis performance, and driving feel do not lag behind its competitors. Moreover, it offers unique experiences such as a large integrated screen and rotating seats, making it possible to gain market share from new-energy vehicle makers. Furthermore, after the first batch of early adopters chooses new-energy vehicles, subsequent followers tend to be more conservative, placing greater emphasis on the heritage and safety of established brands, which is where Geely has an advantage.

02 When Products Reach the Limit of Competition

What is the Winning Formula?

In fact, the path of overstepping competition, characterized by "what others don't have, I have; what others have, I have better," has been proven by numerous domestic brands. It is also one of the logics behind local brands like BYD and Geely driving out joint ventures and taking their place. The previous round saw the BYD Qin priced at 79,800 and 99,800 yuan, and now it's Xingyao 8's turn, with its price band seamlessly connecting to the Galaxy L6.

Now, this approach, adopted, upgraded, and iterated by new-energy vehicle makers, has also been embraced by joint venture automakers. For instance, GAC Toyota has priced the BZ3X, a model with an interior space close to that of a mid-size SUV like the Wildlander, at the price of a compact SUV like the Fenglanda. It also comes with a more advanced intelligent cockpit and lidar.

The latest data shows that in April, the GAC Toyota BZ3X surpassed Volkswagen ID. in sales, taking the top spot for joint venture pure electric vehicle sales with 6,727 units. It seems that the market rewards are here, and Toyota has truly grasped the essence of the Chinese market.

Joint venture automakers like Dongfeng Nissan have also brought models like the N7, a quasi-C-segment pure electric sedan, down to the 100,000-150,000 yuan price range traditionally occupied by A-segment sedans. This allows consumers to purchase vehicles with higher-level space and experience at the price of a former A-segment car, once again disrupting consumers' perceptions of automotive size and space.

Therefore, the current automotive price bands no longer follow conventional rules. In other words, the direct correlation between size, space, and price has almost ceased to exist. The European or global size definition system under the Chinese market rules has completely collapsed. To sell cars in the Chinese market, with adequate space and configurations, price becomes the sole competitive advantage. To have a chance at the table, product strength must surpass that of one tier.

This is the result of extreme competition, especially when leading enterprises occupying the mainstream market initiate this competitive mode on the path of pursuing sales and scale. All automakers are forced to follow suit. Failure to do so will result in a significant gap in product competitiveness, leading to the loss of sales and market share, which no automaker can afford.

The ultimate result is continued homogenization, from space and configurations to design and functionality. Eventually, the competition between automakers will come down to technological backing, brand heritage, service quality, and extreme economies of scale. Automotive enterprises lacking these capabilities will face increasing difficulties and may eventually be acquired or go bankrupt.

Even though the government has stimulated the demand for 10 million vehicle replacements, the market and automotive professionals remain concerned. There are clear signs of the automotive deflation era, characterized by the "increasing volume and decreasing prices" trend in passenger vehicle consumption since the implementation of the trade-in policy. The core reason is the increase in demand for low- to mid-range vehicles.

Theoretically, with the trend of first-time purchases declining and replacement purchases increasing significantly in the Chinese market, a more reasonable outcome should be consumption upgrading rather than downgrading. However, the situation is the opposite. Data from the first quarter of this year further proves this: Sales of models priced below 100,000 yuan increased by 330,000 units year-on-year, while those priced above 250,000 yuan decreased by 270,000 units.

The situation at the market end is that regardless of whether they are joint ventures or domestic brands, cars are getting bigger, more configured, and cheaper, making it increasingly difficult for enterprises to make a profit and ensure sustainable development. This is why in the past month, from Geely to NIO, and from SAIC to GAC, a series of backend and system integrations have been underway. On the one hand, this involves joint research and development and procurement to reduce internal friction and communication costs. On the other hand, it involves cost reduction, striving to increase revenue and reduce expenditure and ensure that funds are used effectively. The goal is to cope with this era of fierce competition.

Editor-in-Charge: Du Yuxin Editor: He Zengrong