Toyota's Net Profit Surpasses Combined Total of China's Top 10 Automakers

![]() 05/14 2025

05/14 2025

![]() 749

749

By Wang Han

Produced by Five Star Car Review

Toyota's prowess in cost management is well-known, yet its latest financial performance is nothing short of astonishing. To grasp the magnitude, let's delve into the numbers from a different perspective.

For the fiscal year 2024 (April 1, 2024, to March 31, 2025), Toyota Motor's net profit stood at approximately 4.8 trillion yen, equating to 1.94 times the combined profits of 12 listed Chinese automakers. Its cash reserves amounted to 8.98 trillion yen, 1.8 times the combined cash holdings of German giants Volkswagen, BMW, and Daimler.

Volkswagen Group, with a comparable size, sold approximately 9 million vehicles in 2024 but reported a profit (after tax) less than half of Toyota's. Even when adding the combined profits of Mercedes-Benz and BMW, it barely matches Toyota's figure. Despite a gradually weakening online presence, Toyota once again underscored the gap with its financial report, proving the adage: "You mock Toyota for not being ahead, but Toyota laughs at you for not making money."

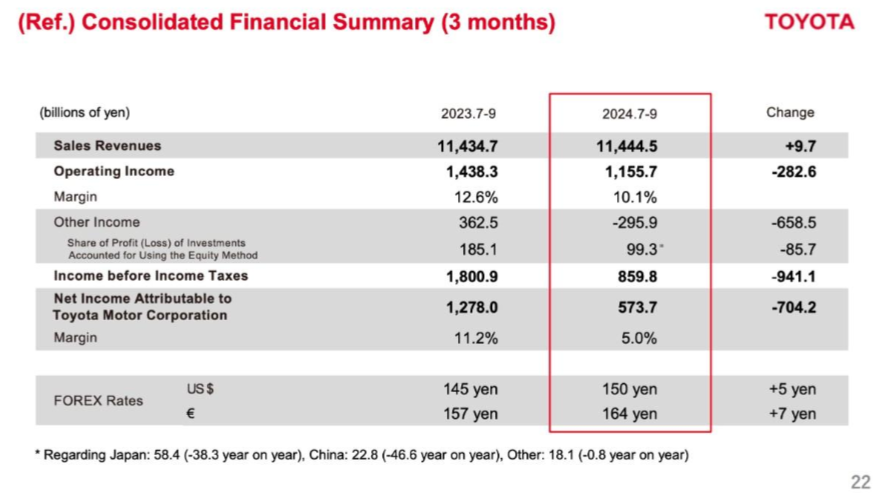

On May 8, Toyota Motor released financial data for the period from April 1, 2024, to March 31, 2025. The data revealed that Toyota sold 10.111 million vehicles in fiscal year 2024, a slight 0.7% decline year-on-year. Combined sales of the Toyota and Lexus brands reached 10.0274 million vehicles, with operating revenue at 48.04 trillion yen (approximately RMB 2.4 trillion), a 6.5% increase year-on-year.

Net profit stood at 4.77 trillion yen (approximately RMB 236.4 billion), down 3.6% from the previous fiscal year's 4.94 trillion yen (approximately RMB 247 billion). This figure is roughly equivalent to the size of six BYDs.

With a profit margin of around 10%, even in a declining state, Toyota outperforms many domestic enterprises that, despite double-digit growth, struggle to reach a 5% profit margin. Compared to Volkswagen's 5.7% and Tesla's 7.2% during the same period, Toyota's double-digit profit margin appears insurmountable.

So, where does Toyota's decline stem from?

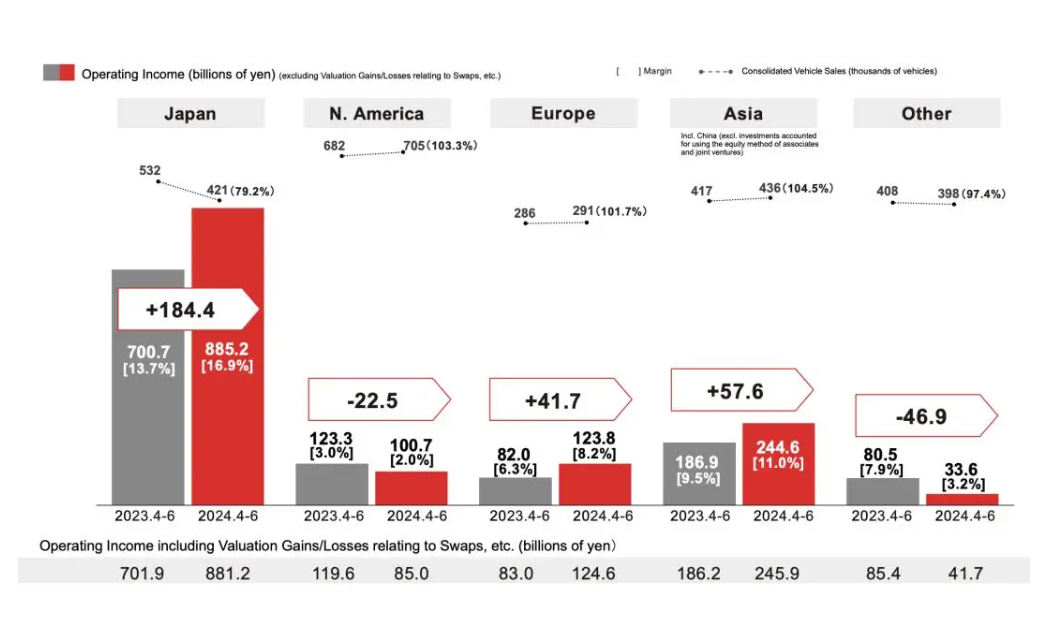

Firstly, Toyota invested 745 billion yen in promising areas such as "talent development, BEV, hydrogen fuel, software, etc.," encompassing suppliers and dealers. Secondly, market environment changes led to a 327.5 billion yen decrease in operating profit in the Japanese domestic market and a 420.5 billion yen plummet in the North American market. Guangqi Toyota and FAW Toyota joint ventures faced significant pressure, with operating profit in the Chinese market also shrinking by 114.8 billion yen.

Japan contributes approximately 65% of Toyota's global profits, encompassing not just sales and finance profits from Japanese vehicles but also gross profits from vehicles produced in Japan and exported overseas. The United States is the largest market for Japan's top five automakers. In 2024, the U.S. market accounted for 23% of Toyota's global sales and 28% of its Japanese production and sales, while Subaru's U.S. sales accounted for 71%. Last year, Japanese automakers sold approximately 5.9 million vehicles in the United States.

Any hindrance to U.S. exports would significantly impact Toyota's profits. The financial report noted that initially, the company recorded a loss of 180 billion yen (approximately RMB 9 billion) in operating profit due to U.S. tariffs in April and May.

For consumers who appreciate the quality and philosophy of traditional Japanese cars, the market environment has been favorable over the past two years. Previously, they envied the "high quality and low price" of Japanese cars abroad, but now the tables have turned. Showing foreigners the current prices of domestic Japanese family cars would likely elicit envy.

In the past two years, Japanese car prices in North American or Australian markets have surged significantly, and used Toyotas have remained resilient, with depreciation rates akin to financial products. Labor costs, usage habits, and other factors in these countries differ markedly from China. However, the prices of domestic "hard currencies" like the Highlander and ES have dropped significantly without a corresponding sales surge, surprising many.

In fiscal year 2024, Toyota's operating profit in China was 182.7 billion yen, a 6.6% year-on-year decrease. Equity method income from joint ventures was 106.9 billion yen, a 60.3% year-on-year decline. The mismatch in market structure due to the penetration of new energy vehicles is the primary reason for the profit decline.

In response, Toyota has taken several "unprecedented" measures to turn around its situation in the Chinese market. Previously, Toyota China used five "more Chinese" strategies to describe its transformation: a more Chinese management and R&D system, more Chinese products, a more Chinese supply chain and sales system, and a more Chinese business system.

On May 12, sales figures for new vehicles in China by Japan's top three automakers in April were released. Toyota Motor's sales increased by 20.8% year-on-year to 142,800 units, marking the third consecutive month of growth. Honda and Nissan sales have declined year-on-year for 15 and 13 consecutive months, respectively. Honda's sales in China decreased by 40.8% to 43,689 units in April, while Nissan's sales decreased by 15.7% to 46,295 units.

As for Mazda, Subaru, Suzuki, and Mitsubishi, their prospects in China are concerning. The latter can only enter the domestic market through parallel imports. Among the once high-end Japanese trio, Acura has officially withdrawn, and Infiniti is no longer in its glory days. Only Lexus, relying on "trading volume for price," remains relatively stable.

The launch of the BZ3X has significantly alleviated the pressure on Toyota to promote new energy vehicles. The price range of 100,000 to 150,000 yuan has "hit the nail on the head." Since deliveries started on March 16, cumulative deliveries have exceeded 10,000 units, with 12,000 orders pending. In comparison, Honda's S7/P7, launched during the same period, faced embarrassment. Initially priced at 259,900 yuan, it officially reduced its price by 60,000 yuan a month later, now hovering between two and three digits in sales.

Nissan's newly launched N7 seems promising and can compete with Toyota in the pure electric field. However, Nissan's downturn in the fuel vehicle sector has not improved, with monthly sales over 40,000 units still less than the peak sales of a single model like the Sylphy. Hence, Toyota's dominance in the Chinese market for some time is inevitable.

Regarding Toyota's high profits, some focus on the success of lean production, while others believe there's still room for profit margins in its products. Regardless, the once tripartite standoff of Japanese automakers no longer exists, and the target group for domestic Japanese cars is unlikely to "jump out of the circle" to make other choices. If a "Matthew Effect" also occurs, Toyota's data for this year will likely be even more impressive.