Reviving Troubled New Force Automakers: An Uphill Battle!

![]() 05/14 2025

05/14 2025

![]() 647

647

Introduction | Lead

Recently, there have been glimmers of hope for several domestic automakers facing financial troubles. Nezha has commenced repaying debts to suppliers, while Geely Zeekr and WM Motor also show signs of recovery. However, whether these automakers can truly revive remains uncertain. The current automotive market is fiercely competitive, and even established players are struggling to stay afloat. For these nascent players with shallow foundations, mere survival is a formidable challenge. Notably, Nezha has recently been subjected to bankruptcy review proceedings.

Produced by | Heyan Yueche Studio

Written by | Zhang Chi

Edited by | He Zi

Total words: 2043

Reading time: 4 minutes

China's fiercely competitive automotive market has made it challenging for many new force automakers to sustain operations. However, Nezha, WM Motor, and Geely Zeekr have recently exhibited signs of resurgence, surprising many observers.

△The number of surviving new force automaker brands is dwindling

Who will be the savior for these three automakers?

According to media reports, Xu Jiye, former PR director of Geely Zeekr, revealed that the company is in talks with 3-4 potential restructuring parties. Rumors also suggest that Zhejiang Geely Zeekr may have been renamed Jiangfengsheng Automotive Technology Co., Ltd., a wholly-owned subsidiary of Geely, hinting that Geely itself could become the savior for Geely Zeekr.

△The restructuring of Geely Zeekr may bring a spark of hope

Similarly, WM Motor has also seen positive news. Shenzhen Xiangfei Automobile, backed by the Baoneng Group, has signed a restructuring investment agreement with WM Motor. Under the terms of the agreement, Shenzhen Xiangfei will inject 10 billion yuan into WM Motor to help it resume production. To bolster confidence, WM Motor has set ambitious goals: launching 1-2 new models annually over the next two years and aiming for sales targets of 600,000 units in 2027 and 1 million units in 2029.

△Baoneng Group-affiliated enterprises may infuse funds into WM Motor to aid its production resumption this year

Regarding Nezha Auto, a recent "Civil Mediation Statement" from the Yuanzhou District People's Court in Yichun City, Jiangxi Province, revealed that Hefeng New Energy (Nezha Auto) agreed to pay approximately 8.1918 million yuan to Effort before the 30th of each month from June to November this year. This development suggests that Nezha Auto may have received capital injections. Online rumors even suggested that Toyota Motor would acquire Nezha Auto, but insiders from Toyota China denied any knowledge of such a deal. The latest news, however, is that Nezha has been filed for bankruptcy review.

The difficulties in reviving these enterprises are unimaginable

For these enterprises to recover, addressing debt issues is paramount. The primary reason for the collapse of new force automakers is the disruption of their capital chain. New investors are reluctant to shoulder the burden of substantial past debts. Therefore, these enterprises must first reach a debt restructuring agreement with their creditors to move forward unencumbered.

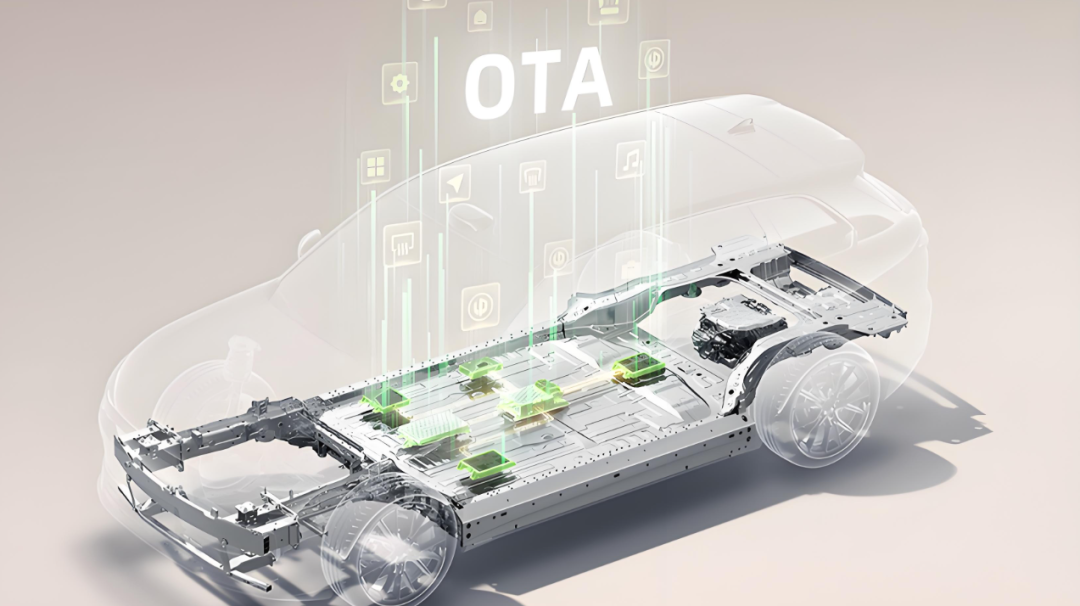

Furthermore, regaining consumer trust poses a significant challenge. Unlike traditional fuel vehicles, smart electric vehicles do not require engine maintenance, but their in-car systems and intelligent driving functions necessitate continuous OTA updates from the backend. Geely Zeekr, WM Motor, and Nezha have all experienced "service disruptions," and rebuilding consumer confidence will require substantial effort from the manufacturers.

△The entire lifecycle of smart electric vehicles relies on manufacturers continuously pushing updated software packages

Moreover, establishing a strong presence in the domestic market is no easy feat. From the founders' perspectives, whether it's Xia Yiping of Geely Zeekr or Shen Hui of WM Motor, witnessing the automakers they built from scratch struggle must be disheartening. However, feeling frustrated is one thing; reviving these brands and making them mainstream or even profitable is an entirely different challenge. From January to April this year, among China's mainstream new force automakers, only XPeng has achieved its full-year target completion rate. The automakers listed below have overall system capabilities far superior to those of WM Motor, Nezha, and Geely Zeekr.

To 'resurrect,' external assistance is necessary, but self-reliance is even more crucial

External assistance often refers to being acquired by a larger group. While a handful of new force automakers might survive through such means, the vast majority face the prospect of bankruptcy or acquisition by larger automaker groups. The automotive industry is capital- and technology-intensive, meaning larger automakers can significantly amortize large upfront investments in research and development and manufacturing, thereby increasing their gross profit margins. Smaller automakers, lacking sufficient scale, may find themselves in a vicious cycle of selling more but losing more. In such a scenario, any hesitation in capital investment can lead to the overnight collapse of new force automakers with almost no anti-risk capabilities.

Given this context, some envision Geely Zeekr returning to Geely. However, ideals are often beautiful, while reality can be harsh. Since the "Taizhou Declaration," Geely has been in a phase of continuous contraction and adjustment. Geely Zeekr relies on Geely for vehicle engineering, and its intelligent driving technology is directly sourced from Baidu. As Geely integrates its excess brands, it remains to be seen whether it will invest funds to become the savior for Geely Zeekr.

Self-reliance, on the other hand, tests an automaker's core research and development capabilities. Previously, Volkswagen and Stellantis invested in XPeng and Zero Run, respectively, because they valued their strong independent research and development capabilities and hoped to obtain technology transfers through equity participation. Among domestic new forces, these two automakers stand out for their robust independent research and development capabilities. In contrast, Nezha Auto's independent research and development capabilities are relatively weaker. Thus, even if Nezha hopes that Toyota will replicate Volkswagen's investment in XPeng and Stellantis's investment in Zero Run to support Nezha Auto, such a possibility seems remote. In the future, only new force automakers that possess their own core technologies and can maintain their leading position through continuous research and development will be able to secure a place in the market. Those that merely rely on procurement and assembly to create new models will struggle to gain consumer favor and will not be favored by investors.

△Zero Run and XPeng are recognized as new force automakers with strong independent research and development capabilities

Commentary

Reviving new force automakers necessitates not only substantial capital injection but also addressing how to rebuild consumer confidence and finding ways to establish a firm footing in the highly competitive domestic automotive market. Relying solely on simple vehicle integration in terms of technology and replicating past business models in terms of commerce will not suffice for long-term survival. Such automakers hold little value in revival efforts.

(This article is originally created by "Heyan Yueche" and cannot be reproduced without authorization)