Nissan's Crisis Deepens: 10,000 More Jobs Cut with No Immediate Relief in Sight

![]() 05/14 2025

05/14 2025

![]() 760

760

Nissan's predicament is far more dire than many outsiders realize.

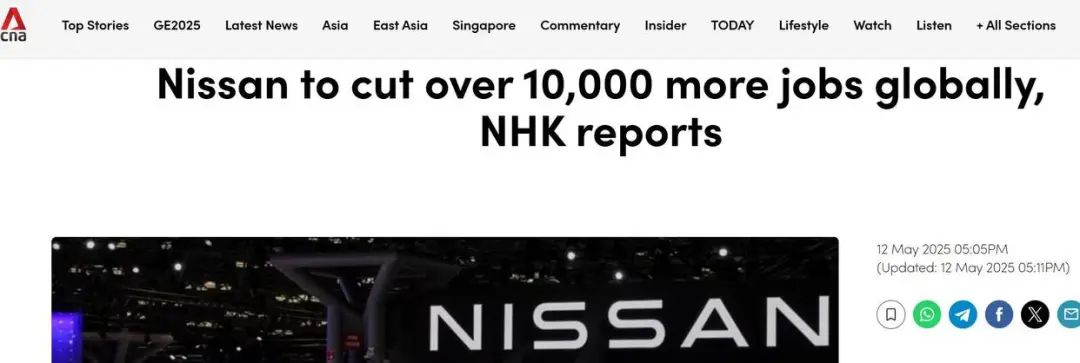

According to an NHK report on May 13, Nissan Motor Co. has announced plans to lay off over 10,000 additional employees worldwide due to its worsening financial performance. This decision comes on top of the previously announced plan from November last year to reduce global production capacity by 20% and lay off 9,000 employees.

To date, the total number of layoffs across the group has reached approximately 20,000, accounting for 15% of its global workforce. This substantial downsizing significantly impacts the company, aiming to expedite its business restructuring efforts.

Accompanying the layoffs is substantial financial loss. Nissan Motor Co. is expected to incur a final loss of up to 750 billion yen for the fiscal year ending March 2025 (April 2024 to March 2025). The company believes that to achieve long-term growth, it must take more drastic measures, further adjusting its overcapacity production system, which translates to factory closures.

From colossal losses to layoffs and factory closures, it's evident that Nissan's crisis is even more severe than anticipated.

Nissan's Axe Hits Its Vital Artery

This automaker, with a history spanning over 90 years, is now facing an unprecedented crisis.

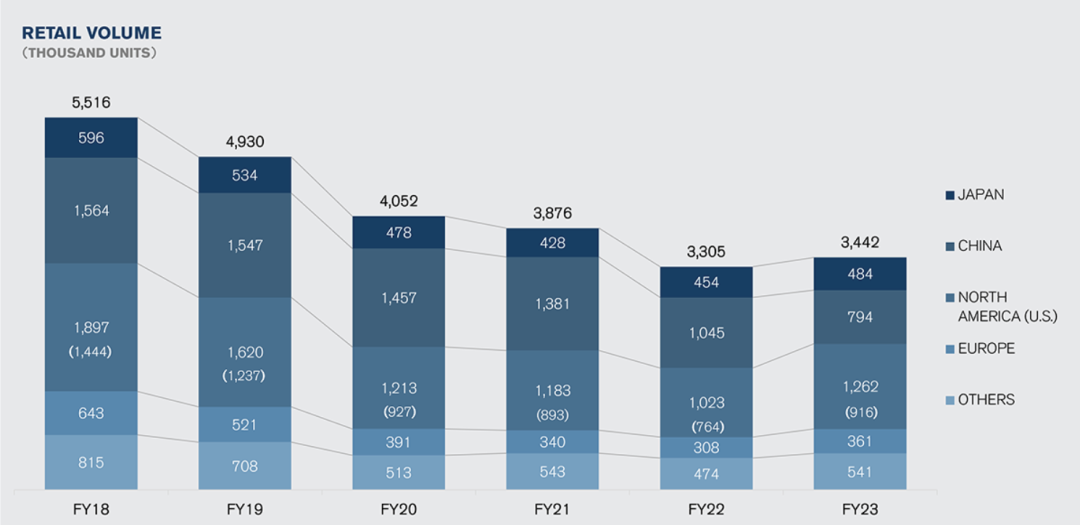

Looking at the numbers, Nissan's global sales have plummeted from 4.93 million in 2019 to 3.3487 million in 2024, marking a 40% decline in five years. Both its key markets, North America and China, have suffered significant losses.

In China and the United States, Nissan has not only lost its traditional strongholds but also failed to keep pace in the new energy market, where it could be said to have "started early" but "missed the late market".

Despite these challenges, Nissan has yet to find a viable solution to stem the decline in sales.

Moreover, Nissan anticipates a staggering deficit of up to 750 billion yen in its annual financial report ending this March, setting a record for the highest deficit in its 92-year history since its founding in 1933. This poor performance is akin to a heavy blow to Nissan's vital artery.

Amid declining sales and huge losses, Nissan has announced the cancellation of its annual dividends for the first time in four years, dealing a significant blow to the confidence of the capital market.

The Financial Times reported that Nissan's financial situation leaves it with only 12-14 months of survival. The capital market has downgraded its outlook on Nissan Motor Co. from stable to negative. Recently, Moody's assigned Nissan a "junk" rating, adding another layer of pressure.

To address the crisis, Nissan has resorted to wielding the "axe" of layoffs and factory closures.

Nissan plans to consolidate its vehicle production plants from 17 to 10 by fiscal year 2027. Additionally, it will streamline its powertrain factories, accelerate job reforms, make shift adjustments, and reduce capital expenditures, including scrapping plans for a lithium iron phosphate battery factory in Kyushu.

In short, when cars can't be sold, production lines become money-burning machines. With sales declining year after year, the utilization rate of Nissan's factories has plummeted. In the Chinese market, Nissan's sales in 2024 totaled only 700,000 units, a 12% year-on-year decrease, marking the ninth consecutive year of decline.

The sales decline has led to a domestic capacity utilization rate of only 40% for Nissan, with the Wuhan factory experiencing an idle capacity rate as high as 96%. The Wuhan factory, which cost billions of yen and had a designed annual production capacity of 300,000 vehicles, ceased production in 2025 with a capacity utilization rate of less than 10%, making it the "shortest-lived" layout in Nissan's global production capacity map after only three years of operation.

Furthermore, due to strategic missteps, Nissan ceased selling hybrid models, missing out on the 43% growth dividend in the US hybrid market. Additionally, Trump's tariff policy directly impacted one-third of Nissan's sales in the United States. Over the past few years, Nissan's market share in North America has plummeted by 32%.

In desperation, Nissan had to make the difficult decision to close factories. It not only shuttered its factory in Indonesia in the Southeast Asian market, further reducing its capacity and sales. It also plans to transfer some models from the Kyushu factory to the United States to mitigate potential tariff barriers.

Notably, Nissan has included the closure of domestic factories in Japan in its discussions. Shutting down domestic factories is an unprecedented move for Nissan. It can even be said that Nissan's axe has struck its own vital artery.

Nissan has five vehicle factories in Japan. The former CEO Makoto Uchida once had a policy to maintain the operation of domestic factories regardless of the challenges. Currently, Nissan's capacity utilization rate in domestic factories is not as high as that in the US market, standing at only 56.7%.

As the "firefighter" in the post-Ghosn era, after Makoto Uchida took office, Nissan unveiled the "Nissan Next" mid-term transformation plan in 2020. This plan can be described as a "cut off one's arm to survive" reform, focusing on cost reduction, operational optimization, and concentrating on core markets and models.

By reducing global production capacity by 20%, optimizing the global product line by 15%, cutting fixed cost expenditures by 350 billion yen, simplifying the global management structure into four core markets, and forming a more streamlined and responsive organizational structure, Nissan successfully turned a profit in 2021. In fiscal years 2022 and 2023, its earnings even exceeded expectations.

However, the situation took a sharp turn for the worse in 2024. On March 31, 2024, which marked the end of Nissan NEXT, poor performance forced Nissan to initiate a series of self-rescue actions. In addition to announcing the layoff of 9,000 employees globally and reducing production capacity by 20%, it also plans to sell up to 10% of Mitsubishi Motors shares to alliance partners.

Nevertheless, these measures failed to turn around Nissan's predicament.

According to sources, after Ashwani Gupta, the new CEO of Nissan, took office on April 1 this year, the company initiated a new system, re-evaluated the restructuring plan, and aims to lay off 20,000 employees during the fiscal years 2024 to 2027. This covers direct, indirect, and contractual positions across manufacturing, sales, general and administrative management, and R&D departments.

The goal is to stem the bleeding. Nissan aims to achieve positive operating profit and free cash flow for its automotive business by fiscal year 2026.

Three Strategic Blunders

Laying off 20,000 employees and closing multiple factories appear to be stopgap measures to address declining sales and huge losses. Behind this precipitous decline lie systematic mistakes made by Nissan in strategic layout, technological roadmap, and market response.

The first strategic blunder is that Nissan has lost focus in both the Chinese and US markets and has been slow to respond.

In the US market, where it holds a first-mover advantage, Nissan has overly relied on fuel vehicles and lagged far behind Toyota and Honda in the transition to new energy. The Nissan LEAF, which went on sale at the end of 2010, was launched two years earlier than Tesla's first Model S, but it has long been overshadowed by competitors.

Data shows that Toyota and Honda have performed exceptionally well in the US hybrid market, combinedly accounting for a market share of up to 70%. It can be argued that hybrid models have become the key to success or failure in sales in the US market. Nissan's poor performance stems from the lack of hybrid models and aging product lines.

American auto critic Matt believes that if Nissan hopes to launch models that meet user expectations for the US market, it must avoid dull products like the ARIYA or outdated ones like the Leaf. He emphasized that "the US market needs more hybrid vehicles."

In the Chinese market, Nissan's electrification strategy has also proven ineffective. The ARIYA, an all-electric model with a new logo signifying a brand reboot, sold only 2,114 units throughout the year, failing to shoulder the hope of Nissan's revival. For now, Nissan can only rely on fuel models such as the Sylphy and Qashqai to limp along.

The strategic loss of focus has led to personnel turmoil, which is the second strategic blunder.

From the high-speed expansion during the Ghosn era to subsequent infighting and division, Nissan's management culture lost its direction. After Ghosn, neither the succeeding CEOs, whether it was Renault's Thierry Bolloré who supported Ghosn nor Hiroto Saikawa who exposed Ghosn, could escape the fate of a one-year tenure.

On the afternoon of March 11, in Tokyo, Nissan announced in a brief 20-minute press conference that Makoto Uchida would step down a year earlier, and Ivan Espinosa, Nissan's 46-year-old Chief Planning Officer, would take over. In the span of seven years, Nissan has changed four CEOs, and each appointment and departure seems to lack "careful consideration".

The change in leadership also determines the direction of Nissan's fate. However, frequent personnel adjustments have led to chaotic management, inefficient internal decision-making, and lagging product planning. All these factors have caused Nissan to "retreat again and again" in the global market competition, and perhaps one day it will find itself with "nowhere to retreat".

"Getting up early but arriving late" is the third strategic blunder.

When the pure electric vehicle market was still in its infancy, Nissan released the pure electric vehicle model Nissan LEAF at the end of 2010, becoming the world's first mass-produced pure electric vehicle and surpassing competitors' technological scope at that time.

However, over the past years, Nissan has stagnated in a "status quo" strategy, progressing slowly on the path of transformation. Today, its lag in the pure electric vehicle market has become Nissan's most significant pain point.

The core problem lies in the uncertainty of its technological roadmap. Nissan has also attempted to catch up. Since the launch of the "Nissan 2030 Vision" in 2021, Nissan has increased its investment in electrification and strives to expand its pure electric vehicle model lineup. Unfortunately, only a handful of truly implemented electrified products have materialized.

In the Chinese market, only two pure electric vehicle models have been launched: the poorly selling ARIYA and the newly introduced N7, which can be described as sluggish. Additionally, Nissan is accelerating the development of solid-state batteries, aiming to differentiate itself with cutting-edge technology. However, the promised solid-state battery technology won't enter mass production until 2028.

The market doesn't wait for anyone.

Previously, Nissan announced plans for an LFP battery factory in Kitakyushu City, with an investment of 153.3 billion yen and a government subsidy of 55.7 billion yen. It was a crucial step for Nissan to revive its EV business, but it was officially announced on May 9 that the project would be canceled due to a lack of funds.

After failing to merge with Honda, the cash-strapped Nissan decided to save itself. On May 13, Nissan officially unveiled the "Re:Nissan" recovery plan. As expected, every new CEO brings their own set of "fires" to put out.

Through the "Re:Nissan" plan, Nissan aims to save 500 billion yen in fixed and variable costs based on the actual costs of fiscal year 2024. The target for variable cost reduction is 250 billion yen.

Apart from drastic cost-cutting measures such as layoffs and factory closures, Nissan will also streamline its development process to reduce engineering costs and complexity, accelerating development speed. The goal is to decrease the average cost per hour of employees by 20% and reduce component complexity by 70%.

However, stemming the bleeding is only a temporary solution. The real challenge lies in transitioning from "stopping the bleeding" to "rebirth". So, who will be the savior capable of completing this challenge for Nissan?

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.