Uber, the Global Ride-Hailing Giant, Navigates Challenges with Resilient Execution

![]() 05/12 2025

05/12 2025

![]() 897

897

On the evening of May 7, Beijing time, before the US stock market opened, Uber, often referred to as the 'Didi of overseas,' unveiled its financial report for the first quarter of 2025. While the quarterly results exhibited some shortcomings, the company's encouraging outlook for the next quarter mitigated the negative impact of the current quarter's performance. Here are the key details:

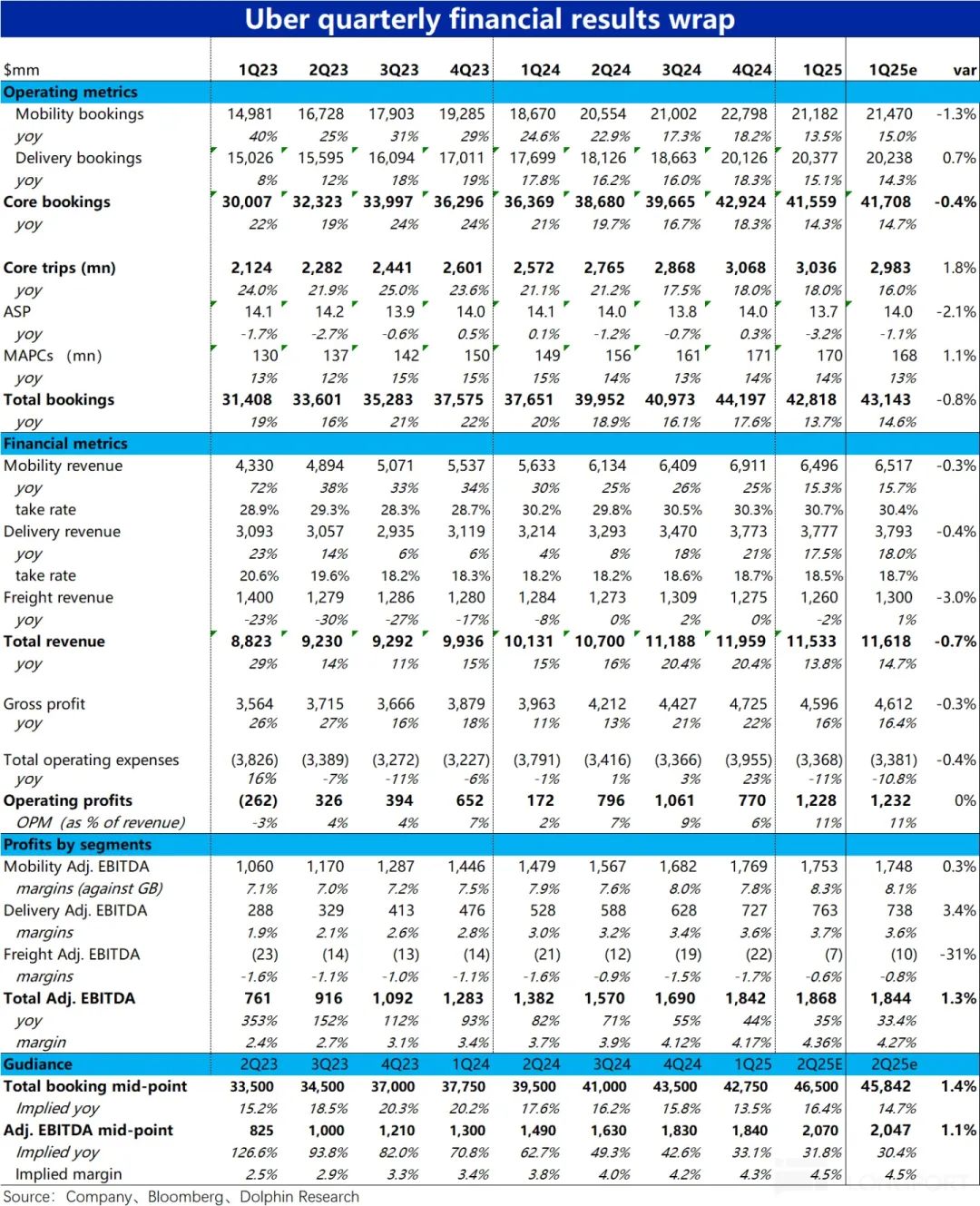

1. The significant slowdown in ride-hailing growth emerged as the most notable setback: Order value grew by just 13.5% year-over-year this quarter, a decline of 4.7 percentage points (pct) from the previous quarter and notably below the market's modest expectation of 15%. Even adjusting for exchange rate fluctuations, the growth rate fell from 24% to 20%, indicating that the slowdown was not solely due to currency effects and reflected a genuine deceleration in the business.

2. Surprisingly, the growth of Uber's other key segment, the food delivery business, remained robust (contrasting with yesterday's DoorDash earnings, which pointed to weaker growth). Order value increased by approximately 15% year-over-year, a slowdown of 3 pct from the previous quarter but still above market expectations of 14.3%. Excluding the impact of exchange rate fluctuations, the growth rate remained steady at 18% quarter-over-quarter.

According to the company, the annualized order value of non-meal deliveries, such as fresh produce and daily necessities, reached $10 billion, accounting for 12% of the overall food delivery order value. This should be a significant contributor to growth.

3. Regarding price and volume dynamics, the year-over-year growth rate of core business order volume remained at 18%, neither slower than the previous quarter nor below market expectations of 16%. Hence, volume growth was not a concern this quarter.

The primary factor was a notable year-over-year decline of 3.2% in the average order value, which dragged down overall order value growth. However, the adverse impact of exchange rates on order value this quarter was 4 pct, only 1 pct higher than the previous quarter, suggesting that exchange rate movements were not the primary reason for the significant drop in average order value.

Dolphin Research and Investment speculates that this could be due to an increase in the proportion of low-priced products and emerging markets in the product mix and market share structure, or perhaps the recent decline in oil prices leading to lower pricing in the ride-hailing business. The actual reason will depend on management's explanation.

4. Beyond the slowdown in order value growth, the revenue growth of the ride-hailing business experienced an even more pronounced decline, with a year-over-year growth rate of just 15%, compared to 25% in the previous quarter.

The underlying reason was that the take rate for the ride-hailing business increased by only 50 basis points (bps) year-over-year this quarter, a significant narrowing compared to the more than 160 bps increase in the past two quarters. This 'stalled' improvement in the monetization rate, combined with the slowing growth in order value, amplified the negative impact, ultimately leading to a sharp drop in revenue growth.

In contrast, although the year-over-year increase in the monetization rate of the food delivery business was just 38 bps, it has remained stable at this level for nearly three quarters and has not significantly dragged down the year-over-year revenue growth rate. In terms of variable exchange rates, the food delivery business's year-over-year revenue growth rate was 18%, a slowdown of only 3 pct from the previous quarter. Excluding the adverse impact of exchange rates, the revenue growth rate of the food delivery business reached 22%, an acceleration of 2 pct from the previous quarter, demonstrating the segment's resilience.

5. In terms of profitability, gross profit increased by 16% year-over-year this quarter, generally in line with market expectations but slightly lower. However, it still outpaced revenue growth. Despite the slowdown in growth and the narrowing of the take rate increase, gross margin still expanded by 73 bps year-over-year, the largest increase in the past six quarters. This underscores the company's ability to leverage efficiency improvements to enhance operational leverage.

From a cost perspective, this quarter saw significant growth only in marketing expenses, which increased by 15% year-over-year, while other expenses generally grew at a low single-digit rate or even declined year-over-year. Moreover, even the growth rate of marketing expenses was roughly equivalent to that of revenue and gross profit, which did not significantly erode profit margins.

Despite a noticeable slowdown in business growth, the company continued to drive profit margin expansion through its exemplary cost control and efficiency improvements. Adjusted EBITDA for this quarter was $1.87 billion, slightly above the expected $1.85 billion, with a year-over-year increase of 33%. The adjusted EBITDA margin increased by 0.7 pct year-over-year and 0.3 pct quarter-over-quarter.

By business segment: 1) The adjusted EBITDA of the ride-hailing business was $1.75 billion, in line with expectations. This was primarily due to the ride-hailing business's profit margin as a percentage of order value being 8.3%, 0.2 pct higher than market expectations, offsetting the impact of slower-than-expected growth.

2) While the food delivery business demonstrated resilient growth, its adjusted EBITDA margin also increased slightly by 0.1 pct quarter-over-quarter to 3.7%, exceeding expectations of 3.6%. The resulting profit was $760 million, 3.6% higher than anticipated.

6. Despite some shortcomings in the quarterly performance, the company's guidance for the next quarter exceeded expectations, mitigating the negative impact of the current quarter's performance. The company's guidance for the median total order value ranges from $45.75 billion to $47.25 billion, with the lower end close to market expectations of $45.84 billion. The median guidance corresponds to a year-over-year growth rate of 16.4%, indicating that the growth rate in the next quarter will accelerate by 2.7 pct compared to this quarter.

However, it's worth noting that the adverse impact of exchange rates in the next quarter will be 1.5 pct, compared to 4 pct in this quarter. Therefore, 2.5 pct of the acceleration in total order value growth is attributable to the improvement in exchange rate effects.

Even so, as tariff impacts will be more pronounced in Q2, the guidance suggests that growth in the next quarter will be roughly the same or slightly better than this quarter, which is still good news.

In terms of profit, the median guidance for adjusted EBITDA is $2.07 billion, slightly above the expected $2.05 billion. However, the implied profit margin of 4.5% is broadly in line with expectations, with the slight exceedance primarily due to a higher-than-expected order value.

Dolphin Research and Investment Perspective:

As mentioned, Uber's current quarter performance had some flaws, but the encouraging guidance for the next quarter partially offset the negative impact of the current quarter's performance. Consequently, the company's share price did not decline significantly following the earnings release.