BAT’s ‘Red Packet War’ Showers Users with RMB 4.5 Billion: Who Will Outpace Doubao First?

![]() 02/09 2026

02/09 2026

![]() 461

461

AI assistants engage in a fierce ‘Three Kingdoms Showdown’ during the Spring Festival.

‘Qianwen crashed.’

‘Less than an hour after launch, Qianwen’s red packet sharing links were blocked by WeChat.’

...

On February 6, the Qianwen APP launched its ‘Spring Festival RMB 3 Billion Free Order’ campaign, drawing a massive influx of users eager to experience AI-powered milk tea purchases. The surge in demand overwhelmed the servers and led to a spike in orders at offline tea shops. According to Qianwen data, the campaign surpassed 10 million orders within just nine hours of its launch.

Notably, Baidu Wenxin and Tencent Yuanbao recently offered RMB 500 million and RMB 1 billion in cash red packets, respectively. Alibaba’s Qianwen, with its RMB 3 billion in free order red packets, arrived later but matched the scale of Baidu Wenxin and Tencent Yuanbao.

However, facing a flood of red packet sharing links, WeChat took strict measures. To date, the red packet invitation links for Wenxin, Yuanbao, and Qianwen have been blocked by WeChat and have switched to passphrase-based red packets. Some netizens joked, ‘WeChat plays fair—it even blocks its own.’

With Qianwen joining the fray, the user acquisition battle among AI assistants has intensified. As RMB 4.5 billion in red packets flood the user acquisition marketing landscape, can BAT replicate the growth miracles of the mobile internet era? Will this WeChat-restricted melee accelerate AI adoption or simply reflect big tech’s FOMO (fear of missing out)?

01. BAT Reignites the ‘Red Packet War’

Every Spring Festival, internet platforms compete fiercely for traffic, as user engagement, activity, and social sharing peak during the holiday—a golden marketing period to ‘nail’ new habits into users’ routines. With AI development shifting from technology to product-side, the urgent task this year is to drive user adoption of AI apps. Naturally, the Spring Festival became a must-win marketing node.

While all three BAT giants distribute red packets, their approaches differ:

- Baidu placed red packet access in its main Baidu APP rather than the Wenxin APP, seemingly prioritizing building awareness for Wenxin’s AI assistant over immediate traffic.

- Yuanbao’s red packets require separate access via the Yuanbao APP, with rewards earned through sharing or task completion.

- Alibaba aims to position Qianwen as an ecosystem gateway, integrating services like Gaode Maps, Taobao shopping, and Fliggy hotel bookings. Its RMB 3 billion ‘free order cards’ require users to download the latest Qianwen APP and place milk tea orders.

In terms of gameplay, each platform strives to connect AI assistants with Spring Festival life:

- Baidu Wenxin tasks include ‘have Wenxin write Spring Festival couplets,’ ‘use Wenxin for image recognition and video creation,’ and daily timed passphrase guesses for hidden red packets or collecting ‘Fantasy Life Cards’ to split prize pools, encouraging sustained use.

- Yuanbao tasks include ‘chat with Yuanbao about Spring Festival,’ ‘create content using Spring Festival templates,’ and ‘experience DeepSeek’s new skills,’ enhancing interaction beyond mere sign-in rewards.

However, far more users shared Yuanbao red packets on WeChat than engaged in interactive tasks. After launch, WeChat groups were flooded with ‘XX sent you a cash red packet’ links. Some netizens even organized ‘Yuanbao Mutual Aid Groups’ to maximize rewards.

‘Qujie Business’ noted that Yuanbao’s campaign prioritized ‘sharing’ tasks, which offered the highest daily completion limits. Fourteen hours after launch, Yuanbao APP topped Apple’s free app chart, surpassing long-dominant Doubao and even crashing its servers temporarily.

Before the campaign, Pony Ma hyped the sharing-based red packet event, aiming to replicate WeChat’s 2015 ‘shake-to-win’ red packet success. However, WeChat swiftly blocked the links within two days, prompting Yuanbao to switch to passphrase-based sharing.

Ironically, when Yuanbao’s links were first blocked, Baidu Wenxin’s official account joked, ‘Tencent treats Wenxin better than Yuanbao.’ Yet Baidu’s links were blocked within a day, forcing a switch to passphrases.

Qianwen’s free order cards integrate deeper into consumption scenarios, encouraging users to adopt Alibaba’s ecosystem via milk tea purchases. ‘Qujie Business’ found Qianwen’s integration with Taobao Instant Shopping seamless, allowing direct payment without redirects. However, high traffic caused lag, and partner merchants remained limited.

Other mainstream AI assistants have yet to announce Spring Festival red packet plans. ByteDance opted for ‘content-interactive’ gameplay, avoiding direct cash giveaways. Instead, it leveraged CCTV Spring Festival Gala exposure and Douyin duet tasks to drive AI adoption. A month earlier, ByteDance announced a partnership with CCTV for the 2026 Gala, with its Volcano Engine cloud platform serving as the exclusive AI cloud partner. This may introduce diverse gameplay beyond ‘red packet grabs,’ likely involving voice interactions.

02. Does Social-Driven Growth Still Work?

Today, marketing tactics like ‘download APP, share for red packets’ or ‘watch AI videos for coins’ are ubiquitous. Can share-based red packets replicate BAT’s 2013 growth surge?

Opinions vary.

Some users complained that switching between apps for red packets yielded less than signing in on Xianyu. Others mocked, ‘Overseas AI giants compete on model updates; in China, it’s red packets.’

The red packet war reflects big tech’s scramble for user mindshare and AI influence. As AI assistants evolve toward general-purpose agents, lasting user retention depends on product value—especially problem-solving capabilities.

Yet red packet gameplay offers only superficial interaction, failing to showcase AI’s irreplaceability in work or life. A Tencent employee criticized Yuanbao’s marketing as ‘low-tier,’ filled with ‘copycat’ tasks that neglected genuine product exploration.

Others countered: Habits form through ‘superficial engagement.’ Many users in non-knowledge-intensive jobs first need simple red packet interactions to perceive AI’s utility.

Whether through Qianwen’s ‘invite friends for free orders’ or Wenxin/Yuanbao’s ‘share for red packets,’ internet platforms still rely on mobile internet-era ‘social logic’ to promote new tools.

Tencent, a PC-era social product expert, excels at leveraging high-frequency social scenarios. Prior to the red packet campaign, it tested ‘Yuanbao Pai,’ a ‘social space’ where users, AI, and friends collaborate on entertainment. Users can create ‘Pai’ groups to watch Tencent Video, listen to QQ Music, and interact with AI in real-time.

User feedback suggests Yuanbao Pai’s AI resembles Weibo’s ‘Comment Robert’—human-like, responsive to group questions, and adept at summarizing key points from chats. Overall, Yuanbao Pai feels like a group chat integrating all Tencent services.

A day after Pony Ma announced Yuanbao Pai, Baidu Wenxin launched ‘Wenxin Group Chat Assistant.’ Unlike Yuanbao Pai, it focuses on solving group discussion problems (e.g., family trip planning, work project division of labor) rather than entertainment.

Internet analyst Zhang Shule argues that Tencent, a leader in semi-acquaintance and acquaintance social networks, is using AI social features defensively—a ‘show of strength’ in AI to buy time for its next social innovation (not necessarily AI-based). Ultimately, users don’t need another WeChat-like group chat in a separate app; red packets and Yuanbao Pai may struggle to boost engagement.

03. Who Will Surpass Doubao First?

Behind the red packet social war lies big tech’s anxiety over securing a foothold in the AI era.

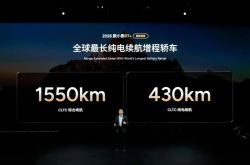

Qianwen, Yuanbao, and Wenxin’s user scales explain their massive budgets. QuestMobile data shows that by August 2025, Doubao and DeepSeek had surpassed 100 million monthly active users (MAUs), while Yuanbao and Wenxin lagged at millions and hundreds of thousands, respectively. By December, Doubao exceeded 100 million daily active users (DAUs). Despite Qianwen’s rapid growth post-rebranding and heavy spending, it still trails Doubao.

ByteDance’s Doubao dominates national AI assistant awareness. Since late 2025, netizens have flooded Douyin with humorous shorts like ‘Using Doubao to supervise homework,’ ‘The friend marinated in Doubao,’ and ‘Doubao styles my concert outfit,’ sparking organic viral trends.

According to 36Kr, Doubao achieved this with the lowest user growth and marketing spending among ByteDance’s billion-DAU products.

Doubao’s lead stems from its first-mover advantage and ByteDance’s strategic prioritization of talent and organization. Launched mid-2023, ByteDance centralized algorithm teams from business mid-platforms into new Seed and Flow teams reporting directly to the CEO—the earliest among internet giants to isolate large model operations.

Tencent, however, only restructured for its Hunyuan large model in 2025, establishing language and multimodal model departments under TEG. In December, under executive coordination, it transferred the model application and search algorithm centers from the large model team to Yuanbao’s Cloud and Smart Industries Group (CSIG) to reduce internal friction.

According to LatePost, Yuanbao is more cautious than Doubao in product exploration, only launching features after scoring at least 80/100. This caution reflects weaker traffic anxiety—Tencent has leading products in nearly every sector (WeChat, QQ, Tencent Video, Tencent Meeting, QQ Browser, QQ Music) and can target any user segment. Yuanbao plans to first match Doubao in key scenarios, then achieve partial surpasses, and finally overtake via innovation.

However, with Qianwen’s DAUs soaring and Alibaba integrating its ecosystem for an ‘AI+services’ closed loop, Yuanbao faces more than just Doubao. The RMB 4.5 billion Spring Festival red packet war is just the prelude to this year’s AI portal battle. The real key battles will involve technological iteration, scenario deepening, and ecological integration—defining the AI market landscape.