Final Verdict: Despite Claims of Outdated Technology, Why Are Automakers Pushing Extended-Range Vehicles?

![]() 02/09 2026

02/09 2026

![]() 511

511

According to China's definition of new energy vehicles, they include Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (HEVs, including Extended-Range Electric Vehicles or EREVs), and Hydrogen Fuel Cell Electric Vehicles (FCEVs). These vehicle categories are eligible for new energy vehicle preferential policies.

Statistics from the China Association of Automobile Manufacturers indicate that in 2025, China's new energy vehicle sales (including exports) will reach 16.49 million units, comprising 10.622 million BEVs (64.4%), 5.861 million plug-in hybrids (including extended-range vehicles, 35.5%), and 8,000 fuel cell vehicles (a negligible share).

Among the 5.861 million plug-in hybrids (including extended-range vehicles) sold last year, the CAAM's statistics do not provide specific data on extended-range vehicle sales. It is estimated to be around 1.8 to 2 million units, representing a significant increase from 1.1 million units in 2024 and accounting for approximately 12% of last year's total new energy vehicle sales.

Opinions on extended-range vehicles vary within the industry. BYD, a leader in new energy vehicles, does not produce extended-range vehicles, and Great Wall Motors has vowed never to do so.

Some argue that using oil to generate electricity in extended-range vehicles is unnecessary and inefficient. Others consider extended-range technology outdated and destined for obsolescence.

However, many domestic automakers are embracing extended-range vehicles. Li Auto has stood out among new forces with its extended-range technology and was the first to achieve profitability. Huawei-empowered Seres AITO M5/M7/M9 extended-range versions continue to sell well, with extended-range models accounting for over 80% of AITO brand sales. Automakers such as Leapmotor, Shenlan, Voyah, Lynk & Co, and Chery are all launching extended-range models.

Despite claims that extended-range technology is outdated, why are manufacturers launching more extended-range models with increasing sales?

Analysts suggest three main reasons:

1. Cost advantages. Extended-range electric vehicles are significantly cheaper than plug-in hybrid models. In a market environment characterized by intense price competition and severe "involution," extended-range models offer better profit margins.

I recall asking a Leapmotor sales manager years ago, during a period of soaring battery prices, why they were introducing extended-range vehicles when they were already doing well with electric vehicles. He replied that extended-range vehicles could generate tens of thousands of yuan more in profit per unit.

2. Relatively low technological barriers and development costs.

For automakers, the extended-range technology route holds unique appeal:

Firstly, development cycles are shortened. Compared to hybrid systems requiring precise electromechanical coupling, extended-range architectures are closer to a combination of "pure electric vehicle + range extender." Data from Changan Automobile's research institute shows that developing a new extended-range platform takes 6-8 months less than developing a new hybrid platform.

Secondly, supply chain management is simplified. The three-electric systems of extended-range vehicles are shared with pure electric models, and range extenders can be outsourced or developed in collaboration with mature engine suppliers. This lowers research and development barriers, particularly benefiting new forces in quickly launching products.

By eliminating complex mechanical transmission components such as gearboxes and clutches, manufacturing costs are lower than those of hybrid systems with equivalent performance. It is estimated that extended-range systems cost about 8%-12% less than plug-in hybrid systems with equivalent performance.

3. Addressing consumer range anxiety and charging anxiety.

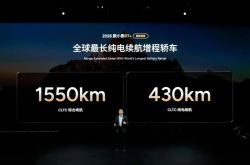

Compared to pure electric vehicles, extended-range vehicles typically offer a combined range exceeding 1,000 kilometers, completely eliminating range anxiety. They also offer flexible energy replenishment options, allowing the use of oil for electricity generation when charging is not available, thus resolving charging anxiety.

Current extended-range technology has made significant progress compared to its early iterations, achieving specialization of range extenders, intelligent energy management, and overall efficiency. The long-criticized issue of high fuel consumption at high speeds has also significantly improved.

Analysts believe that when extended-range models surpass equivalent gasoline vehicles in terms of cost, efficiency, and user experience, the label of "transitional technology" will naturally fall away. The market share of extended-range models in China's new energy vehicle market will also steadily increase, establishing themselves as one of the mainstream technological routes. In the foreseeable future, pure electric, extended-range, plug-in hybrid, and gasoline vehicles will coexist for a long time, each serving different user groups and usage scenarios. (End)