Why Doubao: The Latest Starter with the Lowest Cost Became the Hottest AI

![]() 02/11 2026

02/11 2026

![]() 388

388

In 2025, amidst a fierce battle over parameters, intelligence, and growth-at-all-costs in large AI models, a “latecomer” has unexpectedly emerged as the biggest winner.

By December of last year, Doubao, a ByteDance product, surpassed 100 million daily active users, claiming the top spot among domestic AI applications. More critically, it became ByteDance’s product with the lowest market promotion costs to reach 100 million DAU.

As the latest entrant among China’s tech giants, Doubao’s rapid rise in the consumer market has turned heads across the industry.

Its success path stands in stark contrast to the mainstream AI competition narrative of 2025:

First, while AI products compete on logical reasoning, Doubao focuses on guiding users on fashion choices, supervising children’s homework, and other seemingly trivial tasks.

“Doubao has high emotional intelligence—that’s why it’s the most popular among AI products,” reads a common social media comment. Doubao is the only mainstream AI chatbot with a personalized avatar, defaulting to a character named “Peach.”

Second, while Tencent and Alibaba invest heavily in paid user acquisition, Doubao relies on “organic traffic” from Douyin (TikTok’s Chinese version) creators to drive user growth.

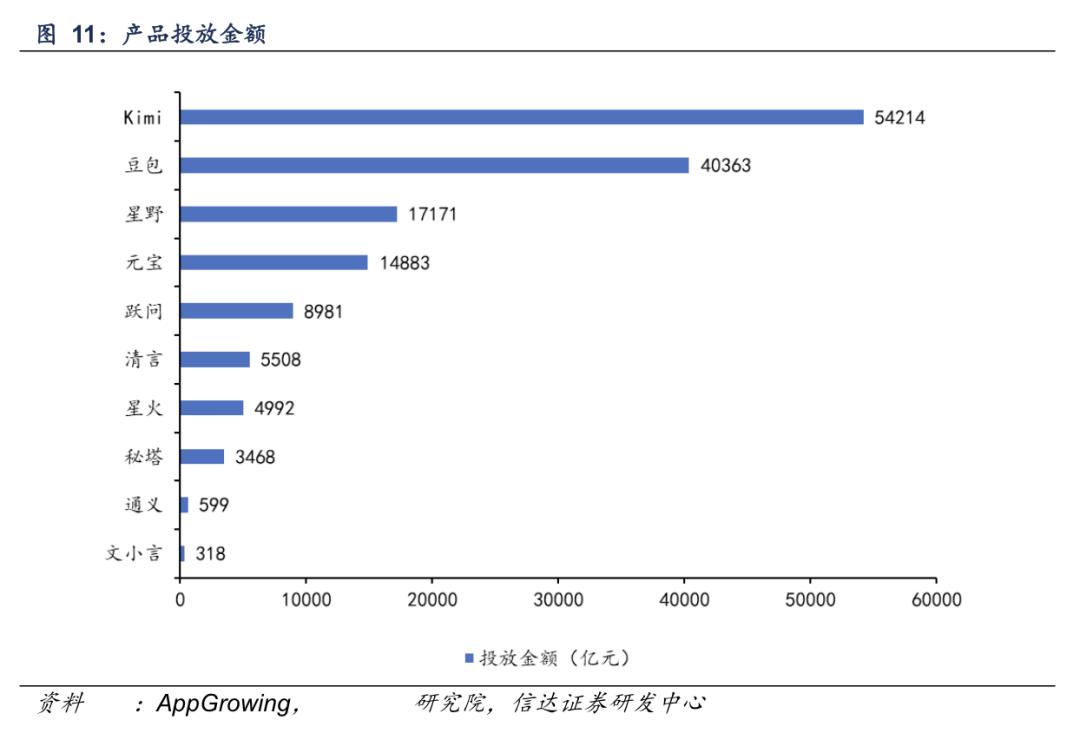

According to DataEye, 891,000 sets of promotional materials for native AI products were released in mainland China’s market in November 2025. Tencent’s Yuanbao accounted for 46%, Qianwen 34%, and Doubao just 11%. In terms of spending, Doubao’s investment intensity was roughly one-third that of Yuanbao and Qianwen.

Doubao’s breakthrough reflects ByteDance’s mature product methodology and content distribution system being fully reused in the AI era: it found a differentiated niche of “emotional and mass-market appeal” in a seemingly crowded field, transforming cutting-edge technology into an everyday product accessible to ordinary people through high-frequency life scenarios and content ecosystem amplification.

Thus, Doubao serves as a valuable industry case study: in a technology-driven, capital-intensive battlefield, it redefined consumer AI competition by prioritizing human understanding over mere technological accumulation.

I. Lowest Cost, Best Results

In late December of last year, Douyin creator @FriendlyVisitor posted a call with Doubao, asking it to teach him how to “dress like a Korean heartthrob.” Under Doubao’s guidance, the creator wore a white shirt, black dress pants, and khaki pants. Doubao concluded: “The relaxed vibe of a Korean heartthrob is there.”

The video went viral, amassing 1.63 million likes, 3.38 million shares, and 100,000 comments. The top-liked comment showed a netizen sending Doubao the creator’s outfit photo, asking, “Did you style this?” Doubao replied, “Yes, I almost died laughing.”

Netizens praised Doubao as “shrewd,” “sarcastic,” and “hilarious,” with many saying, “I’m downloading Doubao too.”

While other large model players focused on productivity, Doubao redirected AI’s imagination toward users’ daily lives.

On platforms like Xiaohongshu and Douyin, users employ Doubao not as a copywriting (copywriting) or coding tool but for mundane tasks: some use it to supervise children’s homework, others for dictation, and some even to monitor pets eating snacks.

Through videos showcasing these diverse Doubao use cases, the app achieved organic growth by providing emotional value.

A Douyin insider remarked that this growth mirrored Douyin’s early days—a fun feature goes viral among creators and young users, sparking exponential spread. “We were baffled; this wasn’t part of any strategy.” According to LatePost, citing a Doubao insider, such playful uses initially drove millions of new users daily.

This spontaneous growth starkly contrasts with the paid acquisition logic of other AI products.

Data shows Doubao’s peak spending occurred in 2024. Cailian Press reported that by November 15, 2024, China’s top 10 native AI apps had spent 1.5 billion yuan on promotions, with Doubao ranking second at over 400 million yuan.

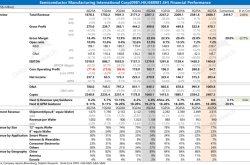

However, by 2025, Doubao’s spending sharply declined compared to rivals. Estimates from National Business Daily and AppGrowing suggest Yuanbao spent 15 billion yuan in 2025, including 5.763 billion in Q3 alone, while Doubao spent just 435 million yuan for the entire year.

Despite this spending gap, Doubao’s DAU surpassed 100 million, becoming the first AI-native app to achieve this milestone. QuestMobile data shows that by December 2025, Doubao had 155 million weekly active users, far surpassing DeepSeek and Yuanbao in second and third place.

As user growth soared, Doubao’s market promotion costs remained the lowest among all ByteDance products to reach 100 million DAU.

II. Is EQ More Important Than IQ?

Among China’s tech giants, ByteDance was the latest to enter the AI race. Before ChatGPT’s launch in late 2022, Baidu and Alibaba had already released large language models.

After ChatGPT’s debut, domestic tech firms rapidly rolled out large models in early 2023. A Minsheng Securities report noted that by April 2023, over 30 domestic large models had been unveiled.

In contrast, ByteDance only established its Flow department in March 2023, led by Zhu Jun, to develop Doubao (then codenamed “Grace”). The name changed from “Grace” to “Doubao” in August, coinciding with its public beta.

The shift from a tech-centric codename (“Grace”) to the approachable “Doubao” signaled a pivot to ByteDance’s strength in mass-market appeal.

The core product philosophy: prioritize emotional value over productivity.

“Doubao has high EQ—that’s why it’s the most popular,” social media users often say. Users label Doubao as “emotionally intelligent” and “human-like,” preferring it over cold, utilitarian tools.

While other AI products showcase intelligence through complex math problems and coding prowess, Doubao focuses on “human-like” qualities. Zhu Jun publicly shared Doubao’s three design principles:

1. Personification: Humanized design lowers AI usage barriers and fosters emotional connections.

2. Proximity to users: Doubao should accompany users anytime, embedding into diverse contexts rather than requiring users to seek it out.

3. Personalization: Supported by an agent ecosystem and the “Kouzi” development platform, it meets individual needs for functionality, style, and memory.

This approach draws inspiration from Character.ai.

Li Fuxiang, Doubao’s strategy product lead, argued in a speech that after AI product exploration enters “uncharted territory,” the strategy should prioritize an “ideal product state” over current technical constraints. AI should be a warm, fun companion, not just a search engine—emphasizing emotional value and novelty.

Thus, Doubao invested earlier and heavier in role-playing and emotional dialogue to forge user connections, rather than merely solving problems efficiently. This positioning sharply contrasts with efficiency-focused rivals like DeepSeek.

DeepSeek attracts professionals like developers and students, while Doubao captures the vast mainstream audience seeking companionship through “meme-savvy, chatty, and emotionally aware” interactions.

To make this “human touch” tangible, Doubao’s R&D heavily prioritizes user experience, diving deeper into multimodal (voice, visual) integration than peers. This resonates strongly with mass users.

For example, users share photos for Doubao to “roast” or engage in real-time voice/video chats. Such multisensory interactions let Doubao swiftly outpace early text-centric rivals, aligning with multimedia-era preferences.

Under this logic, Zhu Jun and his team focus on proactive scenario, playing method (playfulness), and feature exploration. Since it’s unclear which scenario will go viral first, they trial each one.

Overall, high EQ is Doubao’s unique strength. CICC research notes that while competitors like Yuanbao, Qianwen, and even overseas products like ChatGPT and Gemini emphasize IQ, Doubao’s EQ-first, IQ-compatible positioning remains unmatched and difficult to replicate.

III. The Next Super Gateway?

Doubao’s ambitions extend beyond being a chat companion—it aims to dismantle traditional app barriers and become the super gateway in the large model era.

In December, Doubao launched a preview version of its mobile assistant, leveraging its large model and phone maker partnerships. With a single voice command, users can compare prices across platforms, check parking spots, retrieve package codes, book restaurants, or open car trunks.

The initial engineering prototype sold out instantly, with 30,000 units fetching over 30,000 yuan each on the secondary market. However, WeChat, Alipay, Meituan, and some bank apps collectively countered it.

On January 26, at Tencent’s annual conference, Pony Ma criticized Doubao Mobile, stating Tencent opposes uploading user screen data to the cloud as “extremely unsafe and irresponsible.”

But Doubao persists.

According to 36Kr, ByteDance launched the official Doubao Mobile project in late 2025, with new devices expected in mid-to-late Q2 2026. The team is negotiating with mainstream app developers, securing partial permissions from internet firms (ride-hailing, food delivery, ticketing).

Simultaneously, Doubao Mobile is partnering with phone makers in two ways: for giants like OPPO, Vivo, and Honor with self-developed ecosystems (models, computing power, entry points, OS), cooperation focuses on technical integration, such as model interoperability or modular products like “Doubao Input Method.”

For smaller players like Transsion, Meizu, and Lenovo (categorized as “others”), Doubao Mobile directly embeds an AI gateway, with manufacturers paying tech licensing and AI service subscription fees. Transsion has already partnered, Meizu expressed interest, and Lenovo leans toward collaboration.

Currently, despite powerful AI models, smartphones and PCs—our primary devices—remain in early stages of deep AI integration.

Yet “AI-powered phones” are becoming a key trend. IDC predicts that by 2026, China’s next-gen AI phone shipments will reach 147 million units, accounting for over 50% of the market.

Doubao Mobile could ignite this shift.

Globally, deep AI-hardware fusion represents the next revolutionary opportunity, even dubbed the next “iPhone moment.” It redefines future mobile interaction gateways, becoming the next battleground for tech giants.

Once users adopt AI-driven task interactions via voice, the core App traffic gateway status of mobile internet will decline, reducing apps like Taobao and Meituan to mere tools summoned by AI.

Traffic distribution rights will also shift. The mobile internet’s crown jewel is entry points and traffic control. Whoever dominates the first touchpoint captures user attention and commercialization. But in the AI era, this touchpoint is moving from super Apps to super AI.

This shift heralds the end of an era. As traffic flows from super Apps to super AI, it’s not just product iteration but a power reshuffle. Winning the AI gateway means securing influence for the next decade.