Red Packets for Large Models Go Viral, Computing Power Leasing Emerges as the Biggest Winner

![]() 02/11 2026

02/11 2026

![]() 509

509

Tencent Yuanbao 'crashed' due to a surge in traffic from Spring Festival red packet activities. At the same time, A-share concept stocks related to computing power leasing surged. This seemingly contradictory phenomenon precisely reveals the core contradictions and opportunities in today's era of artificial intelligence.

The traffic peak during the Spring Festival not only brought red packets but also exposed the vulnerability of AI infrastructure. When Tencent Yuanbao experienced service instability under a massive influx of user visits, concept stocks related to computing power leasing performed impressively in the capital market.

Behind this phenomenon lies the market's keen response to the scarcity of computing power resources.

Currently, from the explosion of consumer-facing (C-end) AI applications to the intelligent transformation of business-facing (B-end) enterprises, and from strong national policy support to strategic adjustments by global tech giants, computing power leasing—once a relatively specialized field—is rapidly evolving into a core infrastructure industry in the digital economy era. With the implementation of policies by the Ministry of Industry and Information Technology to advance computing power scheduling and interconnection, the computing power leasing industry is ushering in unprecedented development opportunities.

01

Application-Side Exposure of Computing Power Shortage, Rapid Market Response

The explosive growth of AI applications is posing severe challenges to backend infrastructure. Around the 2026 Spring Festival, two major AI application services experienced abnormalities, directly reflecting the current contradiction between computing power supply and demand.

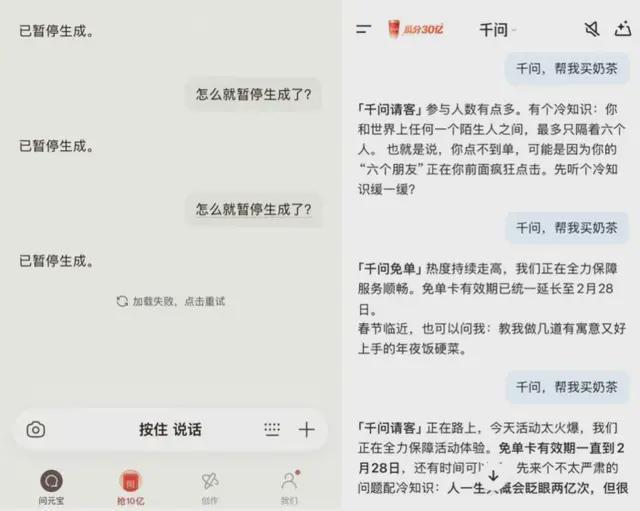

On February 1, the Tencent Yuanbao App launched a 1 billion yuan red packet campaign for the Spring Festival. When users attempted to use features such as "Spring Festival Template to Create Similar Content," they frequently encountered prompts stating "Generation Temporarily Suspended," indicating brief service instability. Similarly, on February 6, Alibaba's Qianwen App experienced multiple instances of lag during its "3 billion yuan in free orders for the Spring Festival" campaign due to a massive influx of traffic, preventing users from completing orders, payments, and sharing.

These incidents occurred in close succession during the peak Spring Festival marketing period, exposing the vulnerability of current AI applications when faced with sudden large-scale access. Tencent officially responded that the issue stemmed from a "sudden surge in traffic," while Alibaba stated it was "urgently adding resources to ensure smooth operation." Both responses pointed to the same problem: insufficient computing power resources to meet peak demand.

Unlike the overt challenges faced by Yuanbao and Qianwen due to sudden traffic spikes, Moonshot AI (Kimi), a prominent startup, faces long-term strategic "trade-offs" under resource constraints. Kimi once stood out for its ultra-long text processing capabilities, achieving remarkable growth in 2024 with monthly active users (MAUs) exceeding 21 million at its peak. However, by 2025, its market position had declined sharply. According to QuestMobile data, by September 2025, Kimi's MAUs had dropped to around 9.67 million, representing just about 5.6% of the leader, Doubao (172 million), and widening the gap with top players like DeepSeek.

Its parent company, Moonshot AI, admitted on social media to experiencing a "severe shortage of computing resources" and publicly called for more suppliers to join. The core reasons for the shortage include the persistent tight supply and high cost of high-end AI chips (such as NVIDIA's H800 series), making it challenging to secure stable sources. Additionally, as an independent startup, Kimi's capital investment capacity cannot compare to the hundreds of billions of yuan in AI expenditures by internet giants, creating inherent "resource constraints." To address this, Kimi is optimizing existing computing power through algorithmic innovation and actively exploring ways to adapt its system to domestic AI chips as alternative solutions.

Interestingly, the capital market reacted quite differently. On February 2, the day after Tencent Yuanbao encountered issues, A-share concept stocks related to computing power leasing experienced abnormal surges. Companies like Qunxing Toys and Litong Electronics hit their daily limits, with shares of Yakang surging over 14%, while Runze Technology, Wangsu Science & Technology, and Zhongfu Tong also saw significant gains.

This phenomenon of "application-side fluctuations and capital market enthusiasm" is not an isolated case. On January 28, Google announced that it would raise prices for its data transfer services starting in May 2026, with rates in North America doubling from current levels. This news directly strengthened concept stocks related to computing power leasing, with Meili Cloud hitting its daily limit. Shares of Wangsu Science & Technology and Qingyun Technology also surged over 10%.

02

Tight Supply and Demand

The rapid rise of the computing power leasing market is no accident but the result of multiple factors working together, propelling the industry into a golden age of development.

The essence of computing power leasing is to provide computing power resources to users through rental, falling under the category of resource leasing services in the cloud computing model. Users can lease servers or virtual machines to complete large-scale computing tasks based on their needs, without having to build their own computing infrastructure or bear the costs and responsibilities associated with equipment maintenance and system upgrades.

Broadly speaking, computing power leasing refers to all business forms that provide computing power leasing in the form of cloud services, including various models billed by computing power usage, server rental duration, etc., such as public cloud and private cloud services. Narrowly defined, it specifically refers to the deployment and integration of computing power in a project-based, contractual manner tailored to clear customer needs, without transferring ownership of the computing power resources, and only charging customers for rental as agreed.

Currently, China's computing power leasing industry has primarily formed three mainstream business models:

Single-Instance Whole Lease Model: Leasing entire servers, typically billed as "per server per month" (each server comes standard with 8 GPUs). This model is suitable for customers requiring long-term, stable use of large-scale GPU resources. It offers access to the latest GPU cards and has lower overall server maintenance costs.

Computing Power Scale-Based Leasing Model: Billed based on the total computing power, typically as "per petaflop per year." Customers can flexibly select the corresponding computing power scale according to their needs, enabling elastic resource allocation.

GPU Card-Hour Leasing Model: Billed per GPU card on an hourly basis ("per card per hour"). This model primarily meets short-term, temporary, or sudden computing power demands, allowing for adjustments in the number of rented cards based on actual usage.

The explosive growth in demand for training and inference of AI large models has become the core driver of expansion in the computing power leasing market. This approach significantly lowers the barrier for downstream users to flexibly utilize computing power, particularly benefiting numerous AI startups, especially small and medium-sized enterprises (SMEs), which, due to financial and technical constraints, are more inclined to acquire computing power resources through leasing. This provides a vast market for the computing power leasing industry. On the other hand, it also activates idle computing power resources, improves overall computing power utilization efficiency, and achieves optimal resource allocation.

The supply side faces multiple challenges. Factors such as tight supply of high-end GPU chips, long construction cycles for data centers, and a shortage of professional operation and maintenance teams all constrain the rapid expansion of computing power resources. Meanwhile, international cloud computing giants are adjusting their pricing strategies. Google announced that it would raise prices for its data transfer services starting May 1, with rates in North America, Europe, and Asia increasing from $0.04, $0.05, and $0.06 per GB to $0.08, $0.08, and $0.085 per GB, respectively. Amazon Web Services (AWS) also raised prices for its EC2 machine learning capacity blocks by about 15%. These changes further highlight the scarce value of computing power resources.

Supportive policy environments provide a solid foundation for industry development. As early as 2021, four departments, including the National Development and Reform Commission, released the Implementation Plan for the Computing Power Hub of the National Integrated Big Data Center Collaborative Innovation System, launching the "East Data, West Computing" project.

In February of this year, the Ministry of Industry and Information Technology issued the Notice on Organizing the Construction of National Computing Power Interconnection Nodes, proposing to build a computing power interconnection system composed of national nodes, regional nodes, and industry nodes.

Local governments are also taking proactive actions. Shenzhen, Shanghai, Beijing, and other cities have introduced "computing power voucher" policies to reduce the cost of computing power usage for enterprises through subsidies. Shenzhen provides subsidies of up to 50% of the service contract amount for enterprises renting intelligent computing power for large model training, with subsidy rates for startups reaching as high as 60%.

03

From Billions to Hundreds of Billions

The computing power leasing market is expanding at an astonishing pace, attracting active layout (strategic moves) from various participants and forming a diversified competitive landscape.

Industry forecast data indicates that ResearchInChina predicts China's computing power leasing market size will surpass 100 billion yuan by 2025. By 2026, the potential revenue scale for domestic computing power leasing is expected to reach 260 billion yuan, with subsequent annual growth rates exceeding 20%. Another market report from QYResearch forecasts that the compound annual growth rate (CAGR) of China's computing power leasing service market will reach 24.2% between 2026 and 2032. These figures all point to a rapidly growing market outlook.

As the market size expands rapidly, corporate investment enthusiasm is high, with frequent large procurement orders.

On August 16, 2025, Xiechuang Data Technology Co., Ltd. announced plans to purchase servers from multiple suppliers, with a total procurement amount expected not to exceed 1.2 billion yuan. The purchased equipment will primarily be used to provide computing power leasing services to customers. This procurement represents another large-scale equipment investment exceeding 1 billion yuan in China's computing power leasing sector this year.

The author learned that this 1.2 billion yuan investment is not Xiechuang Data's first major move in the computing power leasing field. As early as March last year, the company planned to invest 3 billion yuan in procuring servers from suppliers for computing power leasing services. In May of the same year, Xiechuang Data further increased its investment, proposing to spend no more than 4 billion yuan to continue purchasing servers and expand its computing power leasing business layout (strategic moves). In just a few months, the company's cumulative investment exceeded 8 billion yuan, making it one of the most active procurers in China's 2025 computing power server market.

During the same period (last August), Jinkai New Energy Co., Ltd. announced that its subsidiary, Jinkai Xineng Yiwu New Energy Power Generation Co., Ltd. (hereinafter referred to as "Jinkai Yiwu"), had signed a contract with Infinite Mind (Beijing) Intelligent Technology Co., Ltd. (hereinafter referred to as "Infinite Mind") in January. Jinkai Yiwu would provide intelligent computing power and supporting resources to Infinite Mind, with a total lease amount of 69.12 million yuan and a service period of 12 months.

Other companies are also actively making strategic moves. Litong Electronics' computing power cooperation with Tencent is a typical example of long-term collaboration and deep customization with a major client. The two sides conduct full-link cooperation through a joint venture, Century Litong. From late 2024 to 2025, Tencent procured 2,300 high-end GPU servers from Litong Electronics in two phases, expected to generate annualized revenue of 1.8 billion yuan. In 2025, the two sides further signed the 2025-2027 AI Computing Power Strategic Cooperation Memorandum, locking in cumulative orders worth 5 billion yuan, covering H20 server leasing, edge computing node deployment, and liquid-cooled data center transformations. The strategic cooperation agreement between Hainan Huatie and Haima Cloud involves a total rental scale of 1 billion yuan.

Market participants are diverse, including internet giants like Alibaba and Tencent Cloud, as well as professional computing power operators such as YunSAI Intelligent Connection, Hongbo Co., Ltd., and Zhongbei Communication. Different companies have adopted differentiated competitive strategies: some control core resources by building their own data centers; others quickly enter the market through hardware agency and asset-light operation models; while some focus on customized services for vertical scenarios.

04

Conclusion

The excitement and fluctuations in frontend applications are ultimately superficial. The stable supply and elastic support of backend computing power are the true hard requirements in the AI era. As large models become widespread, C-end intelligent applications explode, and B-end intelligent transformations accelerate, computing power is no longer an optional supporting resource but the core foundation for the operation of the digital economy.

Behind the repeated application "crashes" lies an opportunity to reevaluate the value of computing power and accelerate industry upgrades. As infrastructure in the AI era, computing power leasing is just beginning to unlock its strategic importance and market potential.

However, the computing power leasing industry is not without concerns. Some industry insiders state that while many companies can obtain green energy certifications and retain residual value in assets by purchasing servers for computing power leasing, the industry generally faces the issue of long payback periods, putting pressure on corporate cash flow. Meanwhile, data security and privacy compliance risks involved in leasing data and models remain significant challenges that cannot be overlooked in the industry's development.