NetEase: The 'Pig Farm' Still Faces Challenges!

![]() 02/12 2026

02/12 2026

![]() 429

429

NetEase released its financial results for the fourth quarter of 2025 after the close of the Hong Kong stock market on February 11 (Beijing Time). Overall, the Q4 performance fell short of consensus expectations, primarily due to weakness in mobile gaming.

While the market has already factored in some impact from the recent slowdown in revenue growth, there is no need for further pessimism from a medium- to long-term perspective. However, for short-term trends, clear guidance on the new product cycle during the earnings call will be crucial.

Key Observations:

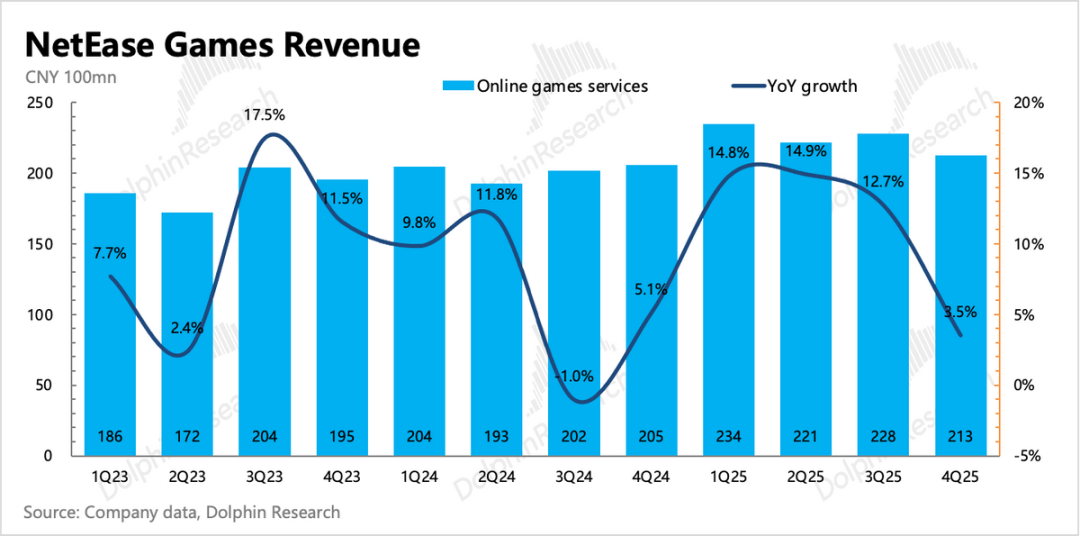

1. Lack of new game releases continues to drag on revenue: Gaming revenue for Q4 reached RMB 21.3 billion, up 3.5% year-on-year, falling short of market expectations.

Dolphin Research believes that the market may have engaged in linear extrapolation, expecting Q4 growth to be only slightly lower than Q3. However, the return bonus from Blizzard's PC games had significantly diminished by Q4 due to a higher base. Meanwhile, mobile gaming was still in a lull for new releases. Without a breakout hit among older games, sequential growth was expected to slow notably.

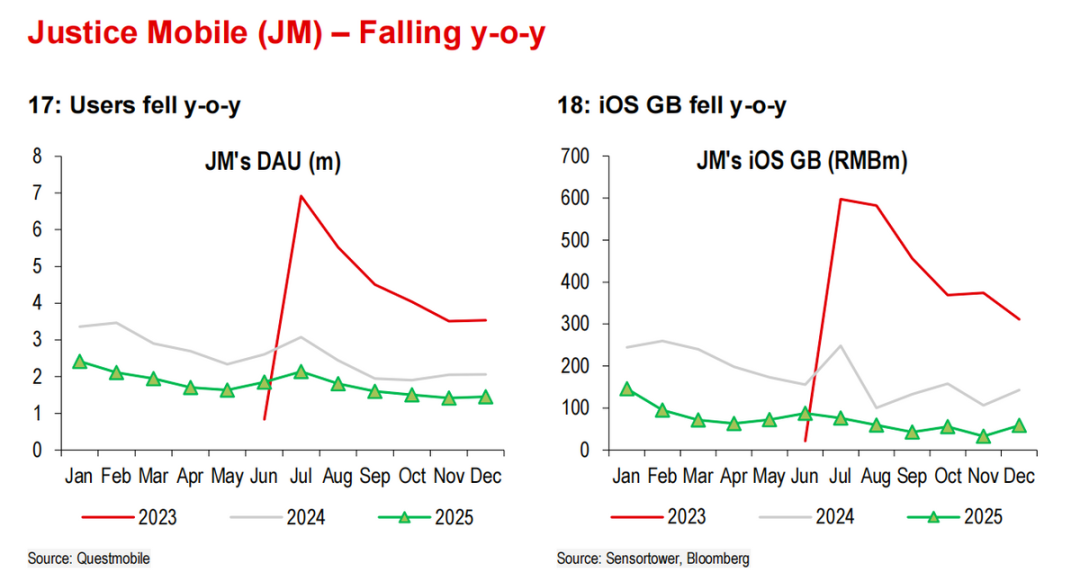

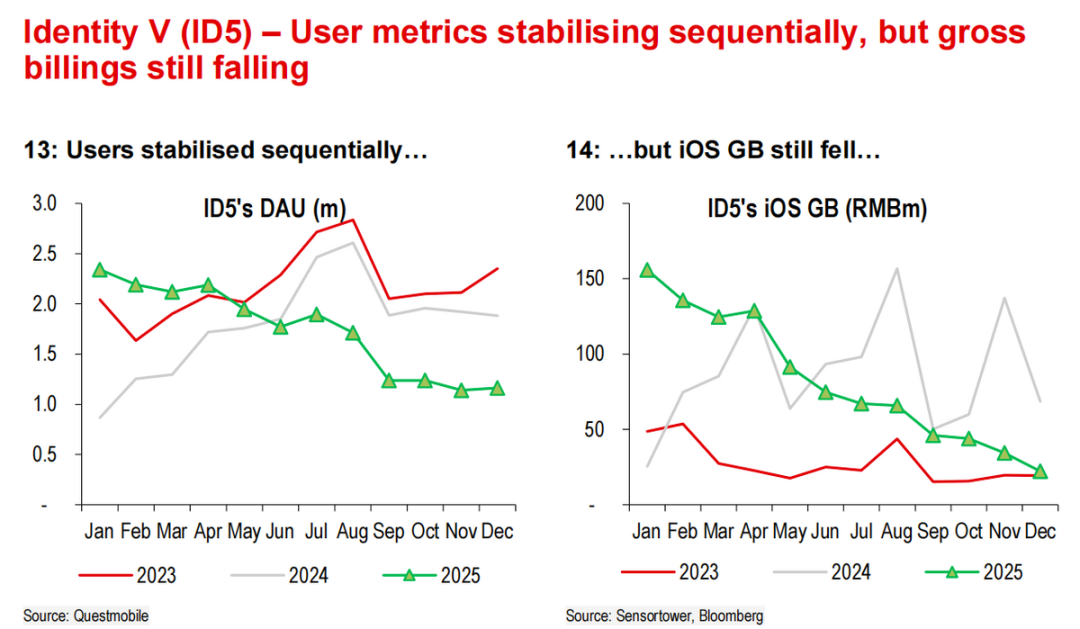

In reality, older games did not fully hold up: PC games performed relatively better, mainly due to incremental contributions from Onmyoji and Fantasy Westward Journey Unlimited versions. However, mobile games faced challenges: Identity V continued to be impacted by competitors, while Justice Online and Naraka: Bladepoint saw revenue declines. Although Onmyoji's mobile version performed well during its anniversary event, it only launched in late December. Similarly, Eggy Party's rebound was more pronounced in December, leaving insufficient time to offset the shortfall.

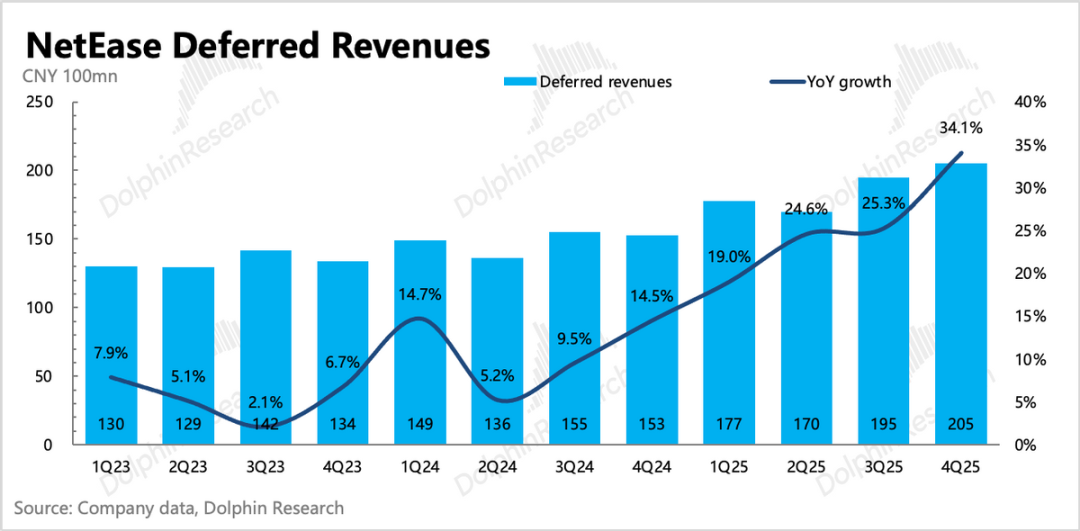

2. Deferred revenue offers hope: Similar to Q3, deferred revenue provided some optimism amid lackluster revenue performance. Q4 deferred revenue continued to exceed market expectations, surging 34% year-on-year and slightly outpacing even optimistic estimates (+32%).

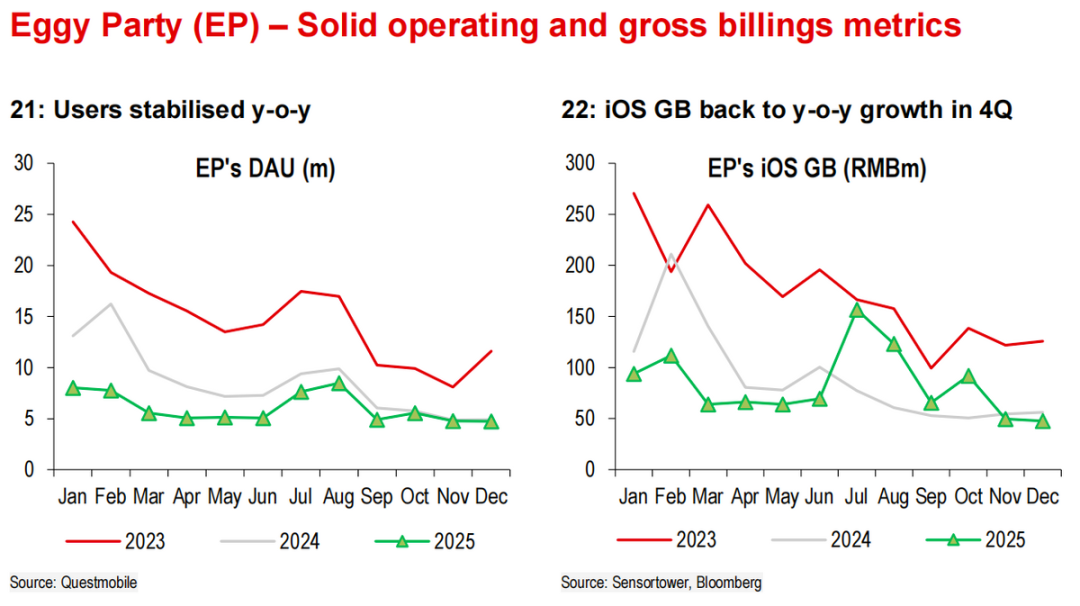

The strong deferred revenue performance reflects the stellar anniversary event for Onmyoji's mobile version and the rebound in Eggy Party's popularity at year-end. This is expected to provide some upside support for Q1 revenue.

3. Strict cost control: Q4 core profitability improved, with the operating profit margin for the main business rising to 30%, up 1 percentage point year-on-year and 2 percentage points quarter-on-quarter. With revenue under pressure, the profitability gain was primarily driven by cost reduction.

In absolute terms, costs, R&D, and administrative expenses all declined year-on-year. While selling expenses surged year-on-year, this was due to special factors (anti-corruption efforts in the prior year created a low base), along with necessary marketing for new game launches.

However, core profit still fell RMB 400 million short of expectations due to revenue weakness. Adjusted net profit (net profit plus share-based compensation) saw a significant year-on-year decline, which appeared alarming but was actually due to changes in unrealized gains/losses on Pinduoduo holdings.

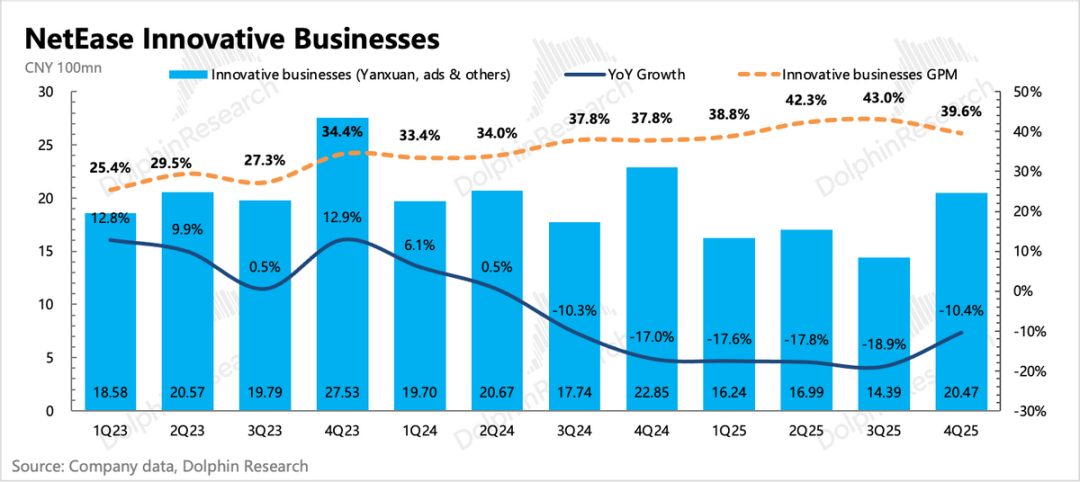

4. Stable performance in subsidiary businesses: Non-gaming segments, including Youdao Education and Cloud Music, performed steadily with no major surprises. Other innovative businesses, led by Yanxuan, saw seasonal growth but remained on an overall contraction trend.

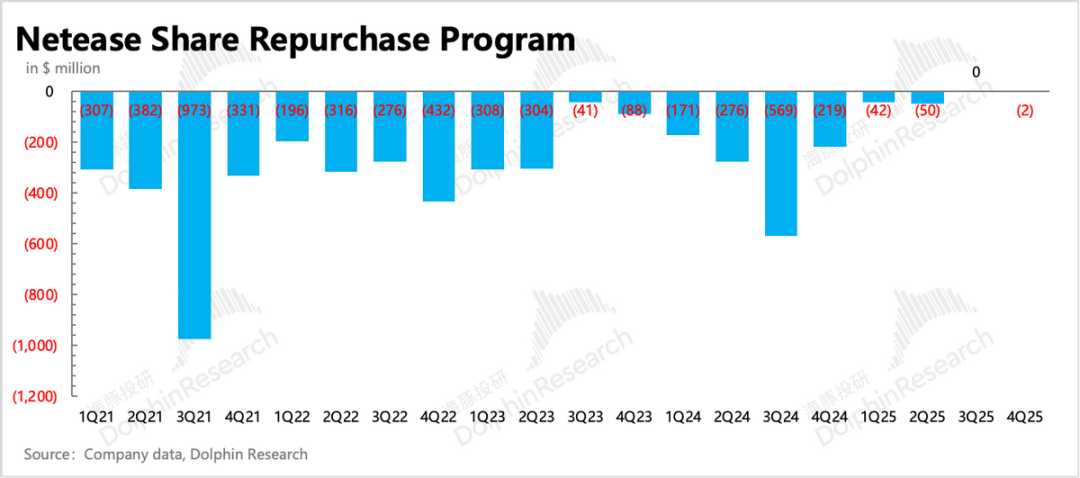

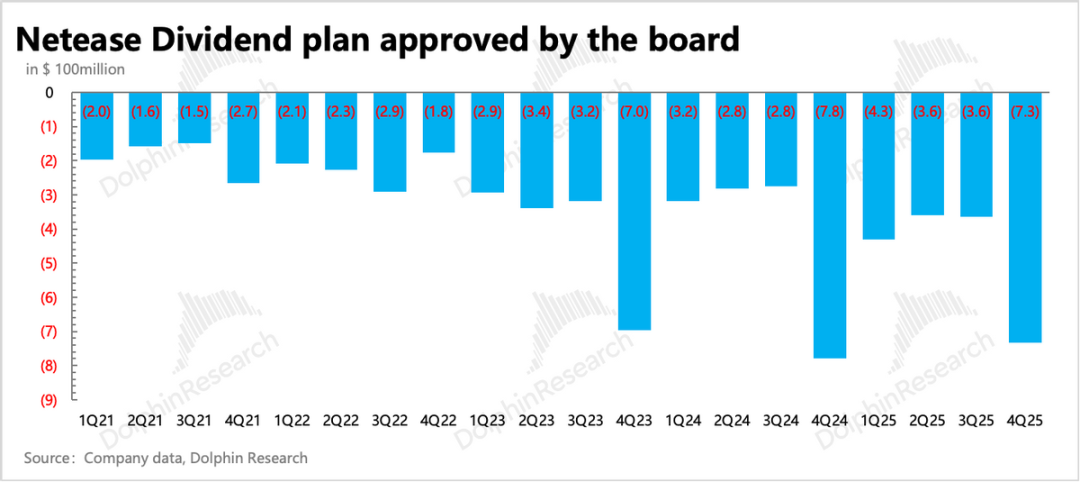

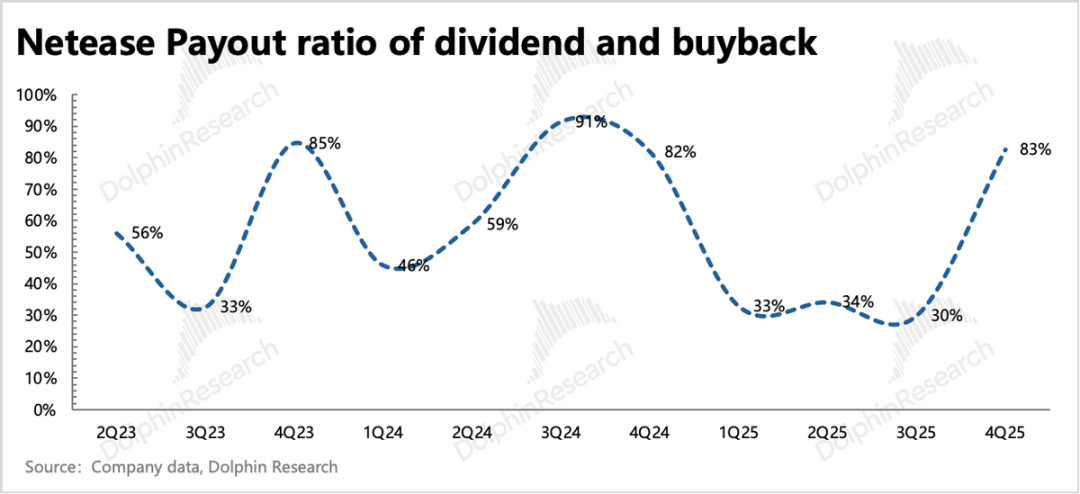

5. Shareholder returns remain inadequate: Q4 shareholder returns primarily came from dividends, with the company noting that share buybacks typically occur during periods of significantly low valuation or market panic. A planned dividend of approximately RMB 5 billion for Q4 represents a payout ratio exceeding 80%, consistent with its usual year-end special dividend.

Full-year shareholder returns (actual buybacks plus planned dividends) amounted to $2 billion (RMB 14.1 billion), accounting for 40% of adjusted net profit attributable to the parent. Given the current market cap of RMB 78.2 billion, the full-year shareholder return yield of 2.5% remains unattractive and insufficient as a floor for valuation.

6. Key financial metrics overview

Dolphin Research's View

NetEase's stock price has recently seen significant corrections, briefly touching historical valuation lows (corresponding to 13-14x 2026 P/E, compared to its typical range of 16x-18x). This decline stems from slowing revenue in key games (e.g., Identity V, Justice Online mobile), rumors of a gaming VAT hike, and emotional market reactions to Genie.

Looking ahead, the latter two factors appear overblown in the short term. However, despite some rebound, NetEase's stock performance remains weak. Dolphin Research believes the market may be awaiting clearer guidance from management during the earnings call on the 2026 new product cycle (launch schedules, revenue targets, etc.).

This raises a medium- to long-term question: How should we view the impact of AI-driven productivity surges on gaming companies?

Before Genie 3, the market largely viewed AI as an excellent tool for gaming companies to accelerate development and inspire content creativity, with minimal direct substitution effects. Genie 3's debut, however, prompted immediate pricing of medium- to long-term risks, with bears arguing it lowers game development barriers, flooding the market with supply and intensifying competition. In our initial analysis (Bloodbath for Gaming Stocks: Google's 'Thanos Snap'), we argued that Genie 3 currently falls far short of independently meeting the requirements for a properly developed game in terms of playability and cost-efficiency.

Drawing from NetEase's successful experience of repeatedly revitalizing older games to navigate the mobile gaming vacuum over the past year, we note that when supply explodes, product quality will become increasingly mixed. After market consolidation, companies with "high-quality IP + long-term operational capabilities" will become scarcer due to their higher success rates for new hits and revenue predictability for older titles.

Tencent and NetEase, the two industry leaders, shifted from product portfolios to high-quality game development nearly two years ago. While this transformation was primarily driven by the averaging effect of game license approvals rather than anticipation of AI-driven productivity gains, the results have been positive. Sustained development of existing evergreen games has driven normal revenue expansion while improving ROI.

Thus, we believe that even as AI boosts supply and intensifies competition, leading companies' advantages may further amplify with AI empowerment. Betting on extreme short-term scenarios is irrational. Moreover, China's gaming market has a unique layer of content regulation—game license approvals. While policies have relaxed in recent years, total approvals remain controlled and gradually increasing.

Detailed Analysis Below

1. Lack of new game releases continues to drag on revenue

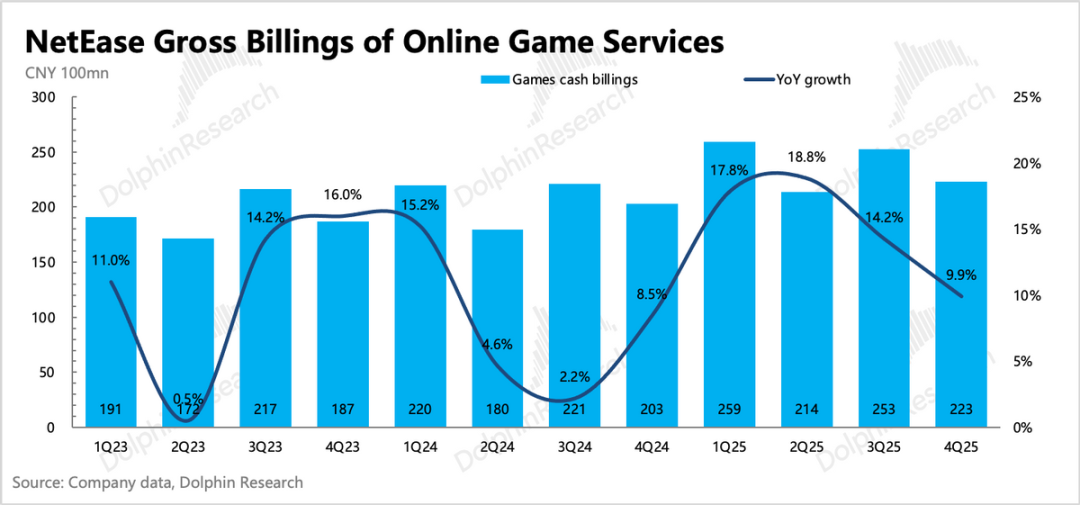

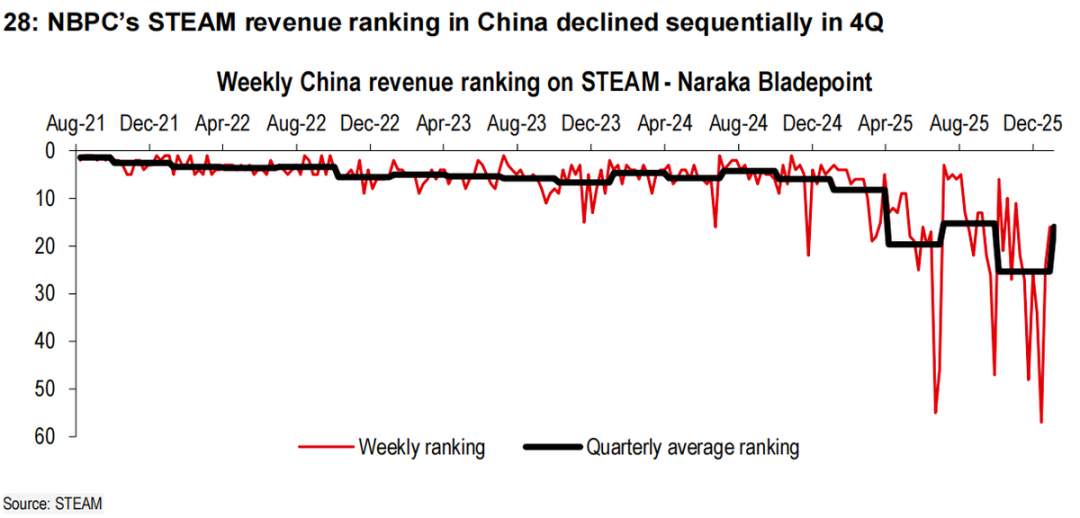

Q4 gaming and value-added services revenue reached RMB 22 billion, with core gaming revenue at RMB 21.3 billion (+3.5% year-on-year). No major new mobile games launched in Q4, while older mobile titles saw significant revenue slowdowns post-summer (e.g., Justice Online, Naraka: Bladepoint) and faced competitive pressures (Identity V). Growth was primarily driven by PC games.

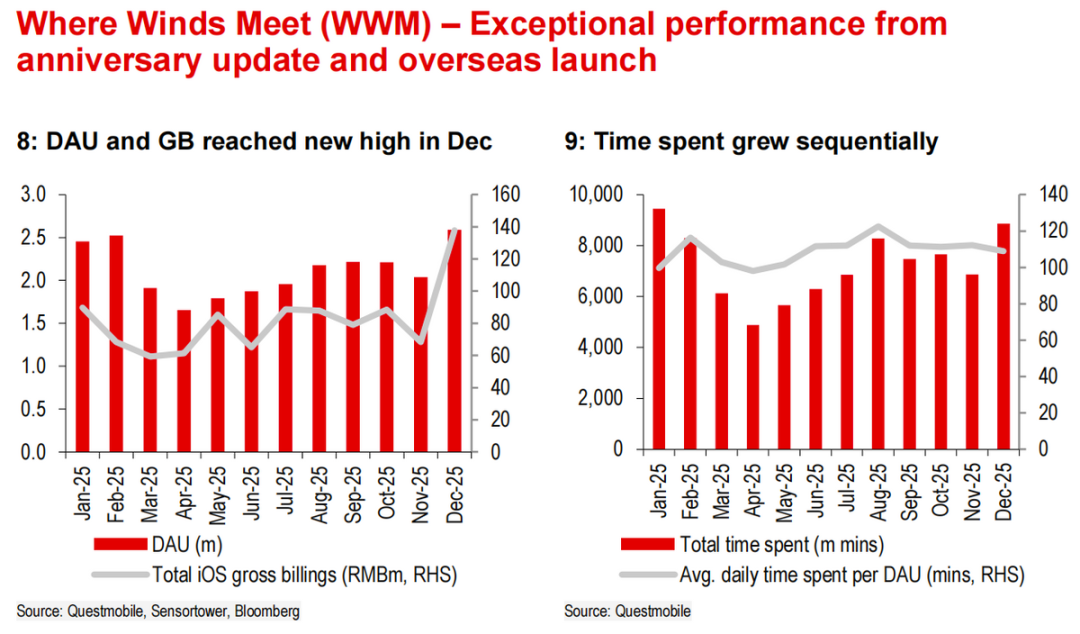

Deferred revenue surged 34% year-on-year in Q4 and grew 5% quarter-on-quarter despite being a low season, outperforming historical trends. This was driven by incremental revenue from Onmyoji's mobile anniversary event and Eggy Party's rebound. Dolphin Research estimates current revenue growth at 10% year-on-year, with sequential slowing expected due to a high base in the prior year.

(1) Mobile gaming still relies on older titles: The absence of new releases kept mobile gaming revenue under pressure in Q4. New mobile games launched during the quarter included domestic-focused Fate: Constellations and overseas-focused unVeil The World and Justice Online.

However, their scale was insufficient to offset declines in key older titles like Justice Online, Naraka: Bladepoint, and Identity V post-summer peaks. While Eggy Party saw a sequential decline in Q4, its December rebound stabilized revenue. Onmyoji's mobile version benefited from its anniversary event, boosting December revenue but contributing limitedly to Q4 revenue recognition.

Looking ahead to Q1 and full-year 2026, the mobile gaming pipeline remains sparse in Q1, suggesting continued growth pressure. Heavyweight new titles like Forgotten Sea and Infinite are expected to launch only from Q2 onward. The earnings call should clarify progress and launch plans for these two games.

The company attaches high importance to these titles, with market expectations for first-year revenue at RMB 5 billion and RMB 10 billion, respectively. However, some investors doubt whether Infinite can launch this year. Confirmation of a 2026 launch schedule would significantly boost short-term expectations.

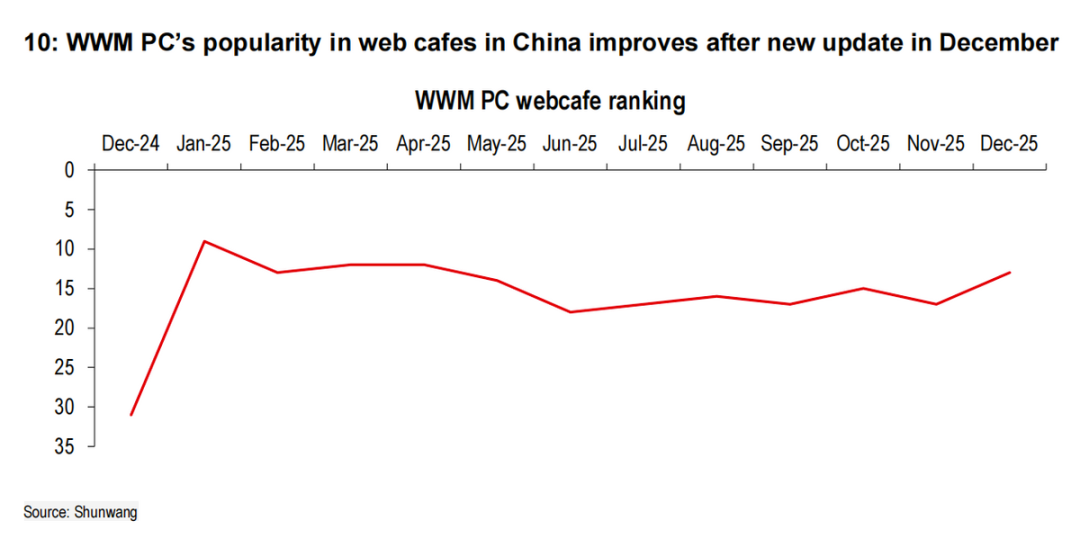

(2) PC gaming's Blizzard return bonus largely exhausted: Q4 PC gaming performance remained acceptable, with classic titles like Fantasy Westward Journey Unlimited version sustaining engagement and revenue, while Onmyoji's international version outperformed expectations, gaining unexpected overseas popularity and improving domestic engagement through content updates. These increments offset declining heat for Naraka: Bladepoint (possibly eroded by competing shooter Delta Force).

Entering 2026, NetEase is gradually entering a new product cycle, though specific launch timelines await management updates.

2. Stable performance in subsidiary businesses

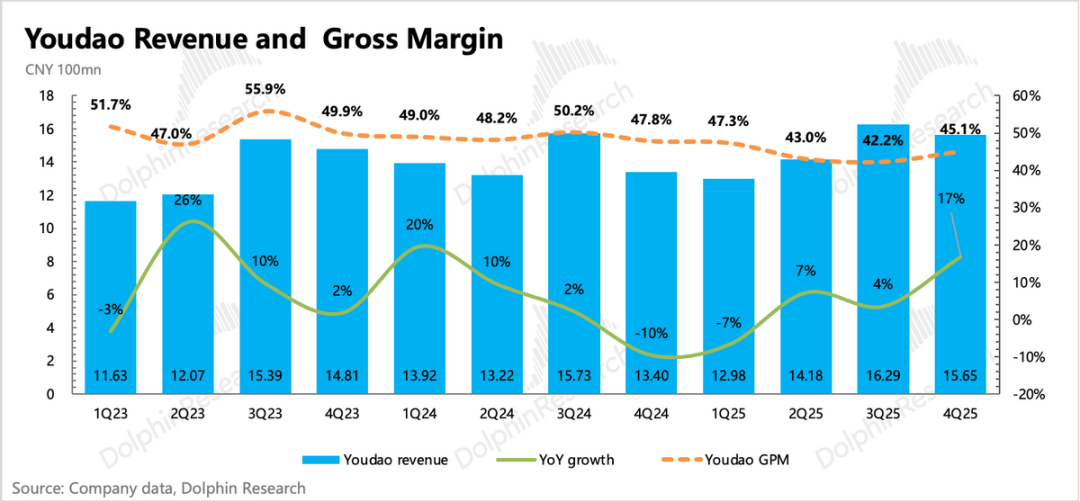

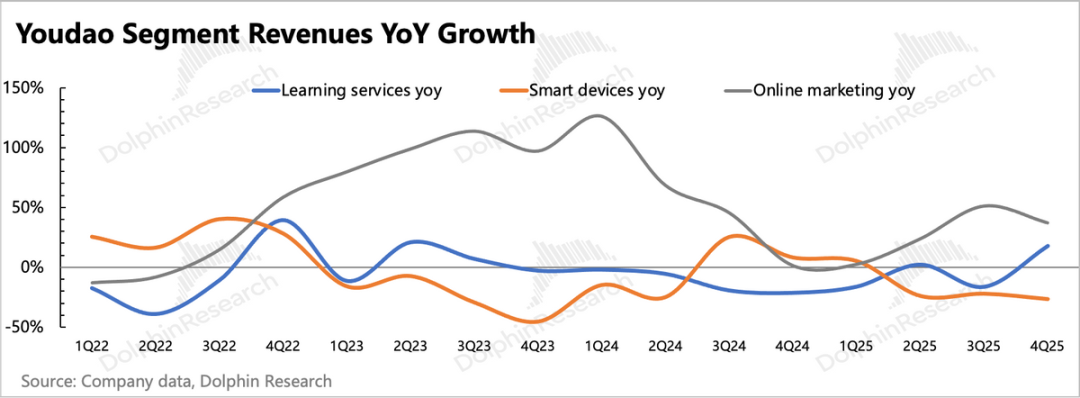

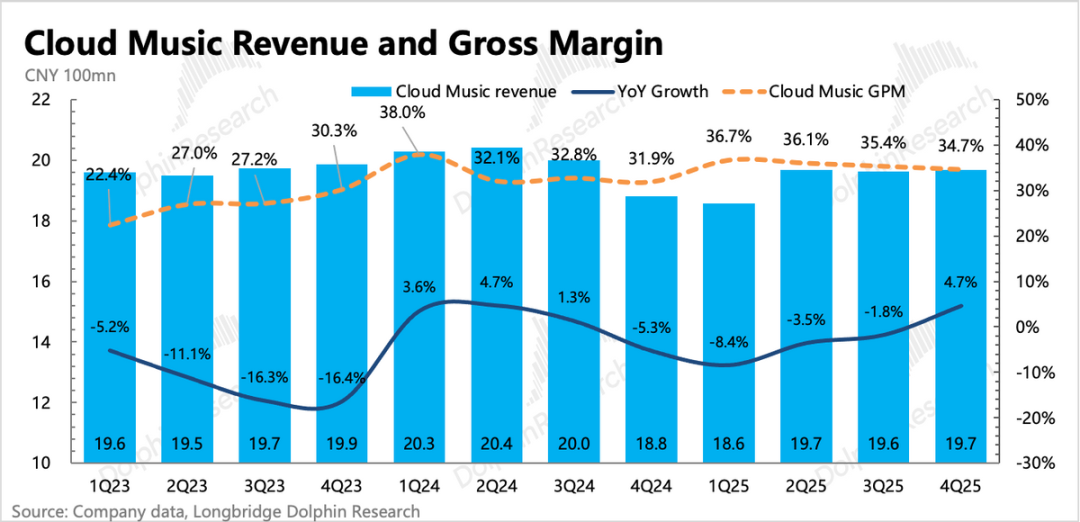

Compared to the disappointing gaming segment, Youdao Education and Cloud Music performed relatively steadily this quarter.

Youdao's Q4 revenue grew 17%, driven by advertising revenue and online courses (including middle school-focused Youdao Lingshi, quality-oriented education-focused Xiaotuling courses, and AI tools under the Ziyue large model). However, learning tablets saw sharp declines amid intense competition.

Cloud Music returned to growth (on a lower base) with stable quarter-on-quarter performance, focusing on efficiency improvements and cost control. Other innovative businesses saw a 10% revenue decline, as Yanxuan continues to contract amid e-commerce competition.

Note: Subsidiary businesses are not closely tracked by Dolphin Research, so further details are omitted. Refer to the charts for specific data.

3. Controlling Expenditures to Protect Profits Amid Revenue Pressure

In Q4, operating profit under GAAP (excluding non-core items such as investment gains, interest, and exchange gains/losses) reached RMB 8.3 billion, with year-on-year growth slowing sharply to 6%. However, the profit margin improved sequentially to 30%, indicating that while revenue growth was sl

As the fourth quarter (Q4) drew to a close, NetEase boasted a substantial net cash reserve of RMB 163.5 billion, which translates to approximately USD 23.4 billion. This marks a notable net increase of USD 1.9 billion compared to the figures from the third quarter (Q3). During Q4, the company opted to distribute generous special dividends, nearly doubling the amount paid out in Q3. However, its share repurchase activities remained relatively limited. As a result, the combined total of actual share repurchases and planned dividends for the entire year reached USD 2 billion (equivalent to RMB 14.1 billion). Based on the current market capitalization of RMB 79 billion, this corresponds to a shareholder return rate of 2.5%.

- END -

// Reprint Authorization

This article is an original piece crafted by Dolphin Research. Any reprinting of this content requires explicit authorization.

// Disclaimer and General Disclosure

This report is intended solely for general reference purposes and is designed to cater to the browsing and data reference needs of users of Dolphin Research and its affiliated entities. It does not take into account the specific investment objectives, product preferences, risk tolerance levels, financial circumstances, or unique requirements of any individual recipient. Before making any investment decisions based on the information provided in this report, investors are strongly advised to seek guidance from independent professional advisors. Any individual who chooses to make investment decisions by utilizing or referring to the content or information contained herein assumes full responsibility for all associated risks. Dolphin Research shall not be held liable for any direct or indirect consequences or losses that may arise from the utilization of the data presented in this report. The information and data featured in this report are sourced from publicly available materials and are provided for reference purposes only. While Dolphin Research makes every effort to ensure the reliability, accuracy, and completeness of the information and data, it does not offer any guarantees in this regard.

Under no circumstances should the information or viewpoints expressed in this report be interpreted or considered as an offer to sell securities, an invitation to buy or sell securities, or as recommendations, solicitations, or endorsements of any specific securities or related financial instruments within any jurisdiction. The information, tools, and materials contained in this report are not intended for distribution to or use by individuals in jurisdictions where such distribution, publication, provision, or use would violate applicable laws or regulations or would require Dolphin Research and/or its affiliates or subsidiaries to comply with any registration or licensing requirements in those jurisdictions.

This report solely reflects the personal viewpoints, insights, and analytical methods of the relevant contributors and does not represent the official stance of Dolphin Research and/or its affiliates.

This report is produced by Dolphin Research, which retains sole copyright ownership. Without the prior written consent of Dolphin Research, no institution or individual is permitted to (i) produce, copy, duplicate, reproduce, forward, or create any form of copies or replicas of this report in any manner, and/or (ii) directly or indirectly redistribute or transfer it to any unauthorized persons. Dolphin Research reserves all relevant rights in this regard.