In-Depth Analysis: XPENG's 2026 - Ambitions and Concerns Coexist

![]() 02/12 2026

02/12 2026

![]() 506

506

Having thoroughly reviewed NIO and Li Auto previously, today we turn our attention to XPENG.

At this time in 2025,

At that time, XPENG set its sales expectation at 380,000 units, but I remained firmly bullish on XPENG, with

Indeed, as I anticipated, XPENG delivered outstanding results in 2025, achieving remarkable success in products, technology, and overseas expansion, ultimately selling approximately 429,445 vehicles.

However, the automotive industry is unforgiving—no one is guaranteed immunity based on past success.

It is essential to remain vigilant, continuously self-examine, and adjust strategies as needed.

So, how will XPENG navigate 2026?

Combining insights from 2025 and 2026, I will analyze XPENG's path from three dimensions: products, technology, and overseas expansion.

XPENG Chairman He Xiaopeng stated that 2025 marks the third year of steady progress for XPENG, introducing a new theme for the year: "Steady Advancement and Breakthrough."

In 2026, XPENG will operate at full throttle, covering the entire spectrum from products to technology to globalization.

You can practically hear the sound of money being spent.

This article is lengthy—hit 'like' before reading and make it a habit.

Now, let's dive in.

01 Products

Let's start with the product lineup. XPENG's sales target for this year is 550,000-600,000 units, representing a growth of approximately 28.1%-39.7% over last year's 429,445 units. Finding growth in a saturated, competitive, and homogenized market is incredibly challenging.

Currently, XPENG offers seven models:

MONA:

Sedan

M03: Sedan, priced at RMB 119,800-139,800

XPENG:

Sedans:

P7+: Mid-to-large sedan, BEV + REEV, priced at RMB 186,800-199,800.

P7: Mid-to-large sedan, BEV, priced at RMB 219,800-301,800.

SUVs:

G6: BEV, priced at RMB 176,800-186,800.

G7: Mid-size SUV, BEV + REEV, priced at RMB 195,800-205,800.

G9: Mid-to-large SUV, BEV, priced at RMB 248,800-278,800.

MPV:

X9: Mid-to-large MPV, BEV (pre-sales start in late January) + REEV, priced around RMB 309,800-410,000 (BEV + REEV).

Overall, XPENG's product price range spans RMB 120,000-420,000. However, despite this broad span, there are gaps in both the RMB 100,000-150,000 and RMB 300,000-500,000 segments.

In the entry-level RMB 120,000-130,000 range, XPENG lacks an SUV model.

Above the G9, there is no higher-positioned SUV model.

Thus, XPENG's product strategy is:

Stabilize the core market, expand downward and upward.

Stabilizing the Core Market

This refers to the existing P, G, and X series.

At the beginning of this year, XPENG launched four updated models: the 2026 XPENG P7+, G7, 2026 XPENG G6 (BEV), and 2026 XPENG G9.

On January 29, pre-sales for the X9 BEV also began.

The G6 REEV has likely passed its declaration and will arrive soon.

Refreshing existing products is standard practice in a competitive era, ensuring sustained competitiveness and stabilizing the core market.

Expanding Downward

This refers to the MONA series.

The M03 in the MONA lineup will receive a facelift, with a key focus on intelligent driving:

1. The Turin chip will likely be introduced in this model. However, considering the high cost of self-developed chips, it may only be available in top-tier or second-tier variants, with entry-level models likely using NVIDIA Orin chips.

2. In terms of functionality, given that other automakers are introducing highway NOA in this price range, the updated M03 should come standard with highway NOA (I'd be disappointed if it didn't).

3. As for other configurations, I believe it will remain class-leading, provided the XPENG product team stays humble and understands the market.

I believe the updated M03 will continue to lead, maintaining monthly sales of over 10,000 units. Additionally, MONA will introduce two SUV models, the D02 and D03, further solidifying and expanding XPENG's market share and dominance in the RMB 100,000-150,000 segment.

Expanding Upward

As mentioned earlier, XPENG also has a gap in the high-end segment. This year, XPENG will introduce two SUV models to fill this gap.

G01: Currently known as the GX, a large six-seater SUV built on the latest SEPA 3.0 (Fuyao Architecture) physical AI vehicle architecture, with key features including:

- Full-size flagship six-seater SUV, dimensions: 5265*1999*1800mm, wheelbase: 3115mm.

- Dual-motor intelligent all-wheel drive, equipped with XPENG's self-developed 800V hybrid silicon carbide coaxial electric drive, delivering a maximum system power of 430kW and a maximum torque of 695N·m.

- Steer-by-wire + rear-wheel steering for agile handling.

- 800V platform + 5C ultra-fast charging AI battery, supporting both super range-extended and BEV powertrains.

Competitors: Li Auto L9, AITO M9, NIO ES8.

This model represents a significant step for XPENG's brand elevation, likely priced between RMB 380,000-500,000. G02 (tentatively named):

The G02 will be positioned between the G9 and GX, as a mid-to-large six-seater luxury family SUV.

The G9 is priced at RMB 248,800-278,800.

In simple terms:

G9 = Practical version

G02 = Balanced luxury version

GX (G01) = Flagship top-tier version

With these models, by the end of 2026, XPENG will have a complete product lineup covering compact to large vehicles across all mainstream market segments in the RMB 100,000-500,000 price range.

While the MONA series ensures market share and scale, the new G series models aim to elevate the brand, achieving higher gross margins and profitability.

In a competitive market, achieving the sales target of 550,000-600,000 units means every segment must perform—a significant challenge.

02 Technology

Technology has always been XPENG's strength and defining feature.

This year, XPENG will advance in autonomous driving, embodied AI, and flying cars simultaneously.

In intelligent driving, XPENG has achieved breakthroughs in both hardware and software.

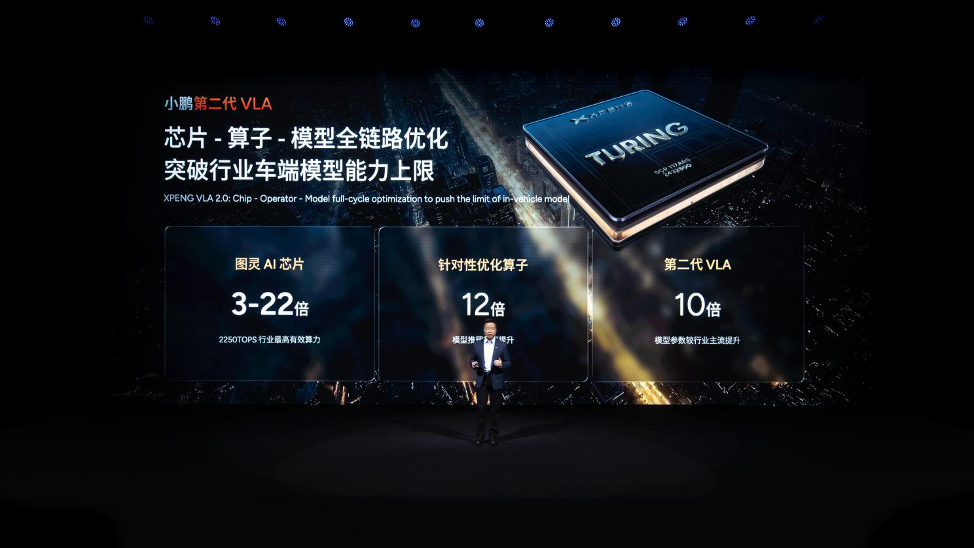

Hardware-wise, the self-developed Turin chip has been integrated, delivering 750TOPS of computing power, outperforming the dual Orin-X (508 TOPS) solution in terms of computing density and overall efficiency. It is custom-designed for XPENG's VLA, with all future models adopting this self-developed chip.

Software-wise, after investing in 30,000 GPUs of computing power and over RMB 2 billion in training costs, the second-generation VLA has been successfully developed. This is XPENG's first mass-produced physical world large model, serving as both an action generation model and a physical world understanding and reasoning model. It can also evolve through self-learning while understanding real-world interactions.

He Xiaopeng admitted that VLA 2.0 has accelerated XPENG's intelligent driving evolution by nearly two years. After testing the system, he described his experience as follows: "The core feeling is reassurance, followed by significantly improved generalization across different scenarios. It demonstrates remarkably smooth operations and precise predictions in complex road conditions, marking a solid step toward true autonomous driving."

In terms of capabilities, based on the second-generation VLA, XPENG will soon release the "Minor Road NGP" function, significantly enhancing intelligent driving performance in complex minor roads and mixed traffic environments, improving the average miles per intervention (MPI) by 13 times on minor roads. Additionally, the second-generation VLA can handle untrained complex scenarios, such as recognizing traffic police gestures and proactively responding to traffic light changes.

This solution will be officially rolled out to users in March this year.

I'm genuinely curious about its performance and whether it can propel XPENG's intelligent driving to the top of the industry.

2026 will mark the first year of L3 autonomous driving implementation, with all automakers poised to compete for leadership. XPENG, known for its intelligence, will not fall behind.

This year, NIO aims to return to the top tier with three major software updates, while Li Auto will introduce its self-developed chip and VLA. All three leading companies are adopting "self-developed chips + self-developed models," making for an exciting competition.

More importantly, XPENG's second-generation VLA + Turin chip will not only be used in-house but has also secured design wins with Volkswagen.

For XPENG, this means diluted R&D costs and faster returns.

In autonomous driving, XPENG will launch three Robotaxi models this year and initiate trial operations.

At the core hardware and software level, the XPENG Robotaxi is equipped with four Turin AI chips, delivering a total onboard computing power of 3,000TOPS.

Technologically, the XPENG Robotaxi does not rely on LiDAR or high-definition maps, instead using a pure vision-based solution to handle diverse road types and traffic environments globally. It features a dual-redundant hardware architecture, with two sets of hardware backing each other up for quick failover in case of failure.

Currently, a Robotaxi based on the GX is undergoing road tests.

In 2026, XPENG will also introduce a new intelligent driving version, "Robo," sharing the same hardware configuration, safety redundancy, and intelligent driving capabilities as the Robotaxi. It will offer two intelligent driving modes and is likely to debut on the XPENG GX.

Of course, the price may not be attractive, likely falling in the RMB 450,000-500,000 range.

As for embodied AI and flying cars, we'll leave those for another discussion.

My current concern is He Xiaopeng's bandwidth. Often, the biggest risk for a company is not doing too little but doing too much.

03 Globalization

Globalization here has two aspects: product globalization and intelligent driving globalization.

Amid intense domestic competition, overseas expansion has become a default strategy for many automakers.

XPENG performed exceptionally well in overseas markets in 2025.

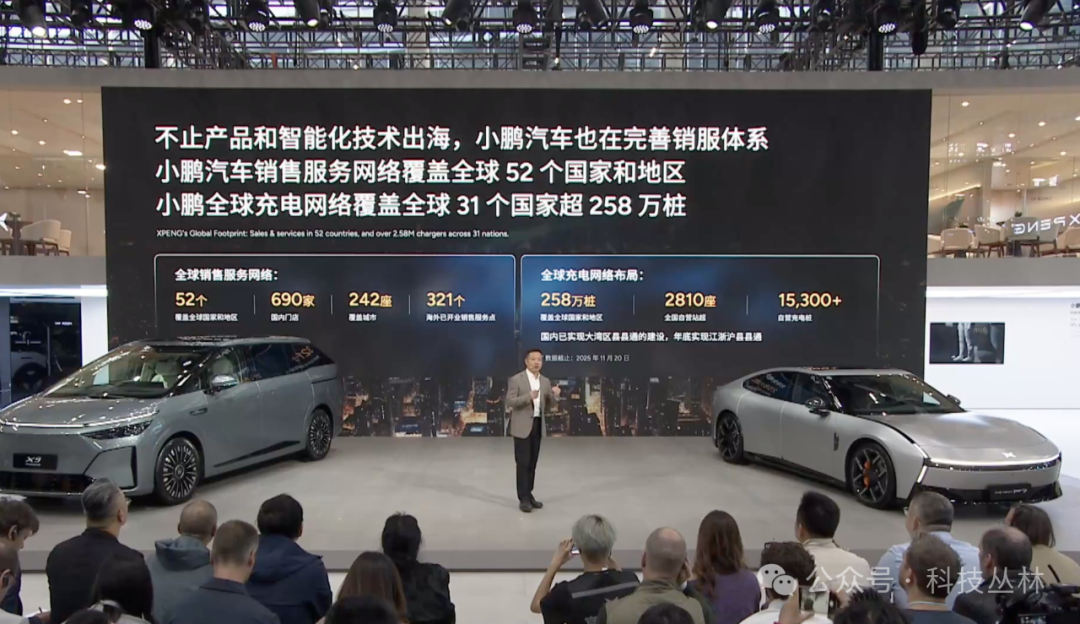

By the end of December 2025, XPENG had expanded into 60 overseas countries and regions (up from 30 in 2024), operating 380 overseas stores covering five global core regions.

Simultaneously, XPENG has initiated three major overseas local production projects to build a global manufacturing network:

- In July 2025, local production began in Indonesia, marking the start of XPENG's global localization strategy.

- In September 2025, XPENG deepened its collaboration with Magna's factory in Graz, Austria, leveraging its existing mature production lines to commence European local production. Models such as the G6, G9, and P7+ have already rolled off the line. In the same month, XPENG's first European R&D center in Munich, Germany, became operational.

- In December 2025, XPENG signed an agreement with Malaysia's EPMB Group to launch its local production project in Malaysia, the second in the Asia-Pacific region and the third globally.

From January to December 2025, XPENG delivered 45,008 vehicles in overseas markets, up 96% year-on-year, becoming the top-selling new energy vehicle brand in overseas markets. This accounted for 10.5% of XPENG's total 2025 sales.

This year, XPENG will enter even more countries and regions, deepening local R&D and manufacturing to bring more global models to left-hand and right-hand drive markets.

Additionally, XPENG plans to establish an independently operated overseas localization supply chain team in Europe this year to support and enhance its overseas supply resource layout and operations, improving supply chain responsiveness.

"I expect that in the next three, five, or ten years, XPENG's overseas sales, partnerships, and contributions will reach a 1:1 ratio or even surpass those in the Chinese market,"

Complementing this is the global layout of charging networks.

As of December 31, 2025, XPENG operated over 3,150 self-owned charging stations (superchargers/ultra-fast chargers + destination stations) covering over 430 cities. This includes over 2,650 self-owned superchargers/ultra-fast chargers, with over 2,100 ultra-fast chargers and over 3,940 stations offering free charging privileges for owners.

Globally, XPENG has access to charging networks in 31 countries and regions, with over 2.66 million connected charging piles and eight global brand stations covering Hong Kong and multiple overseas countries and regions.

In 2026, XPENG's overseas charging network will fully launch, initially focusing on key markets in Europe and Asia-Pacific. Starting from core cities, it will steadily and rapidly expand, with plans to build over 1,000 ultra-fast charging stations in the next three years, creating a closed-loop ultra-fast charging experience for overseas users. Leveraging charging scenarios, XPENG aims to develop comprehensive service stations integrating charging, data, inspection, and robotics.

Technology globalization: This year, XPENG's intelligent driving will also go global, expanding from "usable everywhere in China" to "easy to use globally."

Especially after the emergence of the second-generation VLA's intelligent capabilities, XPENG will debut "navigation-free autonomous driving," Super LCC+, and human-machine co-driving, which can be activated globally without relying on navigation. While cruising, a light turn of the steering wheel allows the vehicle to assist with lane changes and turns.

"Overall, we are entering a true phase of globalization: starting from laying foundations, moving from a few products globally to a large-scale global market entry."

04 Concerns for 2026

From a strategic perspective, XPENG's 2026 layout is meticulous and actionable.

However, several detailed issues cannot be overlooked:

1. Range-extended and BEV models priced the same, with the former offering inferior configurations.

Before discussing this, let's talk about the X9.",

This is the cost advantage that the range extender system brings to XPENG after its integration.

However, for models like the P7+ and G7, it's one thing if the range extender and pure electric versions are priced the same, but it's somewhat perverse when the range extender version, at the same price, offers inferior configuration to the pure electric version.

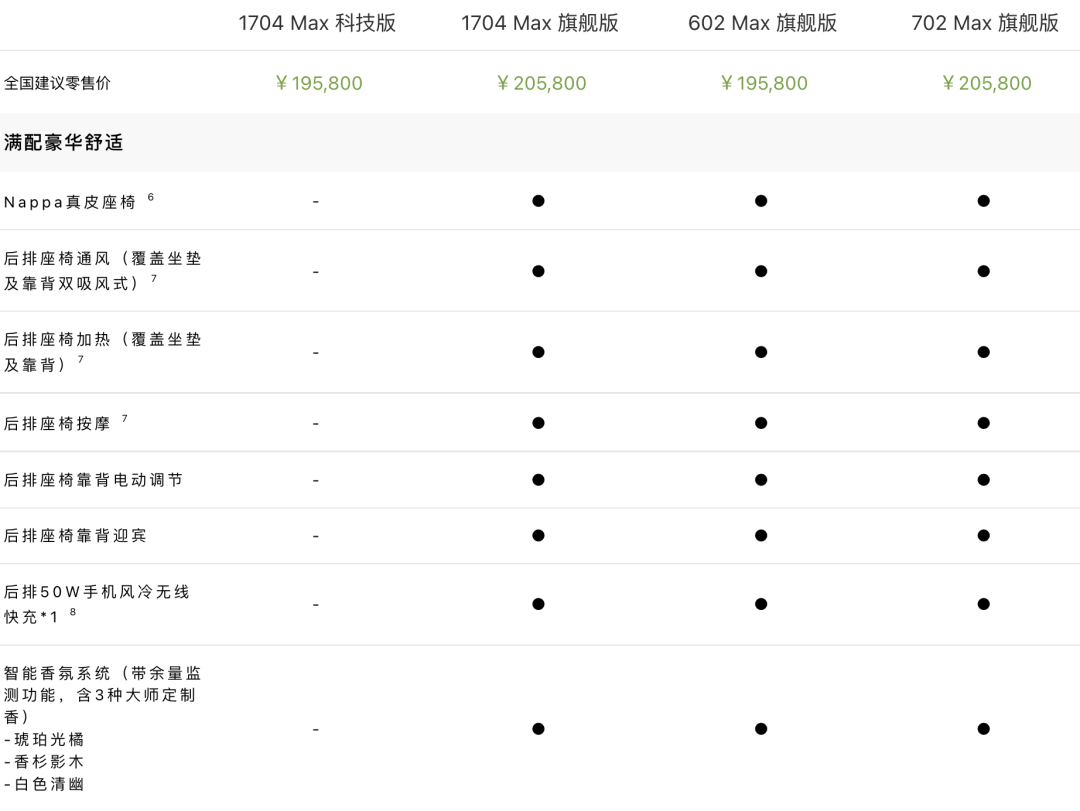

Take the 2026 G7 as an example. The range extender (1704 Max) and pure electric (602 Max) versions are priced the same.

1704 Max (Range Extender): 55.8kWh + 1.5T range extender + 60L fuel tank (92L).

602 Max (Pure Electric): 68.5kWh.

I can accept that the higher cost of the range extender system due to the use of a 'large battery + large fuel tank' is roughly offset by the reduced battery capacity cost.

But can you really justify having the range extender version offer inferior configuration at the same price as the pure electric version?

Just remove the 'fully equipped luxury and comfort' label; it's far from fully equipped.

2. Additional Charges for Second-Generation VLA.

XPENG has been hyping up its 'self-developed Turring chip + second-generation VLA' quite a bit, setting expectations extremely high.

However, a key piece of information has been deliberately obscured: this is not standard equipment across all models; it requires a paid unlock.

Currently, a single Turring chip cannot support the second-generation VLA; two Turring chips only provide the entry-level version of the second-generation VLA; to experience the full version, three Turring chips are required.

A crude way to understand it is:

One Turring chip: Standard Intelligent Driving (including urban NOA, from parking spot to parking spot).

Two Turring chips: VIP Intelligent Driving (second-generation VLA).

Three Turring chips: SVIP Intelligent Driving (second-generation VLA + VLM model).

This isn't much different from the situation back in 2022 when the base version of the G9 required an additional 20,000+ RMB for intelligent driving options.

On one hand, you want to rely on the second-generation VLA to achieve new leadership in intelligent driving, but this feature is not standard across all models; only those who opt for it can enjoy it. Even for the X9 pure electric model, priced at 350,000 RMB, the configuration has ballooned to five options.

Even though I understand that this essentially boils down to different combinations of two battery capacities, two-wheel drive/four-wheel drive, and Turring chips, having five configurations is still confusing. When Li Auto has reduced its SKUs to just one or two, XPENG is starting to 'grow in reverse.' I can only say that XPENG's product strategy is flawed again, showing signs of reverting to old ways.

I don't want to hear excuses about this being the result of compromises among finance, product, and supply chain teams; this is actually just rationalizing the problem.

All I see is a lack of confidence: the desire to showcase the technological leadership of the second-generation VLA while failing to make it standard.

I actually quite dislike automakers hyping up features that are not standard equipment.

Why do I resist this so much?

Because intelligent driving is a core label and strength that XPENG has cultivated for itself.

It is crucial for XPENG's market expansion and sales growth.

From a broad perspective, XPENG seems to fare better in the 100,000-200,000 RMB market than in the 200,000+ RMB market.

The core logic for a car to sell well lies in: high looks (appearance) + high configuration + a sufficiently long strength.

The M03 is a prime example. In this price range and market segment, achieving high looks and a well-rounded vehicle is easy, but being able to make intelligent cockpit and intelligent driving top-notch like XPENG does is rare. That's why this car sells so well.

With the integration of the Turring chip, the M03 can continue to thrive in this market.

However, when entering the 200,000+ RMB market, the competition and the strength of opponents are completely different.

There are no opponents with obvious shortcomings here. Everyone has refrigerators, TVs, and large sofas; even XPENG's once-proud intelligent driving strength cannot create a significant gap.

In terms of intelligent driving, Huawei and Li Auto represent the automaker side, while on the supplier side, solutions from suppliers like Horizon HSD, Momenta, and Yuanrong are sufficient.

In terms of overall capability experience, the difference is negligible: you score 82, I score 85, he scores 84.

So, it's completely understandable for XPENG to want to use its 'self-developed chip + second-generation VLA' to create a gap in intelligent driving and enhance product competitiveness.

The mistake lies in the execution.

XPENG's second-generation VLA is a feature with a barrier; it can only be unlocked and experienced through payment.

Paid and unpaid users will live in two completely different intelligent experience worlds, which is not conducive to forming a unified, strong brand reputation.

Moreover, trying to make this path work with intelligent driving option packages is extremely difficult. Users in the 200,000 RMB range are extremely price-sensitive; 12,000 RMB is equivalent to an additional 5-6% of the car's price.

Users at this price point value 'cost-effectiveness' and 'standard equipment value' more.

For example, take the G7 we just mentioned, where the range extender and pure electric versions are priced the same. The difference between the range extender tech version and the range extender flagship version is 10,000 RMB, while the option for Ultra SE is 12,000 RMB, not much different.

To put it bluntly, if these two options were placed side by side, with the same 10,000 RMB option cost, the vast majority of people would choose to spend the 10,000 RMB on enhancing comfort experience rather than on this intelligent driving option package.

That's the reality.

Not to mention that now, 12,000 RMB only gets you the entry-level experience; to experience the full version, you need 20,000 RMB.

So, it's very difficult for XPENG to make this path work.

Furthermore, the second-generation VLA won't be rolled out until March. No matter how much XPENG hypes it up verbally, practice is the sole criterion for testing truth.

Relying on intelligent driving option packages to achieve a commercial closed loop is only possible if this second-generation VLA can truly bring about near-generational differences in intelligent driving, whether in terms of functional realization or the experience of anthropomorphism and peace of mind, significantly outperforming current offerings from Huawei and Li Auto. Otherwise, relying on option packages to achieve a commercial closed loop is very difficult.

If it cannot achieve this in terms of experience, then it will ultimately just become another instance of XPENG's intelligent driving self-indulgence, and then, like a few years ago, it will switch back from optional to standard equipment.

So, this is something XPENG needs to think clearly about.

Moreover, in He Xiaopeng's view, 2000TOPS computing power is just the foundation.

In other words, even 2000TOPS computing power is just the entry threshold for future L4 autonomy. Keep in mind that XPENG's current Robotaxi computing power is 3000TOPS, and subsequent vehicle computing power will definitely continue to increase in 2027 and 2028.

In an interview, He Xiaopeng stated bluntly that during the initial introduction of self-developed chips, the actual cost will be much higher than solutions like NVIDIA Orin and Thor.

So, only through true mass production and volume scaling can costs be reduced.

If you're currently tempted by XPENG's second-generation VLA, my advice is: go all in or stay basic. Either go for the top and experience the full second-generation VLA with three Turring chips, or stick with the standard configuration for a year or two as a transition, waiting for XPENG to reduce chip costs before upgrading.

So, for XPENG now, it's quite awkward.

On one hand, it wants to further enhance its competitiveness through intelligent driving; on the other hand, it's considering financial balance and cannot find the perfect landing point, leading to distorted and conflicting actions in the end. This is not unique to XPENG; all technology-driven automakers go through this stage when crossing the 'innovation chasm': you've developed the next-generation experience, but the cost of that next-generation experience is still unaffordable for this generation of users.

Do you bite the bullet and roll it out at a loss, or do you set a barrier and slowly recoup costs?

There is no standard answer.

But one bottom line is clear:

Whatever you make optional is what you define as a 'non-essential.'

And what XPENG should least make optional is precisely its own intelligent driving.

05. Final Thoughts

Having written this, it's already over 6000 words, and basically, everything that needed to be said has been said.

The good points have been mentioned, and so have the bad.

This is what 'Tech Jungle,' as a seasoned media person and veteran observer of the automotive circle, sees. I hope you can gain some insights from it.

With this, in-depth analyses of NIO, XPENG, and Li Auto have all been presented.

Besides NIO, XPENG, and Li Auto, we will continue to update in-depth analyses of Leapmotor and Xiaomi, so stay tuned.

The end.