Shenzhen’s Functional Autonomous Vehicles Report for January 2026: 1,168 Units in Operation, 2.42 Million Deliveries in a Single Month, and Over 30 Enterprises and Universities Establish the ‘Shenzhen

![]() 02/12 2026

02/12 2026

![]() 429

429

Introduction

The Shenzhen Intelligent Connected Transportation Association has officially released its “January 2026 Monthly Report on the Operation and Development of Functional Autonomous Vehicles in Shenzhen,” revealing impressive achievements:

The total number of functional autonomous vehicles operating under regulatory oversight in the city reached 1,168 units (including 46 new units added in January), with an overall operational online rate holding steady at a robust 88%.

The cumulative length of open test routes has exceeded 8,000 kilometers.

Monthly delivery volumes surpassed 2.42 million orders, directly generating commercial value worth approximately RMB 19.92 million.

According to “Autonomous Vehicles Are Coming” (WeChat Official Account: Autonomous Vehicles Are Coming):

This is not merely a numerical increase but a sign that after years of exploration, Chinese cities—with Shenzhen as a prime example—have successfully completed the critical “first leg” of large-scale commercial operations in unmanned delivery. A measurable, replicable, and sustainable “urban-level smart logistics model” is taking shape.

(For further reading, please click: 'Shenzhen’s Autonomous Vehicles Surpass 1,000 Units, Reaching 1,122: 86% Online Rate + RMB 16.58 Million in Revenue, Transforming from ‘Pilot’ to ‘Cash Cow’ in December 2025')

I. Data Interpretation: The Commercial Logic and Growth Drivers Behind 2.42 Million Orders

The 2.42 million delivery orders recorded in January represent a 29% month-over-month increase, underscoring the accelerating market acceptance of unmanned delivery services.

Express delivery accounted for 2.25 million orders, including 75,000 campus-specific deliveries.

On-demand fresh food deliveries reached 170,000 orders.

The dominant position of express delivery highlights the irreplaceable role of autonomous vehicles in addressing standardized “last-mile” delivery challenges.

Even more noteworthy is the solidity of its commercial value.

The nearly RMB 20 million in monthly revenue is not reliant on government subsidies or brand marketing but is derived from genuine logistics orders. Based on 1,168 operational vehicles, each vehicle generates approximately RMB 17,000 in monthly revenue.

Assuming an average revenue of approximately RMB 8 per order—compared to the industry’s low-margin model of “RMB 1-2 per order”—Shenzhen’s order value is significantly healthier.

The 88% operational online rate is another critical indicator.

In the logistics industry, this is considered an excellent level, reflecting a mature operations and maintenance system, stable vehicle conditions, and efficient dispatch capabilities.

A high online rate indicates high asset utilization, which is the foundation for profitability. Combined with approximately RMB 2.1 million in monthly comprehensive cost savings, the proposition of “cost reduction and efficiency enhancement” for autonomous vehicles is being validated in Shenzhen.

II. Ecosystem Development: A Systematic Engineering Effort from ‘Policy Pioneering’ to ‘Safety Foundation’

The rapid growth of Shenzhen’s autonomous vehicle industry is not merely a technological or market victory but the result of systematic ecosystem development.

On January 16, the “Trust 2026” Shenzhen Intelligent Connected New Year Conference was successfully held, during which the “Shenzhen Autonomous Driving Safety Laboratory” was officially inaugurated, marking a highly symbolic turning point.

(For further reading, please click: '2026 Shenzhen Intelligent Connected ‘New Year Conference’ Delivers Results: Reconstructing China’s Autonomous Driving Rules with ‘Trust’ as Ink and ‘Ecosystem’ as Paper')

Initiated by the association and jointly established by over 30 leading enterprises and universities—including the Shenzhen Urban Transport Planning Center, Huawei, BYD, Meituan, and Tongji University—the laboratory signifies that Shenzhen’s autonomous vehicle development has shifted from early-stage “encouraging road access and opening road rights” to the deeper waters of “building a solid safety foundation and establishing industry trust.”

The laboratory focuses on ten major directions, including vehicle safety evaluation and accident investigation, adopting a “joint research + infrastructure co-construction” model aimed at clearing the largest obstacle to large-scale commercialization—public and regulatory safety concerns.

(For further reading, please click: 'Establishment of the Shenzhen Autonomous Driving Safety Laboratory: Bringing Together Full Industry Chain Forces Including Tongji University, UESTC Shenzhen Institute, BYD, Meituan, Pony.ai, Huawei, Baidu, Jiushi, and White Rhino')

Meanwhile, nearly twenty industry chain enterprises have newly joined the Shenzhen Intelligent Connected Transportation Association, continuously expanding the industrial collaboration network.

This close collaboration among “government, industry, academia, research, and application” has formed a powerful innovative synergy, enabling rapid simultaneous progress in standard setting, technological breakthroughs, and scenario expansion.

III. Model Validation: Analyzing the Replicability of the ‘Shenzhen Model’

The core of the Shenzhen model can be summarized as: top-level design first, scenario-driven implementation, and equal emphasis on safety and innovation. This approach has demonstrated strong replicability.

First is unified and open road rights management.

The cumulative open test routes exceeding 8,000 kilometers are not indiscriminately released but are dynamically and meticulously managed through a regulatory platform. Enterprises apply online, and management departments approve based on traffic flow and safety assessments, achieving a balance between “opening up” and “maintaining control.”

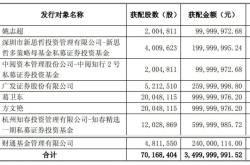

Currently, Neolix leads with 378 units, followed by Jiushi with 138 units and Meituan with 138 units.

White Rhino has 48 units, JD.com has 46 units, Minieye has 13 units, and Cainiao has 6 units.

Second is a focus on high-frequency, rigid-demand scenarios.

The report shows that business is highly concentrated in express and fresh food delivery—scenarios with large market sizes, clear pain points, and strong payment willingness.

Shenzhen has not blindly pursued gimmicky applications like “unmanned retail vehicles” but has instead rooted itself in the logistics industry, achieving depth and stability in cash flow.

Meituan and Dingdong focus on fresh food delivery, while SF, JD.com, ZTO, STO, YTO, Yunda, and China Post focus on express delivery. Among them, SF, JD.com, and China Post rank top three in order volume.

Third is the construction of a value-sharing business model.

Autonomous vehicles do not simply replace couriers but integrate with existing logistics networks.

For example, couriers are freed from repetitive fixed-route transportation to focus on flexible services like door-to-door delivery and customer communication, enhancing overall network efficiency through human-machine collaboration.

This combination of “replacing human labor” and “improving human efficiency” reduces social resistance to adoption.

It is worth noting that in January, Shenzhen residents filed 70 complaints, a 35% month-over-month increase, involving autonomous vehicles from Neolix, Jiushi, JD.com, Meituan, White Rhino, and Cainiao.

IV. Future Outlook: From ‘Logistics Tool’ to ‘Urban Intelligent Mobile Terminal’

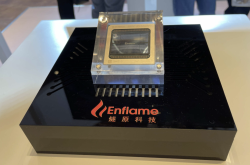

Currently, autonomous vehicles primarily serve as “transportation tools” in Shenzhen. However, their rich array of sensors (LiDAR, cameras, etc.) and real-time communication capabilities endow them with the potential to become “urban intelligent mobile terminals.”

In the future, these autonomous vehicles, which travel over 8,000 kilometers of routes daily, can simultaneously collect real-time data on road conditions, traffic flow, municipal infrastructure integrity, and even air quality, transmitting it back to the city’s “digital twin” platform.

They will evolve from mere “executors” to “nerve endings” of the urban sensing network.

With 2.42 million orders, RMB 20 million in value, and 1,168 vehicles, these figures carry significant weight in the global unmanned delivery landscape. Companies like Nuro and Starship in the United States and Coco Robotics in Europe have not yet achieved comparable scale outside of China. Shenzhen’s practice is forming a “low-cost, high-efficiency, strong-regulation” “Chinese solution,” accumulating know-how for technology exports to Southeast Asia, the Middle East, and Latin America.

In summary, “Autonomous Vehicles Are Coming” (WeChat Official Account: Autonomous Vehicles Are Coming) believes:

Shenzhen’s autonomous vehicle achievements in January represent not just a numerical breakthrough but a signal:

Autonomous vehicles are not substitutes for cars but “new nodes” in the logistics network, “new carriers” of data flow, and “new variables” in the employment structure.

Shenzhen’s exploration is writing a quantifiable “operation manual” for the intelligent transformation of Chinese cities.

And the 2.42 million orders in January are just the beginning.

What do you think, dear?

#AutonomousVehiclesAreComing #AutonomousDriving #SelfDriving #AutonomousVehicles