"Three Strikes at Becoming the Digital Twin Industry's IPO Pioneer: Why is 51WORLD 'Bleeding' to Go Public?"

![]() 03/04 2025

03/04 2025

![]() 674

674

E-yan Business Observations

51WORLD stands at a juncture where its visionary aspirations clash starkly with the dilemmas it faces, wrapped in a halo of controversy.

E-yan Team |

Full text: 2100 words, reading time: approximately 5 minutes |

As a cornerstone of the metaverse and Industry 4.0, digital twin technology has garnered significant attention in the capital market in recent years. Beijing 51Vision Digital Twin Technology Co., Ltd. (abbreviated as "51WORLD"), one of China's earliest startups in this field, has raised over 800 million yuan through multiple funding rounds since its inception in 2015.

However, this industry leader, with a grand vision to 'clone the Earth,' has encountered repeated setbacks in its journey to the capital market. Since 2020, it has failed in its bids for listing on the STAR Market and the Beijing Stock Exchange. On November 29, 2024, 51WORLD submitted a prospectus to the Hong Kong Stock Exchange, aiming to enter the capital market as a 'specialized technology company.'

Behind its three IPO attempts, 51WORLD has grappled with consistent losses and controversies surrounding commercialization, yet its determination to become the 'first IPO in the digital twin industry' remains unwavering. This 'bleeding' listing underscores the survival anxiety of industry leaders and the intricate game played out in capital markets.

'Bleeding' IPO: A Capital Game for Survival

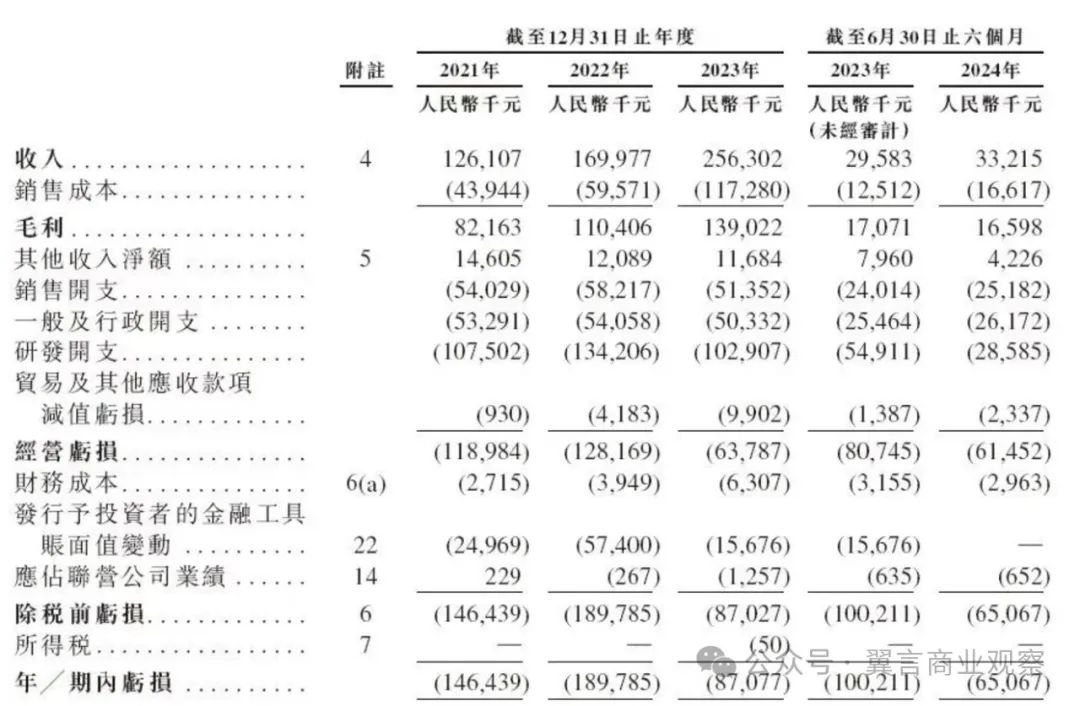

51WORLD's prospectus reveals that from 2021 to the first half of 2024, its revenues were 126 million yuan, 170 million yuan, 256 million yuan, and 33 million yuan, respectively. However, its net losses for the same period amounted to 146 million yuan, 190 million yuan, 87 million yuan, and 65 million yuan, respectively, totaling a cumulative loss of 489 million yuan. Notably, its gross profit margin has declined steadily from 65.2% in 2021 to 50% in the first half of 2024, and its operating cash flow has been negative for three and a half consecutive years, with a cumulative outflow of 401 million yuan. Under the pressure of tight capital chains, an IPO has almost become the only viable option to alleviate liquidity crises.

The contrast between high R&D investment (accumulating to 345 million yuan from 2021 to 2023) and low commercialization efficiency is glaring. Despite claiming a 2.4% market share in 2023, ranking first in the industry, its annual revenue of 256 million yuan only accounts for 10.2% of China's digital twin market size (2.5 billion yuan according to IDC data). Moreover, it does not hold a significant advantage over competitors like GeoWay (270 million yuan) and SuperMap (268 million yuan). This 'high input, low output' model inevitably raises questions among investors about its cash-generating ability.

| Excerpted from 51WORLD's prospectus financial data

Supported by star capital and investors such as SenseTime and Ge Weidong in its decade-long journey, 51WORLD's investors' patience is wearing thin. After the last funding round, the company was valued at 4.4 billion yuan, with revenue in the first half of 2024 being only 33.21 million yuan, resulting in a price-to-sales ratio as high as 132 times, far exceeding the average for AI enterprises on the STAR Market. An IPO has thus become a crucial channel for capital exits.

Clearly, for 51WORLD, going public is not merely a survival strategy but also a pivotal path for capital exits.

Strategic Swing: A Decade of Trend-Chasing and Commercialization Missteps

51WORLD's decade-long journey is almost a textbook case of 'chasing trends but missing the mark.'

Initially, the company ventured into the real estate marketing industry with VR home viewing technology, aiming to revolutionize traditional industries through virtual reality. However, the VR industry never took off, and project-based revenue failed to scale. In 2017, it shifted to the intelligent driving simulation field and launched the 51Sim platform. Yet, the standardization of the autonomous driving industry lagged, and customer willingness to pay was low, causing the business's gross profit margin to plummet to -9.6%, turning it into a 'loss-making venture.'

Amidst the metaverse frenzy in 2022, the company introduced the 51Earth platform, aiming to build an open digital earth community. However, with the rise of large model technology, the metaverse buzz quickly faded. Although 51Earth attracted thousands of developers, it contributed only 10.2% of revenue in the first half of 2024, with commercialization results falling far short of expectations.

Behind these transformations lies a disconnect between technological ideals and market realities: despite being considered the underlying infrastructure of Industry 4.0, digital twin technology's application scenarios are fragmented and highly customized, making it difficult to standardize products. This has led to a gross profit margin that has declined annually from 65.2% in 2021 to 50%.

| 51WORLD claims to have surpassed the three stages of 'static world,' 'dynamic world,' and 'semi-simulated world,' collecting the most basic elements of Earth cloning – 'people and buildings,' 'cars and roads,' 'water and cities,' and fully entering the fourth stage (fully simulated world)

51WORLD's purported 'Earth Cloning Project' is divided into five stages, aiming to build a digital twin of the Earth by 2030. However, it faces two significant dilemmas. Firstly, there are limitations to technology implementation, with current commercialization focused on niche scenarios like smart cities (accounting for 68% of revenue) and autonomous driving simulations (21%), significantly lagging behind 'full-element simulation.' Secondly, there is a cost-benefit imbalance: cloning one square kilometer of a city requires an investment of over one million yuan, but customer willingness to pay is concentrated on limited functional modules such as disaster warning and traffic scheduling, making it difficult for the ROI (return on investment) to cover R&D costs.

To alleviate revenue pressure, the company attempted to expand its consumer business by launching the See3 cultural tourism platform and Short3A short video tool. However, in the first half of 2024, consumer business revenue accounted for less than 5% and faced dual challenges of a lack of user payment habits and a weak content ecosystem.

Halo and Questions: Market Share Bubbles and Capital Games

51WORLD boasts of being the 'number one in China's digital twin industry,' but its market position has always been contentious. The prospectus cites a Frost & Sullivan report stating a 2.4% market share with 256 million yuan in revenue in 2023. However, an IDC report for the same period shows that 51WORLD does not rank among the top seven in the industry, with GeoWay and SuperMap leading with shares of 10.8% and 10.7%, respectively. Additionally, it has been revealed that 51WORLD paid Frost & Sullivan 510,000 yuan to customize a market report, raising questions about 'buying its way onto the list.' The overlap between its customers and suppliers has also sparked external questions about compliance.

Externally, the digital twin sector is also undergoing structural reshuffling. Giants like Alibaba Cloud and Tencent Cloud, leveraging their cloud infrastructure advantages, are rapidly penetrating the market with the 'cloud + AI + twin' model. Alibaba Cloud's City Brain 3.0 has been implemented in over 30 cities, and its IaaS-layer subsidy strategy makes its customer acquisition costs 40% lower than those of startups. Tencent's WeCity digital twin platform, on the other hand, utilizes the WeChat ecosystem to connect consumer scenarios, a traffic entry point that 51WORLD finds challenging to access.

The battle for breakthroughs in niche scenarios is equally challenging. In the industrial field, although 51WORLD has collaborated with Sany Heavy Industry, it faces data barriers from industrial internet platforms like COSMOS and Rootcloud, with its device access rate being less than 30%. In the field of autonomous driving testing scenarios, it encounters tightening policies. After the implementation of the 'Regulations on the Security Management of Data for Intelligent Connected Vehicles,' high-precision map qualifications have become a stringent threshold, and 51WORLD has yet to obtain Grade A surveying and mapping qualifications.

More critically, there is a technological generational gap. While overseas vendors have integrated generative AI into digital twins (such as NVIDIA Omniverse's AI-generated material function), 51WORLD's AIGC layout is still in the experimental stage. Despite its R&D investment accounting for 45%, its basic research accounts for less than 30%, forming a stark contrast with other similar companies.

Conclusion

51WORLD's IPO dilemma may serve as a footnote for China's hard tech enterprises. They have surged forward under the catalysis of capital but have struggled to bridge the gap between technological implementation and commercial returns.

For 51WORLD, which has attempted an IPO three times, the bigger challenge lies in balancing technological ideals with commercial realities, capital expectations with profit pressure, and proving to the market that its vision of a 'digital Earth' is not mere science fiction but a viable commercial future.

END