Reconstruction of Domestic Computing Power Industry Chain in Depth (with Concept Stocks)

![]() 03/05 2025

03/05 2025

![]() 667

667

Recently, the stock prices of the computing power industry chain in U.S. and Hong Kong A-shares have fallen sharply, raising market concerns that the rise of DeepSeek may inhibit global computing power investment.

The author believes that this view misjudges the underlying logic of technological development – investment in computing power is not linearly shrinking, but entering a stage of structural adjustment alongside technological innovation.

01. Counterintuitive Jevons Paradox

Imagine buying a new car that is super fuel-efficient, reducing fuel consumption from 10 liters per hundred kilometers to 5 liters. Intuitively, your monthly fuel costs should halve, right? But in reality, because fuel costs are cheaper, you start driving to the countryside every day and take road trips to Tibet on weekends, ending up with higher fuel expenses than before buying the car.

This is the Jevons Paradox – technological progress improves resource utilization efficiency, but paradoxically leads to an increase in total resource consumption.

William Stanley Jevons revealed the energy efficiency trap in 1865, essentially illustrating the dynamic game rule in technological evolution: the reduction in marginal costs brought about by improved resource utilization efficiency triggers the triple effects of demand expansion, application scenario generalization, and industrial ecosystem reconstruction.

This rule presents a more complex evolutionary logic in the field of computing power – behind the projected global computing power market size exceeding $3.5 trillion by 2025 lies the chain reaction triggered by the leap in AI training efficiency.

Take the DeepSeek-V3 model as an example. Its training cost is only $5.576 million (including the entire process of pre-training, context expansion, and post-training), a reduction of about 53% compared to similar models. Through its unique "auxiliary loss-free load balancing strategy" and "FP8 mixed-precision training" technology, the computing power utilization rate of a single GPU cluster is increased to 92%, far exceeding the industry average of 65%.

This efficiency revolution has not suppressed the demand for computing power but has instead triggered a surge in global computing power chip procurements: NVIDIA's data center GPU shipments reached 3.85 million units in 2023 and are expected to exceed 4 million units in 2024, with a significant demand gap in the Chinese market. Giants like Microsoft and Meta have secured an advantage by locking in H100/H800 chip supplies in advance, while DeepSeek has compressed the training cost of a 10,000-card cluster to one-third of traditional solutions through dynamic sparse training algorithms and expert parallel architecture.

This symbiotic relationship between technological iteration and demand expansion is a concrete expression of the Jevons Paradox in the digital era. When the single training cost of large models drops from $12 million for GPT-3 to $5.576 million for DeepSeek-V3, the number of parallel experiments conducted by leading enterprises jumps from an average of 3 per year to 28.

Additionally, the "above-expectations" increase in capital expenditures by leading capital manufacturers has not only dispelled market concerns about peaking demand for computing power but also signifies that the AI race will enter a stage of high-intensity investment. The future "snowball effect" of capital expenditures will drive technological innovation in multiple directions.

The AI race among leading manufacturers will evolve from competition based on model parameters to competition in ecological environments: on the one hand, as capital expenditures penetrate into computing power infrastructure, AI will accelerate its descent into terminal scenarios; on the other hand, manufacturers have accelerated the decoupling process of chip supply chains and stepped up the progress of self-developed ASIC solutions, such as AWS's Tranium series chips and Google's TPU chips. With capital expenditures being put into place this year, innovations in multiple directions are poised to explode.

The cost reduction brought about by technological breakthroughs has directly catalyzed the exponential expansion of application scenarios – from a focus on text generation in 2023 to penetration into diverse fields such as smart manufacturing, satellite remote sensing, and biomedicine by 2025.

02. In-depth Reconstruction of the Domestic Computing Power Industry Chain

As the global AI race intensifies in 2024, the domestic computing power industry chain is undergoing structural changes. Unlike the demand-driven focus of 2023, the current market presents a complex landscape of technological iteration, policy guidance, and demand upgrading resonating together. In this computing power revolution, all links in the industry chain are undergoing value reconstruction, giving rise to multiple growth tracks with certainty.

The renovation of outdated data centers has shifted from a policy requirement to a rigid market demand.

Take the Beijing Yizhuang Data Center Cluster as an example. This ultra-large-scale data center, which supports the computing power needs of companies like ByteDance and Kuaishou, is implementing a hybrid renovation plan of "liquid cooling + high-voltage direct current." Technical data shows that after the renovation, the power density per cabinet increases from 6kW to 30kW, and the PUE value drops from 1.42 to 1.15, equivalent to saving 210 million kWh of electricity annually. This renovation wave is spreading from first-tier cities to central and western regions. The Erdos "Grassland Cloud Valley" data center achieves a natural cooling time ratio of 78% throughout the year by introducing indirect evaporative cooling technology in a dry climate.

Against the backdrop of limited supply of NVIDIA's H20 chips, the domestic computing power leasing market presents a unique supply-demand structure. For example, UCloud's green computing power base in Ulanqab reduces the carbon emission intensity of computing power leasing to 0.32 kg CO2e/kWh through wind power direct supply and liquid cooling technology, opening up a new track of "green computing power as a service."

The increase in AI computing power density is rewriting data center technical standards. This change forces the upgrading of supporting equipment: Sugon's latest phase-change liquid cooling technology can increase the heat dissipation capacity of a single cabinet to 100kW while reducing pump power consumption by 30%; Kelong Data's 480V high-voltage direct current power supply system improves efficiency by 6 percentage points compared to traditional UPS and has been deployed on a large scale in AIDC projects of China's three major operators.

Despite short-term market fluctuations, the underlying logic of the industry continues to strengthen. Microsoft's capital expenditures increased by 79% year-on-year to $14 billion, with 50% invested in AI infrastructure; China's three major operators (China Mobile, China Telecom, China Unicom) announced that their total computing power investment in 2024 will exceed 100 billion yuan. More symbolically, Baidu Intelligent Cloud's smart computing center in Yangquan, Shanxi, has validated the commercial feasibility of the domestic computing power system.

As Huang Renxun stated in the earnings call, AI applications are still in their infancy, and subsequent developments in AI agents and multimodal AI will continue to maintain high demand for computing power. Currently, both domestic and overseas cloud vendors are increasing investment in AI infrastructure construction, and it is only a matter of time before innovative technological breakthroughs emerge.

In the short term, it is normal for the market to swing in its outlook for AI development prospects. From a long-term perspective, as long as the logic of AI development remains unshaken and the industry develops continuously according to the rules, the prosperity of the computing power industry chain will eventually return. While overseas markets need breakthrough innovations to drive computing power demand, the domestic AI industry started later with a lower base, and the main focus should be on marginal changes in the computing power industry chain.

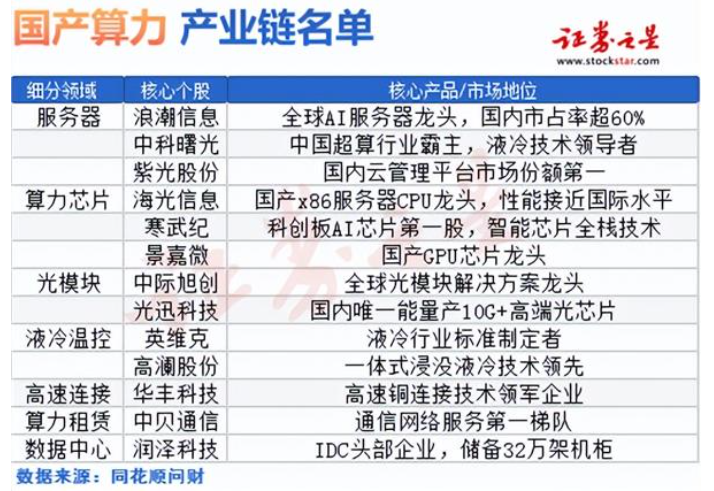

The domestic computing power industry chain can be divided into the following segments and core enterprises:

In the server field, Inspur Information, Sugon, and Unisplendour are dominant. Inspur Information, as the global leader in AI servers, holds over 60% of the domestic market share; Sugon, with its liquid cooling technology advantage, has become the dominant player in China's supercomputing industry; Unisplendour ranks first in the domestic cloud management platform market.

The computing power chip field includes Hygon, Cambricon, and Jingjia Microelectronics. Hygon is a leader in domestic x86 server CPUs, with performance comparable to international standards; Cambricon, as the first AI chip stock on the STAR Market, possesses full-stack intelligent chip technology; Jingjia Microelectronics specializes in the research and development of domestic GPU chips and is at the forefront of the industry.

The optical module field is led by InnoLight Technology and Accelink Technologies. The former is a global leader in optical module solutions, while the latter is the only domestic enterprise to achieve mass production of 10G+ high-end optical chips.

In liquid cooling and temperature control technology, Envicool, as an industry standard setter, leads technological innovation together with Grandland Shares, which excels in integrated immersion liquid cooling technology.

Huafeng Technology is a leader in high-speed copper connection technology in the field of high-speed connectivity; Zhongbei Communication, in the field of computing power leasing, belongs to the first tier of communication network services.

The data center field is centered around Runze Technology, a leading IDC enterprise with a significant scale advantage, having reserved 320,000 cabinets.

In this computing power revolution, industrial transformation presents three distinct characteristics: accelerated convergence of technological generations, continuous innovation in business models, and deep integration of green transformation. As the liquid cooling penetration rate leaps from 15% in 2023 to 40% in 2025, as the computing power leasing market scale exceeds the 100 billion threshold, and as the domestic market share of AI chips continues to break through, these inflection points from quantitative to qualitative changes are reshaping the competitive landscape of the industry.

Global AI development is entering a stage of regional specialization, and the unique evolution path of China's computing power system will profoundly impact the global AI industry landscape. Against this background, the in-depth revaluation of the domestic computing power industry chain may only just be beginning.

- End -