Intelligent Driving Under Regulation, Will New Car Makers Lose?

![]() 04/21 2025

04/21 2025

![]() 536

536

In 56 days, after two rounds of strict regulation on intelligent driving and OTA, new winners and losers have emerged.

"NIO happened to be at the right time. If they can't boost sales this time, it won't be good," because starting in mid-April, technology originally called L2 intelligent driving systems faced stricter regulation. NIO's NMW World Model was scheduled to be pushed in late April to early May. While others were busy supplementing and revising materials, NIO followed its planned schedule, likely reversing previous negative perceptions of its intelligent driving capabilities in one go.

However, within the industry, it seems only NIO is clearly benefiting. For those who have already bought cars, the next OTA upgrade for their vehicles will likely be in June at the earliest. Admittedly, most intelligent car users won't notice much change, as whether it's the smart cabin or intelligent driving, these are just bonuses when buying a car. More attention is paid to factors like low price, long range, and spaciousness, even if they're not perfect.

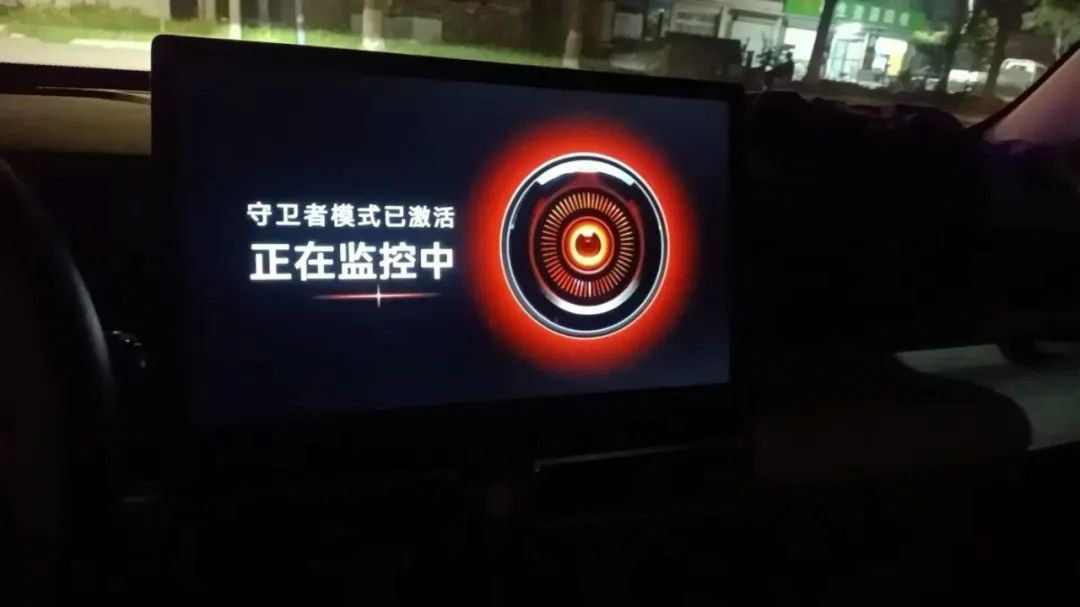

That said, just as with the development of smartphones years ago, humans always find themselves comparing. No one wants to be at the bottom of the pecking order in terms of configuration and intelligence, so in reality, many people, though they don't mention OTA, are looking forward to it. For example, over a million car owners online are calling for the Sentry Mode to be pushed via OTA as promised.

OTA Regulation, Will It Really Affect Carmakers' Sales?

"Ours won't be affected because Huawei's capabilities can easily handle it," After the launch of multiple new vehicles with Hongmeng Zhixing, dealerships once again saw queues of people test-driving on weekends. The appearance of Wenjie M8 broke the monopoly of Li Auto in the home car market above 300,000 yuan. It's clear that those interested in Hongmeng Zhixing have some understanding of intelligent technology. When asked, sales staff at 4S stores were confident in their responses.

However, in many other brands, sales consultants are often unable to answer such questions. Starting in February this year, all major domestic carmakers held press conferences to "popularize intelligent driving." With the implementation of two new regulations on February 28 and April 16, a series of new changes have occurred, as follows:

1. High-level intelligent driving and intelligent driving cannot be used anymore, replaced with assisted driving;

2. Terms like hands-off and eyes-off are not allowed in promotions;

3. Terms like valet parking, one-click summon, and remote control are not allowed in promotions;

4. The term takeover is not allowed to be used in L2-level assisted driving;

Besides the above, the most important information also includes reducing the frequency of OTA, pushing updates to users only after thorough verification. Existing thousand-person and ten-thousand-person testing groups need to be announced and are not allowed to use users for testing. OTA materials submitted to the Ministry of Industry and Information Technology will be required to fill in more detailed information, not just parameters.

If we review the above regulations, the list of affected parties will include most leading carmakers. Changan, BYD, Chery, Geely, and GAC have all held press conferences related to intelligent driving, and relevant expressions will need to be adjusted in the future.

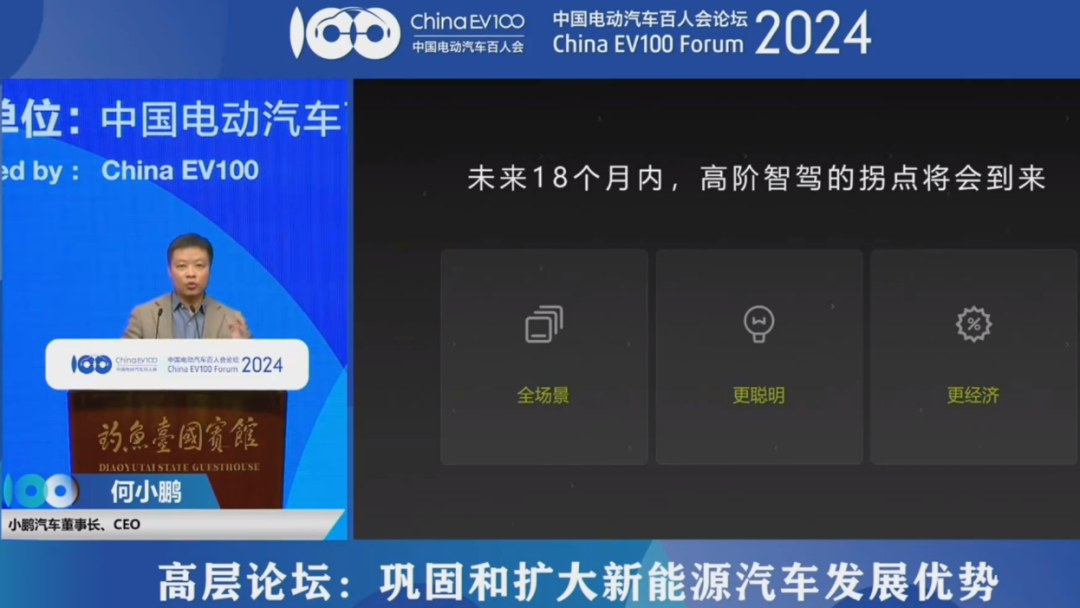

Most new forces are the hardest hit by this round of regulation. For example, He Xiaopeng frequently mentions in press conferences and public forums that existing technology is high-level intelligent driving, and many functions perform close to autonomous driving, constantly emphasizing takeover rates, such as mentioning in August 2024 that only 1-2 takeovers would be needed per week in 2025.

Li Auto is similar. For example, in the OTA 5.2 version in May 2025, it officially announced a takeover rate of 1,320 kilometers per takeover. Hongmeng Zhixing is the same, with numerous expressions related to autonomous driving.

Don't underestimate the impact of the above marketing regulations. Li Auto and Xpeng's sales in 2023-2024 were largely boosted by assisted driving. Public data shows that in 2023, the entry-level Pro version of Li Auto's L series accounted for 50% of sales in the Li L7, and since the rapid rise of AD MAX urban assisted driving and competition with Huawei Qiankun ADS, more people have been choosing non-Pro versions.

At the same time, the maintenance and rise of Xpeng's sales are closely related to XNGP. With its overall product strength inferior to competitors, its assisted driving has always been a prominent highlight. For example, the most memorable point of the Xpeng MONA M03 was He Xiaopeng's announcement at the press conference that high-capability assisted driving was available for the first time at the 150,000 yuan level.

Admittedly, major carmakers will find other ways to implement their existing assisted driving plans. Instead of thousand-person and ten-thousand-person testing groups, they can conduct early bird internal testing with their own employees' vehicles. Popularizing intelligent driving is already a consumer trend, and new car configurations from various manufacturers are being introduced, which will not be paused.

Has Huawei Effectively Won, Leaving New Forces Without Significance?

As sales consultants have said, the Huawei model has effectively won, and of course, this includes not just Huawei's BU but also all leading related technology solutions, such as Horizon Robotics, Hesai, and Momenta.

"It requires sufficient intensive training and high-value data. The gap in the amount of data suppliers have compared to carmakers is not just an order of magnitude but even exponential," This is the feedback from a senior engineer in charge of intelligence at a leading Chinese brand.

Recently, the bosses of three leading companies shared the same view, "Using users for testing, over 99% of the behavior generates data without learning value." Elon Musk of Tesla publicly expressed this view, Li Xiang expressed the same view, and Yu Kai, the founder of Horizon Robotics who just held a press conference in 2025, also expressed the same view.

This view makes sense. In ordinary people's daily driving, behaviors like not signaling when turning, changing lanes while crossing lines, and driving slowly are common. In the era when assisted driving relied on written rules, user driving data had some value, able to identify and rectify deficiencies. However, as we enter the era of large AI models, this type of data cannot be fed into the model, which requires a huge amount of correct learning data from various scenarios.

Therefore, this also directly reveals a difficult problem to solve. Many carmakers previously announced at press conferences, "We have XX million vehicles on the road, generating a huge amount of data, which will rapidly enhance our technological capabilities." Nowadays, with the implementation of world models and tens of thousands of card-level computing centers, this is being substantially surpassed by simulation capabilities.

An example known to everyone is the rise of Deepseek, which has surpassed the math problem-solving abilities of most master's students. Therefore, the direction for assisted driving and subsequent autonomous driving is basically the same.

The reason why the Huawei model can already be considered a winner at this stage is due to Hongmeng Zhixing's data closed loop. Whether it's Chery, BAIC, Thalys, JAC, their data recovery and reuse capabilities rely on Huawei. Additionally, as Huawei's ecological partner circle grows larger, including GAC, SAIC, and Lantu, data can only be more fully utilized by Huawei.

The reason is simple: carmakers don't have Huawei's capabilities, whether it's system capabilities or technological capabilities. Therefore, more fully supplying leading suppliers in cooperation can unleash the greatest power.

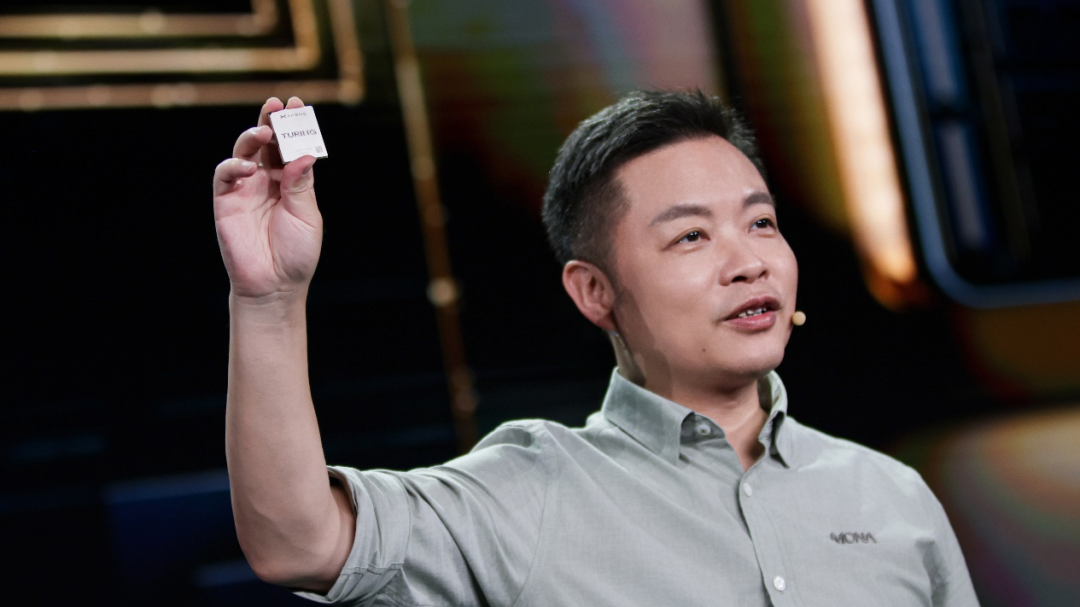

Horizon Robotics, which just held a press conference, also demonstrated the same technical advantages. Currently, the industry trend regarding the next step in the development of assisted driving and autonomous driving has shifted from being dominated by new forces.

Previously, almost all leading carmakers relied on NVIDIA to advance related technologies. This is not only because NVIDIA can provide chips with the highest computing power but also because NVIDIA controls the upstream and downstream, including development toolchains, upstream and downstream application ecosystems, etc. After all, Chinese carmakers are not Tesla, and neither Musk nor Tesla are as wealthy as a country, so they can develop related software and hardware on their own, just like Apple's iOS.

As a result, NVIDIA quickly rose in the intelligent driving chip market, with the installation volume of Orin-X increasing from 1.095 million units in 2023 to 2.1002 million units in 2024. However, the trend of withdrawal is becoming increasingly apparent. Xpeng and NIO have already adopted self-developed chips, and more and more carmakers are starting to purchase chips from Horizon Robotics and Black Sesame.

The reason is simple: NVIDIA's single-vehicle assisted driving computing chips are no longer dominant. This conclusion is drawn from various perspectives, including cost, future development, supply chain constraints, and force majeure. Originally, NVIDIA's Thor chip was expected to go into mass production in 2024, leading many carmakers to place their bets. But the subsequent reality was quite the contrast, with the Xpeng P7+ ultimately choosing to use dual Orin-X instead. Li Auto was also in a passive position, originally planning to quickly replace the entire L series with new chips to compete with Hongmeng Zhixing, but now it has had to make repeated changes.

Moreover, the cost account in the business model is the biggest influencing factor. The main reason why early new forces chose to conduct independent research and development (R&D) was that they all wanted to follow Tesla's path to success and become the next Tesla in China or the world. Another important reason is that there were no suppliers or supporting facilities available in the market, so they had to do it themselves.

However, with the advent of the era of AI and large models, and the rise of more and more related companies, the fact that independent R&D can ensure the best assisted driving functions is no longer very convincing.

Up to now, Huawei Hongmeng Zhixing and Horizon Robotics have both been able to provide high-computing-power chips and complete solutions. After testing, Horizon's HSD solution has surpassed Xiaopeng's XNGP and is catching up with Huawei's ADS3.3 in capabilities. Furthermore, regardless of whether they deeply cooperate with Huawei or Horizon in the future, they can obtain the ability for continuous hardware upgrades, such as installing new chips on old vehicles to endow them with new intelligent driving capabilities.

Final Thoughts

Just half a year ago, the mainstream view in the industry was that such fierce competition would cause many new technologies to be eliminated just half a year after their release. Neither plug-in hybrids, assisted driving, nor smart cabins could escape this fate.

However, after the current stage of development, the above issues have been resolved one by one. Everything seems to be like it was in the era of fuel vehicles, where automakers only conduct independent R&D on the most core parts and leave the rest to professional vertical suppliers such as Bosch, Continental, and Denso.

According to Yu Kai, nowadays, one out of every three smart cars uses Horizon's solutions. Huawei is also gradually moving towards this process. Therefore, compared to automakers, suppliers can share greater costs and offer lower prices for the same functions. For automakers to conduct independent R&D, they must achieve the scale of Tesla or BYD.

Of course, everything is still subject to change. Whether to choose independent R&D or a supplier's solution depends on which one sells better and whose word counts.