Why Are Autonomous Driving Companies Falling Despite Optimism?

![]() 04/30 2025

04/30 2025

![]() 670

670

Introduction

Why is the autonomous driving industry caught in a paradox of "booming optimism and pervasive bankruptcies"?

Recently, the Pudong New Area People's Court in Shanghai accepted the bankruptcy review application of Zongmu Technology (Shanghai) Co., Ltd., officially initiating judicial reorganization proceedings. News of this rekindled industry interest in the intelligent driving company, which had been "out of contact" for two months.

During the Spring Festival two months prior, Zongmu Technology faced exposure over issues such as unpaid wages, halted social security contributions, executive departures, and even rumors that its founder and CEO, Tang Rui, had "disappeared." Although Tang Rui later clarified that he had not lost contact and was actively seeking overseas financing, the company's entry into judicial reorganization proceedings has cast a dark shadow over its future.

Public records show that Zongmu Technology, founded in 2013 with Tang Rui as legal representative and a registered capital of approximately 96.32 million Chinese yuan, specializes in designing, producing, and selling automotive electronic software and hardware products, along with importing, exporting, wholesaling, and agency services for these products.

Emerging as a rising star with its Surround View Advanced Driver Assistance Systems (ADAS) and autonomous driving technology, Zongmu Technology completed rounds of financing from A to E between 2015 and 2022. Investors included Lenovo, Xiaomi Group, Junlian Chengye, among others, valuing the company at over 9 billion Chinese yuan, making it a unicorn in China's ADAS sector.

However, Zongmu Technology's descent from industry unicorn to bankruptcy review underscores a brutal truth beneath the autonomous driving industry's apparent prosperity: even with vast market potential and abundant capital influx, many companies still fail before achieving success.

Moreover, Zongmu Technology's collapse is not isolated. TuSimple Holdings Inc. transformed into a gaming company, Argo AI went bankrupt, and Cruise suffered significant losses. The string of predicaments faced by autonomous driving companies inevitably prompts questions: Why is the autonomous driving industry caught in this paradox?

01 Capital Retreat, Market Returns to Rationality

Autonomous driving has long been viewed as the next trillion-dollar market following smartphones.

Over the past decade, global financing for autonomous driving has increased annually. Zongmu Technology alone attracted 2.2 billion Chinese yuan over ten years, transforming from a nascent startup into an industry unicorn. Similarly, industry leader TuSimple Holdings Inc. once boasted a market value exceeding 12 billion US dollars. These achievements highlight capital's generosity in betting on the autonomous driving sector.

However, capital's enthusiasm has waned due to slow technological implementation and lack of profitability.

Taking Zongmu Technology as an example, despite attracting investments, it incurred net losses of 434 million, 588 million, and 564 million Chinese yuan from 2021 to 2023, respectively. Adjusted net losses were 382 million, 477 million, and 516 million Chinese yuan, respectively. The company's gross profit margin consistently remained below 15%, while research and development (R&D) investment exceeded 50%, leading to persistent capital chain tension.

The 2022 financial report revealed that R&D investment accounted for nearly 70% of total revenue, while revenue increased by only 12% during the same period. This excessive investment made it challenging for the company to maintain normal operations under financial pressure.

Similar phenomena have also plagued other autonomous driving companies. Cruise suffered losses exceeding 5 billion US dollars over three years, Waymo lost billions annually, and the industry generally fell into a vicious cycle of "high input, low output." When such phenomena persist without effective improvement, the wave of bankruptcies due to insufficient income becomes inevitable.

Insufficient income here encompasses IPO failures and funding disruptions.

In 2017, Zongmu Technology first listed on the New Third Board market but delisted a few months later. In November 2022, it again attempted to list on the STAR Market but withdrew its IPO application the following September. In March 2024, Zongmu Technology submitted an IPO application to the Hong Kong stock market but ultimately failed the review. All three IPO attempts ended in failure, exposing shortcomings in technology commercialization.

The IPO failures prevented the company from securing continued funding from the capital market, further straining its capital chain. Subsequently, reports emerged of unpaid wages and social security contributions to employees, issues that erupted during the 2025 Spring Festival.

During this period, TuSimple Holdings Inc.'s market value also plummeted by 99%, leading to its delisting and transformation into a gaming company. Under the capital winter, whether a startup or an industry unicorn, companies unable to generate revenue are the first to be impacted by drastic industry changes.

While investment trend shifts have affected numerous companies, the primary reason for capital retreat is the technological bottleneck faced by the utopia of L4 and the survival reality of L2.

As we all know, the classification of autonomous driving technology is like a chasm. L4, which refers to highly automated driving, is significantly more challenging to implement than anticipated. While focusing on L4-level parking and charging robots, Zongmu Technology missed the market window for high-speed Navigation on Autopilot (NOA) in the L2+/L3 level.

In contrast, automakers recognize that L4-level technology requires massive R&D investments with a long commercialization cycle. Therefore, they prefer L2+ solutions that can be quickly mass-produced, such as Tesla's FSD and Huawei's ADS. However, Zongmu Technology's transformation businesses, due to high R&D investment and limited application scenarios, failed to bring new growth and instead exacerbated cash flow pressure.

It is evident that the slow progress of technology commercialization and strategic missteps not only led to a decline in customer orders and a broken capital chain for Zongmu Technology but also cooled the entire autonomous driving industry.

02 Surviving the Winter is Not Easy

From the above, it is clear that the autonomous driving industry faces common difficulties, including capital rationalization, funding winter, the pressure of rapid technological iteration, and the squeeze from automakers competing for "the soul." These factors significantly impact the development of related enterprises and the industry's winter.

Taking corporate in-house R&D as an example, current autonomous driving enterprises can be categorized into three groups: full-stack in-house R&D automakers like Tesla and BYD, technology suppliers like Mobileye and Zongmu Technology, and Robotaxi operators like Waymo. Zongmu Technology's tragedy essentially reflects the collapse of the technology supplier model amid the trend of automakers conducting in-house R&D.

Whether it's BYD's in-house R&D of IGBT chips, Geely's layout of Xinqing Technology, or NIO's establishment of a chip team, automakers aim to pursue technological autonomy under the intention of "removing third parties." This has led to a sharp decline in orders for Tier 1 suppliers like Zongmu Technology, making the model of large customers contributing over 90% of revenue vulnerable.

Therefore, when technology premiums disappear and automakers form ecological advantages through full-stack integration, they severely squeeze the survival space of small and medium-sized suppliers. Additionally, some enterprises have a limited scenario for autonomous driving technology. For example, Zongmu Technology bet on automatic parking, but this technology has gradually become a standard configuration for automakers. Mobileye relies on EyeQ chips but has struggled to grow after Tesla shifted to in-house chip development.

In summary, the golden aura of the autonomous driving industry is fading. Zongmu Technology's collapse reveals the brutal reality of a triple squeeze from technology, capital, and business models.

Of course, while Zongmu Technology faces collapse, some autonomous driving companies have achieved better development.

For instance, Desay SV Automotive has deep cooperation with multiple automakers, providing them with customized solutions. This vertically integrated relationship has positively impacted Desay SV Automotive's growth. Horizon Robotics has made a comeback through its technological platform approach of chips + toolchains. Companies like Huawei and DJI have built barriers through deep technological cultivation, while XPeng has improved efficiency through architecture streamlining and supply chain reshaping.

These enterprises have stabilized their current situations by achieving binding with leading enterprises through different development paths.

Additionally, there are companies like Yikong Intelligent Driving and Tago Intelligent Driving that specialize in mines, ports, and other focused niche scenarios. Haomo.AI has launched a 100,000 Chinese yuan-level logistics delivery vehicle to capture the market with low prices, achieving technology de-escalation and cost control. Huawei has constructed a "chip-algorithm-cloud" ecosystem to lower the threshold for automakers to achieve intelligentization and ecological breakthroughs.

It is evident that only enterprises with core technological barriers, such as Huawei's end-to-end solutions, ecological integration capabilities like Horizon Robotics' open platform, and deep integration with leading customers like Desay SV Automotive, have the opportunity to survive the elimination race. Especially for small and medium-sized manufacturers, they must either merge and integrate or focus on niche scenarios to seek differentiated survival; otherwise, they will be caught in a "death spiral".

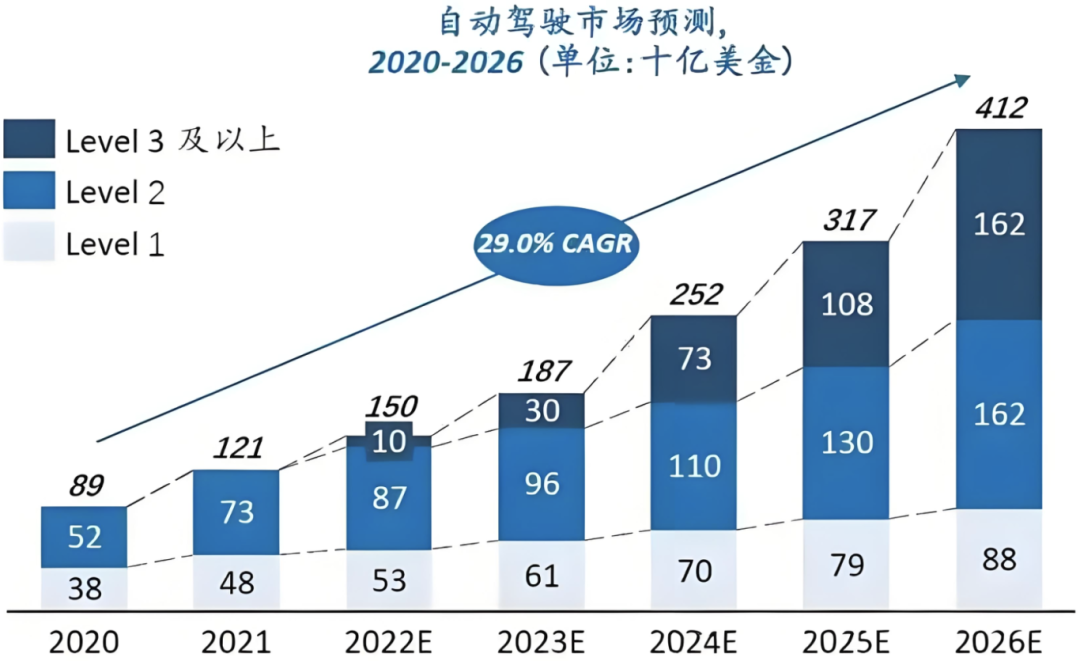

However, on the whole, autonomous driving remains an irreversible trend. Some institutions predict that China's autonomous driving market will exceed 500 billion US dollars by 2030, with an L3 penetration rate of 70%. While the ideal is abundant, the industry must also face reality: technological breakthroughs take time, capital patience is limited, and business models need to be reconstructed.

Therefore, Zongmu Technology's predicament serves as a mirror for observing the industry's development, reflecting the collective anxiety: on the balance beam between technology and business, only by looking up at the starry sky of technological innovation while standing firmly on the ground of profitable revenue generation can one navigate through the cycle and wait for dawn.

Editor-in-Chief: Yang Jing, Editor: He Zengrong