Applovin: Can Good Results Withstand the 'Ghost Stories'?

![]() 02/13 2026

02/13 2026

![]() 548

548

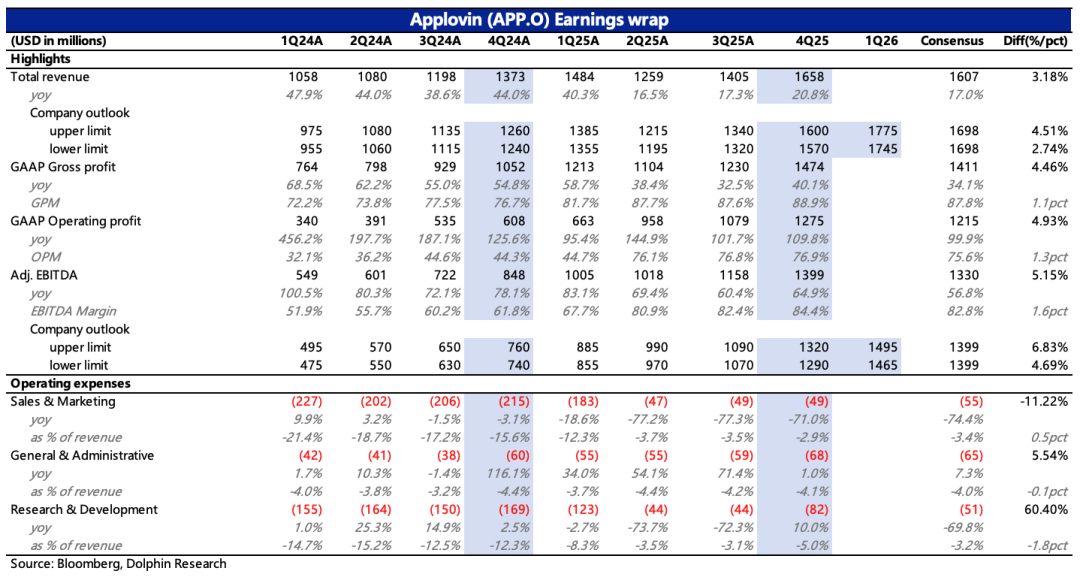

Applovin released its Q4 2025 earnings report after the U.S. market closed on February 11 (EST). The results were decent, though some institutions had more optimistic expectations. However, the actual performance may align more closely with the cautious buyer's perspective. Nevertheless, this does not seem to prevent the stock price from continuing its negative reaction to the earnings report.

Key Details:

1. Strong Revenue Guidance Growth: For Applovin, guidance remains the most critical metric during this key period of business expansion.

The Q1 guidance slightly exceeded consensus expectations (though some institutions had higher expectations), especially considering the management's relatively conservative guidance style. Sequentially, Q1 is expected to grow by 10% compared to Q4. While this is slower than Q4's 18% sequential growth, it primarily accounts for the impact of seasonal fluctuations in e-commerce.

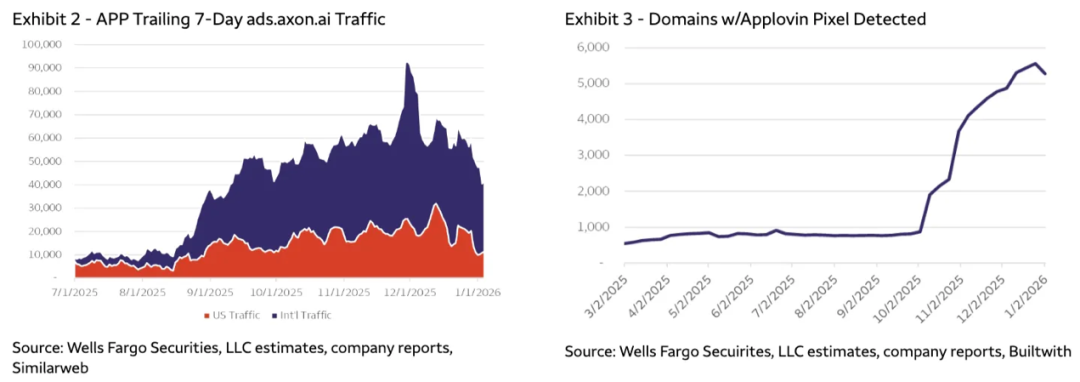

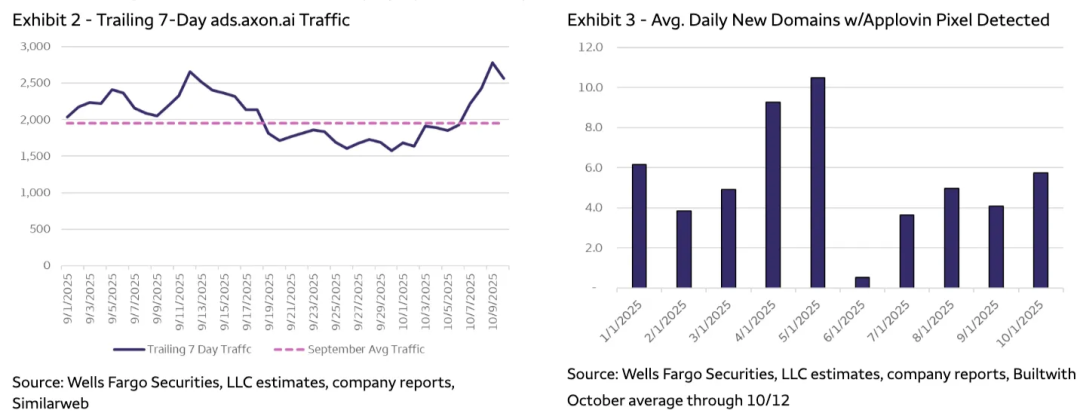

After experiencing a slowdown in high-frequency e-commerce advertising data early in the year, buyer sentiment has adjusted its high-growth expectations. Therefore, Applovin's actual performance, at least in terms of expectation gaps, does not appear to be the primary reason for the stock's underperformance.

2. Game Advertising May Again Exceed Expectations: While last year's hype focused on Applovin's expansion into e-commerce, games remain the core growth driver in absolute terms.

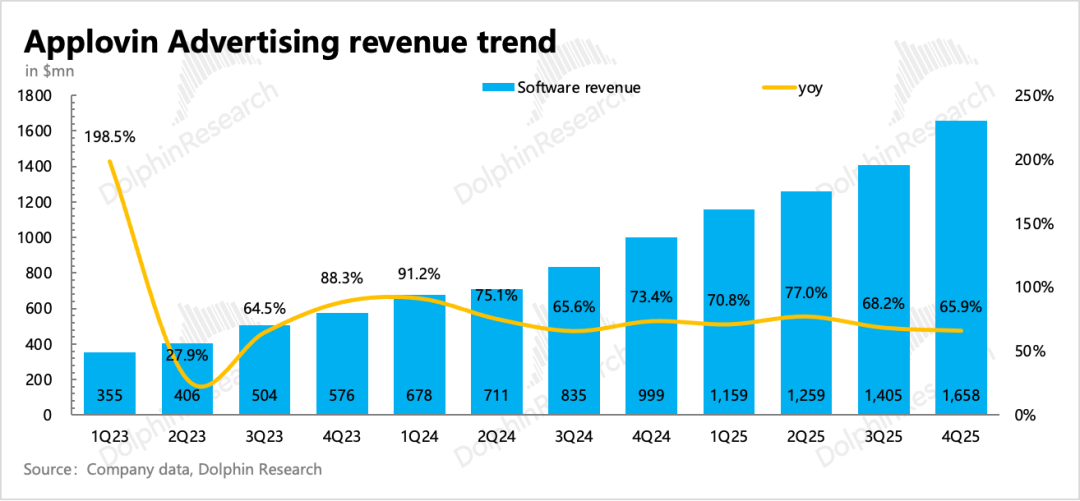

Combining the company's Q1 guidance and channel research, Dolphin Research expects game advertising revenue in Q1 to again exceed the long-term organic growth rate of 20%. This reflects Applovin's continued market share gains in the gaming sector, where it holds a dominant position—potentially alleviating some market concerns about Meta's return to iOS in-app advertising impacting Applovin.

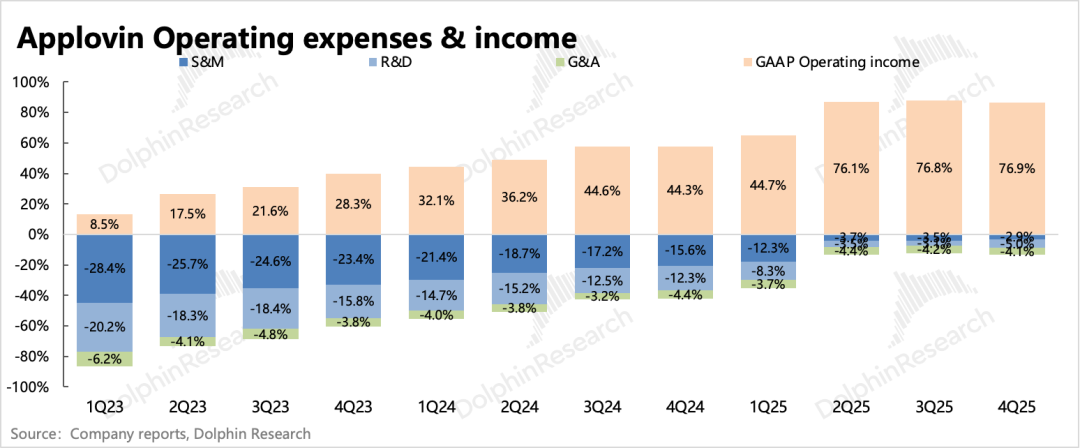

3. Profitability Continues to Improve Slowly: After divesting its 1P gaming app business, Applovin's operating margin has become highly efficient. Expanding into e-commerce also requires increasing client-facing personnel within its relatively small sales team.

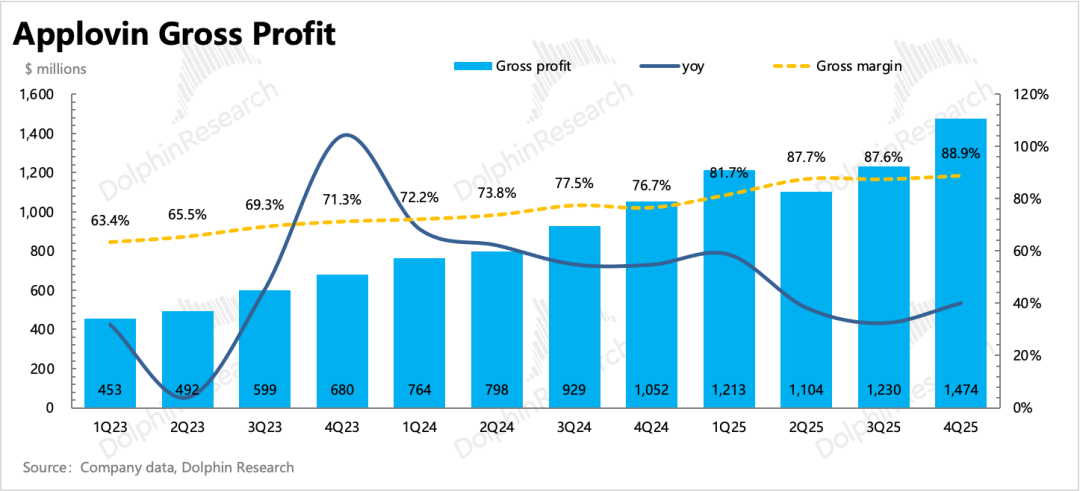

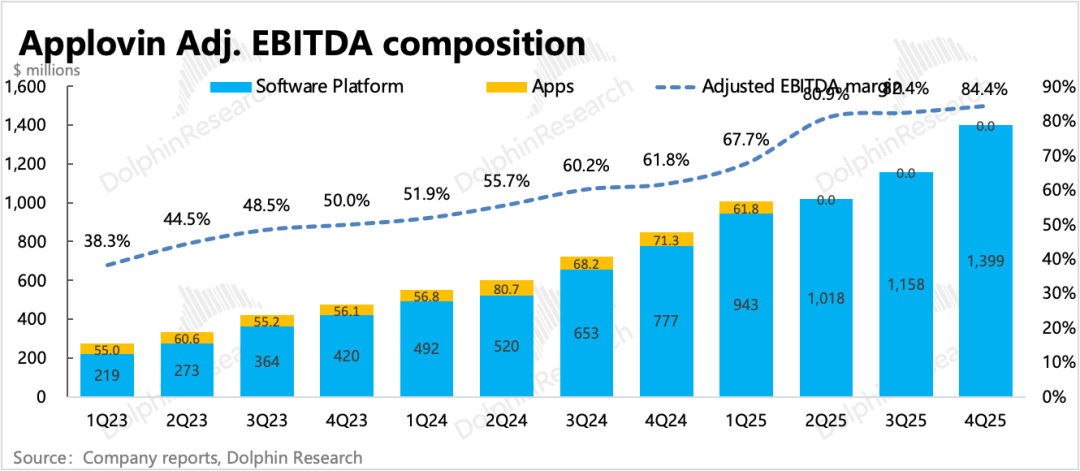

However, the adjusted Q4 EBITDA margin improved by 2 percentage points sequentially, reaching a record high of 84%. This was driven not only by revenue growth but also by a decline in absolute expenses.

Among the three operating expenses, only administrative expenses saw a slight year-over-year increase, which included transaction costs related to the 1P gaming app divestiture. Excluding these costs, administrative expenses also declined year-over-year.

4. Continued Buybacks: Buyback activity slowed in Q4, with $480 million spent to repurchase 800,000 shares at an average price of $600 per share. Full-year 2025 buybacks totaled $2.6 billion, which remains relatively modest compared to its $154.4 billion market cap.

5. Key Financial Metrics Overview

Dolphin Research's View

This was another generally decent earnings report without major misses compared to expectations. However, the consecutive negative reactions reflect fading confidence and interest in traditional software stocks among investors.

Unlike Unity, which has obvious flaws, Applovin's performance has few significant drawbacks. Especially since Applovin's stock already followed Unity's decline yesterday, its valuation has been hit by 'ghost stories,' and buyer expectations had already adjusted due to slowing net growth in AXON Pixel merchant domain names tracked by third-party channels since the beginning of the year. Despite this, the final earnings results still failed to gain investor recognition.

If forced to identify shortcomings, the sequential growth rates in Q4 and Q1 have slowed (though they remain double-digit).

However, with valuation already low, there is little need to be overly critical of the performance. The only explanation is market concerns about whether future growth or profitability can be sustained amid competition from Meta and Cloudx.

This is also Dolphin Research's primary concern about Applovin, as discussed in our Google Genie review. While we remain confident in the AXON model in the short term due to its proprietary and comprehensive user data, the medium-to-long-term outlook raises questions: What competitive edge will AXON maintain once rival algorithm models close the gap? And if Meta chooses to subsidize advertisers' bidding to secure high-quality game ad inventory, could this also erode Applovin's high profitability?

Nevertheless, factoring medium-to-long-term assumptions into the current stock price is irrational. While competitive threats will likely limit rebound potential,

Dolphin Research believes the market's current pickiness stems from simultaneous pressure from multiple factors—a confluence of negative catalysts (e.g., stronger-than-expected nonfarm payrolls dampening rate cut expectations, conservative peer outlooks) creating an emotional trough. Such periods often precede golden buying opportunities once sentiment recovers.

A more detailed valuation analysis has been published in the Longbridge App under the 'Insights - Deep Dive (Research)' section in an article with the same title.

Detailed Analysis Follows

1. Growth Guidance Slightly Exceeds Expectations

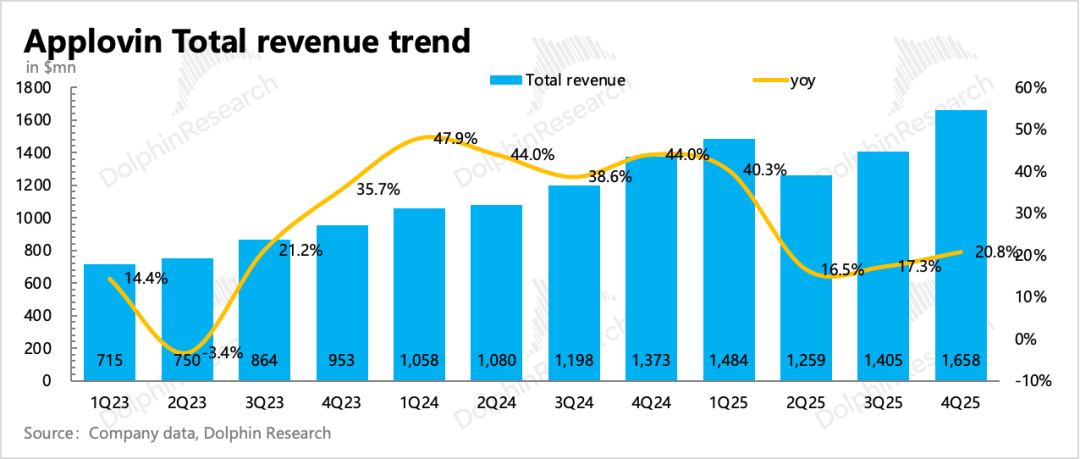

In Q4, Applovin reported total revenue of $1.66 billion, up 21% year-over-year, with sequential acceleration. Excluding the impact of divesting 1P gaming apps, advertising revenue grew 66% year-over-year, roughly in line with Q3's 68%. Given the October launch of automated bidding tools, the market likely priced in additional expectations.

Q1 revenue guidance of $1.75–1.78 billion implies growth of nearly 53% (excluding divestiture impacts). Naturally, Q1 growth slows due to seasonal factors.

Assuming game advertising grows at the company-guided 20% organic rate, Q1 e-commerce revenue would need to reach $380 million, which seems challenging during the off-season. Thus, we believe Q1 growth will still rely on strong gaming revenue offsetting seasonal headwinds. This aligns with channel research indicating game developers continue to allocate more ad budgets to Applovin due to its superior ROAS.

2. Internal Efficiency Gains Exceed Expectations

Overall, the company achieved an 84% EBITDA margin in Q4, up 2 percentage points sequentially, reaching a near-record high. Compared to Q3, cost optimizations primarily came from strict control over absolute operating expenses.

Sales expenses declined year-over-year, while R&D and administrative expenses returned to modest growth. However, Applovin's sales team is already understaffed for e-commerce client expansion.

That said, the current 84% margin is near its peak. If Meta re-enters iOS in-app advertising competition, Applovin may need to offer concessions to defend its market share.

- END -

// Reprint Authorization

This article is an original work by Dolphin Research. For reprint authorization, please add WeChat: dolphinR124.

// Disclaimer and General Disclosure

This report is for general comprehensive data purposes only, intended for users of Dolphin Research and its affiliates for general reading and data reference. It does not consider the specific investment objectives, product preferences, risk tolerance, financial status, or special needs of any individual receiving this report. Investors must consult independent professional advisors before making investment decisions based on this report. Any investment decisions made using or referencing the content or information in this report are at the investor's own risk. Dolphin Research shall not be liable for any direct or indirect losses arising from the use of the data in this report. The information and data in this report are based on publicly available sources and are for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, or completeness of the information and data.

The information and views expressed in this report do not constitute an offer to sell or a solicitation to buy securities in any jurisdiction, nor do they constitute recommendations, inquiries, or endorsements of securities or related financial instruments. The information, tools, and materials in this report are not intended for distribution to, or use by, individuals or entities in jurisdictions where such distribution, publication, provision, or use would violate applicable laws or regulations or require Dolphin Research and/or its affiliates or subsidiaries to comply with registration or licensing requirements in those jurisdictions.

This report reflects only the personal views, insights, and analytical methods of the relevant contributors and does not represent the stance of Dolphin Research and/or its affiliates.

This report is produced by Dolphin Research, and its copyright is solely owned by Dolphin Research. No institution or individual may, without prior written consent from Dolphin Research, (i) reproduce, copy, duplicate, reprint, forward, or create any form of copies or replicas in any manner, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Research reserves all relevant rights.