Is China’s Auto Export Still Tethered to the Russian Market?

![]() 02/13 2026

02/13 2026

![]() 344

344

Introduction

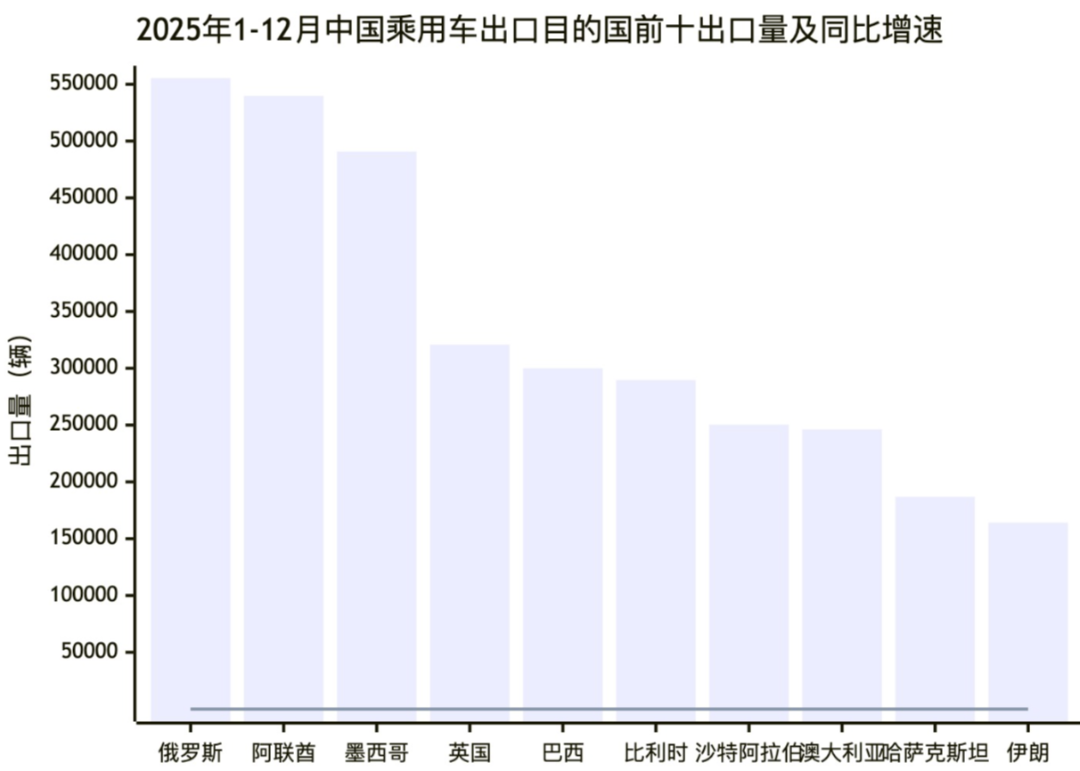

Despite a nearly 50% year-on-year decline, Russia remained the top destination for China’s auto exports in 2025 among the top 10 countries.

In 2025, China’s passenger vehicle exports soared to a record high, surpassing 6 million units annually. While headlines frequently tout the “globalization of Chinese cars,” many may not fully grasp which markets are absorbing these vehicles, which have become focal points for Chinese automakers’ global expansion, and which regions are poised for new growth.

Data from the China Association of Automobile Manufacturers (CAAM) and the General Administration of Customs reveals the top 10 destination countries for China’s passenger vehicle exports in 2025. This list includes long-standing partners and emerging markets, with some experiencing declines and others doubling their growth potential.

The rankings for 2025 are as follows: Russia, the UAE, Mexico, the UK, Brazil, Belgium, Saudi Arabia, Australia, Kazakhstan, and Iran. The top three destinations accounted for 1.5859 million units, half of the total exports to the top 10 countries.

However, the performance and strategies for survival in these three key markets differ significantly.

Russia: From Boom to Bust?

Russia, a perennial leader in China’s passenger vehicle exports, retained its top spot in 2025 with 555,400 units shipped. Yet, a 46.1% year-on-year decline signals the end of the high-growth era for Chinese automakers in Russia.

Two to three years ago, the Russia-Ukraine conflict prompted European and American automakers to exit the Russian market en masse. Chinese brands swiftly filled the void, experiencing explosive export growth. Russia became China’s largest market for passenger vehicle exports, peaking in 2024.

However, 2025 brought a sharp downturn due to multiple factors.

On one hand, Russia implemented policy changes, raising import vehicle scrappage taxes by 70%-85% in October 2024 and increasing import tariffs to 20%-38% in January 2025. Combined with rising customs clearance fees, these measures eroded the price advantage of Chinese cars and drove up terminal prices. On the other hand, the Russian government aggressively supported local automakers through differentiated subsidies, fostering a strong recovery for domestic brands and further squeezing the market share of imported vehicles.

Notably, despite the export decline, Chinese brands still hold over 50% of the Russian market. Haval, Chery, and Geely remain sales leaders, but the competitive landscape has shifted from incremental growth to inventory battles over existing market share. In the future, localized production will be crucial for Chinese automakers to maintain their foothold in Russia.

UAE: A Surprising Contender

In stark contrast to Russia’s decline, the UAE emerged as the “dark horse” of Chinese automakers’ global expansion in 2025. With 539,700 units exported and a 74.3% year-on-year increase, it leapt to second place.

Today, in the UAE’s luxury-dominated market, Chinese cars have shed their “budget” image, transitioning from cost-effectiveness to premium positioning. Models like the Baojun Yep Plus and Yangwang U8L now compete alongside Lamborghinis and Ferraris. The Baojun Yep Plus, priced at around 70,000 yuan in China, sells for as much as 160,000 yuan in Dubai. The BYD Yangwang U8L has become a favorite among Dubai’s elite.

Mexico: A Core Market in the Americas

Mexico, ranking third, saw China export 490,800 passenger vehicles in 2025, a 44.2% year-on-year increase. It has become a key market for Chinese passenger vehicles in the Americas. Data shows that Chinese-made models accounted for nearly 20% of light vehicles sold in Mexico in 2025, meaning one in five new cars came from China. Five years ago, Chinese independent brands held less than 1% of the Mexican market—a remarkable leap.

Beyond the Top Three: European and Emerging Market Breakthroughs

The fourth- to tenth-ranked destinations reflect breakthroughs in European markets and growth in emerging economies.

Exports to the UK reached 320,800 units, a 70.3% year-on-year increase. Brazil, South America’s largest automotive market, saw nearly 300,000 Chinese passenger vehicles exported in 2025, a 34.6% increase. Belgium imported 289,500 units, up 4.5%. Saudi Arabia, Australia, and Kazakhstan also posted varying degrees of growth. However, Iran, a traditional market for Chinese passenger vehicle exports, saw a 31.6% decline to 164,100 units in 2025.

New Energy Vehicles: The Driving Force

The 2025 export data underscores that the core strength of China’s passenger vehicle exports lies in the growth of new energy vehicles (NEVs), achieving a dual surge in European and emerging markets.

NEV export growth far outpaces that of traditional fuel vehicles. In Europe, Belgium and the UK have become hubs for Chinese NEVs. In 2025, China’s NEV exports to these countries surged by over 80% year-on-year, dwarfing the overall export growth rate.

Looking Ahead: From Price to Technology and Brand

In 2025, traditional fuel vehicles remained a “stable yet adjusted” pillar of China’s auto exports, primarily meeting demand in established markets like Russia and Iran. Export volumes held steady, but growth rates slowed. Meanwhile, NEVs emerged as a new growth engine, expanding in both European and emerging markets.

As Chinese automakers deepen their global presence, localized production, R&D, and marketing will dominate. Competitiveness will shift from “price advantage” to “technological and brand strength.” In the near future, Chinese passenger vehicles are poised to further expand their global market share and reshape the global automotive landscape.

Editors: Cao Jiadong, He Zengrong

THE END