AI 'Arms Race': A Conflict Amazon Dares Not Lose

![]() 02/13 2026

02/13 2026

![]() 409

409

Introduction: For Amazon, a company whose operational success is increasingly tethered to cloud computing, the intensifying AI 'arms race' has evolved into a conflict it simply cannot afford to lose.

Li Ping/Author Lishi Business Review/Producer

1

Quarterly Revenue Tops $200 Billion

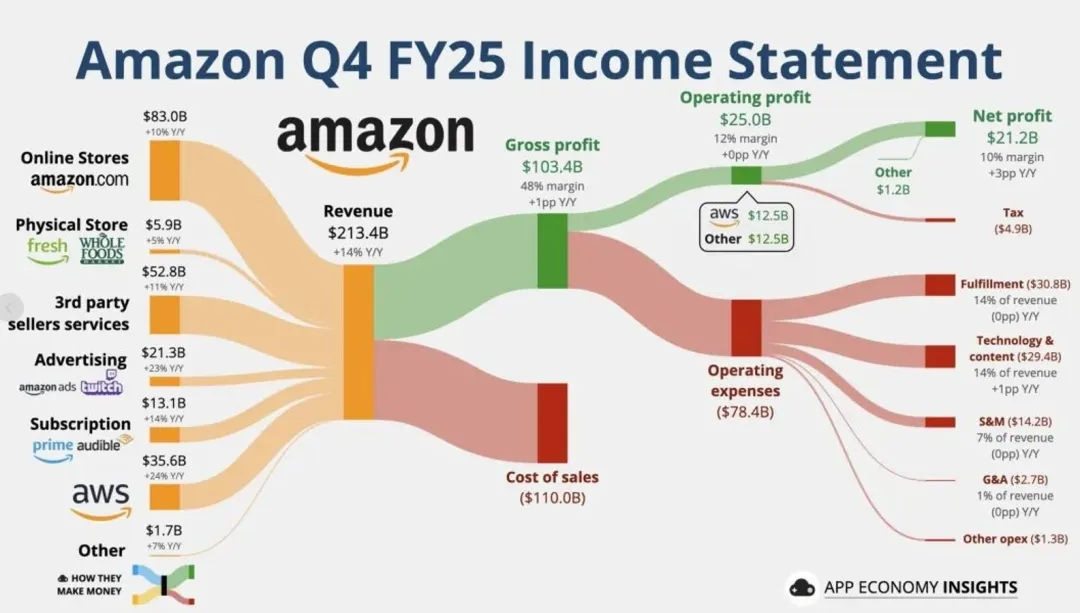

Recently, Amazon unveiled its financial results for the fourth quarter and full year of 2025, covering the period ending December 31. Data reveals that in the fourth quarter of 2025, Amazon's revenue soared to $213.4 billion, marking a 14% year-on-year increase and surpassing the $200 billion milestone for the first time in a single quarter. During the same period, net income reached $21.2 billion, up 6% year-on-year, with diluted earnings per share at $1.95, slightly below the market consensus of $1.97.

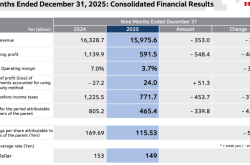

For the entire year of 2025, Amazon's revenue climbed to $716.9 billion, a 12% year-on-year rise, breaking the $700 billion barrier for the first time. Net income surged from $59.2 billion in 2024 to $77.7 billion, reflecting a robust 31% year-on-year growth. Amidst a backdrop of global economic uncertainty, Amazon's profitability has witnessed a significant upturn.

As the world's foremost e-commerce platform, Amazon was established in 1994 by Jeff Bezos as an online bookstore. Leveraging Bezos's forward-thinking vision and customer-centric approach, Amazon swiftly transformed into a consumer and technology behemoth, integrating e-commerce, cloud computing, artificial intelligence, and brick-and-mortar stores. It also became the second U.S. company, after Apple, to surpass a $1 trillion market capitalization.

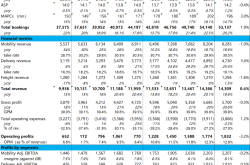

From a revenue standpoint, Amazon's core operations are bifurcated into retail and cloud computing services. The retail segment, the bedrock of the company, is further segmented into online stores, physical stores, third-party seller services (commissions and fulfillment fees from online third-party sellers), membership and subscription services, and online advertising.

Financial data indicates that in the fourth quarter of 2025, Amazon's online stores generated $82.988 billion in revenue, up 10% year-on-year; physical stores contributed $5.855 billion, a 5% increase; third-party seller services brought in $42.816 billion, up 11%; subscription services yielded $13.122 billion, a 14% rise; and advertising revenue reached $21.317 billion, marking a 23% year-on-year surge.

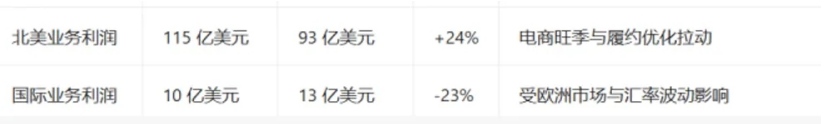

Geographically, Amazon's retail operations are divided into North America and international markets, encompassing revenue from retail activities in these regions, as well as subscription and export sales. North America remains Amazon's primary revenue pillar. Financial data shows that in the fourth quarter of 2025, Amazon's North American sales hit $127.083 billion, up 10% year-on-year, with operating profit soaring 24% to $9.3 billion, reflecting a notable improvement in profitability.

During the same period, Amazon's international e-commerce revenue reached $50.7 billion, up 17% year-on-year, outpacing growth in North America due to expansion in emerging markets and rising e-commerce adoption overseas. However, operating profit in international markets declined 23% year-on-year to $1 billion, impacted by heightened competition, escalating logistics costs, and regional business adjustments. Overall profitability remains thin, indicating ongoing business optimization efforts.

2

Cloud Business Accounts for Over 60% of Profits

In contrast to the steady growth of its retail business, Amazon's cloud operations have garnered greater external attention. In the fourth quarter of 2025, AWS generated $35.6 billion in sales, up 24% year-on-year, marking the highest revenue growth in 13 quarters and serving as the standout highlight of the quarterly earnings. AWS's operating profit reached $12.5 billion, up 18% year-on-year, with an operating margin of 35.0%.

For the full year of 2025, AWS revenue totaled $128.7 billion, up 20% year-on-year, accounting for 18% of total revenue. Cloud computing remains a key driver of Amazon's growth. From a profit perspective, AWS contributed over 60% of Amazon's operating profit in 2025, cementing its status as the company's most critical 'cash cow' business.

In 2006, Amazon founder Bezos delivered a seminal speech on cloud storage and computing, announcing the launch of AWS. That same year, AWS officially introduced Amazon EC2 and Amazon S3 services, marking the birth of cloud computing as a commercial service and establishing Amazon's dominance in the field.

Andy Jassy, Bezos's first 'shadow advisor,' co-developed the vision for AWS with Bezos. Since its inception, Jassy has spearheaded continuous product and service optimizations. His competitive strategy of initiating price wars to suppress rivals has maintained AWS's global market leadership and control over cloud computing.

In July 2021, Bezos stepped down, and Jassy, recognized for his leadership of AWS, assumed the role of Amazon CEO. However, with Microsoft, Google, and other competitors gaining momentum, AWS's dominance faced increasing pressure, and Jassy encountered investor skepticism.

According to Canalys, Amazon Cloud held a 49.4% share of the global IaaS public cloud services market in 2017, while Microsoft Azure accounted for just 12.7%. Since then, Azure's rapid growth has narrowed the market share gap.

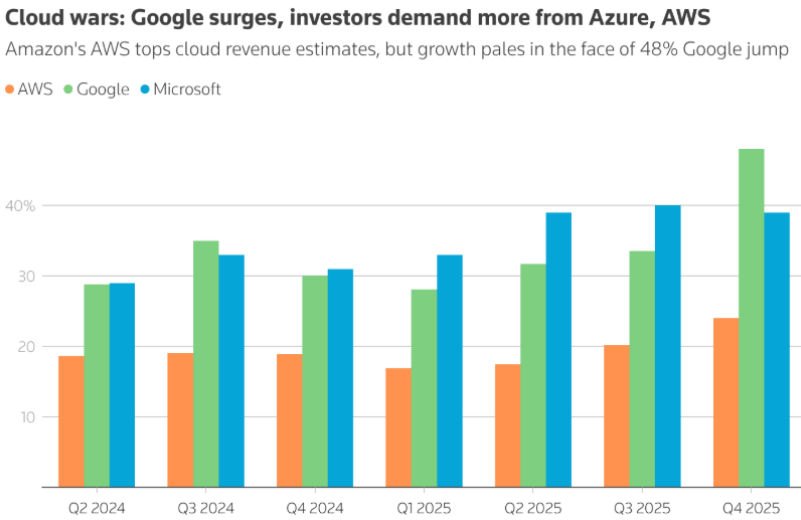

Latest data from Synergy Research Group shows that in the fourth quarter of 2025, Amazon held about 28% of the public cloud market, maintaining its lead among major providers. Microsoft ranked second with 21%, and Google had about 14%. The top three controlled 68% of the market. However, AWS's revenue growth (24%) lagged behind Microsoft Azure (39%) and Google Cloud (48%), with Azure remaining a formidable competitor in the cloud services market.

3

Self-Developed Chips Generate Over $10 Billion in Annualized Revenue

Overall, Amazon delivered a robust fourth-quarter performance, exceeding market expectations in both retail and cloud businesses. CEO Andy Jassy stated, 'AWS grew 24%, its fastest pace in 13 quarters, advertising grew 22%, physical stores in North America and international markets grew rapidly, and chip revenue surged by triple digits—all driven by our relentless innovation and ability to identify and address customer pain points.'

Jassy also announced that given strong demand for existing products and services, as well as opportunities in AI, chips, robotics, and low-Earth orbit satellites, Amazon plans to invest approximately $200 billion in capital expenditures in 2026.

Data shows Amazon's 2025 capital expenditures totaled $131 billion, implying a 52% increase in 2026—far exceeding current revenue growth (14%) and Wall Street analysts' estimates ($144.7 billion). Following the earnings release, Amazon's stock price plummeted over 10% in after-hours trading. By February 9, the stock closed at $208.72, erasing over $250 billion in market value in three trading days.

In reality, secondary market investors have grown increasingly uneasy about the AI arms race among tech giants. Recent earnings data shows Google projecting 2026 capital expenditures of up to $185 billion, nearly doubling year-on-year, while Microsoft's 2026 capital spending is set to rise 66%. Both companies' stock prices tumbled after the announcements, with Microsoft's shares dropping 9.99% in a single day—its worst decline in six years—wiping out $400 billion in market value.

Analysts note that fourth-quarter earnings from Amazon, Google, and others demonstrate that recent massive investments in AI infrastructure by tech giants have translated into customer demand and revenue, explaining the record-high stock prices of the 'Magnificent 7' tech stocks. However, their 2026 capital expenditure plans reveal that Amazon, Microsoft, Google, and Meta alone plan to spend $660 billion on AI infrastructure, indicating that spending far outpaces revenue generation, inevitably sacrificing corporate free cash flow.

To offset rising AI investments, Amazon has significantly cut costs elsewhere. Public reports show that in October 2025 and January 2026, Amazon conducted two large-scale layoffs, eliminating 14,000 and 16,000 jobs, respectively. In the fourth quarter of 2025, Amazon recorded $730 million in severance costs.

Notably, unlike Microsoft and Google's 'all-in' AI strategy, Amazon's $200 billion capital spending includes substantial investments in e-commerce fulfillment networks to optimize retail operations, promote AI shopping assistant Rufus, enhance customer experience, and solidify its retail market leadership.

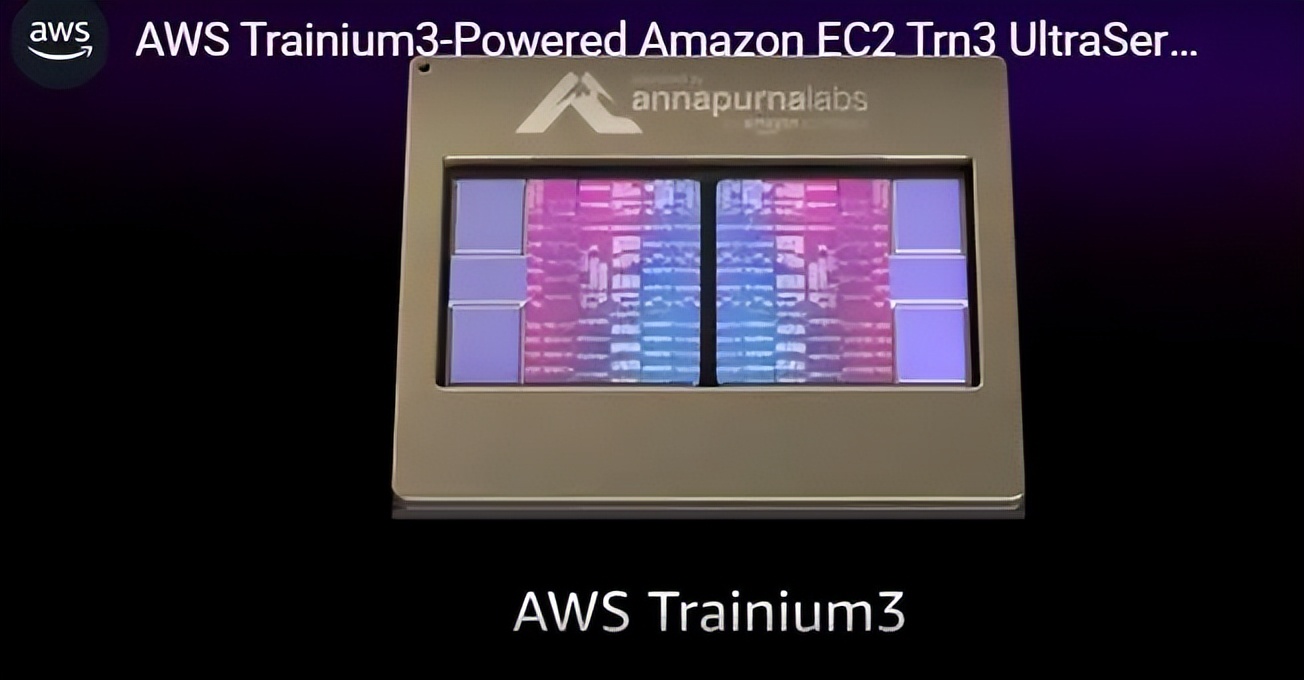

Investments in self-developed chips are another focal point of Amazon's unprecedented capital spending. Earnings reveal that the combined annualized revenue run rate for Amazon's AI training chip Trainium and general-purpose processor Graviton has exceeded $10 billion, maintaining triple-digit annual growth. Trainium 2 shipments reached 1.4 million units, while Trainium 3 supply was fully booked through mid-2026.

In recent years, Amazon has focused on developing AI training chips to reduce reliance on Nvidia. On December 3, 2025, AWS launched Trainium 3, its latest-generation product. Built on a cutting-edge 3-nanometer process, the third-generation chip and its accompanying system deliver over 4x faster training and high-load inference speeds compared to its predecessor, with memory capacity also quadrupled. Customers including Anthropic, Japanese large language model firm Karakuri, SplashMusic, and Decart have adopted Trainium 3, significantly reducing inference costs.

AWS also disclosed progress on the next-generation Trainium 4, expected to begin deliveries in 2027. This chip will deliver a major performance leap and support Nvidia's NVLink Fusion high-speed chip interconnect technology, enabling compatibility with Nvidia GPUs and attracting large AI applications developed for Nvidia's hardware to AWS. This strengthens Amazon's position to challenge Nvidia.

It is foreseeable that Nvidia's monopoly in the AI chip market will end, with Amazon emerging as a major contender after Google—a key reason for its $200 billion bet on the future. For Amazon, whose performance heavily depends on cloud computing, the escalating AI 'arms race' has evolved into a conflict it simply cannot afford to lose.