Honda's Woes: Profit Tumbles 60%, Electrification Efforts Stall

![]() 02/13 2026

02/13 2026

![]() 485

485

Two Wheels Outperform Four

Author|Wang Lei

Editor|Qin Zhangyong

Japan's second-largest automaker is facing mounting challenges.

Honda recently unveiled its financial results for the third fiscal quarter, revealing another substantial drop in profits. Operating profit plummeted by 61.4% year-on-year, marking the fourth consecutive quarterly decline and falling short of market expectations.

Furthermore, there was a stark contrast in profit contributions between the two-wheeled and four-wheeled segments, with the latter emerging as the main contributor to Honda's 'deficit-prone' nature. Since the automotive business slipped from profit to loss in the first quarter of fiscal year 2026, it has been incurring losses for three consecutive quarters.

Without the robust support of the motorcycle business, Honda Motor would now be deep in the red.

More critically, Honda's downward spiral seems unrelenting. In its annual forecast for fiscal year 2026, Honda projects a further decline in operating profit to 550 billion yen, with a profit margin of just 2.6%. This represents a 54.7% year-on-year decrease compared to the previous fiscal year.

As highlighted during the financial results briefing, Honda's automotive business is 'struggling.' After enduring multiple quarters of sustained declines, Honda is now delving into the root cause of this crisis.

01

Propped Up Solely by Motorcycles

Based on the stark data, it's fair to say this is Honda's darkest hour yet.

It's crucial to note that, unlike Chinese companies, the fiscal year for Japanese automakers begins in April. Thus, the financial results for the third fiscal quarter just released reflect performance from October to December 2025.

Although this period saw a reduction in U.S. tariffs on Japanese automotive imports from 27.5% to 15%, the repercussions of the 'tariff game' are far from over within a single fiscal quarter.

According to Honda's third fiscal quarter report, operating profit for the quarter stood at 153.4 billion yen (approximately $987.07 million), missing the average analyst expectation of 174.5 billion yen surveyed by LSEG. In comparison, operating profit for the same period last year was 397.3 billion yen, marking a staggering 61.4% year-on-year decline and the fourth consecutive quarterly drop.

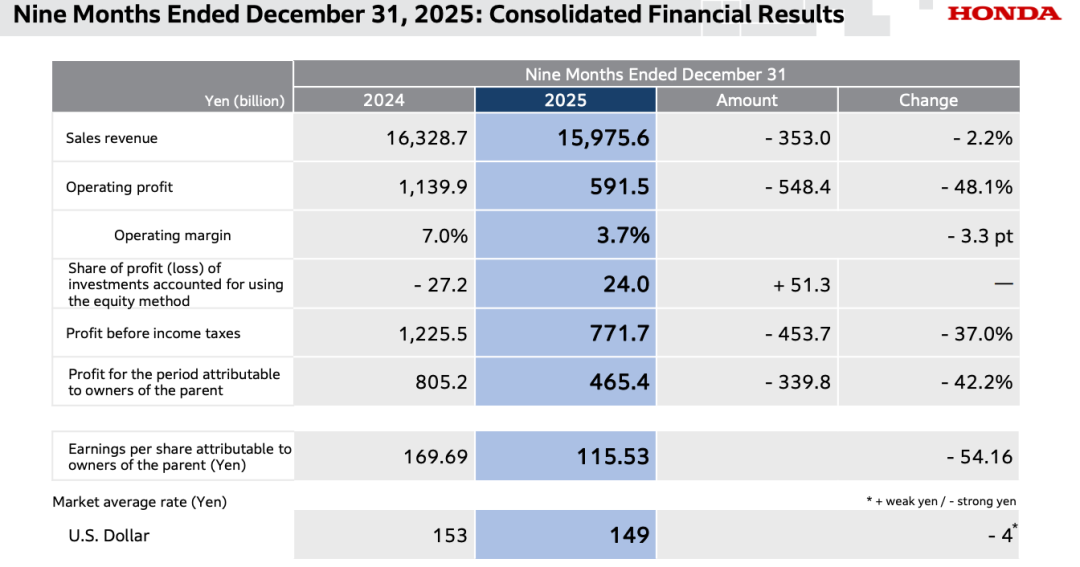

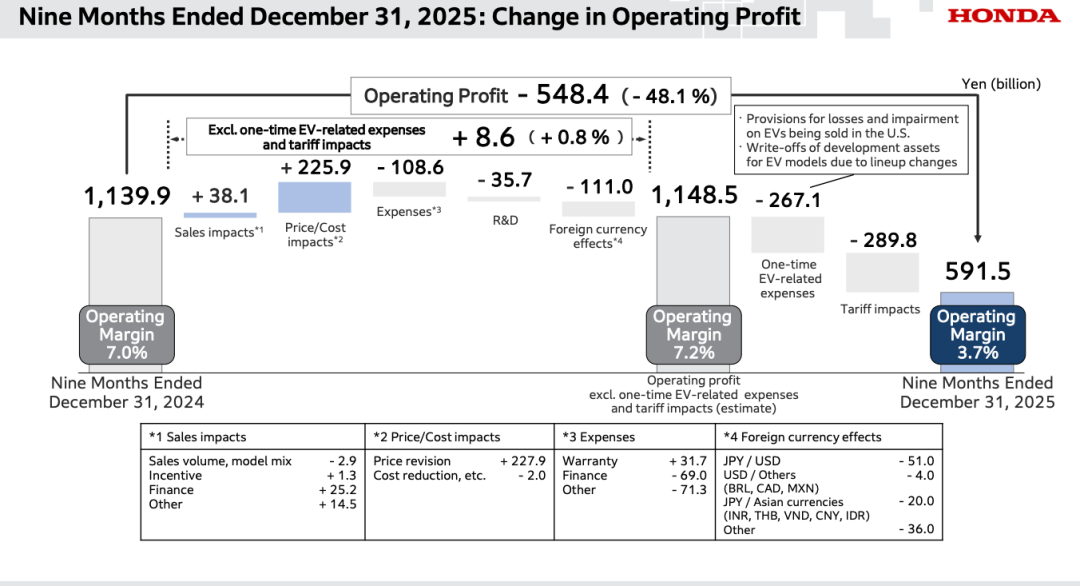

Looking at Honda's first three fiscal quarters, in the nine months ending December 31, 2025, the company's operating revenue was 15.98 trillion yen, a 2.2% year-on-year decrease. Operating profit plummeted to 591.5 billion yen, a 48% reduction compared to the 1.14 trillion yen in operating profit during the same period.

Net profit attributable to shareholders for the first three fiscal quarters was only 465.4 billion yen (approximately $3 billion), also significantly lower than the 805.2 billion yen in the same period last year, representing a year-on-year decline of over 42%.

In layman's terms, while Honda's total revenue from products and services sold over these nine months remained relatively stable, the actual profits earned have plummeted by more than 40%. This underscores immense cost pressures and a severe threat to profitability.

Fortunately, Honda still appears to be in the black.

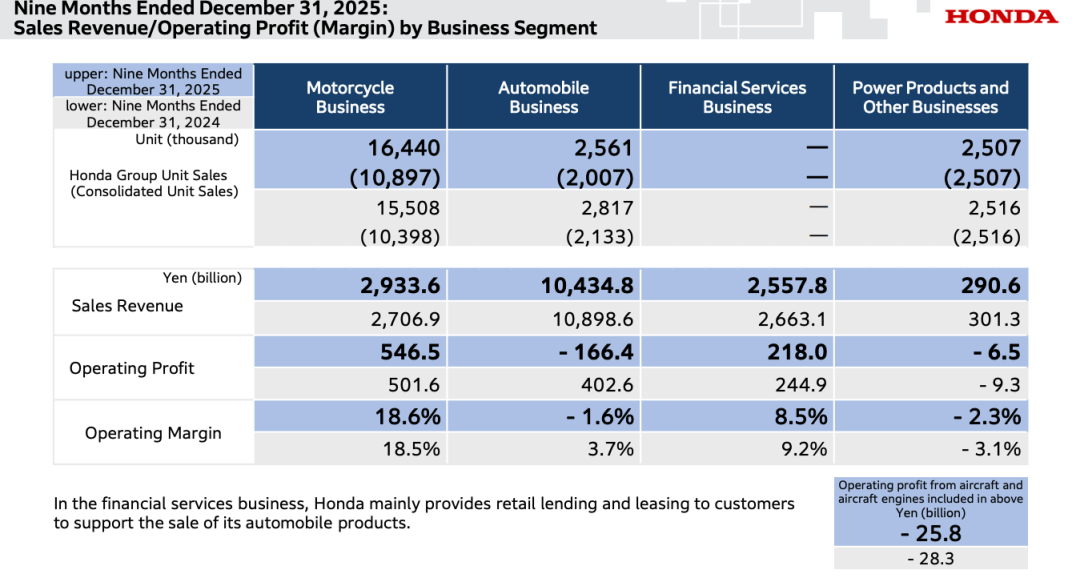

However, the motorcycle and automotive businesses are faring very differently. Without the strong performance of the motorcycle business, Honda Motor would now be operating at a loss.

Specifically, while generating relatively modest revenue, the motorcycle business remains a highly profitable and steadily growing 'cash cow' for Honda. Globally, 16.44 million motorcycles were sold, generating sales revenue of 2.93 trillion yen and an operating profit of 546.5 billion yen, with an impressive operating profit margin of 18.6%. By all key metrics, this represents a historical high.

Honda also noted that the anticipated impact of Vietnam's internal combustion engine restriction policies on sales was much more limited than initially expected, leading to record-high sales volumes, operating profit, and operating profit margins during the same period.

In stark contrast, the automotive business has become a significant drag on Honda's overall financial performance.

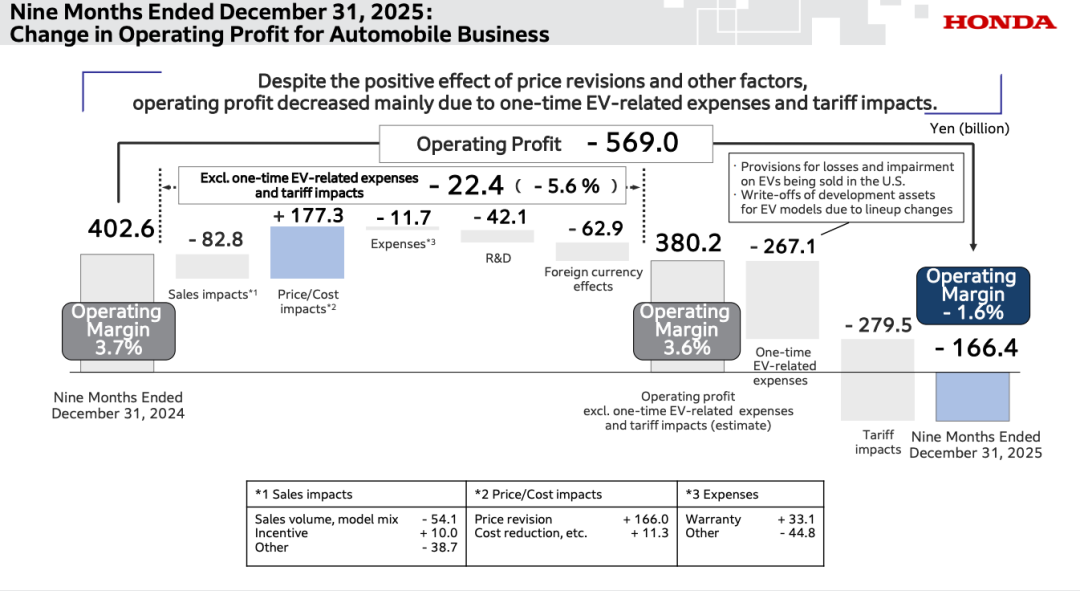

In the nine months ending December 31, 2025, Honda's automotive business sold 2.56 million units, a 9.1% year-on-year decrease. Total revenue was 10.43 trillion yen, not significantly different from the same period last year, but operating profit has turned from a profit of 402.6 billion yen in the same period last year to a loss of 166.4 billion yen (approximately RMB 7.52 billion), representing a precipitous drop.

China, as Honda's second-largest market, has also been a direct contributor to the poor performance of the automotive business. Although specific data for China was not disclosed in the financial report, Honda stated directly in the report that the decline in sales was due to a decrease in sales in Asia, particularly in the Chinese market.

A referenceable data point is that Honda Motor recently released its global production and sales data for the 2025 calendar year, with approximately 3.52 million vehicles sold worldwide. China was listed separately, with only 647,000 vehicles sold last year.

This also means that since reaching a peak of 1.627 million units sold in 2020, Honda's sales in China have declined for five consecutive years, dropping to 852,000 units in 2024 and then selling over 200,000 fewer units this year, representing a 24.28% year-on-year decrease.

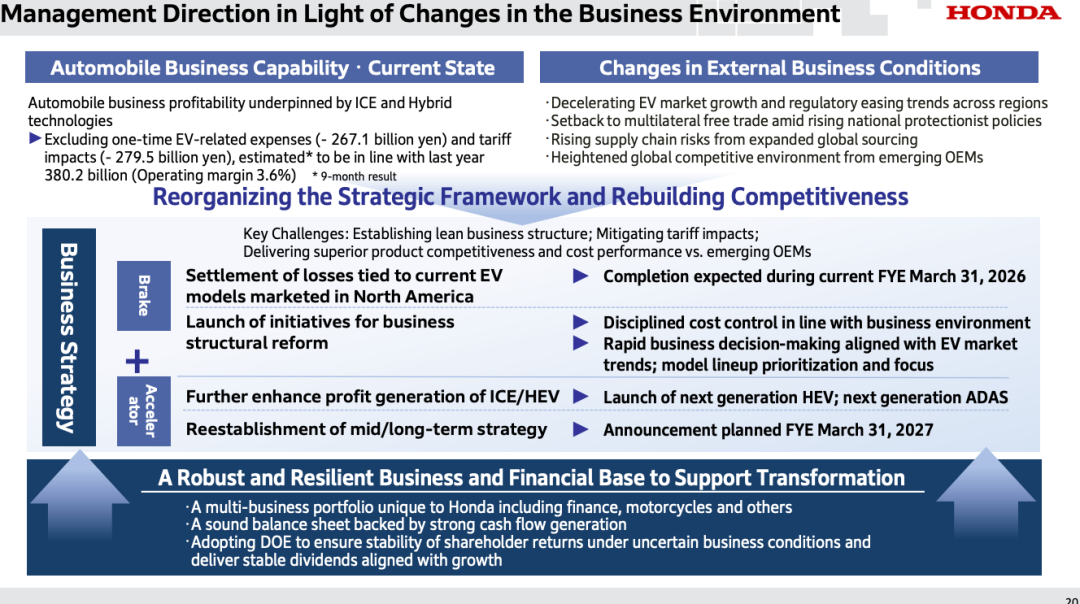

The consecutive quarterly operating losses have compelled Honda to reevaluate its previous large-scale investments in electrification.

02

Electrification Business Faces Retrenchment

Regarding the reasons for the significant profit decline in the first three fiscal quarters, Honda directly pointed out in the report that it was due to the impact of U.S. tariffs and one-time expenses related to electric vehicles.

Interestingly, Honda also provided performance figures in the financial report excluding the impact of one-time electric vehicle-related expenses and tariffs. Operating profit reached 1.14 trillion yen, a figure even stronger than the same period in the previous fiscal year. Similarly, operating profit for the automotive business also reached 380.2 billion yen.

The implication is clear: without being affected by these two factors, their performance would not have been so dismal.

According to the financial report, the negative impact of tariffs on Honda reached 289.8 billion yen (approximately RMB 13.1 billion), representing an unexpected expense for the company.

In April 2025, the United States imposed a 25% tariff on Japanese automobiles, raising the rate from 2.5% to 27.5%. Although it was subsequently reduced to 15% on September 4, it still represented a significant increase from the original 2.5%.

In fact, not just Honda but other Japanese automakers have also cited the impact of U.S. tariff policies in their financial reports. This is a key external factor weighing down the profits of Japanese automakers, given the popularity of Japanese vehicles in the United States.

In Toyota's recently released third fiscal quarter report, it was also explicitly stated that U.S. tariffs had a negative impact of 1.45 trillion yen on Toyota in the nine months ending December 31, 2025. As a result, although Toyota achieved sales growth in the North American market, its operating profit turned into a loss of 5.6 billion yen.

According to previous estimates by Nihon Keizai Shimbun, throughout fiscal year 2026 (ending March 2026), the total impact of U.S. tariffs on Japanese automakers will reach approximately 2.5 trillion yen.

Another major drag on Honda's financial performance was the impairment of electric vehicle development assets due to model lineup adjustments, amounting to 267.1 billion yen (approximately RMB 12.081 billion). This was also a key reason for the shift of Honda's core automotive business from profit to loss.

'The electrification we envisioned has not materialized as expected. We must fundamentally reevaluate our strategy to restore competitiveness,' Honda Executive Vice President Noriya Kaihara admitted during the financial results conference call.

'Our current challenge is to establish a lean operational structure that can flexibly respond to changes in the business environment,' he added, stating that Honda will 'significantly adjust its future electric vehicle strategy' and will announce new plans in the near future.

Moreover, Honda will continue to manage its business related to the North American electric vehicle market as much as possible this fiscal year, such as ending its cooperation with General Motors in the electric vehicle field and paying a certain amount of compensation, then shifting its strategic focus back to hybrid technology.

In fact, as early as the first half of last year, there were reports that Honda had decided to reduce its electrification investment from 10 trillion yen to 7 trillion yen by fiscal year 2031.

The adjusted strategy will also place greater emphasis on the research, development, and production of hybrid models. Honda plans to release 13 next-generation HEV models between 2027 and 2030, simultaneously improving fuel efficiency by 10% and reducing hybrid system costs by 30%, aiming to increase hybrid vehicle sales to 2.2 million units.

Honda is not alone in 'beating a retreat.' North American automakers are also undergoing an 'EV strategic retreat.' Stellantis recently announced that it would incur over 22 billion euros (approximately $26 billion) in impairment charges, related to its significant slowdown in pure electric vehicle plans. Earlier, Ford Motor also announced $19.5 billion in restructuring expenses for its electric vehicle business and reduced production capacity for electric pickups.

However, in the world's most competitive automotive market, China, time is running out for Honda.