Wole Technology: NVIDIA concept stock IPO in Hong Kong

![]() 07/25 2025

07/25 2025

![]() 669

669

In June this year, China's largest high-speed copper cable manufacturer, Wole Technology, submitted an application to the Hong Kong Stock Exchange, sprinting towards an 'A+H' listing.

Since its establishment, Wole Technology has built a complete industrial chain from copper core wire to finished copper cables. Its 224G PAM4 high-speed communication cable achieves a transmission distance of over 2.5 meters at 800G speeds, and this product has passed NVIDIA's GB200 system certification, making it an important indirect supplier.

In 2024, the company's performance and share price both achieved breakthroughs, with revenue and profit growth reaching a three-year high, and the share price also achieving a nearly 240% increase, fully demonstrating the Davis Double Play.

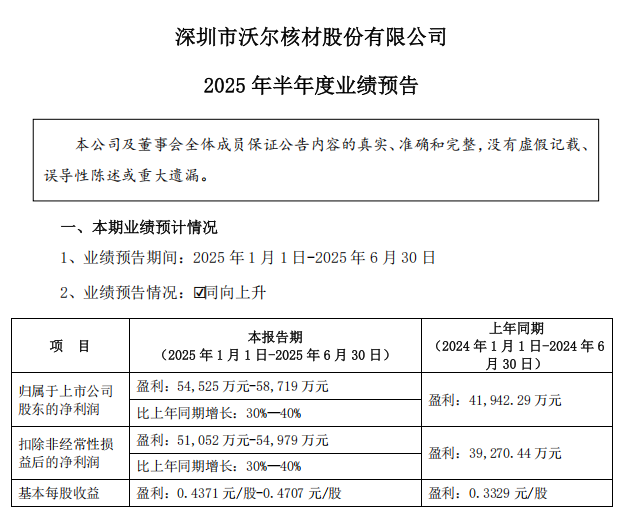

After the latest semi-annual report forecast was announced, Wole Technology demonstrated its ability to maintain profit growth. This year's first half is expected to achieve a net profit attributable to shareholders of 545-587 million yuan, with a year-on-year increase of 30%-40%, which is in line with previous management expectations. However, at the same time, the share price has seen a significant correction. Why is this?

I. NVIDIA Supplier

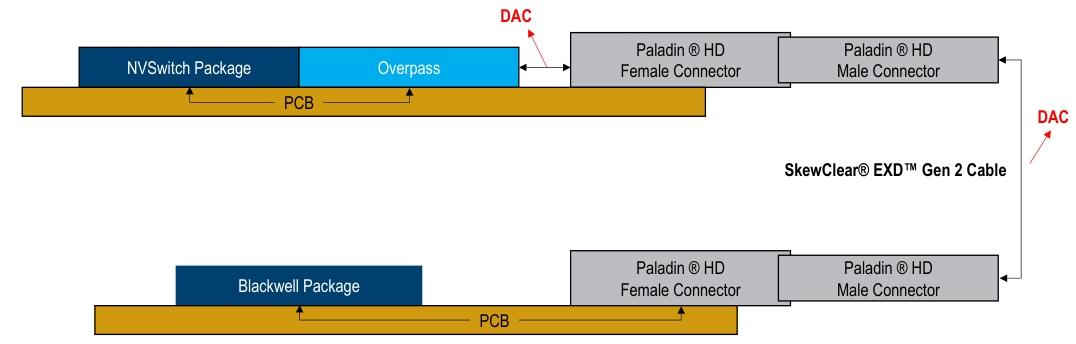

In 2024, NVIDIA launched the GB200 GPU chip and NVL series AI servers. It is understood that its GB200 NVL72 AI server connects internal GPUs and NVSwitches via DAC (Direct Attach Copper, a type of high-speed copper cable).

Source: SemiAnalysis, Daiwa

DAC refers to the technology that uses copper to transmit electrical signals for high-speed data transmission, mainly consisting of high-speed connectors and high-speed cables. In the IT and data center fields, high-speed and reliable connections are crucial, and the choice of cables significantly impacts performance. Copper cables are favored by the market due to their reliable stability and relatively low cost.

Huang Renxun introduced at GTC2024 that the use of copper cables for interconnection in NVL72 significantly saves costs compared to optical modules. It is expected that under the leadership of products such as GB200, the consumption of copper cables in AI data centers will increase. According to the LightCounting report, it is predicted that the high-speed cable market size will more than double in the next five years, reaching 2.8 billion dollars (approximately 20 billion yuan) by 2028.

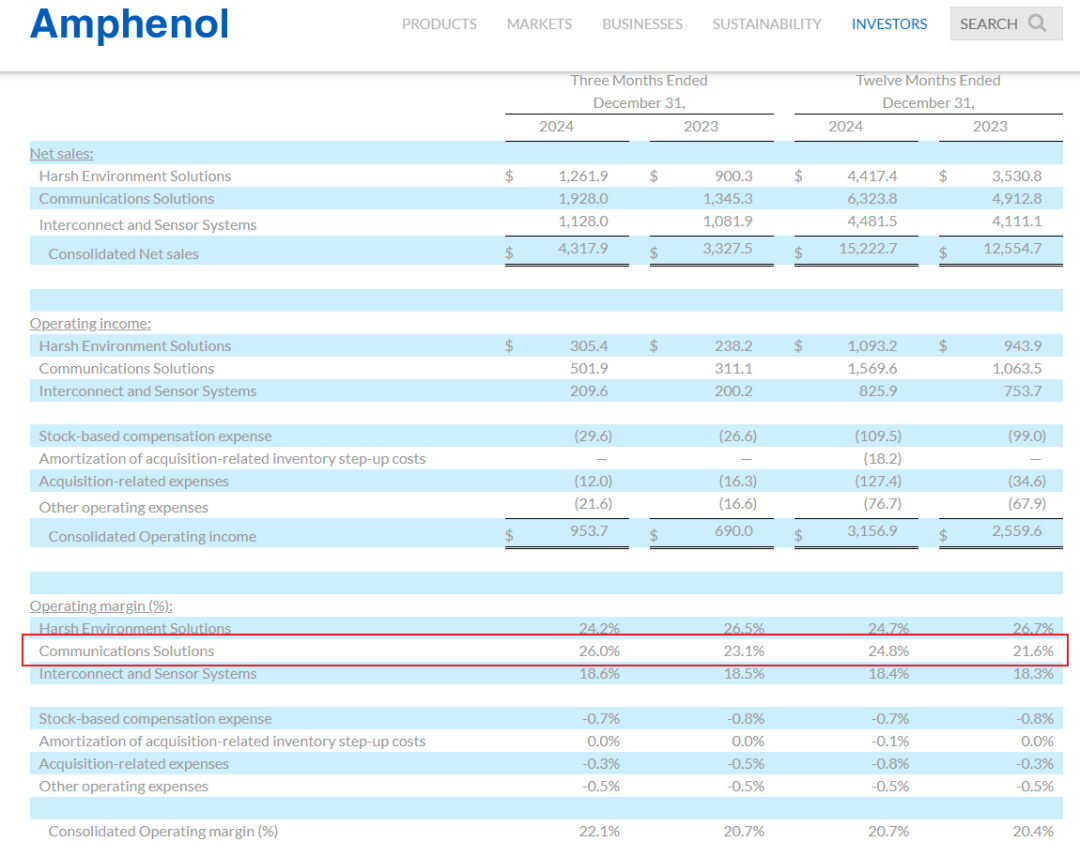

In terms of suppliers, Amphenol is the exclusive direct supplier of copper cables for NVIDIA's GB200 servers. Since acquiring the communication cable business of Leting Group, which has over 30 years of experience in the communication cable field, in 2013, Wole Technology has also strengthened its technical layout in this field. Today, relevant products have passed certification and gained favor from multiple international giant customers, including Amphenol, and are approved for use in NVIDIA's computing servers.

From 2022 to 2024, the company's revenue was 5.341 billion yuan, 5.723 billion yuan, and 6.927 billion yuan, respectively, with year-on-year increases of -1.22%, 7.16%, and 21.02%; net profit was 660 million yuan, 758 million yuan, and 921 million yuan, respectively, with year-on-year increases of 12.91%, 14.79%, and 21.48%.

In 2024, the year with the fastest performance improvement, the company's share price achieved a cumulative increase of nearly 240%.

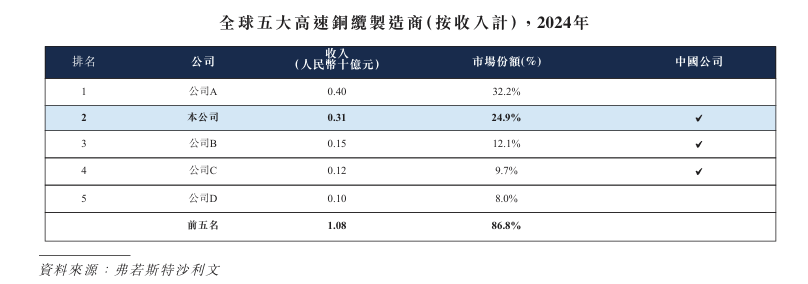

However, Wole Technology is not the sole supplier to Amphenol, and two Chinese peers are also present in the global competitive landscape.

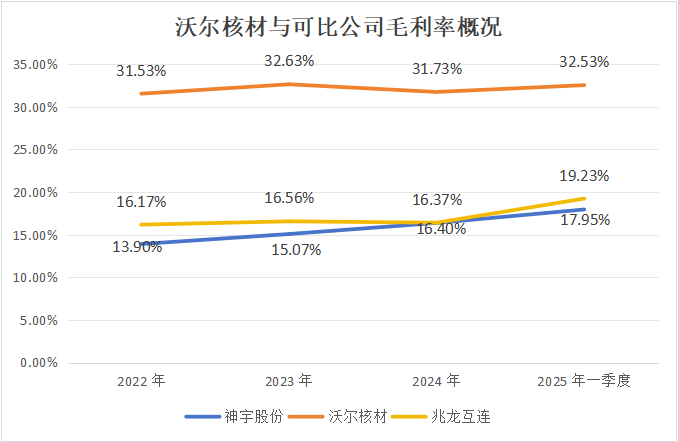

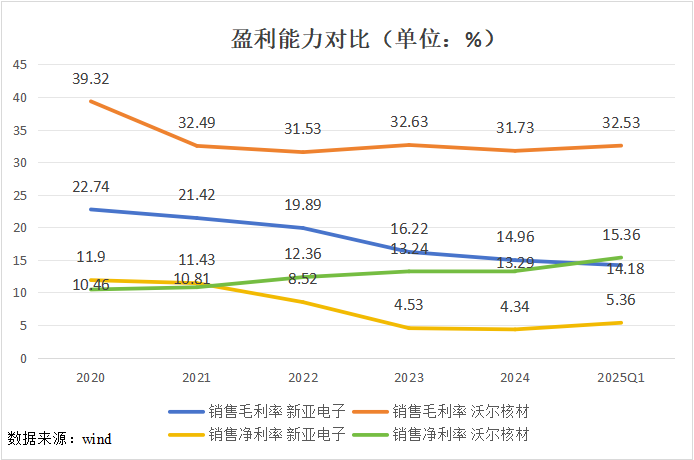

However, comparing profit levels, from 2022 to the first quarter of 2025, Wole Technology's gross profit margin has remained stable at above 30%, far exceeding that of its comparable companies Shenyu and Zhaolong Interconnect.

Firstly, it is because Wole Technology has sufficient core manufacturing equipment.

The core equipment for producing high-speed copper cables is the foaming machine from Rosenberger, for which there are no alternative manufacturers, and the company's annual production capacity is only a dozen units, making this equipment a bottleneck. In the domestic market, Wole Technology currently has 5 units, while Shenyu only has 1. In addition, Wole Technology has ordered 20 foaming machines from Rosenberger, with 10 expected to be delivered next year.

Now, both NVIDIA and Amphenol are urgently requesting copper cable orders. The company with the most sufficient core equipment has the best supply capability and thus gains favor from major customers.

Secondly, the company's products have a high yield rate and technical advantages.

While the foaming machine is important, the demand for related equipment in actual production is also based on technical strength. Wole Technology is the only domestic enterprise to achieve mass production of 224G PAM4 copper cables. Its subsidiary Leting's 224G copper cables perform on par with international top brands, with a long-term stable yield rate of over 90%.

In contrast, Zhaolong Interconnect's high-speed copper cables are still stuck at the relatively low-end specification of single-channel 112G and have not yet achieved mass production of 224G high-speed cable products.

Sufficient equipment, excellent technology, and a stable yield rate are the core competitiveness of Wole Technology. In 2024, the company's revenue from Amphenol accounted for 4%, up from 2.6% two years ago, also indirectly verifying the company's strength.

According to Light Counting data predictions, with the development of AI and the increase in computing power, the global high-speed copper cable market will continue to expand at a CAGR of 25% during the period from 2023 to 2027. However, such an attractive market is always threatened by competitors.

II. Threats from New Technologies

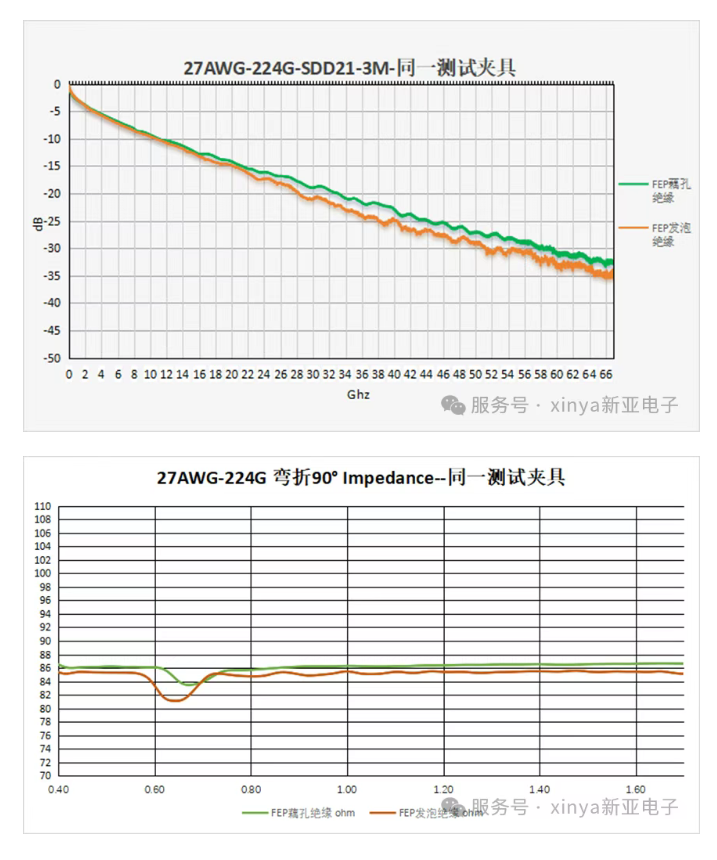

To get rid of the constraints of foaming equipment, Amphenol and Xinya Electronics jointly tackled the problem and developed a new high-speed copper cable extrusion process manufacturing technology - the lotus core structure solution. The advantage of this solution is that it can manufacture high-speed copper cables, including 224G/448G, without overseas foaming machines.

Although the lotus core structure is an old technology, according to data published on Xinya's own official account, its performance is even slightly superior to newer foaming technologies.

The collaboration between major customers and peers may threaten Wole Technology's position as the 'primary supplier'.

From the perspective of supply chain security, Wole Technology has almost monopolized Rosenberger's foaming equipment capacity for the next few years, increasing its discourse power in high-speed cables, which is not good news for Amphenol. The joint development of alternative technologies with Xinya Electronics is out of fear that Wole Technology's 'monopoly' will restrict Amphenol.

Affected by this, Wole Technology's share price experienced some adjustments, while Xinya Electronics, as the pioneer of the alternative technology, gained several trading limits, with the market anticipating its own Davis Double Play.

Although the collaboration between major customers and peers may indeed pose a threat, the high-speed copper cable market is expected to double in size in the future, and besides Amphenol, Wole Technology can also find a 'secondary supplier' by following the same method. It is rumored that the company is currently attempting to establish a cooperative relationship with Credo, the world's second-largest core enterprise in the field of high-speed copper cable connectivity technology.

Furthermore, in the AI industry, when customer demand is urgent, product stability and supply chain response speed are often more important.

Xinya Electronics currently only has 3 production bases, and it is still unknown whether the yield rate and stability of its new technology products can keep up. In contrast, Wole Technology has nine manufacturing bases in China and one overseas factory in Vietnam, supporting its global delivery capabilities, and its high yield rate has been verified over a long period of time.

Source: Wole Technology Prospectus

Returning to the actual operating level, from 2019 to 2024, Wole Technology's period expense ratio decreased from 26.95% to 15.09%. Strengthened cost control has driven continuous growth in net profit rate, and its profitability is unmatched by many industry peers, including Xinya Electronics.

This is not only because the company has certain technological and customer advantages in the field of high-speed copper cables but also because its multi-field business development contributes to its different profit levels.

III. Multi-field Development

Wole Technology has layouts in multiple high-growth fields, which collectively contribute to performance improvement.

The company is not only the world's second-largest and China's largest high-speed copper cable manufacturer with a market share of 24.9% but also China's largest manufacturer of DC charging guns for new energy vehicles with a market share of 41.7%, and the largest manufacturer in the global heat-shrinkable materials industry with a market share of 20.6%.

These industries are expected to grow rapidly in the future. For example, the global high-speed copper cable market is expected to increase from 1.9 billion yuan in 2025 to 4.9 billion yuan in 2029, with a CAGR of 26.9%; the market for China's DC charging gun industry is expected to reach 4.1 billion yuan by 2029, with a CAGR of 24.7% from 2025.

Judging from the business composition in 2024, the combined revenue share of Wole Technology's power and new energy products was approximately 34%, serving as the main driver of its revenue growth. In contrast, according to Wind data, the revenue contributed by the company's high-speed copper cable business was only about 10%.

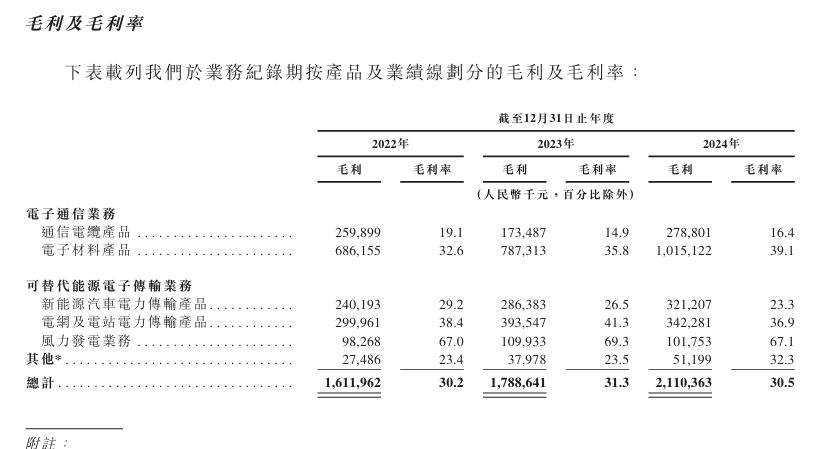

From the perspective of gross profit margin, the high-speed copper cable business is not the main contributor to the company's profit growth. Instead, its communication cable product category has the lowest gross profit margin.

Therefore, the company's continuous performance increase in previous years was due to the overall development of its business, rather than solely driven by high-speed copper cables, and this is expected to remain the case in the coming years.

The revenue of its electric vehicle division is expected to continue to be the main driver, relying on the development of China's electric vehicle infrastructure. In addition, despite market doubts that it may lose its position in the NVIDIA supply chain due to new technologies, the company's high-speed communication cable business is still experiencing rapid revenue growth. The company revealed that its high-speed communication cable equipment is currently operating at full capacity.

Moreover, high-speed copper cables have not yet become Wole Technology's dominant segment, meaning there is still significant potential for it to contribute to performance. Roughly referencing Amphenol's 24.8% gross profit margin for its communication solution business, which includes high-speed copper cables, in 2024, there is still room for further improvement in Wole Technology's profitability in this business.

However, in 2024, the company's share price has already accumulated a nearly 240% increase. Based on current growth assumptions, the current share price is reasonable. Although multi-field development can stabilize the company's profitability, it also restricts the growth rate to a certain extent.

IV. Need for More Catalysts

According to Wind's earnings forecast, its net profit attributable to shareholders for the full year 2025 is expected to be 1.3 billion yuan, corresponding to a PE ratio of around 25 times, which is lower than the industry average. The latest semi-annual report shows that Wole Technology has indeed demonstrated its ability to maintain profit growth. However, this is still significantly lower than the growth rate of other NVIDIA suppliers when they ramp up production, which is one of the reasons why its valuation is lower than the industry average.

There is a tricky aspect to the company's growth story: merely meeting management expectations is not enough. It is still necessary to pay attention to global AI capital expenditures and demand trends.

At the GTC conference in March 2025, NVIDIA unveiled the GB300 and announced that it would be put into production in Q2. In July this year, CoreWeave announced the receipt of the world's first GB300 NVL72 AI server system, marking the entry of GB300 into the commercial stage, albeit in early small-batch supplies.

NVIDIA's products are necessary for AI to move to the next stage, and the rapid rebound in NVIDIA's share price since April has refocused market attention on AI. If the company, as usual, exceeds expectations in Q2 performance and raises its earnings guidance, this could become a catalyst for Wole's share price. Conversely, it would pose a risk.

As of the end of April this year, Woer New Material had approximately RMB 1 billion in cash on its balance sheet and RMB 1.07 billion in bank and other borrowings, indicating certain liquidity risks.

However, such companies have no worries about not being able to borrow money. The short-term market competition landscape will not change significantly, and the company's position remains unchanged. Moreover, as a supplier to NVIDIA, it is a scarce target in Hong Kong stocks. With the continuous penetration of GB200 and the commercialization of GB300, the company's performance is expected to further grow.

It should also be noted that stocks in industries where technology needs continuous iteration and customers have significant influence are not recommended for heavy investment. However, if Woer New Material's Hong Kong stock pricing is discounted compared to its A-share pricing, and the discount is significant, it is still worth paying attention to.

Conclusion

Overall, Woer New Material has strong product and technology barriers. The company's performance has grown steadily over the years, and its profit quality is excellent. As an indirect supplier to NVIDIA, it is expected to achieve volume growth in copper cable products with the launch of related chips, further promoting performance, especially profitability.

However, it should also be noted that the company's profit growth rate has not yet reached the "standard" of NVIDIA's major suppliers. Only when the growth rate continues to narrow the gap and reach the standard, will the company's stock price have the potential for the next major uptrend in this process.