After a 21-Year Odyssey, Chery Automobile Makes Its Long-Awaited Debut on the Hong Kong Stock Exchange

![]() 09/25 2025

09/25 2025

![]() 557

557

After a 21-year journey towards listing, Chery Automobile, China's second-largest independent automotive brand, is poised to embark on a new chapter of global expansion.

On September 25, Chery Automobile Co., Ltd. (9973.HK) made its official debut on the Hong Kong Stock Exchange, opening at HK$34.2 per share. The stock price then soared rapidly, with the market capitalization at one point surpassing HK$200 billion.

For this listing, Chery Automobile set the share price at the upper limit of the offer price, HK$30.75 per share. It globally offered approximately 297 million H shares and raised HK$9.14 billion. This IPO stands as the largest automotive offering on the Hong Kong Stock Exchange so far in 2025. The Hong Kong public offering witnessed a subscription rate of 308.18 times, while the international placement saw a subscription rate of 11.61 times, reflecting the strong market enthusiasm for this leading Chinese independent automotive manufacturer.

Chery Automobile's path to listing has been a long and arduous one. The initial listing plan surfaced in 2004 but was put on hold due to complex shareholding relationships with SAIC Motor. Subsequently, Chery explored various avenues, such as backdoor listings and cross-shareholdings, to advance its listing ambitions. However, none of these efforts bore fruit due to unfavorable market conditions and business adjustments.

On February 28 of this year, Chery Automobile submitted its initial prospectus to the Hong Kong Stock Exchange. It passed the listing hearing on September 7 and finally achieved its listing goal on September 25.

This successful listing marks Chery Automobile's 'ice-breaking' foray into the capital market and signifies the official entry of the last unlisted leading domestic automotive enterprise into this arena. It not only provides Chery with an international capital platform but also represents the culmination of its two-decade-long journey towards listing.

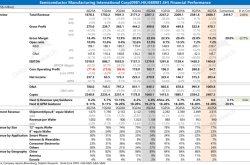

According to the prospectus, Chery Automobile has demonstrated remarkable performance growth in recent years. From 2022 to 2024, the company's operating revenue surged from RMB 92.618 billion to RMB 269.897 billion, boasting a compound annual growth rate of 70.7%. Net profit rose from RMB 5.806 billion to RMB 14.334 billion, with a compound annual growth rate of 57.1%.

In the first quarter of 2025, the company achieved operating revenue of RMB 68.2 billion, marking a year-on-year increase of 24.2%. Net profit reached RMB 4.7 billion, representing a substantial year-on-year surge of 90.9%.

In terms of sales volume, Chery Automobile achieved a global sales volume of 2.295 million units in 2024, a record high. This solidified its position as the 'second-largest seller of Chinese independent brand passenger vehicles' and ranked it 'eleventh in global passenger vehicle sales.'

In the first half of 2025, Chery Automobile sold 1.26 million units, a year-on-year increase of 14.5%. Exports reached 550,300 units, up 3.3% year on year, maintaining its top position among Chinese automotive exporters. Sales of new energy vehicles reached 359,400 units, a year-on-year increase of 98.6%, ranking among the fastest-growing in the industry.

According to the fundraising plan, Chery Automobile intends to allocate 35% of the raised funds to R&D for different models and versions of passenger vehicles, 25% to R&D for next-generation vehicles and advanced technologies, 20% to expanding overseas markets and implementing the company's globalization strategy, 10% to upgrading production facilities in Wuhu, Anhui, and the remaining 10% to working capital.

This fund allocation plan is closely aligned with Chery Automobile's current strategic priorities. By increasing R&D investment, the company aims to accelerate R&D in new energy technologies and product deployment, as well as expedite the completion of its global strategy.

For Chery Automobile, which has been in operation for 28 years, listing is not merely a financing channel but also a new starting point for global competition. Whether Chery can harness the power of the capital market to accelerate its transition to new energy vehicles and its globalization strategy will determine its ability to secure a more prominent position in the future global automotive industry landscape.