Zhida Technology: The 'Pioneer Stock' in Home EV Charging Debuts on HKEX with a 192% First-Day Surge

![]() 10/11 2025

10/11 2025

![]() 678

678

Zhida Technology makes its HKEX debut, with Chairman Huang Zhiming (left)

On October 10, mainland tech stocks listed in Hong Kong saw a widespread decline. Amidst the sea of red, Zhida Technology, China's first publicly traded home EV charging station provider, stood out with a remarkable surge on its debut.

After submitting its prospectus to the HKEX three times, Zhida Technology finally listed on October 10, opening with a 183.92% spike. By market close, its shares had soared to HK$195.5, marking a 192.14% increase from its IPO price of HK$66.92, giving it a market capitalization of HK$11.689 billion.

Zhida Technology holds a unique position in China's home EV charging solutions market, boasting the largest market share. The company offers a comprehensive suite of services, including charging station equipment, installation services, a digital platform, and digital energy management for home charging scenarios. It also stands out with its 'hardcore technology,' exemplified by the development of an automatic charging robot.

However, Zhida Technology is still on its path to achieving profitability.

In its prospectus, Zhida Technology outlined its strategy: "We are strategically lowering prices to expand our market share and maintain our leading position."

"Once the competitive landscape stabilizes, we will focus on improving gross margins," the company stated. Additionally, it aims to achieve profitability through optimizations in the domestic EV supply chain, innovative marketing strategies, overseas market expansion, and technology product development.

01 The Pioneer in Home EV Charging

For the new energy vehicle and charging industries, Zhida Technology initially made a strong impression as Tesla's home charging service provider.

Founded in 2010, Zhida Technology embarked on its journey by providing home charging station installation services.

The story begins in Shaxian County, Fujian Province, the birthplace of the renowned "Shaxian Delicacies."

In 1993, Huang Zhiming, the top scorer in the science section of Shaxian No.1 High School's college entrance exam, was admitted to the Automotive Engineering Department at Tongji University in Shanghai. He is the founder of Zhida Technology.

Huang Zhiming speaking at the listing ceremony

After graduating from Tongji University's Automotive Engineering Department, Huang Zhiming worked at SAIC Volkswagen for 12 years.

In 2010, Huang Zhiming founded Shanghai Zhida Technology Development Co., Ltd., targeting the then-nascent charging station industry.

At that time, China's new energy vehicle market was still in its demonstration and pilot operation phase, with no significant private consumer market or charging station market.

In 2014, Tesla entered China and sought local installation service providers. Huang Zhiming seized the opportunity and became Tesla's first and primary home charging service provider.

As China's new energy vehicle market grew, Zhida Technology expanded its business scope to include not only installation services but also the production and sales of home charging station equipment, service platforms, and a small-scale involvement in community charging. It also provided energy management solutions that combined photovoltaic power with charging for home charging scenarios.

Zhida Technology and shareholder Zhongding jointly built a charging station production factory

Its business forms and clients have continuously evolved.

Providing home charging stations and installation services for automakers remains its core business, but its clients have shifted to the major players in China's new energy vehicle market. BYD is not only one of its largest clients but also a shareholder.

Beyond BYD, among China's top ten automakers by EV sales in 2024, Zhida Technology provides charging stations, accessories, or services to seven of them. As Chinese new energy vehicles expand overseas, Zhida Technology also supplies charging stations and installation services abroad.

Additionally, as some automakers have stopped providing free charging stations and installation services, Zhida Technology now directly sells charging stations and installation services to consumers. On e-commerce platforms, Zhida Technology ranks among the top three brands in charging station sales.

Furthermore, Zhida Technology has undertaken some community charging projects, sells home energy management solutions, and develops automatic charging robots.

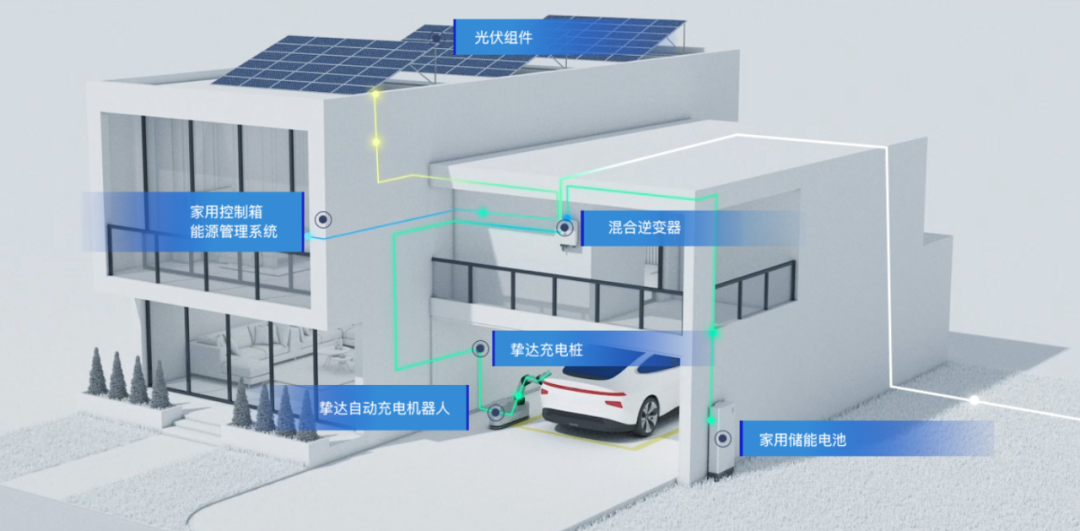

Zhida Technology's home energy management solution

Thus, Zhida Technology has become the leader in this niche market. According to its prospectus, since 2022, Zhida Technology has ranked first in China in terms of cumulative sales volume and sales revenue of home EV charging stations, with market shares of approximately 13.6% and 10.3%, respectively. Globally, it ranked fifth in home EV charging station sales in 2024, with a market share of approximately 3.9%. In China, it ranked third in home EV charging station sales in 2024, with a market share of approximately 6.6%.

Cumulatively, Zhida Technology has delivered 1.3 million EV charging stations and completed 1.3 million installations and after-sales service tasks.

From 2022 to 2024, Zhida Technology's revenues were RMB 697 million, RMB 671 million, and RMB 593 million, respectively.

Given its rankings and revenues, why has Zhida Technology seen a declining trend?

02 Even Leaders Face Challenges

In the home charging station market, automakers generally rely on third parties for charging equipment and installation services.

However, this market is characterized by intense price competition, low customer recognition of product differentiation, and low competitive barriers.

According to the prospectus, the average selling price of Zhida Technology's charging stations to automakers was RMB 711.6, RMB 839.1, RMB 697.9, and RMB 721.9 in 2022, 2023, 2024, and the first quarter of 2025, respectively.

This situation is compounded by Zhida Technology's over-reliance on its major client, BYD.

In its prospectus, Zhida Technology disclosed that in 2022, 2023, each year, and the first quarter of 2025, revenues from "Client B" accounted for approximately 38.3%, 32.0%, 25.0%, and 17.0% of its total revenues in the respective periods.

In mid-2023, amid intensifying price competition, Zhida Technology failed to secure a bid from Client B, leading to a drop in EV charging station sales to Client B from 85,000 units in 2023 to 2,706 units in 2024, and to zero units in the first quarter of 2025. Revenues from Client B were RMB 214 million, RMB 148 million, and RMB 36.9 million, accounting for 32.0%, 25.0%, and 17.0% of its revenues, respectively.

This largely explains the decline in Zhida Technology's revenues.

Meanwhile, despite having a gross margin close to 20%, Zhida Technology's profitability remains poor due to relatively high operating expenses.

"Since our inception in 2010, we have been operating at a loss," the prospectus stated. Zhida Technology reported net losses of RMB 25.1 million, RMB 58.1 million, and RMB 235 million in 2022, 2023, and 2024, respectively.

What is the solution?

Firstly, the battle must continue. Zhida Technology stated in its prospectus that it is also lowering prices to expand its market share and maintain its leading position, hoping to focus on improving gross margins once the competitive landscape stabilizes.

Regarding clients, Zhida Technology aims to reduce its reliance on automakers and increase its direct-to-consumer retail sales. Although price competition exists in this market, prices are generally higher than those for automakers. In the first quarter of 2025, Zhida Technology sold 40,200 retail charging stations, a significant 4.36-fold increase year-on-year.

Searching for "charging stations" on Tmall, Zhida's products rank at the top

In 2024, Zhida Technology's retail business revenue reached RMB 75.2 million, accounting for 12.7% of its total revenue.

Given the higher profit margins and profitability of retail sales, this revenue stream will also enhance overall profitability.

Secondly, Zhida Technology is developing high-margin products, exemplified by its automatic charging robot, which boasts a gross margin of up to 30%.

Zhida Technology launched its first EV charging robot product in October 2023, generating RMB 4.1 million in revenue in 2024. In the first quarter of 2025, it delivered 10 EV charging robots, generating RMB 1.9 million in revenue. The average selling price of charging robots is approximately RMB 188,200.

Zeekr's automatic charging robots primarily come from Zhida Technology.

Thirdly, Zhida Technology is actively expanding its international business. Its products and services now cover 22 countries. In Thailand and Brazil, two rapidly growing EV markets outside China, Zhida Technology is one of the first and most recognized providers. It has also built and commenced operations at a factory in Thailand and is constructing a joint venture factory in Saudi Arabia.

Zhida Technology's Thai factory is now operational

As the average selling price of charging stations in overseas markets is generally higher than in China, this will contribute to higher profitability.

Additionally, Zhida Technology aims to effectively manage sales costs and reduce operating expenses to enhance overall profitability.

The challenges in achieving profitability stem from both Zhida Technology's internal issues and industry-wide problems. Besides the aforementioned price wars, there are also difficulties with payment terms.

Zhida Technology reported that the average trade receivables turnover days were 194, 248, 231, and 163 days in 2022, 2023, 2024, and the first quarter of 2025, respectively.

The 163 days in this quarter are already described by Zhida Technology as an "improvement."

During Zhida Technology's pursuit of listing, China's automotive authorities have also been addressing payment delays.

Following the State Council's revision of the "Regulations on Ensuring Payments to Small and Medium-sized Enterprises," major automakers have committed to their suppliers to keep payment terms within 60 days.

If the issues of excessive price competition and prolonged payment delays in China's automotive industry can be resolved, it will be a significant boost for Zhida Technology's path to profitability.

This would also be beneficial for the new energy vehicle industry. After all, how can a home charging station industry, where even the leader is struggling to be profitable, provide positive support to the entire vehicle sector?

-END-