Are Joint Venture Automakers Finally Launching a "Desperate Counterattack"?

![]() 10/11 2025

10/11 2025

![]() 559

559

After enduring a "trough period" for five consecutive years, the market share of joint venture automakers has finally halted its decline and started to rebound. In addition to the recovery in the fuel vehicle market, more significantly, through a series of transformative initiatives, joint venture brands have begun to regain their momentum.

Joint venture brands, which have seen their market share in China decline for five straight years, seem to be entering a new phase of "desperate counterattack." According to data from the China Association of Automobile Manufacturers (CAAM), in the first seven months of this year, except for February, the cumulative monthly market share of passenger cars from joint venture brands remained consistently above 31%, without showing a significant month-by-month decline (calculated based on the monthly released market share data of Chinese brands). The latest statistics from the China Passenger Car Association (CPCA) reveal that in July this year, the retail sales volume of mainstream domestic joint venture brands reached 450,000 units, marking a 1% year-on-year increase. This represents the second time this year that a positive year-on-year growth has been achieved, following a 5% increase in June.

Some analysts argue that the "halt in decline and rebound" of joint venture automakers is not solely attributable to the recent recovery in the fuel vehicle market but also, more importantly, to their self-reflection and transformation in recent years. For instance, by breaking away from the original pricing system, actively embracing new energy and intelligent connected technologies, accelerating product update cycles and innovative marketing models, as well as intensifying, broadening, and deepening cooperation with Chinese enterprises, joint venture brands are regaining their development pace and attempting to secure greater growth opportunities while stabilizing their existing market positions.

From the "Altar" to Initial Signs of Recovery

Over the past five years, joint venture brands have fallen from their pedestal and bid farewell to the golden era of "effortless profitability."

Recall that in 2020, joint venture brands dominated the Chinese passenger car market with a 64% market share and annual sales of 12.4 million units. At that time, joint venture brands topped multiple rankings released by the CPCA, including manufacturer retail sales, sedan segment, and SUV segment.

However, times have changed. With the rapid rise of new energy vehicles in the domestic market, the market share of domestic brands has surged. According to data from the CAAM, the overall sales volume of Chinese brand passenger cars soared from 7.749 million units in 2020 to 17.97 million units in 2024, while the market share of joint venture brand passenger cars plummeted from 61.6% in 2020 to 34.8% last year.

In just five years, the dynamics between Chinese brands and joint venture automakers have reversed. During this period, some marginal joint venture brands were forced to exit the Chinese market, including DS, Renault (which later returned as imported vehicles), Acura, GAC-FCA, and Mitsubishi Motors. Some brands were compelled to close factories and reduce production capacity. In January 2024, Beijing Hyundai's Chongqing factory was sold for 1.62 billion yuan, a "bargain price" that was over 2 billion yuan lower than the initial listing price. In 2024, Dongfeng Nissan closed its Changzhou factory, marking the first time Nissan has shuttered a passenger car factory in China. Some have resorted to layoffs to cut costs. In 2023, Guangqi Honda conducted its first layoff, dismissing approximately 900 contract workers, accounting for 7% of its then approximately 13,000 employees. In May 2024, Guangqi Honda offered generous compensation and solicited approximately 1,700 voluntary resignations, accounting for 14% of the company's total workforce. Dongfeng Honda followed suit, laying off approximately 500 labor dispatch workers and 2,000 regular employees.

Fortunately, by the first half of this year, there were finally signs of recovery in the "winter" faced by joint venture brands. Data from the CPCA shows that in June this year, the retail sales volume of mainstream domestic joint venture brands increased by 5% year-on-year and 6% month-on-month. Sales of brands such as FAW Toyota, FAW-Volkswagen, SAIC Volkswagen, and GAC Toyota all achieved varying degrees of growth.

Support from the Rebound in the Fuel Vehicle Market

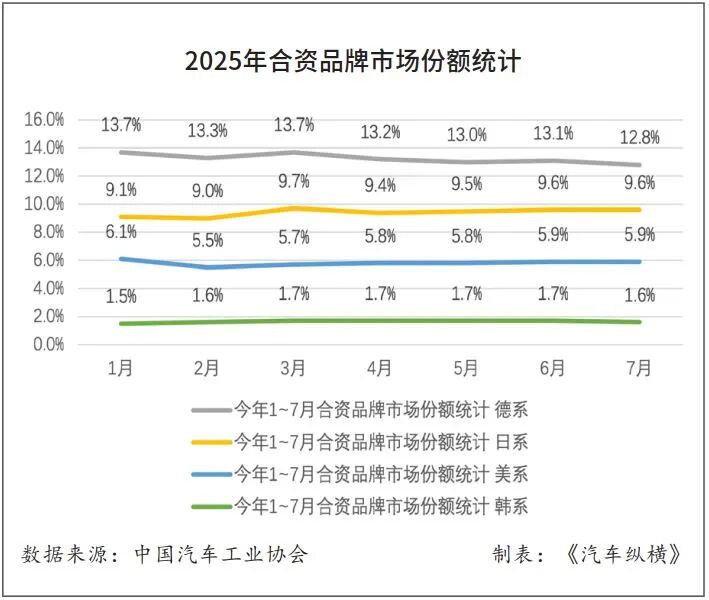

According to statistical data from the CAAM, in the first seven months of this year, the cumulative market share of domestic joint venture passenger cars has remained consistently above 31% (except for February at 30.6%) and has not shown a gradual decline. Among them, the market share of German brand passenger cars has hovered around 13%, Japanese brands have exceeded 9%, American brands have approached 6%, and Korean brands have stabilized at over 1.5%.

The most direct reason for this rebound is the recent recovery in fuel vehicles. Data recently disclosed by the CAAM shows that in July, domestic sales of traditional fuel vehicles reached 981,000 units, marking an 8.4% year-on-year increase and the second consecutive month of growth. In the first half of this year, FAW-Volkswagen sold a cumulative total of 436,100 units, a 3.5% year-on-year increase. Among them, the market share of fuel vehicles increased by 0.7 percentage points year-on-year to 7.6%. SAIC Volkswagen's terminal sales in the first half of the year reached 523,000 units, a 2.3% year-on-year increase. Fuel vehicle models such as the Lavida, Passat, and Tiguan contributed 137,000, 117,000, and 91,000 units, respectively.

It is worth noting that although the fuel vehicle market is a traditional stronghold for joint venture brands, they did not achieve a turnaround solely by relying on past successes. According to Cui Dongshu, Secretary-General of the CPCA, the positive performance of many joint venture brands in the first half of the year is inseparable from strategies to stabilize channels and prices. Joint venture brands such as SAIC Volkswagen, GAC Toyota, and SAIC General Motors have all introduced a "fixed price" model for some models, enhancing cost-effectiveness and reducing consumer hesitation. Looking ahead, Zhou Lingkun, President of the China Enterprise Technology and Performance Business Group at Deloitte, believes that after the penetration rate of new energy vehicles in China increases from 50% to 60%, it may enter a plateau period and show a gradual upward trend. He suggests that joint venture and foreign automakers can extend the lifecycle of fuel vehicles by tapping into the replacement demand of existing fuel vehicle users and adopting measures such as product intelligence, scenario-based marketing, and improving user services.

Accelerating the Transition to New Energy and Intelligent Connected Directions

Indeed, fuel vehicles still play a significant role in the product sales of joint venture brands, but a comparison of current market performance shows that joint venture brands pursuing a "parallel advancement of fuel and electric vehicles" strategy have achieved better sales results.

In July this year, Nissan's sales in China reached 57,400 units, marking a 21.8% year-on-year increase. The core "contributor" to ending the streak of consecutive losses was the Dongfeng Nissan N7, which had been on the market for only three months. It is understood that this pure electric sedan, positioned for the mainstream family market, sold 6,455 units in July and achieved a cumulative sales volume of 16,300 units in three months, becoming Nissan's first new energy vehicle model in China to exceed 10,000 units in sales. Toyota performed even better. In the first half of this year, FAW Toyota and GAC Toyota sold 374,000 and 345,000 units, respectively, with year-on-year increases of 21.1% and 2.6%. In contrast, Honda, another Japanese brand, experienced a relatively obvious decline in the first half of this year due to its failure to form economies of scale in the launch rhythm and pricing strategy of new energy models in China.

While pursuing "parallel advancement of fuel and electric vehicles," "parallel intelligence of fuel and electric vehicles" has also become another powerful measure for joint venture brands to seek market share growth. The German brands "FAW-Volkswagen and SAIC Volkswagen" are prime examples. According to official data, the cumulative sales growth of FAW-Volkswagen and SAIC Volkswagen in the first half of this year reached 3.5% and 2.3%, respectively. This is mainly attributed to the two automakers' efforts to enhance the intelligent experience of fuel vehicle models while accelerating the launch of new energy products. The all-new Tayron L launched by FAW-Volkswagen features the IQ.Pilot intelligent driving system, while the new model from SAIC Volkswagen, the Teramont Pro, adopts an intelligent vehicle connectivity system capable of six-screen interaction. On August 15, Volkswagen Group and Xpeng Motors signed a new cooperation agreement, expanding their strategic cooperation in electronic and electrical architecture technology to cover platforms for fuel vehicles and plug-in hybrid vehicles, in addition to pure electric vehicles.

Joint venture brands mainly adopt two approaches to accelerate their layout in the fields of new energy and intelligent connected technologies. On the one hand, they increase the intensity of localized research and development and enhance the autonomy and decision-making power of local R&D teams. Lu Xiao, General Manager of SAIC General Motors, announced early this year that starting from 2025, the definition of new products will be 100% led by the Chinese team. Toyota Motor's project to establish a wholly-owned Lexus pure electric vehicle and battery R&D and production company in Shanghai has officially landed. The advanced driving assistance system released by Volkswagen was developed by the Volkswagen Group China team and is tailored specifically for China's complex and diverse road conditions. On the other hand, joint venture brands are deeply collaborating with Chinese technology companies to address shortcomings and gaps in certain technological areas. Mainstream brands such as Mercedes-Benz, BMW, Audi, Volkswagen, and Toyota have all chosen to cooperate with Momenta to develop intelligent driving systems. Companies such as Huawei, Xiaomi, Baidu, and Meizu have also entered the supply chain systems of joint venture automakers. By incorporating more technologies and configurations that align with Chinese consumer trends, joint venture automakers can more quickly and accurately capture market changes and accelerate the iteration and commercialization of intelligent technologies.

Building New Export Bases

In fact, this round of "recovery" is not limited to leading joint venture brands.

According to official data, Beijing Hyundai's sales in July reached 17,761 units, marking a 41.5% year-on-year increase, with cumulative sales of 100,000 units in the first half of the year. Yueda Kia's sales in the same month reached 20,000 units, marking the fifth consecutive month of monthly sales exceeding 20,000 units. From January to July this year, Yueda Kia's cumulative sales reached 144,000 units, a 9.3% year-on-year increase.

For non-leading joint venture brands, in addition to product marketing innovation and cost reduction and efficiency improvement, another important breakthrough lies in expanding export businesses and transforming Chinese factories into global automotive manufacturing bases. At the end of last year, Li Shuangshuang, Executive Deputy General Manager of Beijing Hyundai, stated that Beijing Hyundai's business footprint now covers multiple regions, including Africa, the Middle East, Central Asia, and Southeast Asia, and will expand to South America in the future. Looking ahead to 2025, Beijing Hyundai will continue to broaden its export channels, increase the variety and quantity of export models, and plans to increase its export volume to 80,000-100,000 units.

Benefiting from its export strategy, Ford China also delivered impressive financial results in the first half of this year. On July 31, Ford Motor's financial report for the second quarter showed global revenue of $50.2 billion, a steady 5% year-on-year increase. What particularly stood out was Ford China's "reverse trend and outstanding performance" – with eight consecutive quarters of profitability, it became the "ballast stone" in the group's global business. In the first half of this year, Ford China's export sales volume and profit both increased year-on-year.

Perhaps some may question whether this stabilization and rebound of joint venture brands represent a turning point or merely a "flash in the pan." It cannot be denied that joint venture automakers still face numerous challenges, including the urgent need to accelerate localization processes and transformation speeds, the still fierce market competition, and the need to keep up with rapidly evolving technological changes and consumer trends. However, there are reasons to believe that after regaining their development pace, as long as joint venture automakers can fully leverage the profound technological accumulations of both Chinese and foreign partners and their localized wisdom, continue to deepen their presence in the Chinese market, actively embrace the transition to electrification and intelligence, and collaborate with partners across the industrial chain to create value, they have the potential to seize new opportunities arising from China's automotive consumption upgrade and market expansion, thereby achieving even more significant development.

Note: This article was first published in the "Hot Topic Tracking" column of the September 2025 issue of Auto Review magazine. Please stay tuned.

Image: From the Internet

Article: Auto Review

Layout: Auto Review