New Energy Vehicle Start-up Sales in the First Week of October: National Day Holiday Triggers General MoM Sales Decline, Yet Leapmotor Holds Firm at the Top

![]() 10/11 2025

10/11 2025

![]() 574

574

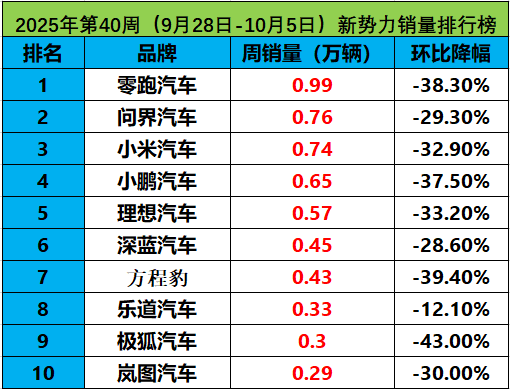

Due to the impact of terminal delivery schedules and data - collection timelines during the National Day holiday, the release of the sales ranking for new - energy vehicle start - ups in the 40th week of 2025 (from September 28th to October 5th) was slightly postponed.

As the transition period between the end of one month and the start of the next, combined with the fact that holiday travel demands diverted consumers' attention from car - buying decisions, sales of new - energy vehicle start - up brands generally experienced a month - over - month decline. This phenomenon is in line with the seasonal trends commonly observed in the industry. With the conclusion of the holiday, sales are anticipated to gradually rebound in the coming week as terminal demand is unleashed. Now, let's delve into the specific sales figures!

Leapmotor takes the top spot, with sales reaching 9,900 units. Despite a 38.3% month - over - month decline influenced by the National Day holiday, it still maintains a significant lead. As a new - energy vehicle start - up brand that has led the market for several consecutive months, its core models, such as the C10 and C16, continue to enjoy strong sales in the mainstream market. Additionally, its expansion into overseas markets has further solidified its market position.

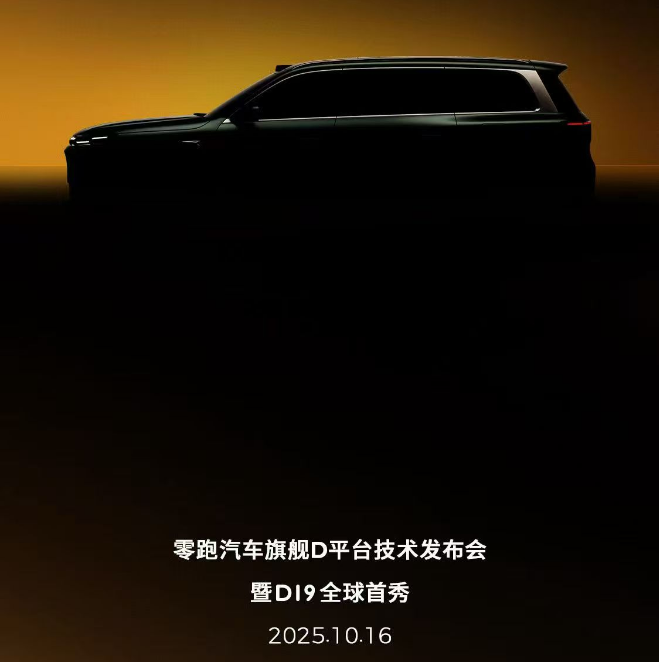

Leapmotor D19 is set to make its global debut on October 16th. As a product from Leapmotor targeting the high - end market, will it achieve success this time?

AITO secures the second position, with sales of 7,600 units, marking a 29.3% month - over - month decline. Leveraging the Hongmeng Intelligent Connectivity Ecosystem, models like the M9 and M8 have performed exceptionally well in the high - end SUV market. The newly launched M7 further expands its reach into the mainstream market at the 300,000 - yuan price point, creating a product matrix advantage. This time, its sales surpassing Xiaomi reflects consumers' recognition of its intelligent experience and product strength.

Xiaomi comes in third, with sales of 7,400 units, showing a 32.9% month - over - month decline. Despite facing production capacity constraints, the Xiaomi SU7 and YU7 models have maintained high market popularity. Although weekly sales have seen a slight decline, its subsequent growth potential remains promising (viewed optimistically) due to its technological ecosystem integration capabilities and brand premium.

Xiaomi's recall event in September had a substantial impact on its reputation, as debates over whether it was a "voluntary" or "passive" recall further affected Xiaomi's standing in the market.

XPeng takes the fourth place, with sales of 6,500 units, experiencing a 37.5% month - over - month decline. The XPeng MONA M03, as the best - selling intelligent electric vehicle in the 200,000 - yuan price range, continues to be the main contributor to its sales volume. Meanwhile, models like the G7 and P7+ have performed steadily. With the launch of the X9 extended - range version, XPeng is accelerating its layout of the "pure electric + super electric" dual technology routes.

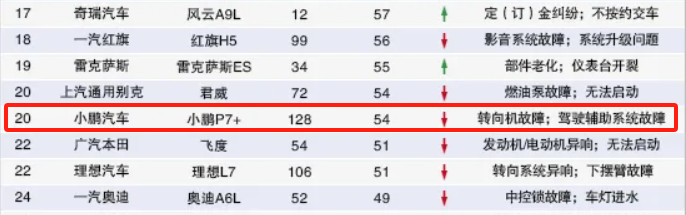

However, the recall of the XPeng P7+ in September still had a significant impact on XPeng. Moreover, XPeng P7+ users are still lodging complaints, indicating that XPeng has not been able to appease its users in a short period.

Li Auto is in fifth place, with sales of 5,700 units, showing a 33.2% month - over - month decline. The Li Auto i6 has received a warm market response since its launch, with over 10,000 orders placed within just 5 minutes, demonstrating its strong competitiveness. Although overall sales were affected by the holiday, its precise positioning in the family user market makes it clear that there are high expectations for subsequent growth.

Shenlan takes the sixth position, with sales of 4,500 units, experiencing a 28.6% month - over - month decline. Models like the Shenlan SL03 and S7 continue to penetrate the 150,000 - 250,000 yuan price range. Relying on Changan Automobile's technological support and cost - effectiveness advantages, its market share has gradually expanded.

Fangchengbao is in seventh place, with sales of 4,300 units, showing a 39.4% month - over - month decline. As a hardcore off - road brand under BYD, the Fangchengbao Titan 3 and Titan 7 have attracted niche market users with their unique positioning. However, sales have been volatile, indicating that further improvement in product stability is required.

Leadao takes the eighth position, with sales of 3,300 units, experiencing a 12.1% month - over - month decline. Models like the Leadao L90 target the mid - to - high - end family market, providing a differentiated complement to the NIO brand and showing relatively stable sales performance.

Arcfox is in ninth place, with sales of 3,000 units, showing a 43% month - over - month decline. The Arcfox T1, positioned in the A0 - class market, has performed outstandingly since its launch, with over 43,000 orders placed before its debut. Priced starting at 62,800 yuan and featuring a spacious configuration, it has successfully opened up the market. However, limited by the price ceiling of entry - level products, the brand still needs to deploy core models in the mid - to - high - end market and enhance its brand premium through technological accumulation and product upgrades.

Voyah is in tenth place, with sales of 2,900 units, experiencing a 30% month - over - month decline. Models like the Voyah FREE+ and the 2026 Voyah Dreamer equipped with Huawei's full suite of technologies have performed outstandingly recently, showing potential to achieve breakthroughs in the high - end new - energy vehicle market.

The above is a summary of the sales ranking of new - energy vehicle start - ups for the 40th week of 2025 (from September 28th to October 5th). Feel free to leave comments and discuss the performance of each automaker in the comments section.