Geely Poised to Revive SAIC-GM Baosheng Plant to Boost Production and Reclaim Leadership Among Domestic Automakers

![]() 11/12 2025

11/12 2025

![]() 546

546

Lead | Introduction

The automotive industry is abuzz with news of Geely's potential takeover of the SAIC-GM Baosheng Plant for the production of its Galaxy models. This strategic move to revitalize idle manufacturing capacity presents a win-win scenario for both Geely and local governments. However, the success of this new venture as a pivotal element in Geely's quest to overtake BYD, or as a potential liability, hinges on the sustained growth in sales of the Geely Galaxy lineup.

Published by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Word Count: 2,796

Estimated Reading Time: 4 minutes

Recent reports indicate that Geely Auto is planning to lease the SAIC-GM Baosheng Plant in Shenyang to bolster production capacity for its Galaxy series. The Phase I and Phase II facilities of the SAIC-GM Baosheng Plant, which ceased operations this year, are slated for demolition, with the land earmarked for real estate development. The relatively newer Phase III plant will undergo renovations and be repurposed for Geely's Galaxy model production.

Job postings on local recruitment platforms reveal that Zhejiang Geely Holding Group is actively seeking engineering and technical personnel in Shenyang for positions in stamping, welding, painting, final assembly, and powertrain assembly. Furthermore, Shenyang Jichi Auto was registered and established in May this year, investing RMB 890 million in the renovation of the Baosheng Phase III plant. The company's name suggests a possible connection to Geely's future production plans in Shenyang.

△Geely May Acquire Phase III of SAIC-GM Baosheng Plant

Geely Galaxy's Sales Surge

Geely's decision to seek a new production base for the Galaxy series is driven by its recent stellar performance. In October, Geely Auto's monthly sales surpassed 300,000 vehicles for the first time, with the Galaxy brand contributing a remarkable 127,000 units, marking a year-on-year increase of up to 101%. This surge positioned Galaxy as the primary catalyst behind Geely's overall sales growth. Notably, several models in the Galaxy series have excelled, particularly in fleet operations. The Xingyuan model alone achieved monthly sales of 50,000 units, while models like the Panda Mini, Galaxy E5, and Galaxy A7 consistently exceeded 10,000 units in sales. The recently launched Galaxy M9 garnered over 23,000 orders within 24 hours of its debut, thanks to its exceptional value for money, establishing it as another blockbuster model for Geely.

△The Galaxy M9 Emerges as a Blockbuster in the Domestic Auto Market

Despite Galaxy's impressive performance, the absence of a dedicated production base remains a significant concern. Online research reveals that Galaxy models are currently manufactured across multiple sites, including Linhai in Taizhou, Baoji in Shaanxi, Guiyang in Guizhou, Xiangtan in Hunan, and Qiantang, alongside other Geely brand models. While Galaxy has achieved remarkable success, Geely's other brands, such as Geely, Lynk & Co, and Zeekr, also have their production priorities. Internally, Geely may not be able to allocate all resources to Galaxy at present. Therefore, leveraging the existing SAIC-GM plant, considering the established parts supply chain around SAIC-GM and BMW Brilliance, is a more direct and efficient approach to increasing Galaxy's production capacity. Additionally, the Shenyang location of the SAIC-GM Baosheng Plant can help Geely, and even Galaxy, fill the gap in their passenger vehicle production base in Northeast China.

In addition to the potential acquisition of the SAIC-GM Baosheng Plant, Geely also signed an agreement with the Wuhan Economic Development Zone this year to produce new Galaxy models at the Lotus factory in Wuhan. In 2020 and 2021, Geely invested RMB 8 billion and RMB 6.3 billion, respectively, to construct the Lotus Global Smart Factory, which has an annual production capacity of approximately 150,000 vehicles, and the Lotus Tech Global Headquarters. However, Lotus's current production capacity falls significantly short of expectations, making it feasible to utilize existing production lines to manufacture the popular Galaxy models on the same platform.

△Lotus Factory

Looking ahead, Geely Galaxy's future performance is highly anticipated. From a strategic standpoint, targeting BYD's advantageous models in niche markets has been a cornerstone of Galaxy's development. The facts bear this out: by offering a more extensive lineup at more affordable prices, Geely Galaxy has successfully diverted a significant portion of BYD's sales. Taking the Galaxy Xingyuan, which clinched the single-model sales crown in the Chinese auto market in the first half of this year, as an example, its starting price of RMB 66,800 has overshadowed the BYD Seagull and Dolphin. Beyond competitive pricing, the Xingyuan's superior vehicle dimensions and over-specified configurations, such as CATL batteries, rear-wheel drive systems, front trunks, and electric rear tailgates, have further solidified Galaxy's strategy of offering higher value for money compared to BYD's Ocean/Dynasty series. From Geely's perspective, expanding Galaxy's production capacity is a crucial step in catching up with BYD and reclaiming the title of the top-selling domestic brand.

△Xingyuan Positions Galaxy for a Strategic Counter-Offensive

Significant Benefits for the Old Industrial Base

The shutdown of the SAIC-GM Shenyang Baosheng Plant had a profound impact on Shenyang and Liaoning Province.

The SAIC-GM Baosheng Plant in Shenyang was once a vital production hub for SAIC-GM. Commencing operations in 2004, the plant underwent three phases of expansion and was responsible for manufacturing mainstay models like the Buick GL8, boasting an annual production capacity exceeding 300,000 vehicles. However, with the decline in SAIC-GM's sales, the Baosheng Plant was forced to cease operations in February of this year. For Shenyang, in addition to SAIC-GM, BMW Brilliance has also been underperforming. Amid the relentless competition from domestic new energy brands such as Li Auto, AITO, and NIO, BMW's role in driving the local economy has diminished. In this context, revitalizing the SAIC-GM Baosheng Plant for Galaxy model production holds positive implications for the region.

△The Buick GL8 was Once Produced at the SAIC-GM Baosheng Plant

Industrial Population Inflow: A leading automotive brand can significantly boost employment and population inflow in the region. Lowering settlement standards to attract talent has been a top priority for cities in recent years, particularly in Northeast China, which has been grappling with population outflow. The shutdown of the SAIC-GM Baosheng Plant resulted in a certain number of job losses. Geely's timely intervention can effectively address unemployment and attract other personnel to relocate to Shenyang for employment.

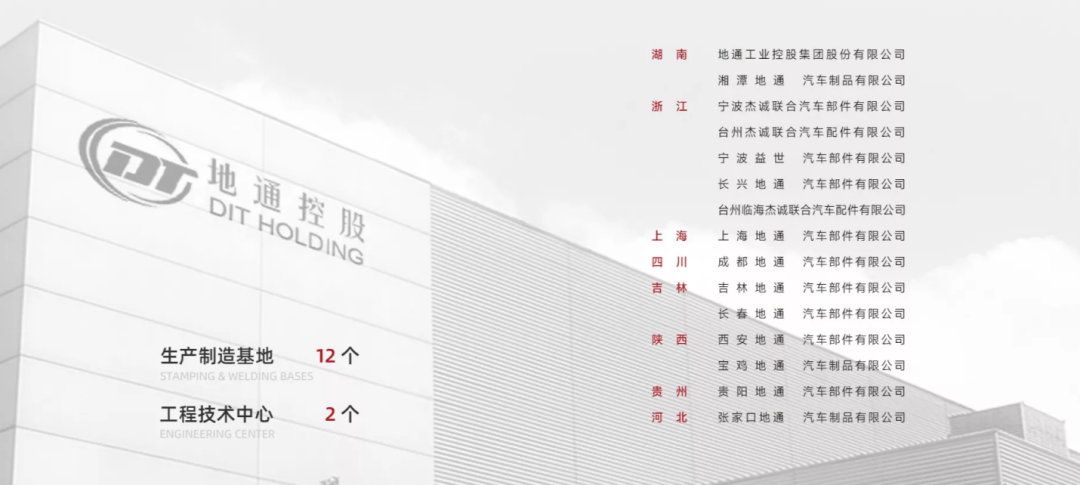

Economic Growth Receives a New Impetus: The automotive industry exerts a substantial influence on the upstream and downstream supply chains. Prior to the establishment of Geely's Shenyang factory, Ditong Industrial Holding Group, a key supplier for Geely Auto, had already set up operations in Shenbei New District and planned to invest in a parts manufacturing base with an annual output value of RMB 1 billion. As Geely's Shenyang factory production capacity continues to grow, more parts companies are expected to establish a presence in Shenyang and its surrounding areas to supply Geely locally, potentially becoming a new engine for local economic development.

△Ditong Group, a Close Collaborator with Geely, Announces Investment Project in Shenyang

What is Geely's Production Capacity Utilization Like?

At this year's Chongqing Forum, Li Shufu, the head of Geely Auto, highlighted that out of the total sales of 31.43 million vehicles in the Chinese market in 2024, approximately 20 million units of production capacity remain idle, resulting in an actual production capacity utilization rate of only around 50%. The production capacity utilization rate of auto OEMs, as reported in the National Bureau of Statistics' "Statistical Bulletin on National Economic and Social Development in 2024 of the People's Republic of China" in February this year, also hovers around 50%. Consequently, encouraging enterprises to transform and utilize existing production capacity, rather than approving new vehicle factories, will become the primary focus of policy efforts.

△Li Shufu Announces at the Chongqing Forum that Geely Will Not Establish New Factories

Geely's most astute move was refraining from negotiating with SAIC-GM to acquire the plant directly. Instead, it waited for SAIC-GM to shut down before negotiating with the Shenyang Municipal Government to take over the facility, significantly reducing the cost of acquiring this ready-to-use factory. However, for Geely, in addition to integrating the Shenyang factory and enhancing the production capacity utilization rate of its Wuhan factory, it must also consider reorganizing its production capacity and eliminating some idle capacity.

The acquisition of the SAIC-GM plant exemplifies the comprehensive advancement of Chinese autonomous brands. Nevertheless, foreign brand joint ventures have not relinquished their foothold in the Chinese auto market. Taking SAIC-GM as an example, it has not only implemented promotional strategies such as fixed pricing but also introduced new energy sub-brands like Ziyoujing, effectively curbing the overall sales decline trend. Ziyoujing, in particular, bears some resemblance to Galaxy. If Geely Galaxy captures market share from BYD's Dynasty/Ocean series with more cost-effective models, Ziyoujing could potentially replicate Geely Galaxy's path. Therefore, Geely must exercise greater caution in its expansion to mitigate risks associated with rapid capacity growth.

△The Downward Trend in SAIC-GM's Sales Has Been Effectively Curbed

Commentary

Timely advance layout of production capacity is essential for automakers. However, an overly rapid pace can pose certain risks to the enterprise. The Chinese auto market has transitioned from a period of rapid growth to one focused on stock rather than increment. The current surge in sales of domestic brands is primarily attributable to capturing market share from joint venture automakers. As joint venture automakers regain their composure and begin to introduce more practical new models, the sustained rapid growth trend of domestic brands may prove challenging to maintain. Controlling the urge to expand production and operating prudently and steadily in the domestic market is the key to sustainable development.

(This article is original to Heyan Yueche and may not be reproduced without authorization.)