Final Ruling: Joint Venture Passenger Vehicle Market Share Dwindles Further in 2025

![]() 02/13 2026

02/13 2026

![]() 366

366

For an extended period, the domestic passenger vehicle market has been predominantly led by foreign-branded vehicles produced through joint ventures. Back in 2020, domestic brands held a mere 35.7% of the market share, whereas joint venture brands commanded a substantial 64.3%.

However, the landscape has shifted dramatically in recent years, fueled by the swift ascent of new energy vehicles. Consequently, the domestic market share of passenger vehicles from domestic brands has soared. In 2022, domestic brands secured 49.9% of the market share. By 2023, they surpassed the 50% mark for the first time. The upward trajectory continued in 2024 and 2025, with domestic brands rapidly expanding their market presence, while joint venture brands witnessed a steady decline in theirs.

Opinions are divided regarding the precise domestic market share of passenger vehicles from joint venture brands in the recently concluded year of 2025.

According to data from the China Association of Automobile Manufacturers, sales of domestically produced passenger vehicles (encompassing domestic, joint venture, and wholly-owned brands) reached 30.103 million units in 2025. Among these, 20.936 million units were from Chinese domestic brands, constituting 69.5% of the total sales. Some media outlets erroneously equated this sales proportion with market share, leading to the incorrect conclusion that the market share of passenger vehicles from joint venture brands stood at only 30.5%.

Another set of statistics from the CAAM reveals that domestic sales of passenger vehicles in 2025 amounted to 24.065 million units, with exports reaching 6.038 million units. Joint venture automakers and wholly-owned automaker Tesla supplied approximately 10% of the exported vehicles. After deducting exports, domestic sales of passenger vehicles from Chinese domestic brands in 2025 were estimated at around 15.53 million units, representing a 64.6% market share. Conversely, the market share of passenger vehicles from joint venture brands stood at 35.4%. Thus, 2025 marked the year with the lowest market share for passenger vehicles from joint venture brands.

In a mere five-year span, the market share ratio between passenger vehicles from joint venture brands and domestic brands underwent a complete reversal, shifting from 64.3:35.7 to 35.4:64.6.

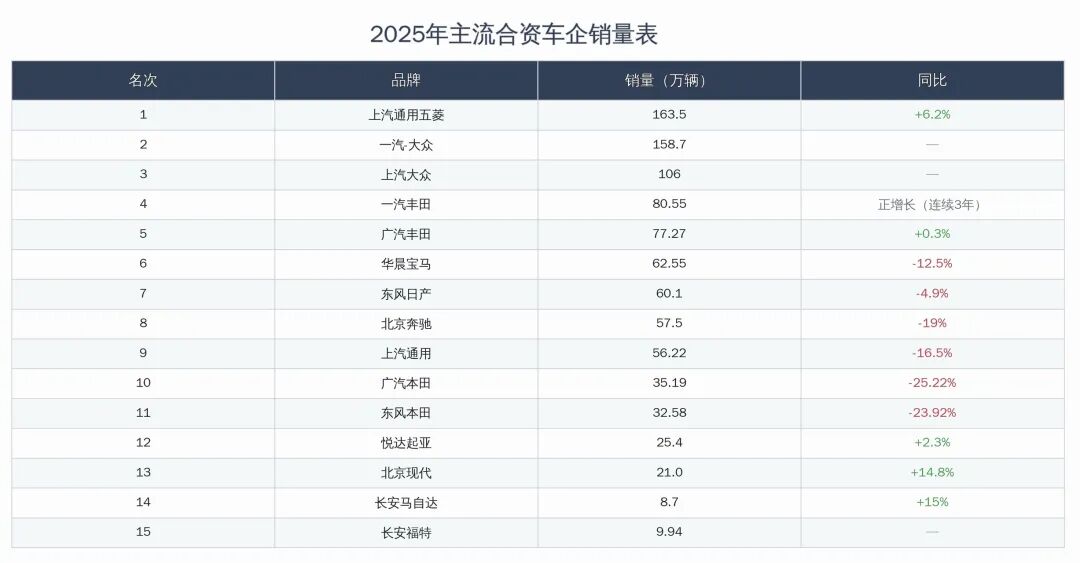

Based on data from various joint venture automakers, among the 15 mainstream joint venture automakers in 2025, seven witnessed positive sales growth, while eight experienced negative growth, with five suffering double-digit declines.

Sales of Mainstream Joint Venture Brands in 2025

A closer look at the market performance of joint venture automakers in 2025 uncovers five notable characteristics.

Firstly, the leading group among joint venture brands has largely taken shape, with Volkswagen maintaining a firm grip on the top spot.

In 2025, FAW-Volkswagen and SAIC Volkswagen collectively sold approximately 2.647 million units, accounting for 31% of the domestic market share of joint venture passenger vehicles. These two Volkswagen entities served as the "anchor" for joint venture brands. In 2025, FAW-Volkswagen retained its titles as the top seller among both joint ventures and fuel vehicles. SAIC Volkswagen's Volkswagen brand maintained its position as the top-selling single brand, with fuel vehicles like the Sagitar, Magotan, Lavida, and Passat continuing to perform strongly in their respective market segments.

Secondly, a significant divergence has emerged among Japanese brands, with Toyota remaining stable and Honda facing pressure.

Both FAW Toyota and GAC Toyota achieved positive sales growth in 2025. FAW Toyota saw an increase in the proportion of high-end and hybrid models, while GAC Toyota rebounded with its flagship models and the bZ3X. However, GAC Honda and Dongfeng Honda both experienced significant sales declines (-23.92% and -25.22%, respectively), primarily due to the weak market performance of their mainstay models and lackluster progress in new energy transitions.

Thirdly, divergence in new energy transitions is evident, with SAIC-GM-Wuling and GAC Toyota emerging as standout performers.

In 2025, SAIC-GM-Wuling's new energy vehicle sales surpassed one million units for the first time, leading joint venture automakers in growth rate. GAC Toyota's bZ3X became the top-selling pure electric model among joint ventures. SAIC-GM's MPV new energy sales increased by 152% year-on-year. Brands like BMW Brilliance and SAIC-GM still had relatively low proportions of new energy vehicles, facing significant transition pressure.

Fourthly, American and luxury brands are under pressure, while Korean brands are showing signs of recovery.

In 2025, both Changan Ford and SAIC-GM continued to experience negative growth. Luxury brands faced insufficient competitiveness in electrification and intelligence, with BMW Brilliance, FAW-Audi, and Beijing Benz all seeing year-on-year declines. Kia, relying on exports, achieved positive growth for two consecutive years. Beijing Hyundai saw a 58% year-on-year increase in the second half of the year, with full-year sales reaching 210,000 units, up 14.8% year-on-year.

Fifthly, structural optimization and profitability are being prioritized simultaneously.

From a product mix perspective, the proportion of high-value models among passenger vehicles from joint venture brands has significantly increased. In 2025, high-end models accounted for 61% of FAW Toyota's sales, while flagship models made up nearly 49% of GAC Toyota's sales. SAIC-GM relied on high-value products like MPVs to remain profitable for five consecutive quarters, reflecting a market strategy of "prioritizing profit over volume." (End)