Mitsubishi Electric 'Severs Ties' and Exits: What the Decline of Japanese Titans Teaches Chinese Automakers

![]() 02/13 2026

02/13 2026

![]() 538

538

Author: Wu Rui

Produced by: Insight Auto

Recently, Japanese manufacturing behemoth Mitsubishi Electric made a bold move, announcing plans to divest its entire automotive components business for a price ranging from 8.8 billion to 13.2 billion yuan. The decision was swift and resolute, leaving no room for hesitation. While it may seem like a strategic retreat for a single company, it is, in reality, a manifestation of the collective unease among Japanese automakers in the face of the global electric vehicle (EV) revolution.

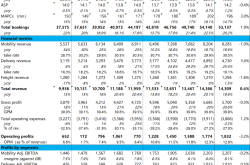

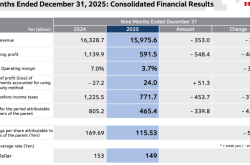

According to Mitsubishi Electric's financial report for the first half of fiscal year 2025, its automotive components division generated revenue of 422.8 billion yen (approximately 18.6 billion yuan), yet boasted an operating profit margin of just 5%, a staggering 3.2 percentage points below the group's average. This business has become a "tough nut to crack"—unprofitable yet difficult to let go.

This decisive "sacrifice" not only exposes the dilemma Japanese manufacturing faces in its electrification transformation but also underscores the profound reshaping of the global automotive industry landscape. The ascent of China's supply chain is rewriting the industry's playbook.

Mitsubishi's 'Sacrificing Pawns to Save the King' and Japan's Last Line of Defense

Mitsubishi Electric's withdrawal is far from a passive defeat; rather, it is a calculated move to "sacrifice pawns to save the king."

Amid the global surge in EV adoption, Mitsubishi's automotive components business is grappling with profitability challenges. The crux of the issue lies in its focus on standardized fields such as inverters and motors, which are now under intense pressure from China's cost-competitive supply chain. The price war quagmire renders sustaining a 5% profit margin untenable.

In fact, Mitsubishi's decision is not an isolated incident. Panasonic has already led the way by divesting its automotive business last year. The consecutive exits of these two Japanese giants signal a sobering realization among Japanese companies: in the realm of standardized components, they cannot compete with China's supply chain cost advantages.

Shedding the burden of low-end manufacturing and focusing its resources on power semiconductors is Mitsubishi's hidden core strategy and the last line of defense for Japanese companies.

It is reported that Mitsubishi Electric's 8-inch power semiconductor factory in Kumamoto Prefecture has commenced trial production. Its developed silicon carbide (SiC) devices are precisely tailored for the current mainstream 800V high-voltage platform in EVs, directly challenging global semiconductor giants such as Infineon and ON Semiconductor.

As industry experts know, 60% of an EV's bill of materials (BOM) cost is concentrated in the power electronics sector. SiC devices can directly enhance vehicle range by 5-8%, representing the core of current EV technology advancements.

Mitsubishi's strategic pivot essentially reflects a collective consensus among Japanese companies: retreating to the high-end chip sector to avoid direct price competition with China's supply chain.

China's Supply Chain Core Technologies: The Key to Breakthroughs

Behind Mitsubishi Electric's exit lies the all-encompassing rise and "overwhelming" dominance of China's automotive supply chain.

Today, the Yangtze River Delta motor industry cluster has established a formidable scale advantage. Inovance Technology's servo motors are priced 30% lower than Japanese counterparts, rapidly capturing market share with their cost-effectiveness. BYD Semiconductor's IGBT module production capacity ranks among the top three globally, breaking the long-standing monopoly of European, American, and Japanese companies. Huawei Digital Energy's 800V solutions have swept the European market, setting a benchmark for China's supply chain going global.

This industry reshuffle serves as a profound wake-up call for Chinese automakers and points out future directions for breakthroughs. First, they must not blindly believe in the "Made in Japan" halo. In the electrification race, even former industry benchmarks are struggling. Chinese automakers have already achieved a "curve overtaking" through supply chain advantages.

Second, power semiconductors remain the "bottleneck" battlefield for the automotive industry in the next decade. Currently, China's dependence on imports for mid-to-high-end IGBTs remains nearly 95%. Only by mastering this core technology can true industrial initiative be seized. The collaboration between CRRC Times Semiconductor and Li Auto represents a beneficial attempt at technology sharing and bottleneck breakthroughs.

Third, enterprises without vertical integration capabilities will ultimately become casualties of price wars. Mitsubishi's decisive move reveals that competition in the automotive industry has entered a new phase of core component rivalry. Only by mastering core technologies and building an autonomous and controllable supply chain system can they stand firm in fierce global competition. This is also the key to China's automotive industry transitioning from a "quantitative leap" to a "qualitative leap."

END