The country's largest auto dealer can't hold on any longer! Guanghui Auto plans to be delisted

![]() 07/23 2024

07/23 2024

![]() 608

608

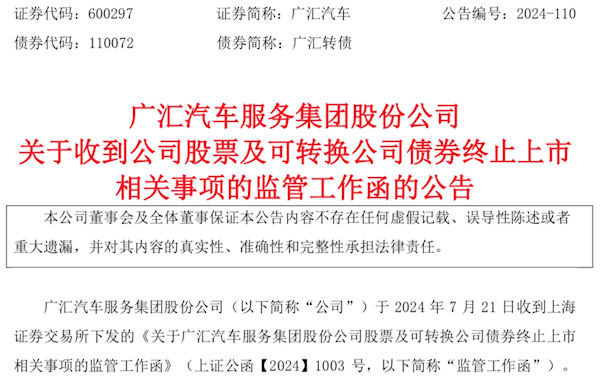

Fast Tech news on July 22, Guanghui Auto released the latest announcement stating that the company received a "Letter of Regulatory Work on the Delisting of Guanghui Auto Service Group Stock Corporation Shares and Convertible Corporate Bonds" issued by the Shanghai Stock Exchange on July 21, 2024.

According to the announcement, Guanghui Auto's daily stock closing price has been below 1 yuan for 20 consecutive trading days from June 20 to July 17, 2024.

Under the listing rules, Guanghui Auto's shares and convertible corporate bonds have triggered the delisting conditions.

Trading of Guanghui Auto shares and convertible corporate bonds has been suspended since the market opened on July 18.

The Listing Review Committee of the Shanghai Stock Exchange will review whether to delist the company's shares and convertible corporate bonds within 15 trading days after the expiration of the relevant period for Guanghui Auto to request a hearing, make representations, and defend its position, or after the conclusion of the hearing procedures.

The Shanghai Stock Exchange will make a corresponding delisting decision based on the review opinions of the Listing Review Committee.

Public data disclosure shows that in the first quarter of this year, Guanghui Auto's revenue decreased by 11.49% year-on-year, and its net profit excluding non-recurring gains decreased by 99.80% year-on-year, plunging the company's performance into a quagmire.

Guanghui Auto's market value once exceeded 100 billion yuan, but as of the close on July 19, Beijing time, its total market value was 6.466 billion yuan.

However, on the verge of delisting, Guanghui Auto transferred control to another company in an attempt to save itself.

On July 11, Guanghui Auto announced that its controlling shareholder, Guanghui Group, had signed a framework agreement with Jinzheng Technology, intending to transfer shares.

The agreement stipulates that after December 19, 2024, Guanghui Group will transfer 24.5% of its shares in Guanghui Auto to Jinzheng Technology, and upon completion of the transaction, the company's control will change.

In other words, Guanghui Auto will welcome a new controlling shareholder. At that time, industry insiders believed that behind Guanghui Auto's plan to change its controlling interest was the hope that the new controlling shareholder's entry would bring its share price back to 1 yuan, eliminating the risk of "delisting due to par value".

However, currently, changing the controlling shareholder has had limited effect on boosting the share price, and it has not changed the situation where the share price is still below 1 yuan.

As of December 31, 2023, Guanghui Auto's nationwide auto dealership network covers 28 provinces, autonomous regions, and municipalities, operating a total of 735 outlets, including 695 4S stores, making it one of the largest dealer groups in China.

Moreover, Guanghui Auto has consecutively ranked first in the Top 100 Dealer Group List of China's Auto Circulation Industry for many years. However, against the backdrop of China's new energy vehicle transformation and price wars, it has still struggled with underperforming performance and is on the verge of delisting.